Aluminum Hydroxide Market

Aluminum Hydroxide Market Size, Share & Trends Analysis Report by Type (Industrial Grade, Pharmaceutical Grade, and Others, and by End-User Industry (Plastics, Pharmaceuticals, Coatings, Adhesives, Sealants and Elastomers, and Others), Forecast Period (2025-2035)

Industry Outlook

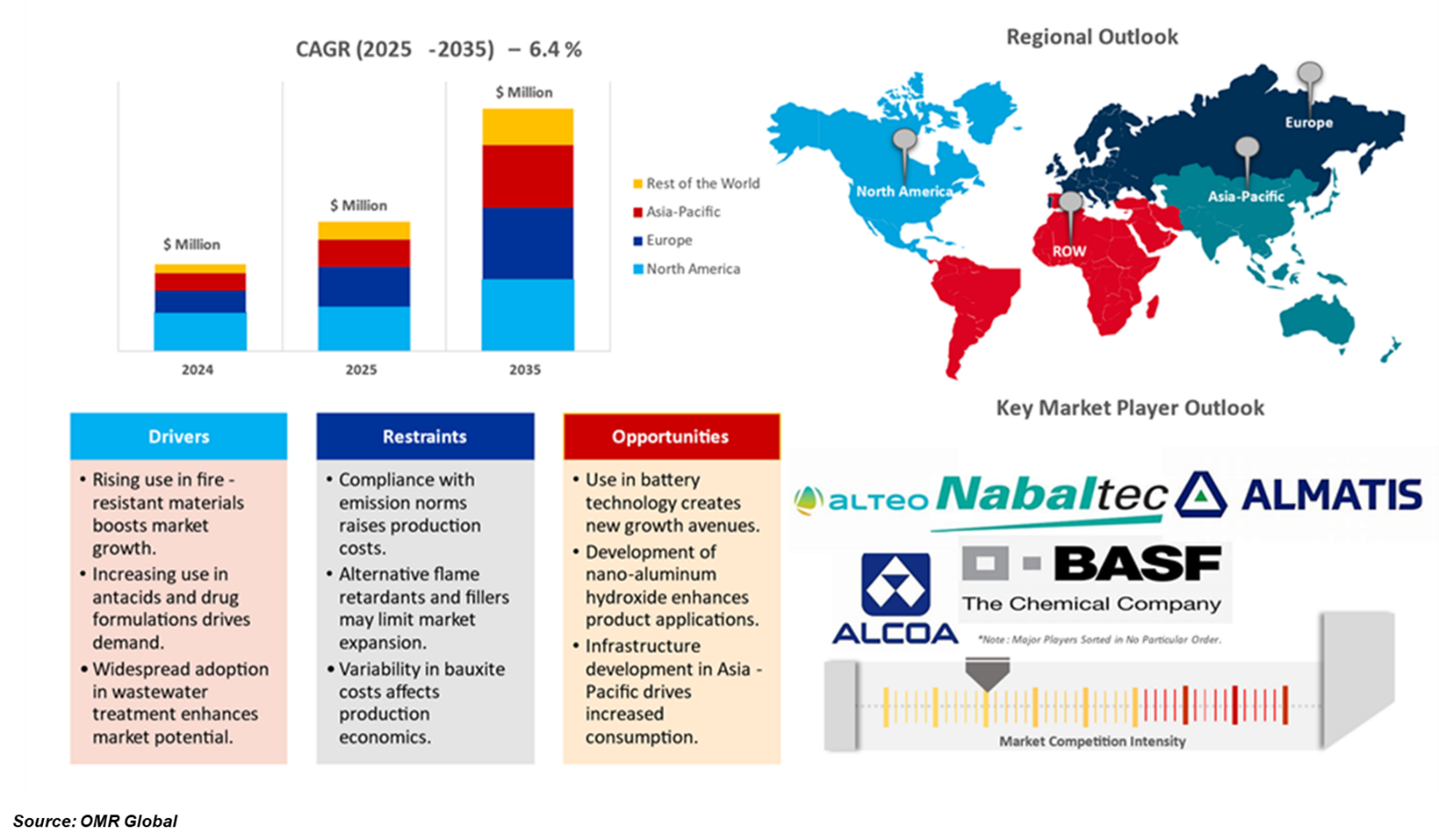

Aluminum hydroxide market is projected to grow at a CAGR of 6.4% during the forecast period (2025-2035). The market expansion is driven by the increasing demand for aluminum hydroxide within the pharmaceutical industry, specifically for treating gastrointestinal disorders. The variety of cases of digestive diseases is increasing including peptic ulcers, gastritis, and acid reflux disorder, that are contributing drastically to the development of the marketplace. To sustain growth in the aluminum hydroxide market, key players are focusing on product innovation, improved formulation for medical applications, and expanded usage in industries such as flame retardants, water treatment, and plastics. Aluminum hydroxide serves a vital role in neutralizing excess stomach acid, providing relief from gastric hyperacidity, and is a key component in antacid formulations.

Segmental Outlook

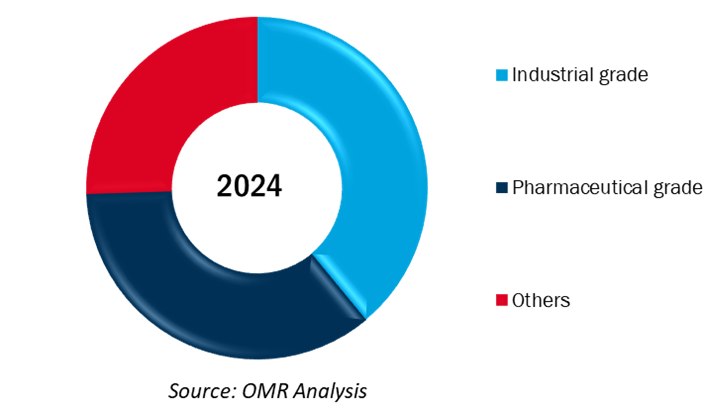

The global aluminum hydroxide market is segmented based on its type and end-user industry. Based on its type, the market is sub-segmented into industrial grade, pharmaceutical grade, and others (reagent grade). Further, based on the end-user industry, the market is sub-segmented into plastics, pharmaceuticals, coatings, adhesives, sealants and elastomers, and others (chemical). Among the type’s segments, the industrial grade sub-segment is anticipated to hold a prominent market share, since aluminum hydroxide is increasingly used as a buffering agent in a variety of industrial processes, including agriculture, food processing, medicine, and photography.

