Antinuclear Antibody (ANA) Test Market

Global Antinuclear Antibody (ANA) Test Market Size, Share & Trends Analysis Report by Product Type (Assay Kits & Reagents, Antinuclear Antibody Test System, and Antinuclear Antibody Test Software), by Test Type (Indirect Immunofluorescence, Enzyme-Linked Immunosorbent Assay (ELISA), and Multiplex Testing), by Disease Type (Systemic Lupus Erythematosus, Sjogren’s Syndrome, Rheumatoid Arthritis, Scleroderma, and Others), and by End-User (Hospitals and Clinical Laboratories) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The global ANA test market is anticipated to grow significantly at a CAGR of 12.3% during the forecast period. Unusual antibodies, such as those generated by bacteria and viruses, attack the cell's healthy proteins. These are most commonly found in people whose immune systems inflame their body tissues. Antinuclear antibody testing is used to check for autoimmune diseases that affect the body's tissues and organs. Some of the symptoms related to autoimmune diseases are swelling, rashes, fatigue, and arthritis. Moreover, antinuclear antibodies can damage muscles, skin, joints, and other parts of the body. The advent of automation in the laboratory process, as well as the rising prevalence of autoimmune disorders such as lupus and diabetes type 1 across the globe, are major factors driving the global antinuclear antibody test market.

Moreover, the market's growth is being fueled by a growing population's interest in health insurance. Apart from it, the lack of regulatory policies for the approval of drugs and the lack of skilled medical professionals are the factors that are restraining the manufacturing of test kits. The high cost of antinuclear antibody tests restrains its adoption in middle-income groups. However, the increasing demand for advanced test kits and the increase in healthcare expenditure in the emerging economies are expected to create opportunities for the market during the forecast period.

Impact of COVID-19 Pandemic on Global ANA Test Market

The global ANA test market is hit by the outbreak of COVID-19 in December 2019. The excruciating need to screen and test large numbers of patients for potential SARS-Cov-2 infection is the most common problem for governments in all COVID-19-affected countries. As a result, the majority of them are experiencing severe shortages of testing kits to screen for the virus. Diagnostics virology companies are under a lot of pressure to have accurate testing kits, and laboratories in a lot of countries are clamoring for in-vitro or point-of-care testing capabilities. The market will witness “V” shape recovery in near future owing to the restart of key industries in major economies.

Segmental Outlook

The global ANA market can be segmented based on product type, test type, disease type, and end-users. Based on product type, the market is classified into assay kits & reagents, antinuclear antibody test systems, and antinuclear antibody test software. Among the type of products, the assay kits & reagents segment hold the largest market share in the antinuclear antibody test market due to the increasing number of autoimmune diseases such as diabetes type-1 and the rising number of reagent rental agreements across the globe. Based on test type, the market is bifurcated into indirect immunofluorescence, enzyme-linked immunosorbent assay (ELISA), and multiplex testing. Based on disease type, the market is segmented into systemic lupus erythematosus, Sjögren’s syndrome, rheumatoid arthritis, scleroderma, and others (Addison disease and pulmonary fibrosis). Based on end-users, the market is diversified into hospitals and clinical laboratories.

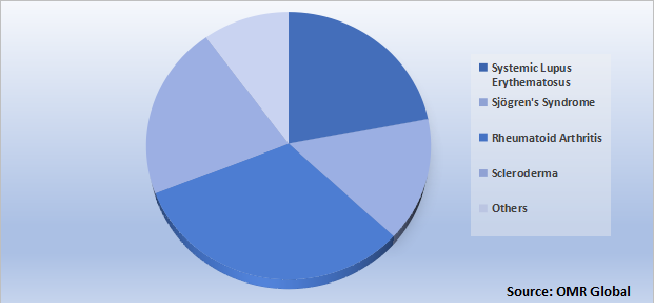

Global ANA Test Market Share by Disease Type, 2021 (%)

Rheumatoid Arthritis Segment holds a significant share in the Global ANA Test Market

Among the disease type for the global ANA test market, the rheumatoid arthritis segment held the highest share in 2020 and is also anticipated to grow during the forecast period. This is majorly attributed due to the increasing incidence of rheumatoid arthritis. For instance, According to the Centers for Disease Control and Prevention (CDC), about 54 million people in the US had arthritis in 2018, accounting for about 23% of the population. Around 78 million (26 %) adults in the US aged 18 and above will have doctor-diagnosed arthritis by 2040, according to estimates. The two common forms of arthritis are rheumatoid arthritis and osteoarthritis.

