Animation and VFX Market

Animation and VFX Market Size, Share & Trends Analysis Report, by Category (2D Animation, 3D Animation, and Visual Effects (VFX)), by End-User (Media and Entertainment, Gaming, and Others) and Forecast, 2020-2026

The animation and VFX market is estimated to grow at a considerable CAGR of around 10% during the forecast period (2020-2026). The growing usage of the animation and VFX technology by the end-user verticals is a key factor promoting the growth of the animation and VFX market across the globe. Visual effects (VFX) technology is being highly preferred by the game developers, animators, and filmmakers in the cases where they technically want to exhibit something which is otherwise impossible to shot in a live or real environment. The VFX technology is being used to develop creative effects in making the logo, brand advertisement, and product promotion of companies. Moreover, with the adoption of the VFX technology in the film, cinema, and gaming this technology is being also applied in visual analytics, information visualization, systems visualization, product visualization, scientific visualization, and other related fields.

The growth of the online video streaming platform that uses animation and VFX to a large extent is again boosting the growth of the animation and VFX market. For instance, Netflix one of the major video streaming service providers in the US which have acquired around 10% of the overall screen time in the US in 2018 is using such technology in their video content. The rising threat from piracy, intense competition with high price sensitivity, and lack of proficiency are the major factors hindering the growth of the global animation and VFX market. The advent of 4D and 5D animation technology is expected to offer immense opportunities for the growth of the animation and VFX market across the globe.

Segmentation

The global animation and VFX market is segmented based on category and end-user. Based on the category, the market is classified into 2D animation, 3D animation, and visual effects (VFX). Based on category, 3D animation is anticipated to hold considerable share during the forecast period. The rising adoption of VFX technology in film making along with the high demand for 3D mobile applications, 3D visualization, and 3D gaming are the key factor boosting the market share of the 3D animation segment.

Moreover, a significant rise in the demand for 3D animation software for creating 3D animation movies to further promote the growth of this market segment. For instance, Walt Disney Company, Pixar, Universal Studios Inc., and Dream Works Animation are making use of 3D animation software and technologies such as 3D modeling, 3D rendering, and special effects for the creation of epic movies, thereby driving the market growth of this segment. Based on the end-user, the market is classified into media and entertainment, gaming, and others.

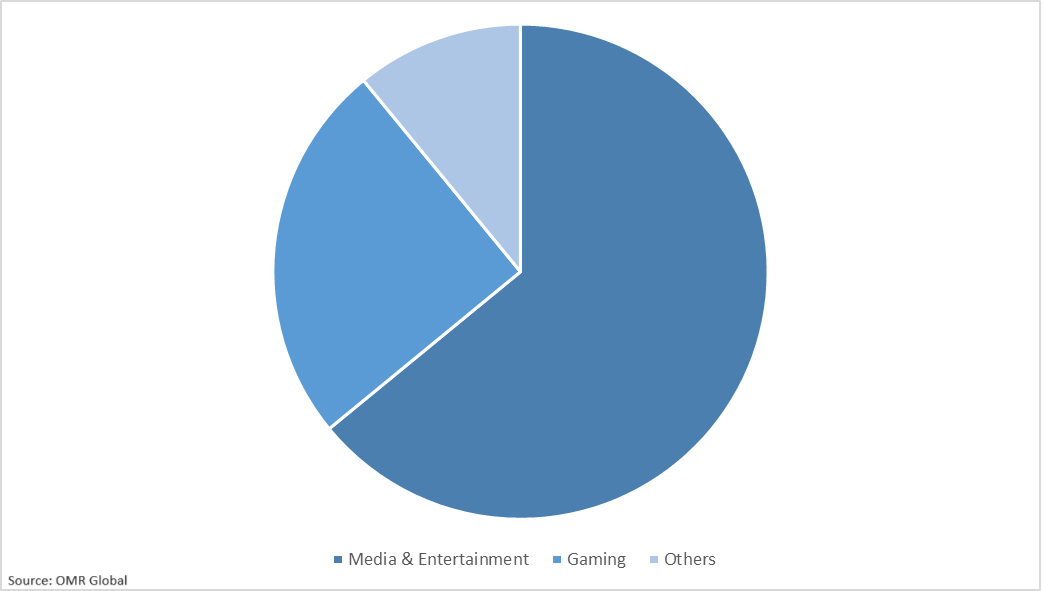

Media and Entertainment to exhibit considerable growth based on End-user

The media and entertainment segment is anticipated to showcase considerable growth during the forecast period. The rapid adoption of visual effects in the media and entertainment industry is a key factor contributor to the growth of this market segment. The rising internet penetration, easy access to multimedia devices and high consumer spending on highly animated motion pictures are the key factors driving the growth of this market segment.