Pharmaceuticals Sub-Segment is Anticipated to Hold a Prominent Share in the Global Aluminum Hydroxide Market

The pharmaceutical sub-segment is anticipated to hold a prominent share in the global aluminum hydroxide market. It is driven by factors such as increasing the old-age population, where increasing aging populations, increasing awareness about digestive health, and increasing prevalence of conditions such as acid reflux, gastroesophageal reflux disease (GERD), and factors such as peptic ulcers are contributing to the development of the segment. The chemical properties of aluminum hydroxide, including its incompatibility in water and organic solvents, make it an effective antacid by neutralizing gastric hydrochloric acid. Additionally, with an increase in digestive health and increasing demand for over-the-counter (OTC) antacid drugs, the pharmaceutical sub-segment is ready to maintain a strong market presence in the forecast period. For instance, in December 2023, the World Journal of Gastrointestinal Endoscopy Studies highlighted that GERD is the most common upper gastrointestinal disorder in the elderly, with a prevalence of 10.0%-20.0% in Western countries. The study further emphasized that elderly patients with GERD are at a higher risk of severe complications, including erosive esophagitis, esophageal stricture, and Barrett’s esophagus.

Global Aluminum Hydroxide Market Share By Type, 2024 (%)

Regional Outlook

The global aluminum hydroxide market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, Russia, and Others), Asia-Pacific (India, China, Japan, South Korea, ASEAN Countries, Australia & New Zealand, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). Among these, North America is estimated to hold a major share over the forecast period, owing to the increasing usage in polymer applications, mainly as fire retardants, and increasing safety standards in building construction.

