Ampoules Packaging Market

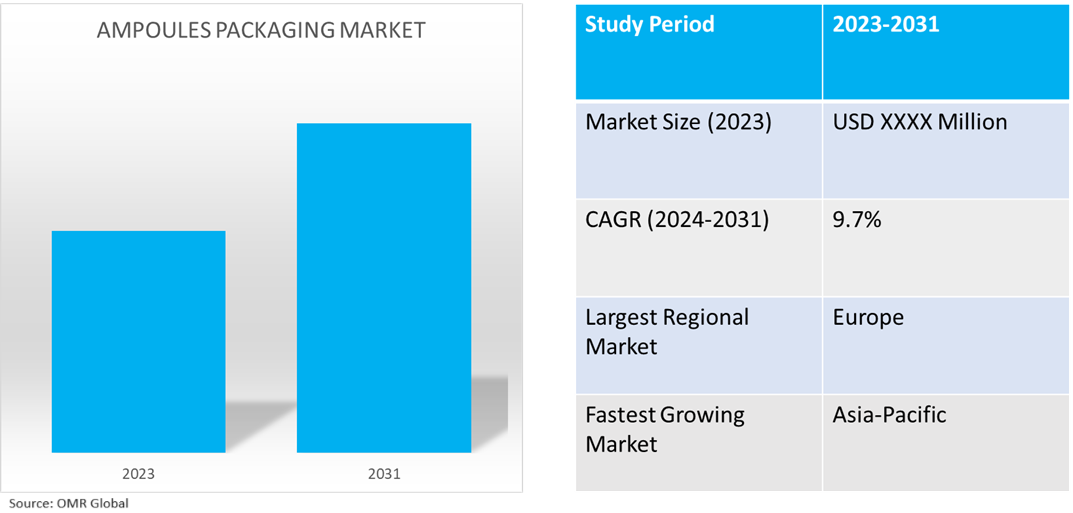

Ampoule Packaging Market Size, Share & Trends Analysis Report by Material (Glass, and Plastic), by End-User (Pharmaceuticals, Personal Care, and Cosmetics) Forecast Period (2024-2031)

Ampoule packaging market is anticipated to grow at a significant CAGR of 9.7% during the forecast period (2024-2031). The market growth is attributed to the presence of favorable government policies, rising demand from consumers, and technological innovations. The market offers a broad range of goods and services to meet the demands of many industries, including manufacturing, healthcare, and retail driving the growth of the market. According to the World Integrated Trade Solution (WITS), in 2023, the top importers of ampoules of glass conveyance or packing US were Japan ($1,782.14K, 1,861 Kg), European Union ($610.91K, 14,340 Kg), Ireland ($168.47K, 848 Kg), Germany ($167.93K, 9,833 Kg), Canada ($156.02K).

Market Dynamics

Increasing Demand for Smart Packaging

Smart technologies, such as RFID tags and QR codes, are being incorporated into ampoule packaging to improve traceability, ensure authenticity, and give end-users more information. Medical packaging needs to safeguard the product and prevent product penetration or diffusion while not altering the composition of the pharmaceutical preparation. New medications demand new packaging, and the pharmaceutical industry's requirements are always expanding. Systems that monitor and notify patients about the product's quality are being employed in increasing numbers; they are known as intelligent packaging or smart packaging systems.

Growing Adoption of Serialization and Anti-Counterfeiting Measures

Advanced features are being integrated into ampoule packaging because of growing regulatory requirements for serialization and anti-counterfeiting procedures. This directive mandates that the outer packaging have safety features that allow wholesale distributors and other authorized parties to supply medical products to the public to confirm the legitimacy of the product and identify individual packs, as well as a device that allows verification of whether the outer packaging has been tampered with, pharmaceutical companies will need to rely more heavily on packaging manufacturers.

Market Segmentation

- Based on the material, the market is segmented into glass and plastic.

- Based on the end-users, the market is segmented into pharmaceuticals, personal care, and cosmetics.

Glass is Projected to Hold the Largest Share

The pharmaceutical and personal care industries primarily use glass for packaging as it restricts the alkalinity and hydrolytic resistance of glass ampoules. Although they are chemically resistant to the majority of pharmaceutical goods and a bit impermeable to air and moisture, they offer higher protection as well as high transparency, making it simple to inspect their contents. The introduction of Velocity Vials contributes to the ongoing evolution of offerings and services and expands the portfolio of high-quality tubular glass packaging. For instance, in June 2023, Corning and SGD Pharma announced a joint venture to open a new glass tubing facility and expand access to Corning Velocity Vial technology in India. The collaboration enables faster, more efficient delivery of vital medicines and supports India's growing pharmaceutical industry.