Animation and VFX Market Share by End-User, 2019 (%)

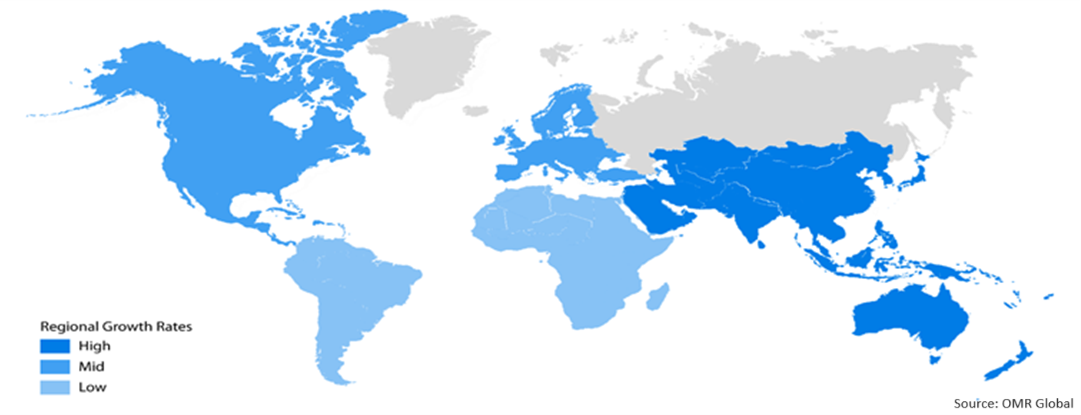

Regional outlook

The global animation and VFX market is further segmented on the basis of geography including North America, Europe, Asia-Pacific, and Rest of the World. North America held a major market share in the global animation and VFX technology market in 2019. The presence of major market players such as Adobe Inc., and Autodesk Inc., in the region are a key contributor to the high market share of the region in the global market. The market for animation and VFX in Latin America and the Middle East and Africa is still in its nascent stage. The lack of technological advancement and poor financing is the major restraining factors of market growth in the region.

Animation and VFX Market Growth, by Region 2020-2026

Asia-Pacific to exhibit Significant Growth in the Global Animation and VFX Market

Asia Pacific market is anticipated to hold considerable market share based on geography. Australia, New Zealand Singapore, China, South Korea, and Japan among others are the major countries contributing towards the high market share of the market in the Asia-Pacific region. NewZealand has emerged as a major hub for the VFX artists and is providing a favorable ecosystem for animation and VFX schools that offer advanced education in various streams.

Competitive Landscape

Adobe Inc., Autodesk Inc., iPi Soft LLC., Smith Micro Software Inc., DWANGO Co. Ltd., Planet side Software LLC, Toon Boom Animation Inc., and so on are the key players operating in the global animation and VFX market. The major players of the market are actively engaged in adopting different growth strategies such as mergers & acquisitions, partnerships, collaborations, and new product launches to remain competitive in the market place. For instance, in March 2017, Bandai Namco Holdings, Inc. had acquired Anime Consortium Japan (ACJ). The acquisition was done to develop a new internet streaming platform for overseas markets along with an e-commerce business for the production of the official anime content.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global animation and VFX market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusions

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Exocortex Technologies, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Autodesk, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. iPi Soft LLC

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Smith Micro Software, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Adobe, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Animation and VFX Industry Market by Category

5.1.1. Animation

5.1.1.1. 2D Animation

5.1.1.2. 3D Animation

5.1.2. Visual Effects (VFX)

5.2. Global Animation and VFX Industry Market by End-User

5.2.1. Media and Entertainment

5.2.2. Gaming

5.2.3. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Act-3D B.V.

7.2. Adobe, Inc.

7.3. Autodesk Inc.

7.4. Bandai Namco Holdings, Inc.

7.5. Blender Foundation

7.6. Clara.io (Exocortex Technologies Inc.)

7.7. Corel Corp.

7.8. DWANGO Co., Ltd.

7.9. Epic Games, Inc. (Unreal Engine)

7.10. iPi Soft, LLC.

7.11. Planetside Software, LLC

7.12. Serif, Ltd.

7.13. Smith Micro Software, Inc.

7.14. Sony Pictures Animation, Inc.

7.15. Synfig Studio

7.16. The Foundry Visionmongers, Ltd.

7.17. Toon Boom Animation, Inc.

1. GLOBAL ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY CATEGORY, 2019-2026 ($ MILLION)

2. GLOBAL ANIMATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($MILLION)

3. GLOBAL ANIMATION MARKET RESEARCH AND ANALYSIS BY TYPE 2019-2026 ($MILLION)

4. GLOBAL 2D ANIMATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($MILLION)

5. GLOBAL 3D ANIMATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL VISUAL EFFECTS (VFX) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

8. GLOBAL MEDIA AND ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL GAMING MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL OTHER END-USERS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY CATEGORY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

15. EUROPEAN ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

16. EUROPEAN ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY CATEGORY, 2019-2026 ($ MILLION)

17. EUROPEAN ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY CATEGORY, 2019-2026 ($ MILLION)

20. ASIA-PACIFIC ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

21. REST OF THE WORLD ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY CATEGORY, 2019-2026 ($ MILLION)

22. REST OF THE WORLD ANIMATION AND VFX INDUSTRY MARKET RESEARCH AND ANALYSIS BY END-USER, 2019-2026 ($ MILLION)

1. GLOBAL ANIMATION AND VFX INDUSTRY MARKET SHARE BY CATEGORY, 2018 VS 2025 (%)

2. GLOBAL ANIMATION AND VFX INDUSTRY MARKET SHARE BY END-USER, 2019 VS 2026 (%)

3. GLOBAL ANIMATION AND VFX INDUSTRY MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ANIMATION AND VFX INDUSTRY MARKET SIZE, 2019-2026 ($ MILLION)