Anticoccidial Drugs Market

Global Anticoccidial Drugs Market Size, Share & Trends Analysis Report, By Drug Type (Antibiotic, Ionophore, Chemical Derivative), By Animal Type (Poultry, Swine, Cattle, and Companion Animal) and Forecast, 2020-2026 Update Available - Forecast 2025-2035

The anticoccidial drugs market is expected to show a modest growth rate at a CAGR of around 4% during the forecast period 2020-2026. Coccidiosis is one of the most common diseases in the chicken. It is an intestinal disease that is caused due to the parasitic organism attaching itself to a chicken’s intestinal lining due to which chicken is not able to absorb the required nutrients through intestines. Besides, it is also a prevalent disease in other animals including, cattle, swine, and companion animals. The disease is treatable most of the time through anticoccidial drugs if diagnosed at an early stage. Route of administration of the drug is through the water supply of chicken and if not possible, it is fed orally.

High meat consumption, increasing awareness related to healthy food, rising disposable income, rising chances of zoonotic diseases (disease passing from animals & insect to people) are the key factors for the growth of the anticoccidial drugs industry across the globe. Factory farming for meat is on the rise globally where a large number of animals including cows, pigs, turkeys, goats, sheep, pigs, or chickens are kept together to increase productivity at the lowest possible cost. For instance, in the US, more than 95% of animals are produced in factory farming for maximizing agribusiness profit. These considerably raises the chances of spreading diseases among other fellow animals if one animal gets infected by a particular disease.

Moreover, government support to poultry and dairy farming and the development of a better supply chain of drugs are also considerable factors contributing to the growth of the market. However, an alternative solution such as vaccines for coccidiosis is also available in the European region which is a restraining factor for the drug market growth. In some regions, herbal medicines are also widely used for the treatment of coccidiosis which is restraining the market growth.

Market Segmentation

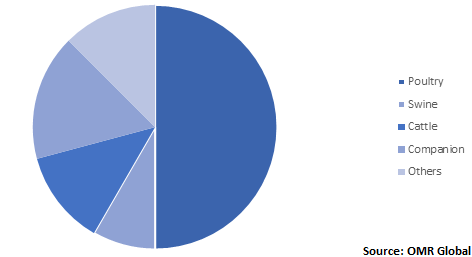

The global anticoccidial drugs market is segmented based on drug type and dosage type. By drug type, the market is segmented into antibiotics, ionophore, and chemical derivative. Ionophores is expected to hold the major market share with a lucrative growth rate during the forecast period. Amprolium has emerged as a common anticoccidial ionophore. By animal type, the market is segmented into poultry, swine, cattle, companion animal, and other. Poultry will hold the largest market share during the forecast period. Companion animals will also hold a considerable market share during the forecast period.

Global Anticoccidial Drugs Market Share by Animal Type, 2019 (%)

Regional Outlook

On the basis of geography, the global anticoccidial drugs market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (RoW). North America is anticipated to hold a major market share during the forecast period. Cohesive government regulation, better healthcare facilities for animals, high per capita meat consumption, presence of most of the major market players are the major factor for the considerable market share of the region.

Asia-Pacific is expected to have significant market growth during the forecast period. Rising penetration of private veterinary hospitals in emerging economies, government support as awareness programs, development of supply chain of drugs, and considerable growth in the meat consumption along with the awareness toward healthy food are some of the major factors for the growth of the market in the region. Moreover, significant activities can be witnessed in the near future in Europe. As in October 2018, the European Parliament restricted the usage of antibiotics in healthy livestock. The legislation will become law in 2022.

Global Anticoccidial Drugs Market Growth, by Region 2020-2026

Market Players Outlook

The anticoccidial market is a fragmented market as generic versions of the drugs are also available in the global market. Some of the key players operating in the market include Zoetis, Inc., Bayer AG, BOEHRINGER Ingelheim International GmbH, Ceva Santé Animale, Huvepharma EOOD, Merck & Co., Inc., Venkateshwara Hatcheries Pvt. Ltd., Vetoquinol S.A. and Virbac S.A.The companies are adopting growth strategies including mergers & acquisitions, product launches, and partnerships & collaborations to gain a competitive edge in the market. For instance, in February 2020, Elanco Animal Health Inc. sold its global rights of Vecoxan for $55 million Merck Animal Health. Vecoxan is used to prevent and treat coccidiosis in calves and lambs. The aim of the disinvestment is to reduce the debt of the company.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Anticoccidial Drugs market.

- Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdowns

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Merck & Co., Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Zoetis, Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Bayer AG

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Vetoquinol S.A.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Anticoccidial Drugs Market by Drug Type

5.1.1. Antibiotic

5.1.2. Ionophore

5.1.3. Chemical Derivative

5.2. Global Anticoccidial Drugs Market by Animal Type

5.2.1. Poultry

5.2.2. Swine

5.2.3. Cattle

5.2.4. Companion Animal

5.2.5. Other

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Bayer AG

7.2. Bioproperties Pty. Ltd.

7.3. BOEHRINGER Ingelheim International GmbH

7.4. Ceva Santé Animale

7.5. Elanco Animal Health Inc.

7.6. Huvepharma EOOD

7.7. Impextraco N.V.

7.8. Kemin Industries, Inc.

7.9. Merck & Co., Inc.

7.10. Phibro Animal Health Corp.

7.11. Qilu Animal Health Products Co., Ltd.

7.12. Schering-Plough Corp.

7.13. Venkateshwara Hatcheries Pvt. Ltd.

7.14. Vetoquinol S.A.

7.15. Virbac S.A.

7.16. Zoetis, Inc.

1. GLOBAL ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2019-2026 ($ MILLION)

2. GLOBAL ANTIBIOTIC MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

3. GLOBAL IONOPHORE MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

4. GLOBAL CHEMICAL DERIVATIVE MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

5. GLOBAL ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

6. GLOBAL POULTRY MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

7. GLOBAL SWINE MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

8. GLOBAL CATTLE MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

9. GLOBAL COMPANION ANIMAL MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

10. GLOBAL OTHER ANIMAL MARKET RESEARCH AND ANALYSIS, 2019-2026 ($ MILLION)

11. NORTH AMERICAN ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2019-2026 ($ MILLION)

13. NORTH AMERICAN ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

14. EUROPEAN ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2019-2026 ($ MILLION)

16. EUROPEAN ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

17. ASIA PACIFIC ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA PACIFIC ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2019-2026 ($ MILLION)

19. ASIA PACIFIC ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

20. REST OF THE WORLD ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY DRUG TYPE, 2019-2026 ($ MILLION)

21. REST OF THE WORLD ANTICOCCIDIAL DRUGS MARKET RESEARCH AND ANALYSIS BY ANIMAL TYPE, 2019-2026 ($ MILLION)

1. GLOBAL ANTICOCCIDIAL DRUGS MARKET SHARE BY DRUG TYPE, 2019 VS 2026 (%)

2. GLOBAL ANTICOCCIDIAL DRUGS MARKET SHARE BY ANIMAL TYPE, 2019 VS 2026 (%)

3. GLOBAL ANTICOCCIDIAL DRUGS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

11. REST OF EUROPE ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC ANTICOCCIDIAL DRUGS MARKET SIZE, 2019-2026 ($ MILLION)