Pharmaceuticals Segment to Hold a Considerable Market Share

The glass ampoules are airtight and tamper-evident, they ensure the sterility and integrity of the contents and are widely used in the pharmaceutical industry for the packaging of vaccines and injectable drugs. Immunization against diseases including polio, chicken pox, TB, and hepatitis B fosters the market's expansion and necessitates appropriate vaccine storage. Glass ampoules are used in the chemical and cosmetics sectors in addition to the pharmaceutical sector to package sensitive formulations and high-purity materials. Market players are offering specialty glass for the pharma industry with improved glass tubing to the global pharma sector. For instance, in October 2023, SCHOTT AG introduced FIOLAX Pro glass tubing. Pharmaceutical converters to produce high-quality vials, ampoules, syringes, or cartridges to store both simple and even highly complex drugs use SCHOTT’s pharmaceutical glass tubing. Especially in the latter category, the company sees rising demand for biotech pharmaceuticals in the future, which will need to meet stricter requirements and regulations for packaging and materials. T

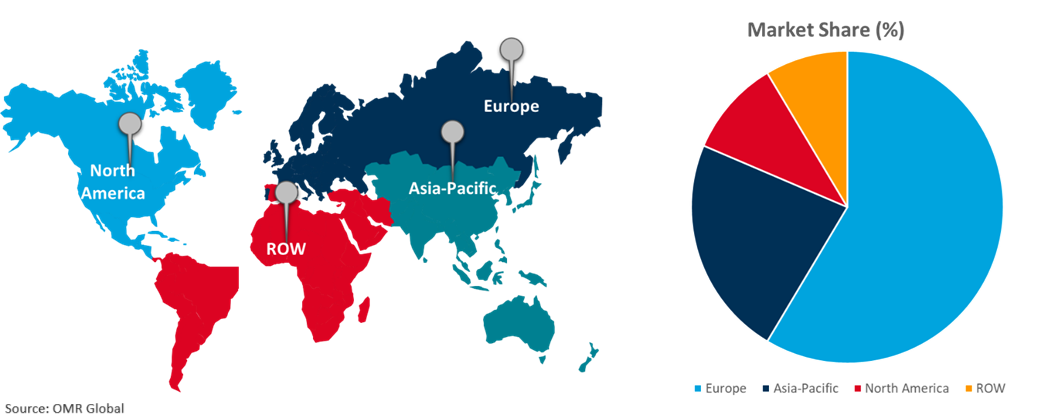

Regional Outlook

The global ampoules packaging market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Ampoules Packaging in Asia-Pacific

Ampoule packaging is predicted to see development potential as the pharmaceutical industry in the Asia-Pacific region expands. Pharmaceutical packaging firms in China and India are encouraged to form autonomous research and development teams to investigate novel, safe, functional, sustainable, and environmentally friendly packaging materials and products. The market has grown because of increased innovation, cooperation, acquisition, and output in the pharmaceutical manufacturing sector. According to the World Integrated Trade Solution (WITS), in 2022, the top exporters of ampoules of glass conveyance or packing are China ($30,314.07K, 17,464,200 Kg), India ($16,194.10K, 2,439,850 Kg).

Global Ampoules Packaging Market Growth by Region 2024-2031

Europe Holds Major Market Share

The market growth is attributed to the increasing demand for vaccination against diseases that call for appropriate vaccine storage, such as polio, chicken pox, TB, and Hepatitis B. Glass ampoules are used in the chemical and cosmetics sectors in addition to the pharmaceutical sector to package sensitive formulations and high-purity materials. According to the World Integrated Trade Solution (WITS), European Union imports of ampoules of glass conveyance or packing was $11,389.33K and quantity 1,388,500Kg. In 2023, the Top importers of Ampoules of glass conveyance or packing from the UK were the European Union ($529.06K, 77,544 Kg), Greece ($154.98K, 46,219 Kg), Ireland ($135.42K, 9,943 Kg), France ($69.07K, 7,367 Kg). The increasing demand for bio-based closures for ampoule packaging containers with the global movement towards reducing single-use plastics. For instance, in October 2023, Gerresheimer partnered with Rezemo for bio-based closures. The collaboration includes offering innovative and sustainable closures for primary packaging solutions in the cosmetic field, food and beverages, and the pharmaceutical industry. This partnership marks a significant step towards advancing environmentally friendly packaging solutions in the industry, combining endlessly recyclable glass containers with bio-based closures.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the ampoules packaging market include Amcor Group GmbH, Gerresheimer AG, Hindustan National Glass & Industries Ltd., Nipro Europe Group Co., and Schott AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

Recent Development

- In March 2022, SGD Pharma introduced the industry’s first ready-to-use sterile 100 ml molded glass vials in SG EZ-fill packaging technology. The addition of 100 ml molded glass vials to the Sterinity platform is pioneering, with SGD Pharma being the first global molded glass manufacturing company to offer this size of solution in the RTU market. The 100 ml vials, available in both clear and amber molded glass, are powered by the Stevanato Group’s EZ-fill platform.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ampoules packaging market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amcor Group GmbH

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Gerresheimer AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Hindustan National Glass & Industries Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Nipro Europe Group Co.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Schott AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Ampoules Packaging Market by Material

