Aluminum Casting Market

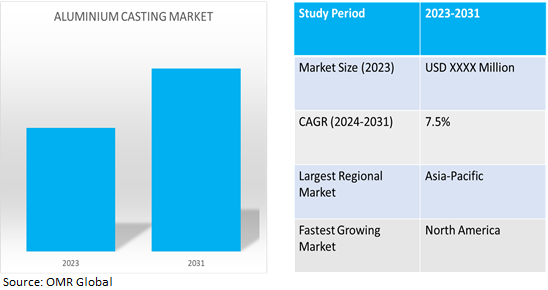

Aluminum Casting Market Size, Share & Trends Analysis Report by Process (Die casting, Sand Casting, and Permanent Mold Casting) and by End-Use Sector (Industrial, Transportation, and Building and Construction), Forecast Period (2024-2031)

Aluminum casting market is anticipated to grow at a CAGR of 7.5% during the forecast period (2024-2031). Aluminum castings are widely used in the automotive sector for producing various automotive parts of different shapes. Aluminum die castings are used in producing alloy wheels, body frames, pistons, engine blocks, valve covers, carburetors, fan clutches, and others. Increase in investments in building infrastructure in countries such as the US, China, Japan, Mexico, and India, have led the building & construction sector to witness significant growth where the aluminum casting process is widely employed for designing and production of both interior and exterior metallic structures, window frames, and others. Furthermore, factors such as increasing disposable income, technological upgrades, and spurring a rise in original equipment manufacturers (OEMs) have led the automotive & transportation sector to witness significant growth.

Market Dynamics

Increasing Government Regulations to Control CO2 Emissions

Aluminum casting has gained popularity owing to its impeccable features, such as lightweight and high strength, which make it ideal for application in a multitude of industries. The automotive industry is one of the major end users of aluminum casting, where it finds adoption due to the need to improve fuel efficiency by reducing vehicle weight and, subsequently, reducing CO2 emissions. The transport sector significantly contributes to environmental pollution, and most auto manufacturers are focusing on producing lightweight vehicles to reduce carbon emissions. According to the United Nations Environment Programme, the partnership for Clean Fuel and Vehicles (PCFV) is the global public-private initiative promoting cleaner fuels and vehicles in developing countries. Seventy-three organizations from PCFV are focusing on lowering greenhouse gas emissions from road transport to achieve cleaner air by combining their resources and efforts.

Rapid Growth in the Construction Industry

The use of aluminum is increasing at a rapid pace in the construction industry. Modern building and construction involve more than erecting structures as efficiently as possible. In addition to functional and economic criteria, aesthetic and design considerations, as well as ecological requirements, play an equally important role in building projects. This indicates that the materials utilized are of great significance. Throughout the 20th century, aluminum, the modern building material, established itself as an important factor in the building and construction industry. Aluminum enables the realization of every conceivable architectural concept, regardless of whether it is a new construction or a renovation. Possible applications range from facades and roof and wall systems to interior decoration and the design of living space and include windows and doors, balconies, and conservatories in the fields of surface treatment, thermal insulation and soundproofing, air conditioning, and solar heating. The growth of the construction industry and real estate sector will increase the adoption of aluminum due to its various benefits.

Market Segmentation

Our in-depth analysis of the global aluminium casting market includes the following segments by process, and end-use sector:

- Based on process, the market is segmented into die casting, sand casting, and permanent mold casting.

- Based on product, the market is segmented into industrial, transportation, and building and construction.

Die Casting is Projected to Emerge as the Largest Segment

Die-casting segment is expected to hold the largest share of the market. Automobile parts such as engines, cylinders, and gears are made with die-casting methods for rapid and mass production of vehicles. The die casting method is further categorized into pressure die casting, vacuum, and squeeze die casting. The rise in demand for vehicles will increase the production of automobile parts, resulting in a rise in demand for aluminum-cast products over the forecast period. The distinct characteristics offered by pressure die casting such as smooth surface finish, easy filling of cavity, strong mechanical properties, and tighter dimension tolerance are expected to assist segment growth, especially in the automotive sector. The other categories include vacuum and squeeze die casting.

Transportation Segment to Hold a Considerable Market Share

The transportation segment is expected to dominate the market due to the enhancement of the end-user. The growth will accelerate in the future due to the increasing demand for lighter vehicles, which leads to replacing the iron and steel parts on the vehicles with aluminum products. The rising demand for cast aluminum in the automobile industry is attributed to the enhancement of light vehicles with better fuel efficiency in the aluminum castings. Increasing emission laws by government regulatory authorities and consumer demand for higher fuel-efficient vehicles are collectively driving the demand for aluminum casting in the transportation sector. Increasing demand and production of airplanes around the world has further surged the demand for aluminum casting in the aerospace sector. The electric vehicle market is witnessing enormous growth, and it is going to increase the usage of aluminum in its production.