Regional Outlooks

The global ANA test market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, and Others), and the Rest of the World (the Middle East and Africa, and Latin America). North America has been predicted to dominate the global ANA test market, followed by Europe. The growth is mainly attributed due to the rising geriatric population and an increasing number of the population covered by medical insurance. High reimbursement policies by the government in the healthcare sector and the sedentary lifestyle of the population are significantly contributing towards the market growth in the region. For instance, according to the National Health Expenditure Accounts (NHEA), in the US in health care spending rose to 4.6% in 2019, which is around $11,852 per person.

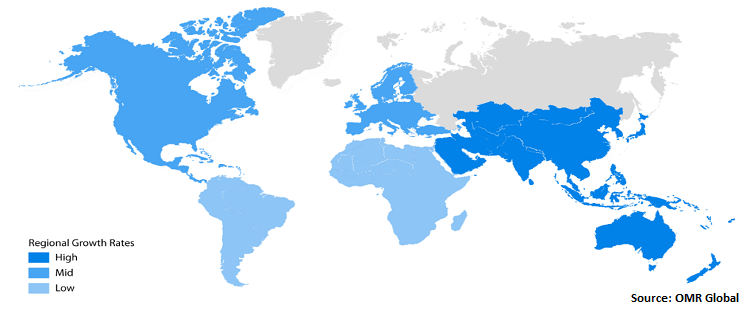

Global ANA Test Market Growth, by Region 2022-2028

Asia-Pacific is projected to have considerable growth in the Global ANA Test market

Asia-Pacific is anticipated to exhibit the fastest growth in the global ANA test market. In the region, China and India are showing rapid progress. This is due to rising awareness among the population regarding the use of antinuclear antibody tests. The other factors such as unmet clinical needs and the need for better diagnosis are also fueling the growth of the market during the forecast period. Unmet needs for autoimmune disease diagnostics in countries like India are anticipated to boost the regional demand during the forecast period.

Market Players Outlook

The key players of the global ANA test market include Abbott Laboratories, ERBA Diagnostics, Inc., Trinity Biotech plc, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., and Antibodies, Inc., among others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in May 2020, Abbott Laboratories announced that it has received the US FDA Emergency Use Authorization (EUA) approval for the SARS-CoV-2 IgG lab-based serology blood test named Alinit I system. This antibody testing has supported researchers learn more about the virus, such as how long antibodies linger in the body and how many people have been infected.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global ANA test market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

- Current Industry Analysis and Growth Potential Outlook

- Impact of COVID-19 on the Global ANA TestIndustry

- Recovery Scenario of Global ANA TestIndustry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global ANA Test Market by Product Type

5.1.1. Assay Kits & Reagents

5.1.2. Antinuclear Antibody Test System

5.1.3. Antinuclear Antibody Test Software

5.2. Global ANA Test Market by Test Type

5.2.1. Indirect Immunofluorescence

5.2.2. Enzyme-Linked Immunosorbent Assay (ELISA)

5.2.3. Multiplex Testing

5.3. Global ANA Test Market by Disease Type

5.3.1. Systemic Lupus Erythematosus

5.3.2. Sjögren’s Syndrome

5.3.3. Rheumatoid Arthritis

5.3.4. Scleroderma

5.3.5. Others (Addison Disease And Pulmonary Fibrosis, Polymyositis)

5.4. Global ANA Test Market by End-User

5.4.1. Hospitals

5.4.2. Clinical Laboratories

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korea

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories

7.2. Abcam Plc.

7.3. AESKU.GROUP GmbH

7.4. American Laboratory Products Company (ALPCO)

7.5. AMS S.r.l

7.6. Antibodies Inc.

7.7. Aviva Systems Biology Corp.

7.8. BIOCOM Africa (Biotech)

7.9. Bio-Rad Laboratories, Inc.

7.10. ELITechGroup

7.11. Erba Diagnostics Mannheim GmbH

7.12. EUROIMMUN MedizinischeLabordiagnostika AG

7.13. Hycor Biomedical Inc.

7.14. Immuno Concepts NA Ltd.

7.15. Inova Diagnostics, Inc.

7.16. MBL International Corp.

7.17. Merck KGaA

7.18. Meridian Bioscience, Inc.

7.19. Quest Diagnostics Inc.

7.20. Thermo Fisher Scientific Inc.

7.21. TrueHealthLabs.com.

7.22. Wiener Laboratorios SAIC

7.23. ZEUS Scientific, Inc.

1.GLOBAL ANA TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

2.GLOBAL ASSAY KITS & REAGENTS IN ANA TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.GLOBAL ANTINUCLEAR ANTIBODY TEST SYSTEM IN ANA TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.GLOBAL ANTINUCLEAR ANTIBODY TEST SOFTWARE IN ANA TEST MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.GLOBAL ANA TEST MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2021-2028 ($ MILLION)

