Anomaly Detection Market

Global Anomaly Detection Market Size, Share & Trends Analysis Report by Deployment (On-Premises and Cloud-Based), and by End-Users (BFSI, Manufacturing, IT & Telecom, Healthcare, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global anomaly detection market is anticipated to grow at a significant CAGR of 15.8% during the forecast period. Increasing fraud detection in online transactions is expected to boost the growth of the global anomaly detection market. Moreover, there is increasing penetration of connected devices in various industries including BFSI, IT & telecom, healthcare, government and defense, and others which tend to further drive the growth of the anomaly detection industry. These industries generate and deal with important data regularly, which makes these industries vulnerable to getting exposed to serious thefts, fraud, and hacking. Thereby, the demand for anomaly detection solutions in such industries increases to prevent criminals from gaining control over the firm’s infrastructure.

Impact of COVID-19 Pandemic on Global Anomaly Detection Market

As several countries gradually release social distancing measures, rapid detection of new localized COVID-19 hotspots and subsequent intervention will be key to avoiding a large-scale resurgence of transmission. During COVID-19 Pandemic, the organizations’ applied AI/ML learning algorithms to proactively surface anomalies and root causes negatively impacting business transactions. This functionality frees IT resources from tedious root cause analysis, enabling them to focus on innovation for business impact. According to Cisco Systems, Inc., applications are used more often and at a greater scale due to the COVID-19 pandemic. August 2020 saw four times as many anomalies per application as January 2020.

Segmental Outlook

The global anomaly detection market is segmented based on the deployment and end-users. Based on the deployment, the market is bifurcated into on-premises and cloud-based. Based on the end-users, the market is sub-segmented into the BFSI, manufacturing, IT & telecom, healthcare, and others. The above-mentioned segments can be customized as per the requirements. Among the deployment, the cloud-based segment is expected to drive the growth of the market over the forecast period. As Cloud computing applications are becoming increasingly mature, several industries and enterprises are deploying many applications within cloud platforms, to improve efficiencies and on-demand services where resources are limited.

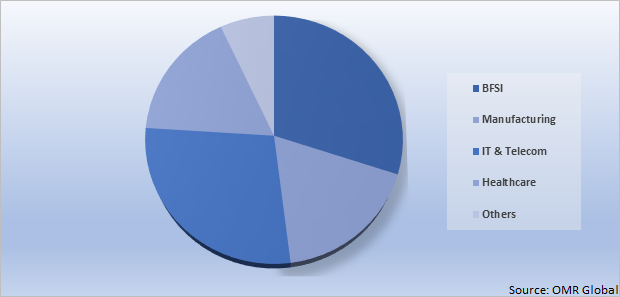

Global Anomaly Detection Market Share by End-Users, 2021 (%)

The BFSI Segment Holds the Significant Share in the Global Anomaly Detection Market Over the Forecast Period

BFSI is expected to hold a significant share in the global anomaly detection market, owing to the huge customer base in the industry that leads to a diverse flow of information. Anomaly detection is one of the most important tools for data analysis tasks that are used to identify emerging patterns in different domains such as financial fraud detection, computer network intrusion, human behavioral analysis, and gene expression analysis. BFSI operations include various activities and transactions performed by customers, employees, as well as external agencies. Such activities are quite complex and require constant monitoring to make sure that the bank and its customers are not affected by malicious and random activities. This creates an opportunity for the players to offer solutions and services for preventing such anomalies.

Regional Outlooks

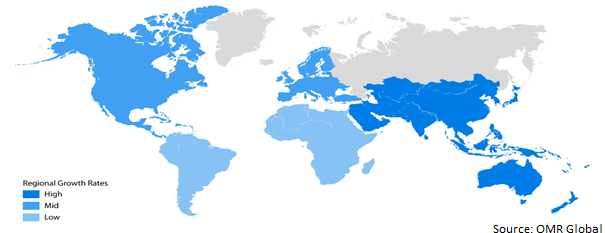

The global anomaly detection market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among all regions, the Asia-Pacific region is anticipated to grow at a remarkable rate during the forecast period due to the increasing establishment of BFSI and the IT & telecom industry in the region over the forecast period.

