Animal-Based Protein Supplement Market

Animal-Based Protein Supplement Market Size, Share & Trends Analysis Report Market by Product Type (Protein Powder, Protein Bars, Ready-to-drink), By Distribution Channel (Supermarkets/Hypermarkets, Online, Chemist/ Drugstore, Specialty Store, Other), By Application (Sports Nutrition, Functional Food) Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Animal-based protein supplement market is anticipated to grow at a considerable CAGR of 7.3% during the forecast period. The rising numbers of health-conscious consumers have created demand for protein supplements having high nutritional value, which in turn driving the global animal-based protein supplement market. Moreover, animal based protein supplements have numerous health benefits and it has been supported by strong scientific evidence and recognized by the government food regulatory institutions, such as the FDA.

Hence, a considerable increase in the number of health issues among consumers due to a lack of healthy nutrients is anticipated to promote the growth of the global animal-based protein supplement market. For instance, as per the information provided by Global Diabetes Community UK, it has stated that in 2018, across the globe there were 415 million diabetic patients and by 2040, it will reach 642 million people in the globe. Moreover, the increasing prevalence of obesity, diabetes, and CVD is also propelling the market to grow. Several studies have proved that minimum consumption of proteins daily basis will help in the prevention of various lifestyle-related diseases. With the population being inclined towards sports and fitness, the demand for these supplements is further expected to escalate during the forecast period. The growing inclination of consumers towards plant-based protein supplements owing to increasing availability of such products may restrain the growth of the global animal-based protein supplement market.

Segmental Outlook

The global animal-based protein supplement market is segmented based on product type, distribution channel, and application. Based on product type, the market is segmented into protein powder, protein bars, and ready-to-drink. Based on distribution channel, the market is segmented into supermarkets/hypermarkets, online, chemist/ drugstore, specialty store, and other. Based on application, the market is sub-segmented into sports nutrition and functional food.

Supermarkets/Hypermarkets Held Major Market Share in Global Market

Supermarkets and hypermarkets held major market share in animal-based protein supplements owing to the higher prevalence in North America. Furthermore, an increasing number of supermarkets and hypermarkets in developing countries such as China, India, and Brazil is anticipated to drive the growth of this market segment. The specialty stores segment is anticipated to exhibit considerable CAGR during the forecast period. The robust growth of specialty stores in developed and developing countries owing to their wide product offerings in a single category, flexible store formats, unique designs, and product displays has been attracting customers towards specialty stores.

Regional outlooks

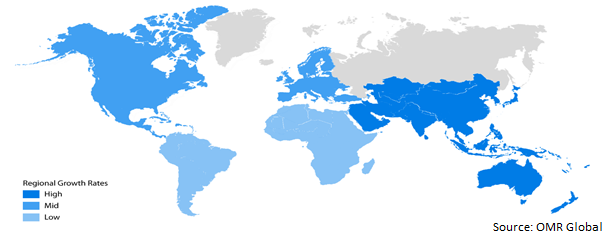

The global animal-based protein supplement market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Asia-Pacific held significant share in the global animal-based protein supplement market and is also anticipated to exhibit highest CAGR during the forecast period. The increasing demand for premium animal-based protein supplement in emerging economies such as India and China has driven the regional market growth.

Global Animal-Based Protein Supplement Market Growth, by Region 2023-2030

North America Held Significant Share in the Global Animal-Based Protein Supplement Market

North America held major market share in 2022 owing to high consumer awareness regarding the protein content in animal based supplements and focus on leading healthy and active lifestyles. Moreover, the high popularity of e-commerce portals as one of the selling mediums has further contributed to the growth of the regional market.

Market Players Outlook

The major companies serving the global animal-based protein supplement market include Glanbia plc, Muscle Pharm Corp., Abbott Laboratories, Cyto Sport, Inc., and Iovate Health Sciences International Inc. among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, and new product launches, to stay competitive in the market.

For instance, in 2021, GoodSport Nutrition, a US-based healthy sports drink manufacturing company, launched the GoodSport sports drink, a first-of-its-kind natural sports drink made from 97.0% dairy. The drink delivers three times more electrolytes and 33.0% less sugar than a conventional sports drink.

