Anti-Ageing Drugs Market

Global Anti-Ageing Drugs Market Size, Share & Trends Analysis Report by Drug Class (Antioxidants and Enzymes, Serums and Supplements, Stem Cells, and Others), by Type (Injectable, Oral, and Topical), and by Application (Skin, Hair, Muscles, Age-Related Disorders, and Others) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global anti-ageing drugs market is anticipated to grow at a considerable CAGR of 7.1% during the forecast period. The rising penetration of the key players globally has created a plethora of anti-ageing drug development options resulting in the expansion of the market. The rising R&D activities for the development of new anti-ageing products for different applications such as hair, skin, and others compel the demand for anti-ageing drugs market across the globe. Major Companies in the market are inclining their efforts towards the launch of aesthetic treatment that addresses the increasing concern of ageing skin and hair among people. For instance, in May 2021, Cindy Crawford, an American actress, and model launched anti-ageing hair care line. The launch of the new line also addresses the six main signs of aging hair including thinning, dullness, dehydration, breakage, dryness, and lack of scalp health with a line-up of standout products. Furthermore, in 2021, StriVectin launched three new anti-ageing skincare products which include contour restore tightening and sculpting face cream, contour restore firming moisture balm for eyes, and pro glowfoliant mix-in microderm crystal. These products were launched to address issues of skin elasticity and dullness.

Impact of COVID-19 Pandemic on Global Anti-Ageing DrugsMarket

The COVID-19 pandemic has negatively impacted market growth due to complete disorder in global supply chains and several trade barriers all over the globe. The production of anti-ageing drugs and products was also affected owing to various measures imposed by the government intended to slow down the spread of COVID-19. Furthermore, the shift in consumers’ spending habits and purchase decisions also contributed to a decline in demand which as a result negatively impacted the overall market growth during the pandemic.

Segmental Outlook

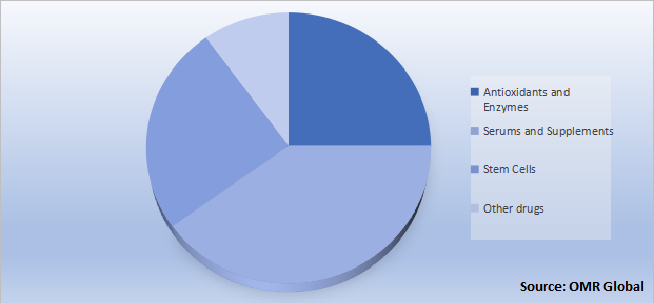

The global anti-ageing drugs market is segmented based on drug class, type, and application. Based on the drug class, the market is sub-segmented into antioxidants and enzymes, serums and supplements, stem cells, and others. Based on the type, the market is sub-segmented into injectable, oral, and topical. Further, based on application, the market is sub-segmented into skin, hair, muscles, age-related disorders, and others. Among the drug class segment, the serums and supplements sub-segment is expected to cater a considerable growth over the forecast period, due to its increasing adoption among consumers coupled with innovation of safe and efficient skincare solutions by key players.

Global Anti-Ageing Drugs Market Share by Drug class, 2021 (%)

The Serums and Supplements Sub-Segment is Anticipated to Hold a Prominent Share in the Global Anti-Ageing Drugs Market

Among the drug class, the serum and supplement sub-segment accounts for a significant share in the global market, owing to their growing popularity among end-users. The water content in the serum aids to absorb quickly into the skin while some vitamins and supplements have anti-ageing properties which delay the biology of the ageing process. To address this growing demand, key players are inclining their efforts towards the development of new anti-ageing serums and skincare supplements. For instance, in 2022, Galderma, a leading dermatology company, launched ALASTIN Skincare HA IMMERSE SERUM. This newly launched product is designed to immerse the skin with moisture at the surface while supporting to amplifying the skin’s natural ability to create hyaluronic acid deep within for fuller, more youthful-looking skin over time.