Regional Outlook

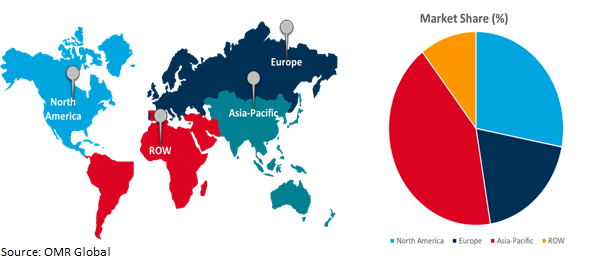

The global aluminum casting market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America to Grow at Fastest CAGR

North America is expected to grow significantly, with the highest CAGR during the forecast period 2024-2031. The expected growth is linked to the demand for fuel-efficient vehicles due to increasing fuel prices. Automobile companies are utilizing aluminum casting products to reduce the weight of vehicles and increase their efficiency of vehicles. The presence of electric vehicle giant Tesla is utilizing aluminum-cast products to increase the range of their electric vehicles. Alcoa Corporation will supply Ronal Group with low-carbon aluminum for the production of the wheels for the Audi e-Tron GT, Audi's first electric sports car. Elysis, a joint venture between Alcoa and Rio Tinto, has developed the new metal and is currently working to scale up the process for full commercial operation.

Global Aluminium Casting Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the rapidly expanding manufacturing sector in China and India. Automakers are shifting or expanding their production facilities in these countries owing to the low labor cost and government policy support, such as 100.0% FDI allowed under automatic routes for auto components. The automotive industry in China anticipates a nearly 40.0% increase in orders by 2026. This is a result of the reviving and expanding economies in those regions. Currently, aluminum die-casting production in China is less expensive than in the US. The region is gaining growth also due to the presence of the largest consumer and producer of aluminum casting all over the globe.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global aluminum casting market include Alcoa Corp., Aluminum Corp. of China Ltd., Dynacast., and Endurance Technologies Ltd., among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2022, Alcoa established a partnership with Mission Possible to control global warming and use sustainable methods in the aluminum industry.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aluminum casting market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Alcoa Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Aluminum Corporation of China Limited

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Dynacast

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Endurance Technologies Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Aluminum Casting Market by Process

4.1.1. Die casting

4.1.2. Sand Casting

4.1.3. Permanent Mold Casting

4.2. Global Aluminum Casting Market by End-Use Sector

4.2.1. Industrial

4.2.2. Transportation

4.2.3. Building and Construction

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Alcast Technologies Ltd.

6.2. Bodine Aluminum, Inc.

6.3. BUVO Castings

6.4. Consolidated Metco, Inc.

6.5. Georg Fischer Ltd.

6.6. GIBBS Die Casting Corp.

6.7. Martinrea Honsel Germany GmbH

6.8. Nemak

6.9. Olson Aluminum Casting

6.10. Rajshi Technologies India Private Ltd.

6.11. Rio Tinto

6.12. RUSAL

6.13. Ryobi Die Casting

6.14. Shandong Xinanrui Machinery Co. Ltd.

6.15. Walbro

6.16. Wolf Industries GmbH

1. GLOBAL ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

2. GLOBAL ALUMINUM DIE CASTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ALUMINUM SAND CASTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ALUMINUM PERMANENT MOLD CASTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY END-USE SECTOR, 2023-2031 ($ MILLION)

6. GLOBAL ALUMINUM CASTING FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ALUMINUM CASTING FOR TRANSPORTATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ALUMINUM CASTING FOR BUILDING AND CONSTRUCTION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. NORTH AMERICAN ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

11. NORTH AMERICAN ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

12. NORTH AMERICAN ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY END-USE SECTOR, 2023-2031 ($ MILLION)

13. EUROPEAN ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. EUROPEAN ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

15. EUROPEAN ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY END-USE SECTOR, 2023-2031 ($ MILLION)

16. ASIA-PACIFIC ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY END-USE SECTOR, 2023-2031 ($ MILLION)

19. REST OF THE WORLD ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY PROCESS, 2023-2031 ($ MILLION)

21. REST OF THE WORLD ALUMINUM CASTING MARKET RESEARCH AND ANALYSIS BY END-USE SECTOR, 2023-2031 ($ MILLION)

1. GLOBAL ALUMINUM CASTING MARKET SHARE BY PROCESS, 2023 VS 2031 (%)

2. GLOBAL ALUMINUM DIE CASTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ALUMINUM SAND CASTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ALUMINUM PERMANENT MOLD CASTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ALUMINUM CASTING MARKET SHARE BY END-USE SECTOR, 2023 VS 2031 (%)

6. GLOBAL ALUMINUM CASTING FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ALUMINUM CASTING FOR TRANSPORTATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ALUMINUM CASTING FOR BUILDING AND CONSTRUCTION MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ALUMINUM CASTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. US ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

11. CANADA ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

12. UK ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

13. FRANCE ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

14. GERMANY ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

15. ITALY ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

16. SPAIN ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

17. REST OF EUROPE ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

18. INDIA ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

19. CHINA ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

20. JAPAN ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

21. SOUTH KOREA ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF ASIA-PACIFIC ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

23. LATIN AMERICA ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)

24. MIDDLE EAST AND AFRICA ALUMINUM CASTING MARKET SIZE, 2023-2031 ($ MILLION)