Further, in February 2022, Nestlé Health Science, a Switzerland-based nutrition company, acquired Vital Proteins for an undisclosed amount. The acquisition would help Nestlé add another brand to its vitamin, mineral, supplement, and wellness portfolio.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global animal-based protein supplement market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Glanbia Plc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Quest Nutrition

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Amco Protein

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Animal-Based Protein Supplement Market by Product

4.1.1. Protein Powder

4.1.2. Protein Bars

4.1.3. Ready-to-drink

4.2. Global Animal-Based Protein Supplement Markey by Distribution Channel

4.2.1. Supermarkets/Hypermarkets

4.2.2. Online

4.2.3. Chemist/ Drugstore

4.2.4. Specialty Store

4.2.5. Other

4.3. Global Animal-Based Protein Supplement Market by Application

4.3.1. Sports Nutrition

4.3.2. Functional Food

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Abbott Laboratories

6.2. AMCO Protein

6.3. CytoSport, Inc.

6.4. Glanbia plc

6.5. Iovate Health Sciences International Inc.

6.6. MusclePharm Corp.

6.7. NOW Foods

6.8. QuestNutrition

6.9. THE BOUNTIFUL COMPANY

6.10. Transparent Labs

6.11. WOODBOLT DISTRIBUTION LLC

1. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

2. GLOBAL ANIMAL-BASED PROTEIN POWDER MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL ANIMAL-BASED PROTEIN BARS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL ANIMAL-BASED READY TO DRINK PROTEIN MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

5. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

6. GLOBAL SUPERMARKETS/HYPERMARKETS BASED ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

7. GLOBAL ONLINE BASED ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

8. GLOBAL CHEMIST/ DRUGSTORE BASED ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

9. GLOBAL SPECIALTY STORE BASED ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

10. GLOBAL OTHER DISTRIBUTION CHANNEL BASED ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

11. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT FOR SPORTS NUTRITION MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

12. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT FOR FUNCTIONAL FOOD MARKET RESEARCH AND ANALYSIS, 2022-2030 ($ MILLION)

13. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. NORTH AMERICAN ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. NORTH AMERICAN ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

16. NORTH AMERICAN ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

17. NORTH AMERICAN ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

18. EUROPEAN ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. EUROPEAN ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

20. EUROPEAN ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

21. EUROPEAN ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

22. ASIA- PACIFIC ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. ASIA- PACIFIC ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

24. ASIA- PACIFIC ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2022-2030 ($ MILLION)

25. ASIA- PACIFIC ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

26. REST OF THE WORLD ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

27. REST OF THE WORLD ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2022-2030 ($ MILLION)

28. REST OF THE WORLD ANIMAL-BASED PROTEIN SUPPLEMENT MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SHARE BY PRODUCT, 2022 VS 2030 (%)

2. GLOBAL ANIMAL-BASED PROTEIN POWDER MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL ANIMAL-BASED PROTEIN BARS MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL ANIMAL-BASED READY TO DRINK PROTEIN MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SHARE BY DISTRIBUTION CHANNEL, 2022 VS 2030 ($ MILLION)

6. GLOBAL SUPERMARKETS/HYPERMARKETS BASED ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL ONLINE BASED ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL CHEMIST/ DRUGSTORE BASED ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL SPECIALTY STORE BASED ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL OTHER DISTRIBUTION CHANNEL BASED ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SHARE ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

12. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT FOR SPORTS NUTRITION MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT FOR FUNCTIONAL FOOD MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. US ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

16. CANADA ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

17. UK ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

18. FRANCE ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

19. GERMANY ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

20. ITALY ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

21. SPAIN ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF EUROPE ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

23. INDIA ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

24. CHINA ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

25. JAPAN ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

26. SOUTH KOREA ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF ASIA-PACIFIC ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD ANIMAL-BASED PROTEIN SUPPLEMENT MARKET SIZE, 2022-2030 ($ MILLION)