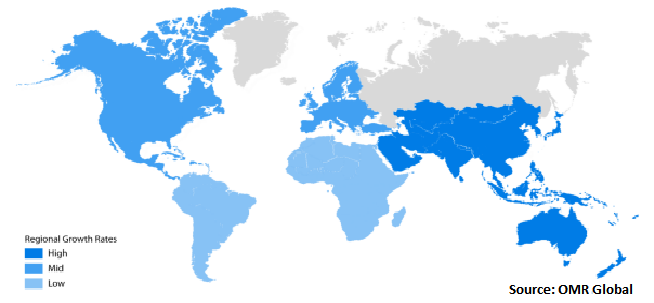

Regional Outlooks

The global anti-ageing drugs market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among these, the North American regional market is expected to cater a considerable growth over the forecast period, owing to the rising healthcare expenditure and presence of numerous key manufacturers in this region

Global Anti-Ageing Drugs MarketGrowth, by Region 2022-2028

The North American Region is Expected to Hold a Prominent Share in the Global Anti-Ageing Drugs Market

The North American region is expected to hold a prominent share in the global anti-ageing drugs market. Owing to increasing healthcare expenditure is considered to be the major factor for regional growth. North America accounts for high spending on healthcare which contributes to the development of innovative drugs and infrastructure for conducting advanced research. The developed economies such as the US and Canada comprise high living standards and large earning capacity which drive the anti-ageing drugs market in the region to new heights. Moreover, the presence of numerous key manufacturers in the region and their efforts towards developing clinically-validated health products based on advancements in medical science is further escalating the demand for anti-ageing drugs. For instance, in January 2022, Elysium Health, Inc., a life sciences company based in the US launched SIGNAL. It is a novel combination of direct NAD+ precursor, NMN, and potent SIRT3 activators used to promote a healthy metabolism by replenishing critical metabolic factors, which are lost with age, and activating processes to support healthy mitochondrial function.

Market Players Outlook

The major companies serving the global anti-ageing drugs market include Allergan plc, Daewoong Pharmaceutical Co., Ltd., Elysium Health, Inc., Galderma SA, MerzPharma Canada Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in June 2021, Galderma announced that Alluzience which is a liquid form of botulinum toxin type A has completed its European decentralized procedure resulting in a positive decision for the first ready-to-use neuromodulator, a wrinkle relaxing injection, in Europe. Designed for precision, Alluzience is intended for use in adult patients as a treatment to temporarily improve the appearance of moderate to severe glabellar lines.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global anti-ageing drugs market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1.Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global Anti-Ageing Drugs Market

- Recovery Scenario of Global Anti-Ageing Drugs Market

1.1.Research Methods and Tools

1.2.Market Breakdown

1.2.1.By Segments

1.2.2.By Region

2.Market Overview and Insights

2.1.Scope of the Report

2.2.Analyst Insight & Current Market Trends

2.2.1.Key Findings

2.2.2.Recommendations

2.2.3.Conclusion

3.Competitive Landscape

3.1.Key Company Analysis

3.2.Allergan plc (AbbVie Inc.)

3.2.1.Overview

3.2.2.Financial Analysis

3.2.3.SWOT Analysis

3.2.4.Recent Developments

3.3.Daewoong Pharmaceutical Co., Ltd.

3.3.1.Overview

3.3.2.Financial Analysis

3.3.3.SWOT Analysis

3.3.4.Recent Developments

3.4.Elysium Health, Inc.

3.4.1.Overview

3.4.2.Financial Analysis

3.4.3.SWOT Analysis

3.4.4.Recent Developments

3.5.Galderma SA

3.5.1.Overview

3.5.2.Financial Analysis

3.5.3.SWOT Analysis

3.5.4.Recent Developments

3.6.MerzPharma Canada Ltd.