The Asia-Pacific Region is Anticipated to Hold a Significant Share in the Global Aluminum Hydroxide Market

The Asia-Pacific region is projected to witness sufficient growth in the global aluminum hydroxide market for the forecast period. This regional expansion is mainly inspired by increasing aluminum hydroxide as flame retardation in industries such as construction, motor vehicles, and electronics to follow strict fire-safety rules. This rapid demand for fire-fighting materials, in collaboration with rapid industrialization and urbanization, is contributing further to the development of the market. Certainly, countries such as China, Japan, and India play an important role in the regional markets driven by their expanded manufacturing sectors and have increased investment in infrastructure development. This ongoing progress in flame retardant applications, along with increasing emphasis on safety standards and environmental regulations, has increased the demand for aluminum hydroxide in the Asia-Pacific region.

Market Players Outlook

The major companies serving the global aluminum hydroxide market include Alcoa Corp., Alumina Chemicals & Castables, Almatis B.V., Alteo Holding, Nabaltec AG, Huber Corp., BASF SE, and others. These market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Developments

- In December 2024, Almatis GmbH announced a strategic partnership with Alteo Alumina for its specialty alumina product offerings, aiming to meet the growing demand in the ceramics and abrasives sectors.

- In October 2024, Huber Advanced Materials introduced its martoxid calcined aluminas, which are known for high chemical purity and optimized particle size distribution. The purpose of this product launch is to cater to the increasing demand for technical ceramics and refractori offers enhanced material performance and durability. This development underscores Huber's commitment to innovation and growing its presence in high-performance material solutions.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global aluminum hydroxide market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1 Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Aluminum Hydroxide Market Sales Analysis – Type| End-User Industry ($ Million)

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Aluminum Corporation of China Ltd. (Chalco)

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Huber Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. LKAB Minerals AB

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Aluminum Hydroxide Market by Type ($ Million)

4.1.1. Industrial Grade

4.1.2. Pharmaceutical Grade

4.1.3. Other (Reagent grade)

4.2. Global Aluminum Hydroxide Market by End-User Industry ($ Million)

4.2.1. Plastics

4.2.2. Pharmaceuticals

4.2.3. Coatings

4.2.4. Adhesives

4.2.5. Sealants and Elastomers

4.2.6. Others (Chemical)

5. Regional Analysis

5.1. North America Aluminum Hydroxide Market Sales Analysis - Type | End-User Industry ($ Million)

5.1.1. United States

5.1.2. Canada

5.2. Europe Aluminum Hydroxide Market Sales Analysis - Type | End-User Industry ($ Million)

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Russia

5.2.7. Rest of Europe

5.3. Asia-Pacific Aluminum Hydroxide Market Sales Analysis - Type | End-User Industry ($ Million)

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Australia & New Zealand

5.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And Other)

5.3.7. Rest of Asia-Pacific

5.4. Rest of the World Aluminum Hydroxide Market Sales Analysis - Type | End-User Industry ($ Million)

5.4.1. Latin America

5.4.2. Middle East and Africa

6 Company Profiles

6.1 ALUMINA - CHEMICALS & CASTABLES

6.2 American Elements

6.3 Carborundum Universal Limited (CUMI)

6.4 Century Aluminum Company

6.5 CoorsTek, Inc.

6.6 Henan Qingjiang Industrial Co., Ltd.

6.7 Hindalco (Aditya Birla Management Corp. Pvt. Ltd)

6.8 Nabaltec AG

6.9 Nippon Light Metal Co., Ltd.

6.10 Norsk Hydro ASA

6.11 Padarsh Pharmaceuticals Pvt. Ltd.

6.12 Rio Tinto Group

6.13 SCR-Sibelco NV

6.14 Sino-Aluminas Ltd.

6.15 Specialty Pharmaceuticals Ingredients Pharma

6.16 Sumitomo Chemical Co. Ltd

6.17 TOR Minerals International Inc.

6.18 Washington Mills

6.19 XI'AN FUNCTION MATERIAL GROUP CO., LTD.

6.20 Zibo Unique Refractory Materials Co., Ltd.

1. Global Aluminum Hydroxide Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Industrial Grade Aluminum Hydroxide Market Research And Analysis By Region, 2024-2035 ($ Million)

3. Global Pharmaceutical Grade Aluminum Hydroxide Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Other Aluminum Hydroxide Type Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Aluminum Hydroxide Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

