Anti-Money Laundering (AML) Market

Global Anti-Money Laundering (AML) Market Size, Share & Trends Analysis Report By Type (Transaction Monitoring Systems, Currency Transaction Reporting Systems, Customer Identity Management Systems, Compliance Management Software, and Others), By Deployment Type (Cloud, and On-Premises) BY End-Use (Banking & Financial Institutes, Insurance Providers, Government, Telecom & IT) Forecast Period (2021-2027). Update Available - Forecast 2025-2031

The global AML market is anticipated to grow at a significant CAGR of 15.2% during the forecast period. The increased adoption of AI and ML (machine learning) and advanced technologies in developing AML solutions will fuel the AML market. AI & ML help to identify and deactivate the 98% of cases that are false positives, due to which the adoption of AI & ML has increased in AML solutions. The companies are launching new AI & ML based solutions for AML. For instance, in April 2021, ThetaRay launched AI-based AML analytics which is available on public and private clouds. This new platform practices unsupervised ML to observe financial transactions, integrated data, and alerts. Further, its new cloud purposes to upsurge the speed at which cybersecurity company’s clients, banks and fintech firms can discover likely threats.

Impact of COVID-19 Pandemic on Global AML Market

The COVID-19 has given rise in the demand for AML solutions. Owing to restrictions imposed by lockdown there was a shift from offline to online payment system. The rise in online payment via internet, prepaid cards and mobile payment has increased money laundering activities. The transactions are executed without face-to-face interaction between the person making payment and the service provider due to which there is increased possibility of occurance of money laundering activities. Further FATF has levied various regulations to prevent money laundering activities which has forced banks and financial institutions to adopt AML solutions to avoid the penalties framed by regulatory bodies. In case of non-compliace of such regulations the banks attract strict penalties due to which AML solutions are being adopted globally.

Segmental Outlook

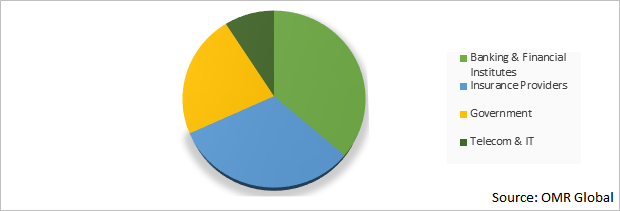

The global AML market is segmented based on the type, deployment type and end-use. Based on the type, the market is sub-segmented into transaction monitoring systems, currency transaction reporting systems, customer identity management systems, compliance management software. Based on the deployment type, the market is sub-segmented into the cloud, and on-premises. Based on the end-use, the market is sub-segmented into the banking & financial institutes, insurance providers, government. The banking & financial institutions are the major end-user of the AML solutions due to high risk of financial crimes associated with them.

Global AML Market Share by End-Use, 2020 (%)

The Banks & Financial Institutions Emerge as the Growing Segment in the Global AML Market.

The Banks & Financial Institutions segment is emerging as growing end-users of AML solutions due to higher risk of financial fraud in BFSI industry . There are various regulations imposed by government and regulatory authorities. In case of violation and non-compliance of regulations the penalties will be imposed on them due to which they adopt AML solutions. The amount of fine increases every year imposed for breach of regulations on various banks. For instance, in December 2021, Britain’s financial regulator imposed a fine of $85.2 million for failure in AML process. Further, Natwest was fined $360 million by British court for failure to prevent the laundering of nearly $543 million. Owing to such strict regulations banks & financial institutions are accepting the AML solutions and contributing towards the growth of AML market.

Regional Outlooks

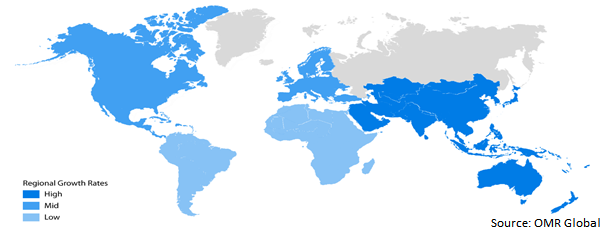

The global AML market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for particular region or country level as per the requirement.

Global AML Market Growth, by Region 2021-2027

The North America Region Accounted the Major Share in the Global AML Market.

The North America region accounted for major share in global AML market due to high internet penetration in the US and Canada, and presence of various market players in that region. The adoption of various strategies among AML solution providers to implement AI is further fueling the demand for AML in that region. For instance, in September 2021, NICE Actimize and its AI based AML Essentials Sloutions, had been selected by fintech company KOHO Financial Inc. based in Toronto, Canada to support its digital platform. With this collaboration KOHO expanded its financial crime operations with NICE Actimize AML Essentials Solutions including Suspecious Activity Monitoring (SAM) and KYC capabilities to meet the guidelines issued by the Financial Transactions and Reports Analysis Center of Canada (FINTRAC).

Market Players Outlook

The major companies serving the global AML market include ACI Worldwide Inc., BAE Systems Plc, Experian Information Solutions, Inc., Fair Isaac Corp., Fenergo Ltd., Fiserv Inc., IBM Corp., Larsen & Toubro Infotech Ltd., Merlon Intelligence, Inc., Ml Verify Ltd. and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in June 2020, FIS partnered with FICO® to help North American financial institutions in protecting from sophisticated money laundrers and other financial crimes. The FISTM AML Compliance Manager integrated with FICO ® Falcon ®X technology to provide financial institutions with a unified platform for AML risk and compliance. The new solution, based on AI & ML supports bank investigators in detecting suspicious activities owing to which banks and other institutions are expected to adopt this technology in coming years.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global AML market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global AML Market

• Recovery Scenario of Global AML Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global AML Market by Type

4.1.1. Transaction Monitoring Systems

4.1.2. Currency Transaction Reporting Systems

4.1.3. Customer Identity Management Systems

4.1.4. Compliance Management Software

4.1.5. Others

4.2. Global AML Market by Deployment Type

4.2.1. Cloud

4.2.2. On-Premises

4.3. Global AML Market by End-Use

4.3.1. Banking & Financial Institutes

4.3.2. Insurance Providers

4.3.3. Government

4.3.4. Telecom & IT

4.3.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aci Worldwide Inc.

