Anticoagulants Market

Global Anticoagulants Market Size, Share & Trends Analysis Report, By Type (Novel Oral Anticoagulants, Vitamin K Antagonist, and Heparin and Low Molecular Weight Heparin), By Application (Pulmonary Embolism, Atrial Fibrillation/Myocardial Infarction (Heart Attack), Deep Vein Thrombosis, and Others) and Forecast Period, 2020-2026 Update Available - Forecast 2025-2031

The global anticoagulants market is estimated to grow at a CAGR of 7.2% during the forecast period. The major factors contributing to the market growth include the growing incidences of cardiovascular disease (CVD) and the increasing adoption of novel oral anticoagulants (NOACs). An increasing prevalence of CVD has been reported owing to sedentary lifestyle habits. As per the American Heart Association, in 2017, it was estimated that 126.5 million people were suffering from ischemic heart disease globally. Additionally, the global prevalence of stroke was 104.2 million people in 2017. This, in turn, is resulting in an increasing demand for anticoagulants that are used to prevent the blood from clotting as rapidly or as potentially as normal. Anticoagulants are also known as blood thinners.

These medications are used for the treatment and prevention of blood clots that may occur in the blood vessels. Blood clots can block blood vessels (a vein or an artery). A blocked artery inhibits oxygen and blood from getting to a part of the body (for instance, to a part of the lungs, heart, or brain). This, in turn, may cause severe problems including a heart attack or stroke. A blood clot in a large vein, including a deep vein thrombosis (DVT), can cause severe problems. Therefore, anticoagulants are utilized for the prevention of blood clots and atrial fibrillation (AF) is the most common condition in which blood clots are formed.

Anticoagulation therapy is used to prevent strokes and warfarin is used as the most commonly utilized vitamin K antagonist (VKA) to reduce the risk of stroke in certain AF patients with risk factors. Earlier, warfarin was significantly used, however, it has normally been underutilized coupled with the need for frequent monitoring and its narrow risk-benefit interval. Therefore, a range of non-vitamin-K antagonist oral anticoagulants (NOACs) has been gaining significance as it has demonstrated tremendous safety and efficacy without the requirement of subsequent dose adjustment and frequent monitoring.

Market Segmentation

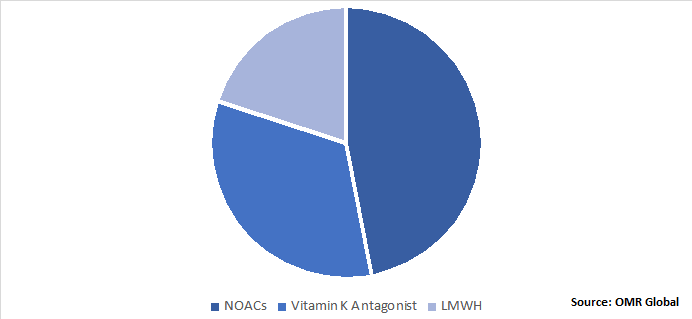

The market is segmented based on type and application. Based on type, the market is classified into novel oral anticoagulants (NOACs), vitamin k antagonist, and heparin, and low molecular weight heparin (LMWH). Based on application, the market is classified into a pulmonary embolism, atrial fibrillation/myocardial infarction (heart attack), deep vein thrombosis, and others.

NOACs is Anticipated to Hold Significant Share in the Market

In 2019, NOACs are anticipated to witness a potential share in the market. NOACs is an effective alternative to warfarin for high-risk patients (which comprises those with a history of stroke) who have AF. NOACs may be safer for patients as there is a low risk of bleeding, and these anticoagulants may also be highly effective for the prevention of blood clots compared to warfarin. To minimize the risk of stroke in appropriate AF patients, NOACs are now the ideal suggested drug class compared to warfarin, except for patients suffering from moderate to severe mitral stenosis or an artificial heart valve. NOACs comprises edoxaban, dabigatran, apixaban, and rivaroxaban.

