Antiseptics and Disinfectants Market

Global Antiseptics and Disinfectants Market Size, Share & Trends Analysis Report, by Type (Enzyme, Chlorine Compounds, Alcohols & Aldehyde Products, Quaternary Ammonium Compounds, and Others), by Application (Enzymatic Cleaners, Surface Disinfectants, and Medical Device Disinfectants), and by End-User (Clinic, Hospitals, and Others), Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global antiseptics and disinfectants market is anticipated to grow at a significant CAGR of 9.5% during the forecast period. The growing demand for cleaning, deodorizing, and disinfecting in various public places such as educational institutes, commercial buildings, hotels & restaurants, and hospitals among others coupled with it the demand for the antiseptics and disinfectants is growing. Additionally, government by approving and clearing the newly developed antiseptics and disinfectants products by companies to maintain clean environment, plays a major role anf this in turn driving market grwoth . For instance, in November 2020, 3M Co., a product TB Quat Disinfectant Ready-to-Use Cleaner was approved by the U.S. Environmental Protection Agency (EPA). The product kills claims against SARS-CoV-2 and it is third-party laboratory testing of 3M's TB Quat Disinfectant Ready-to-Use Cleaner is effective within 60 seconds of contact time on hard, non-porous surfaces. However, the high quantity of chemicals used in antiseptics and disinfectants that causes side effects factors that hampers the market growth.

Impact of COVID-19 Pandemic on Global Antiseptics and Disinfectants Market

Due to the rise in COVID-19 cases, the antiseptics and disinfectants market witnessed positive growth as the population across the globe was focusedonmaintaining personal and community hygiene to remain safe. Additionally, during the COVID-19 pandemic, hospital admissionsalso increased, which raised the adoption and demand for medical disposables along with the requirement of cleaning, deodorizing, and disinfecting healthcare facilities and others. The market is also been driven due to thevarious initiatives rolled out by individuals, government, and other organizations to stay healthy and safe. For instance, in 2020, the German Federal Statistical Office reported a hike of 80% in the sale and demand for cleaning and hygiene products solely in Germany.

Several key players operating in the market were also rapidly opteing for natural and organic disinfectants and has launched new products in the market. For instance, in November 2020, Procter & Gamble launched Microban 24 spray in the US mass market after the spike in COVID-19 cases. The new bottled disinfectant kills 99%.

Segmental Outlook

The global antiseptics and disinfectants market is segmented based on type, application, and end-user. Based on type, the market is segmented into enzymes, chlorine compounds, alcohols & aldehyde products, quaternary ammonium compounds, and others. Based on the application, the market is divided into enzymatic cleaners, surface disinfectants, and medical device disinfectants. Based on the end-user, the market is sub-segmented into clinics, hospitals,and others. Among the application, the medical device disinfectants sub-segment is expected to hold a prominent share in the market,as itis used in the cleaning ofsurgical units and endoscopes. Furthermore, the rising number of surgeries performed across the globe is increasing the demand for this product and all these factors are contributing to the market growth.

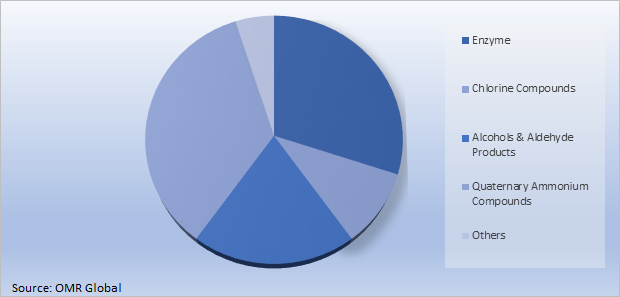

Global Antiseptics and Disinfectants Market Share by Type, 2021 (%)

The Quaternary Ammonium Compounds Segment is Expected to Hold a Dominate the Global Antiseptics and Disinfectants Market

Among the type segment, the quaternary ammonium compounds sub-segment is expected to hold a prominent share in the market, due to the rising use of surface disinfectants in hospitals, laboratories, and clinics to control the spread of healthcare-associated infections. These compounds are also used forreprocessing and disinfecting medical equipment and devices that are used multiple times and come in contact with skin.Furthermore, due to the increased number of COVID-19 cases, the patient pool across the globe was administered in hospitals that in turn has increased the demand for quaternary ammonium compounds and owing to it the segmenta is holding prominent share in the market. For instance, in 2020, the US Environmental Protection Agency (EPA) recommended quaternary ammonium compounds which are active ingredients in over 200 disinfectants, for use to inactivate the SARS-CoV-2 (COVID-19). All these factors and benefits associated with this compound are boosting segmental growth.