Global Anomaly Detection Market Growth, by Region 2022-2028

The North America Region Anticipated to Hold a Prominent Share in the Global Anomaly Detection Market

North America is expected to hold the Prominent market share in the anomaly detection industry during the forecast period. There is an increasing demand for anomaly detection solutions in North America due to the significant presence of identity thefts related to the payment and banking sectors, which increases the adoption of anomaly detection solutions in the region. According to the report published by the National Security Commission of the US on AI, in March 2021, organizations require to deploy sensors and instrumentation to train existing AI systems to detect and respond to threats on the network. Additionally, the government further plans to employ defenses to expand machine speed information sharing behavior-based anomaly detection and malware mitigation across government networks in the US.

Market Players Outlook

The major companies serving the global anomaly detection market include Happiest Minds Technologies Pvt. Ltd, Hewlett Packard Enterprise Co., LogRhythm, Inc., Microsoft Corp., Netskope, Inc., Rapid7, Trend Micro Inc., Trustwave Holdings, Inc, Varonis Systems, Inc., Wipro Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2021, Nokia and Vodafone launched an ML-powered network anomaly detection service running on the Google cloud. Vodafone expects the anomaly detection Service to automatically detect and address 80% of its mobile network issues and capacity demands.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global anomaly detection market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Anomaly Detection Market

• Recovery Scenario of Global Anomaly Detection Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Cisco Systems, Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. IBM Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. SAS Institute, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Symantec Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Verint Systems, Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Anomaly Detection Market by Deployment

4.1.1. On-Premises

4.1.2. Cloud-Based

4.2. Global Anomaly Detection Market by End-Users

4.2.1. BFSI

4.2.2. Manufacturing

4.2.3. IT and Telecom

4.2.4. Healthcare

4.2.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Anodot, Ltd.

6.2. Flowmon Networks A.S.

6.3. Guardian Analytics, Inc.(NICE Actimize)

6.4. Happiest Minds Technologies Pvt. Ltd.

6.5. Hewlett Packard Enterprise Co.

6.6. LogRhythm, Inc.

6.7. Microsoft Corp.

6.8. Netskope, Inc.

6.9. Rapid7

6.10. Trend Micro Inc.

6.11. Trustwave Holdings, Inc

6.12. Varonis Systems, Inc.

6.13. Wipro Ltd.

6.14. WSO2 Inc.

1. GLOBAL ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2028 ($ MILLION)

2. GLOBAL ON-PREMISES ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL CLOUD-BASED ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

5. GLOBAL ANOMALY DETECTION FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL ANOMALY DETECTION FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL ANOMALY DETECTION FOR IT AND TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL ANOMALY DETECTION FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL ANOMALY DETECTION FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2028 ($ MILLION)

13. NORTH AMERICAN ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

14. EUROPEAN ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. EUROPEAN ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2028 ($ MILLION)

16. EUROPEAN ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2028 ($ MILLION)

19. ASIA-PACIFIC ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)

20. REST OF THE WORLD ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. REST OF THE WORLD ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2021-2028 ($ MILLION)

22. REST OF THE WORLD ANOMALY DETECTION MARKET RESEARCH AND ANALYSIS BY END-USERS, 2021-2028 ($ MILLION)?

1. IMPACT OF COVID-19 ON GLOBAL ANOMALY DETECTION MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ANOMALY DETECTION MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL ANOMALY DETECTION MARKET, 2022-2028 (%)

4. GLOBAL ANOMALY DETECTION MARKET SHARE BY DEPLOYMENT, 2021 VS 2028 (%)

5. GLOBAL ON-PREMISES ANOMALY DETECTION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL CLOUD-BASED ANOMALY DETECTION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL ANOMALY DETECTION MARKET SHARE BY END-USERS, 2021 VS 2028 (%)

8. GLOBAL ANOMALY DETECTION FOR BFSI MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL ANOMALY DETECTION FOR MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL ANOMALY DETECTION FOR IT AND TELECOM MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL ANOMALY DETECTION FOR HEALTHCARE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL ANOMALY DETECTION FOR OTHER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL ANOMALY DETECTION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. US ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

15. CANADA ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

16. UK ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

17. FRANCE ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

18. GERMANY ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

19. ITALY ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

20. SPAIN ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

21. REST OF EUROPE ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

22. INDIA ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

23. CHINA ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

24. JAPAN ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

25. SOUTH KOREA ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF ASIA-PACIFIC ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF THE WORLD ANOMALY DETECTION MARKET SIZE, 2021-2028 ($ MILLION)