3.6.1.Overview

3.6.2.Financial Analysis

3.6.3.SWOT Analysis

3.6.4.Recent Developments

3.7.Key Strategy Analysis

3.8.Impact of COVID-19 on Key Players

4.Market Segmentation

4.1.Global Anti-Ageing Drugs Market by Drug Class

4.1.1.Antioxidants and Enzymes

4.1.2.Serums and Supplements

4.1.3.Stem Cells

4.1.4.Others

4.2.Global Anti-Ageing Drugs Market by Type

4.2.1.Injectable

4.2.2.Oral

4.2.3.Topical

4.3.Global Anti-Ageing Drugs Market by Application

4.3.1.Skin

4.3.2.Hair

4.3.3.Muscles

4.3.4.Age-Related Disorders

4.3.5.Others

5.Regional Analysis

5.1.North America

5.1.1.United States

5.1.2.Canada

5.2.Europe

5.2.1.UK

5.2.2.Germany

5.2.3.Italy

5.2.4.Spain

5.2.5.France

5.2.6.Rest of Europe

5.3.Asia-Pacific

5.3.1.China

5.3.2.India

5.3.3.Japan

5.3.4.South Korea

5.3.5.Rest of Asia-Pacific

5.4.Rest of the World

6.Company Profiles

6.1.Beiersdorf AG

6.2.Bloomage Biotechnology Corp. Ltd.

6.3.DermaFix

6.4.Eirion Therapeutics, Inc.

6.5.ELCA Cosmetics Pvt. Ltd.

6.6.HUGEL, Inc.

6.7.La Roche-Posay (L'Oréal Group)

6.8.Lineage Cell Therapeutics, Inc.

6.9.L’Oréal Group

6.10.Lynton Lasers Ltd.

6.11.MEDICAL MARIJUANA, INC.

6.12.Medytox

6.13.Nu Skin Enterprises Inc.

6.14.Phytotech

6.15.Procter & Gamble Ireland

6.16.SANOFI SA

6.17.SAS REVITACARE

6.18.SciVision Biotech Inc.

6.19.Shiseido Cosmetics

6.20.Suneva Medical

1.IMPACT OF COVID-19 ON GLOBAL ANTI-AGEING DRUGS MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL ANTI-AGEING DRUGS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL ANTI-AGEING DRUGS MARKET, 2022-2028 (%)

4.GLOBAL ANTI-AGEING DRUGS MARKET SHARE BY DRUG CLASS, 2021 VS 2028 (%)

5.GLOBAL ANTI-AGEING ANTIOXIDANTS AND ENZYMES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6.GLOBAL ANTI-AGEING SERUMS AND SUPPLEMENTS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL ANTI-AGEING STEM CELLS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8.GLOBAL OTHER DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9.GLOBAL ANTI-AGEING DRUGS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

10.GLOBAL INJECTABLE ANTI-AGEING DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11.GLOBAL ORAL ANTI-AGEING DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12.GLOBAL TOPICAL ANTI-AGEING DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13.GLOBAL ANTI-AGEING DRUGS MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

14.GLOBAL ANTI-AGEING DRUGS FOR SKIN MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15.GLOBAL ANTI-AGEING DRUGS FOR HAIR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16.GLOBAL ANTI-AGEING DRUGS FOR MUSCLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17.GLOBAL ANTI-AGEING DRUGS FOR AGE-RELATED DISORDERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18.GLOBAL ANTI-AGEING DRUGS FOR OTHER APPLICATIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19.GLOBAL ANTI-AGEING DRUGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20.US ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

21.CANADA ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

22.UK ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

23.FRANCE ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

24.GERMANY ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

25.ITALY ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

26.SPAIN ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

27.REST OF EUROPE ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

28.INDIA ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

29.CHINA ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

30.JAPAN ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

31.SOUTH KOREA ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

32.REST OF ASIA-PACIFIC ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)

33.REST OF THE WORLD ANTI-AGEING DRUGS MARKET SIZE, 2021-2028 ($ MILLION)