6. Global Aluminum Hydroxide For Plastics Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Aluminum Hydroxide For Pharmaceuticals Market Research And Analysis By Region, 2024-2035 ($ Million)

8. Global Aluminum Hydroxide For Coatings Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Aluminum Hydroxide For Adhesives Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Aluminum Hydroxide For Sealants and Elastomers Market Research And Analysis By Region, 2024-2035 ($ Million)

11. Global Aluminum Hydroxide For Other End-User Industry Market Research And Analysis By Region, 2024-2035 ($ Million)

12. Global Aluminum Hydroxide Market Research And Analysis By Region, 2024-2035 ($ Million)

13. North American Aluminum Hydroxide Market Research And Analysis By Country, 2024-2035 ($ Million)

14. North American Aluminum Hydroxide Market Research And Analysis By Type, 2024-2035 ($ Million)

15. North American Aluminum Hydroxide Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

16. European Aluminum Hydroxide Market Research And Analysis By Country, 2024-2035 ($ Million)

17. European Aluminum Hydroxide Market Research And Analysis By Type, 2024-2035 ($ Million)

18. European Aluminum Hydroxide Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

19. Asia-Pacific Aluminum Hydroxide Market Research And Analysis By Country, 2024-2035 ($ Million)

20. Asia-Pacific Aluminum Hydroxide Market Research And Analysis By Type, 2024-2035 ($ Million)

21. Asia-Pacific Aluminum Hydroxide Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

22. Rest Of The World Aluminum Hydroxide Market Share Analysis By Region, 2025-2035 ($ Million)

23. Rest Of The World Aluminum Hydroxide Market Research And Analysis By Type, 2024-2035 ($ Million)

24. Rest Of The World Aluminum Hydroxide Market Research And Analysis By End-User Industry, 2024-2035 ($ Million)

1. Global Aluminum Hydroxide Market Share By Type, 2024 Vs 2035 (%)

2. Global Industrial Grade Aluminum Hydroxide Market Share By Region, 2024 Vs 2035 (%)

3. Global Pharmaceutical Grade Aluminum Hydroxide Market Share By Region, 2024 Vs 2035 (%)

4. Global Other Aluminum Hydroxide Type Market Share By Region, 2024 Vs 2035 (%)

5. Global Aluminum Hydroxide Market Research And Analysis By End-User Industry, 2024 Vs 2035 (%)

6. Global Aluminum Hydroxide For Plastics Market Share By Region, 2024 Vs 2035 (%)

7. Global Aluminum Hydroxide For Pharmaceuticals Market Share By Region, 2024 Vs 2035 (%)

8. Global Aluminum Hydroxide For Coatings Market Share By Region, 2024 Vs 2035 (%)

9. Global Aluminum Hydroxide For Adhesives Market Share By Region, 2024 Vs 2035 (%)

10. Global Aluminum Hydroxide For Sealants and Elastomers Market Share By Region, 2024 Vs 2035 (%)

11. Global Aluminum Hydroxide For Other End-User Industry Market Share By Region, 2024 Vs 2035 (%)

12. Global Aluminum Hydroxide Market Share By Region, 2024 Vs 2035 (%)

13. US Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

14. Canada Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

15. UK Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

16. France Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

17. Germany Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

18. Italy Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

19. Spain Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

20. Russia Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

21. Rest Of Europe Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

22. India Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

23. Australia & New Zealand Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

24. ASEAN Countries Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

25. China Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

26. Japan Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

27. South Korea Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

28. Rest Of Asia-Pacific Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

29. Rest Of The World Aluminum Hydroxide Market Size, 2024-2035 ($ Million)

FAQS

The size of the Aluminum Hydroxide market in 2024 is estimated to be around USD 12.05 billion.

Asia-Pacific holds the largest share in the Aluminum Hydroxide market.

Leading players in the AMOLED display market include Alcoa Corp., Alumina Chemicals & Castables, Almatis B.V., Alteo Holding, Nabaltec AG, Huber Corp., BASF SE, and others.

Aluminum Hydroxide market is expected to grow at a CAGR of 6.4% from 2025 to 2035.

The aluminum hydroxide market is growing due to rising demand in flame retardants, pharmaceuticals, water treatment, and the aluminum chemicals industry.