4.1.1. Glass

4.1.2. Plastic

4.2. Global Ampoules Packaging Market by End-User

4.2.1. Pharmaceuticals

4.2.2. Personal Care

4.2.3. Cosmetics

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AAPL Solutions

6.2. Adelphi Healthcare Packaging

6.3. Aenova Holding GmbH

6.4. Afton Scientific

6.5. AIPAK PHARMA

6.6. Anhui Huaxin Pharmaceutical Glass Products Co., LTD.

6.7. Ardagh Group

6.8. Bormioli Pharma S.p.A.

6.9. Corden Pharma International GmbH

6.10. DWK Life Sciences GmbH

6.11. Esco Micro Pte. Ltd.

6.12. J. Penner Corp.

6.13. James Alexander Corp.

6.14. MedicoPack

6.15. Nipro Corp.

6.16. Origin Pharma Packaging

6.17. Pacific Vial Manufacturing Inc.

6.18. Piramal Glass Pvt. Ltd.

6.19. Sandfire Scientific Ltd.

6.20. SGD Pharma

6.21. Shandong Pharmaceutical Glass Co., Ltd.

6.22. Solopharm

6.23. Stevanato Group S.P.A

6.24. Syntegon Technology GmbH

6.25. Vetter Pharma-Fertigung GmbH & Co. KG

1. Global Ampoules Packaging Market Research And Analysis By Material, 2023-2031 ($ Million)

2. Global Glass Ampoules Packaging Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Plastic Ampoules Packaging Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Ampoules Packaging Market Research And Analysis By End-Users, 2023-2031 ($ Million)

5. Global Ampoules Packaging For Pharmaceuticals Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Ampoules Packaging For Personal Care Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Ampoules Packaging For Cosmetics Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Ampoules Packaging Market Research And Analysis By Region, 2023-2031 ($ Million)

9. North American Ampoules Packaging Market Research And Analysis By Country, 2023-2031 ($ Million)

10. North American Ampoules Packaging Market Research And Analysis By Material, 2023-2031 ($ Million)

11. North American Ampoules Packaging Market Research And Analysis By End-Users, 2023-2031 ($ Million)

12. European Ampoules Packaging Market Research And Analysis By Country, 2023-2031 ($ Million)

13. European Ampoules Packaging Market Research And Analysis By Material, 2023-2031 ($ Million)

14. European Ampoules Packaging Market Research And Analysis By End-Users, 2023-2031 ($ Million)

15. Asia-Pacific Ampoules Packaging Market Research And Analysis By Country, 2023-2031 ($ Million)

16. Asia-Pacific Ampoules Packaging Market Research And Analysis By Material, 2023-2031 ($ Million)

17. Asia-Pacific Ampoules Packaging Market Research And Analysis By End-Users, 2023-2031 ($ Million)

18. Rest Of The World Ampoules Packaging Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Rest Of The World Ampoules Packaging Market Research And Analysis By Material, 2023-2031 ($ Million)

20. Rest Of The World Ampoules Packaging Market Research And Analysis By End-Users, 2023-2031 ($ Million)

1. Global Ampoules Packaging Market Research And Analysis By Material, 2023 Vs 2031 (%)

2. Global Glass Ampoules Packaging Market Share By Region, 2023 Vs 2031 (%)

3. Global Plastic Ampoules Packaging Market Share By Region, 2023 Vs 2031 (%)

4. Global Ampoules Packaging Market Share By End-Users, 2023 Vs 2031 (%)

5. Global Ampoules Packaging For Pharmaceuticals Market Share By Region, 2023 Vs 2031 (%)

6. Global Ampoules Packaging For Personal Care Market Share By Region, 2023 Vs 2031 (%)

7. Global Ampoules Packaging For Cosmetics Market Share By Region, 2023 Vs 2031 (%)

8. Global Ampoules Packaging Market Share By Region, 2023 Vs 2031 (%)

9. US Ampoules Packaging Market Size, 2023-2031 ($ Million)

10. Canada Ampoules Packaging Market Size, 2023-2031 ($ Million)

11. UK Ampoules Packaging Market Size, 2023-2031 ($ Million)

12. France Ampoules Packaging Market Size, 2023-2031 ($ Million)

13. Germany Ampoules Packaging Market Size, 2023-2031 ($ Million)

14. Italy Ampoules Packaging Market Size, 2023-2031 ($ Million)

15. Spain Ampoules Packaging Market Size, 2023-2031 ($ Million)

16. Rest Of Europe Ampoules Packaging Market Size, 2023-2031 ($ Million)

17. India Ampoules Packaging Market Size, 2023-2031 ($ Million)

18. China Ampoules Packaging Market Size, 2023-2031 ($ Million)

19. Japan Ampoules Packaging Market Size, 2023-2031 ($ Million)

20. South Korea Ampoules Packaging Market Size, 2023-2031 ($ Million)

21. Rest Of Asia-Pacific Ampoules Packaging Market Size, 2023-2031 ($ Million)

22. Rest Of The World Ampoules Packaging Market Size, 2023-2031 ($ Million)

23. Latin America Ampoules Packaging Market Size, 2023-2031 ($ Million)

24. Middle East And Africa Ampoules Packaging Market Size, 2023-2031 ($ Million)