Regional Outlooks

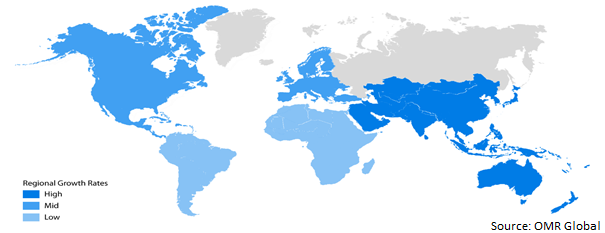

The global antiseptics and disinfectants market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East &Africa, and Latin America. North America region is estimated to hold prominent share in the global antiseptics and disinfectants market owing to the well-established healthcare infrastructure and increasing patient pool with various health issues in the region.

Global Antiseptics and Disinfectants Market Growth, by Region 2022-2028

The Asia-Pacific Regionis Fastest Growing in the Global Antiseptics and Disinfectants Market

The Asia-Pacific is anticipated to be the fastest-growing region in the market owing to the growing prevalence of various bacteria and virus infectious diseases such as healthcare-based infections, food poisoning, cholera, and typhoid fever and among others diseases in the region are anticipated to increase the demand for antiseptics and disinfectants market.For instance, as per the datat provided by Center for Disease Dynamics, Economics & Policy (CDDEP), e second highest incidence of malaria, amongst all WHO regions, occurs in Asia Pacifc, and India bears the third-highest proportion of malaria cases globally. Drug resistant infections cause 58,000 deaths in newborns every year, in India. Furthermore, the government of several countries such as India, and othersare inclined towards the adoption of variousinitiatives such as campaigns and regulating guidelines to maintain health and hygiene and are working on several projects. For instance, in May 2021, the Karnataka state government launched a pilot project to spray organic disinfectant aerially by airplanes. Theproject was developed by Aerialworks Aero LLP.The spray disinfectants were sprayed was approved by all statutory bodies to reduce and eradicatethe COVID-19 cases.

Moreover, the strong presence of various companies in the regionthat are manufacturing and launching new products to fulfill the unmet demand and requirements of the customers is another major factor driving the growth of the market. For instance, in October 2021, OKI Electric Cable developed the OH Cable that is used with food manufacturing equipment and offers high resistance to cleaning fluids, disinfectants, and edible oils and fats.

Market Players Outlook

The competitive landscape includes key strategies of leading players, recent developments, and key company analysis. The major players that contribute to the growth of the market include 3M Co., Becton, Dickinson and Co., Cardinal Health, Inc., Johnson & Johnson Service Inc., Medline Industries, LP., Reckitt Benckiser group, STERIS Corp., The Clorox Co.,and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.For instance, in June 2021, Aniket and Namrata Parikh, based in Mumbai launched a multipurpose disinfectant tablet. This newly launched tablet named Sanitab is approved by EN14476-certified by the US-based Microchem Laboratory and FDA, it is also been recommended by WHO, UNICEF, the UK Department of Health, and the Ministry of Health and Family Welfare, India.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global antiseptics and disinfectants market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Antiseptics and Disinfectants Market

• Recovery Scenario of Global Antiseptics and Disinfectants Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Becton, Dickinson and Co.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Cardinal Health, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Reckitt Benckiser group

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. STERIS

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

3.8. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Antiseptics and Disinfectants Market byType

4.1.1. Enzyme

4.1.2. Chlorine Compounds

4.1.3. Alcohols & Aldehyde Products

4.1.4. Quaternary Ammonium Compounds

4.1.5. Others (Iodine compound, Biguanides, and Amides)

4.2. Global Antiseptics and Disinfectants Marketby Application

4.2.1. Enzymatic Cleaners

4.2.2. Surface Disinfectants

4.2.3. Medical Device Disinfectants

4.3. Global Antiseptics and Disinfectants Market by End-User

4.3.1. Clinic

4.3.2. Hospitals

4.3.3. Others

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. RAllumer Medical Pvt. Ltd.