6.GLOBAL ANA TEST BY INDIRECT IMMUNOFLUORESCENCE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7.GLOBAL ANA TEST BY ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA) MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8.GLOBAL ANA TEST BY MULTIPLEX TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9.GLOBAL ANA TEST MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2021-2028 ($ MILLION)

10.GLOBAL ANA TEST FOR SYSTEMIC LUPUS ERYTHEMATOSUS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11.GLOBAL ANA TEST FOR SJÖGREN’S SYNDROME MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12.GLOBAL ANA TEST FOR RHEUMATOID ARTHRITIS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13.GLOBAL ANA TEST FOR SCLERODERMA MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14.GLOBAL ANA TEST FOR OTHER DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15.GLOBAL ANA TEST MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

16.GLOBAL ANA TEST FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

17.GLOBAL ANA TEST FOR CLINICAL LABORATORIES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

18.GLOBAL ANA TEST MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

19.NORTH AMERICAN ANA TEST MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20.NORTH AMERICAN ANA TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

21.NORTH AMERICAN ANA TEST MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2021-2028 ($ MILLION)

22.NORTH AMERICAN ANA TEST MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2021-2028 ($ MILLION)

23.NORTH AMERICAN ANA TEST MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

24.EUROPEAN ANA TEST MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25.EUROPEAN ANA TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

26.EUROPEAN ANA TEST MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2021-2028 ($ MILLION)

27.EUROPEAN ANA TEST MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2021-2028 ($ MILLION)

28.EUROPEAN ANA TEST MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

29.ASIA-PACIFIC ANA TEST MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

30.ASIA-PACIFIC ANA TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

31.ASIA-PACIFIC ANA TEST MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2021-2028 ($ MILLION)

32.ASIA-PACIFIC ANA TEST MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2021-2028 ($ MILLION)

33.ASIA-PACIFIC ANA TEST MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

34.REST OF THE WORLD ANA TEST MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

35.REST OF THE WORLD ANA TEST MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

36.REST OF THE WORLD ANA TEST MARKET RESEARCH AND ANALYSIS BY TEST TYPE, 2021-2028 ($ MILLION)

37.REST OF THE WORLD ANA TEST MARKET RESEARCH AND ANALYSIS BY DISEASE TYPE, 2021-2028 ($ MILLION)

38.REST OF THE WORLD ANA TEST MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON GLOBAL ANA TEST MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON GLOBAL ANA TEST MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF GLOBAL ANA TEST MARKET, 2022-2028 (%)

4.GLOBAL ANA TEST MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

5.GLOBAL ASSAY KITS & REAGENTS IN ANA TEST MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6.GLOBAL ANTINUCLEAR ANTIBODY TEST SYSTEM IN ANA TEST MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.GLOBAL ANTINUCLEAR ANTIBODY TEST SOFTWARE IN ANA TEST MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8.GLOBAL ANA TEST MARKET SHARE BY TEST TYPE, 2021 VS 2028 (%)

9.GLOBAL ANA TEST BY INDIRECT IMMUNOFLUORESCENCE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10.GLOBAL ANA TEST BY ENZYME-LINKED IMMUNOSORBENT ASSAY (ELISA) MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11.GLOBAL ANA TEST BY MULTIPLEX TESTING MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12.GLOBAL ANA TEST MARKET SHARE BY DISEASE TYPE, 2021 VS 2028 (%)

13.GLOBAL ANA TEST FOR SYSTEMIC LUPUS ERYTHEMATOSUS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14.GLOBAL ANA TEST FOR SJÖGREN’S SYNDROME MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15.GLOBAL ANA TEST FOR RHEUMATOID ARTHRITIS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16.GLOBAL ANA TEST FOR SCLERODERMA MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17.GLOBAL ANA TEST FOR OTHER DISEASE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18.GLOBAL ANA TEST MARKET SHARE BY END-USER, 2021 VS 2028 (%)

19.GLOBAL ANA TEST FOR HOSPITALS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

20.GLOBAL ANA TEST FOR CLINICAL LABORATORIES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

21.GLOBAL ANA TEST MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

22.US ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

23.CANADA ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

24.UK ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

25.FRANCE ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

26.GERMANY ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

27.ITALY ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

28.SPAIN ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

29.REST OF EUROPE ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

30.INDIA ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

31.CHINA ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

32.JAPAN ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

33.SOUTH KOREA ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

34.REST OF ASIA-PACIFIC ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)

35.REST OF THE WORLD ANA TEST MARKET SIZE, 2021-2028 ($ MILLION)