6.2. Bae Systems Plc

6.3. Experian Information Solutions, Inc.

6.4. Fair Isaac Corp.

6.5. Fenergo Ltd.

6.6. Fiserv Inc.

6.7. Ibm Corp.

6.8. Larsen & Toubro Infotech Ltd.

6.9. Merlon Intelligence, Inc.

6.10. Ml Verify Ltd.

6.11. Nelito Systems Ltd.

6.12. Nice Ltd.

6.13. Oracle Corp.

6.14. Profile Software S.A

6.15. Quantexa Ltd.

6.16. Sas Institute Inc.

6.17. Tata Consultancy Services Ltd.

6.18. Temenos AG

6.19. Transunion

6.20. Verafin Inc.

6.21. Wolters Kluwer Nv

6.22. Workfusion, Inc.

1. GLOBAL AML MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

2. GLOBAL AML IN TRANSACTION MONITORING SYSTEMS IN AML MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

3. GLOBAL AML IN CURRENCY TRANSACTION REPORTING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL AML IN CUSTOMER IDENTITY MANAGEMENT SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL AML IN COMPLIANCE MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL AML IN OTHER COMPLIANCE MANAGEMENT SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL AML MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2020-2027 ($ MILLION)

8. GLOBAL CLOUD AML MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL ON-PREMISES AML MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL AML MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

11. GLOBAL AML FOR BANKING & FINANCIAL INSTITUTES MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL AML FOR INSURANCE PROVIDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL AML FOR GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL AML FOR Telecom & IT MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

15.

16. GLOBAL AML MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

17. NORTH AMERICAN AML MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

18. NORTH AMERICAN AML MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

19. NORTH AMERICAN AML MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2020-2027 ($ MILLION)

20. NORTH AMERICAN AML MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

21. EUROPEAN AML MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

22. EUROPEAN AML MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

23. EUROPEAN AML MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2020-2027 ($ MILLION)

24. EUROPEAN AML MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

25. ASIA-PACIFIC AML MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

26. ASIA-PACIFIC AML MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

27. ASIA-PACIFIC AML MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2020-2027 ($ MILLION)

28. ASIA-PACIFIC AML MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

29. REST OF THE WORLD AML MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

30. REST OF THE WORLD AML MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

31. REST OF THE WORLD AML MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT TYPE, 2020-2027 ($ MILLION)

32. REST OF THE WORLD AML MARKET RESEARCH AND ANALYSIS BY END-USE, 2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AML MARKET, 2020-2027 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AML MARKET BY SEGMENT, 2020-2027 ($ MILLION)

3. RECOVERY OF GLOBAL AML MARKET, 2021-2027 (%)

4. GLOBAL AML MARKET SHARE BY TYPE, 2020 VS 2027 (%)

5. GLOBAL AML IN TRANSACTION MONITORING SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

6. GLOBAL AML IN CURRENCY TRANSACTION REPORTING SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL AML IN CUSTOMER IDENTITY MANAGEMENT SYSTEMS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

8. GLOBAL AML IN COMPLIANCE MANAGEMENT SOFTWARE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

9. GLOBAL AML IN OTHER COMPLIANCE MANAGEMENT SOFTWARE MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

10. GLOBAL AML MARKET SHARE BY DEPLOYMENT TYPE, 2020 VS 2027 (%)

11. GLOBAL CLOUD AML MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

12. GLOBAL ON-PREMISES AML MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

13. GLOBAL AML MARKET SHARE BY END-USE, 2020 VS 2027 (%)

14. GLOBAL AML FOR BANKING & FINANCIAL INSTITUTES MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

15. GLOBAL AML FOR INSURANCE PROVIDERS MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

16. GLOBAL AML FOR GOVERNMENT MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

17. GLOBAL AML FOR MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

18. GLOBAL AML MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

19. US AML MARKET SIZE, 2020-2027 ($ MILLION)

20. CANADA AML MARKET SIZE, 2020-2027 ($ MILLION)

21. UK AML MARKET SIZE, 2020-2027 ($ MILLION)

22. FRANCE AML MARKET SIZE, 2020-2027 ($ MILLION)

23. GERMANY AML MARKET SIZE, 2020-2027 ($ MILLION)

24. ITALY AML MARKET SIZE, 2020-2027 ($ MILLION)

25. SPAIN AML MARKET SIZE, 2020-2027 ($ MILLION)

26. REST OF EUROPE AML MARKET SIZE, 2020-2027 ($ MILLION)

27. INDIA AML MARKET SIZE, 2020-2027 ($ MILLION)

28. CHINA AML MARKET SIZE, 2020-2027 ($ MILLION)

29. JAPAN AML MARKET SIZE, 2020-2027 ($ MILLION)

30. SOUTH KOREA AML MARKET SIZE, 2020-2027 ($ MILLION)

31. REST OF ASIA-PACIFIC AML MARKET SIZE, 2020-2027 ($ MILLION)

32. REST OF THE WORLD AML MARKET SIZE, 2020-2027 ($ MILLION)