Global Anticoagulants Market Share by Type, 2019 (%)

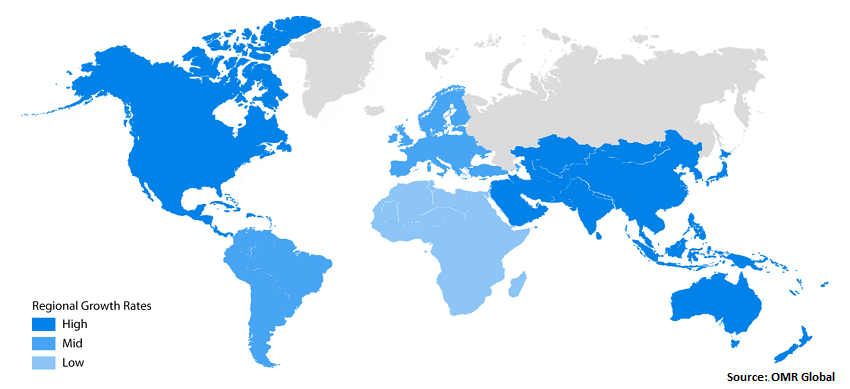

Regional Outlook

Geographically, in 2019, North America held the largest share in the market owing to the increasing prevalence of heart diseases and significant awareness regarding the condition in the region. As per the Centers for Disease Control and Prevention (CDC), in the US, someone has a heart attack every 40 seconds. This, in turn, is driving the demand for anticoagulants which shows effectiveness in the treatment and prevention of venous thrombosis and pulmonary emboli. Vitamin K antagonists are one of the oral anticoagulants demonstrated for long-term therapy of patients suffering from CHD, primarily after an acute coronary syndrome (ACS).

Global Anticoagulants Market Growth, by Region 2020-2026

Market Players Outlook

Some prominent players in the market include Johnson & Johnson Services, Inc., Bristol Myers Squibb Co., Pfizer Inc., Daiichi Sankyo Co. Ltd., and Boehringer Ingelheim GmbH. The market players are using some key strategies to increase their market share. For instance, in December 2019, the US FDA approved two applications for the first generics of Eliquis (apixaban) tablets which are intended to minimize the risk of systemic embolism and stroke in patients with nonvalvular atrial fibrillation. It is also intended for the prophylaxis of deep vein thrombosis (DVT), which may result in pulmonary embolism (PE), in patients who have experienced hip or knee replacement surgery. Moreover, this drug is intended to treat DVT and PE and decrease the risk of recurrent DVT and PE following initial therapy. The US FDA permitted approval of the generic apixaban applications to Mylan Pharmaceuticals Inc. and Micro Labs Limited.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global anticoagulants market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules and Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Johnson & Johnson Services, Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bristol Myers Squibb, Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Pfizer, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Daiichi Sankyo Company, Ltd.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Boehringer Ingelheim GmbH

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Anticoagulants Market by Type

5.1.1. Novel Oral Anticoagulants (NOACs)

5.1.2. Vitamin K Antagonist

5.1.3. Heparin and Low Molecular Weight Heparin (LMWH)

5.2. Global Anticoagulants Market by Application

5.2.1. Pulmonary Embolism

5.2.2. Atrial Fibrillation/Myocardial Infarction (Heart Attack)

5.2.3. Deep Vein Thrombosis (DVT)

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. AstraZeneca plc

7.3. Baxter International, Inc.

7.4. Bayer AG

7.5. Boehringer Ingelheim GmbH

7.6. Bristol Myers Squibb Co.

7.7. Cipla, Ltd.

7.8. Daiichi Sankyo Company, Ltd.

7.9. Dr. Reddy's Laboratories, Ltd.

7.10. GlaxoSmithKline plc

7.11. Johnson & Johnson Services, Inc.

7.12. Lupin, Ltd.

7.13. Merck & Co., Inc.

7.14. Mylan N.V.

7.15. Novartis International AG

7.16. Pfizer, Inc.

7.17. Portola Pharmaceuticals, Inc.

7.18. Sanofi S.A.

7.19. Sun Pharmaceutical Industries, Ltd.

1. GLOBAL ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

2. GLOBAL NOVEL ORAL ANTICOAGULANTS (NOACS) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL VITAMIN K ANTAGONIST MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL HEPARIN AND LOW MOLECULAR WEIGHT HEPARIN (LMWH) MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

6. GLOBAL ANTICOAGULANTS IN PULMONARY EMBOLISM TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL ANTICOAGULANTS IN ATRIAL FIBRILLATION/MYOCARDIAL INFARCTION(HEART ATTACK) TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL ANTICOAGULANTS IN DEEP VEIN THROMBOSIS TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL ANTICOAGULANTS IN OTHER TREATMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. EUROPEAN ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

16. EUROPEAN ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. REST OF THE WORLD ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL ANTICOAGULANTS MARKET SHARE BY TYPE, 2019 VS 2026 (%)

2. GLOBAL ANTICOAGULANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

3. GLOBAL ANTICOAGULANTS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD ANTICOAGULANTS MARKET SIZE, 2019-2026 ($ MILLION)