6.2. Angelini S.p.A.

6.3. chemways Health Care

6.4. Diversey Ltd.

6.5. Ecolab Inc.

6.6. Fortive Corp.

6.7. Getinge AB

6.8. Johnson & Johnson Service Inc.,

6.9. Kemin Industries, Inc.

6.10. MEDLIFE

6.11. Medline Industries, LP.

6.12. Nanjing Golden Chemical Co., Ltd.

6.13. Novartis International AG

6.14. Nufarm Ltd.

6.15. Procter & Gamble

6.16. S.C. Johnson & Son Inc.

6.17. Sceptre Medical India Pvt. Ltd.

6.18. Spartan Chemical Company, Inc.

6.19. The Clorox Co.

6.20. Whiteley Pty Ltd.

1. GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

2. GLOBALENZYME ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBALCHLORINE COMPOUNDS ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

4. GLOBALALCOHOLS & ALDEHYDE PRODUCTS ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBALQUATERNARY AMMONIUM COMPOUNDS ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

6. GLOBALOTHERSANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($MILLION)

7. GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL ANTISEPTICS AND DISINFECTANTS IN ENZYMATIC CLEANERSMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL ANTISEPTICS AND DISINFECTANTS IN SURFACE DISINFECTANTSMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL ANTISEPTICS AND DISINFECTANTS IN MEDICAL DEVICE DISINFECTANTSMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

12. GLOBAL ANTISEPTICS AND DISINFECTANTS FOR HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL ANTISEPTICS AND DISINFECTANTS FOR CLINICMARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBALANTISEPTICS AND DISINFECTANTS FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

15. GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN ANTISEPTICS AND DISINFECTANTS MARKETRESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN ANTISEPTICS AND DISINFECTANTS MARKETRESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

18. NORTH AMERICAN ANTISEPTICS AND DISINFECTANTS MARKETRESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. NORTH AMERICAN ANTISEPTICS AND DISINFECTANTS MARKETRESEARCH AND ANALYSIS BYEND-USER, 2021-2028 ($ MILLION)

20. EUROPEAN ANTISEPTICS AND DISINFECTANTS MARKETRESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. EUROPEAN ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

22. EUROPEAN ANTISEPTICS AND DISINFECTANTS MARKETRESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

23. EUROPEAN ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BYEND-USER, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC ANTISEPTICS AND DISINFECTANTS MARKETRESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC ANTISEPTICS AND DISINFECTANTS MARKETRESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC ANTISEPTICS AND DISINFECTANTS MARKETRESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

27. ASIA-PACIFIC ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BYEND-USER, 2021-2028 ($ MILLION)

28. REST OF THE WORLD ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY TYPE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

31. REST OF THE WORLD ANTISEPTICS AND DISINFECTANTS MARKET RESEARCH AND ANALYSIS BYEND-USER,2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET, 2022-2028 (%)

4. GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET SHARE BY TYPE, 2021 VS 2028 (%)

5. GLOBAL ENZYME ANTISEPTICS AND DISINFECTANTS MARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL CHLORINE COMPOUNDSANTISEPTICS AND DISINFECTANTS MARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL ALCOHOLS & ALDEHYDE PRODUCTS ANTISEPTICS AND DISINFECTANTS MARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL QUATERNARY AMMONIUM COMPOUNDS ANTISEPTICS AND DISINFECTANTS MARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL OTHERS ANTISEPTICS AND DISINFECTANTS MARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL ANTISEPTICS AND DISINFECTANTS SHARE BY APPLICATION, 2021 VS 2028 (%)

11. GLOBAL ANTISEPTICS AND DISINFECTANTS IN ENZYMATIC CLEANERSMARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL ANTISEPTICS AND DISINFECTANTS IN SURFACE DISINFECTANTS MARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL ANTISEPTICS AND DISINFECTANTS IN MEDICAL DEVICE DISINFECTANTS MARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL ANTISEPTICS AND DISINFECTANTS MARKET SHARE BY END-USER, 2021 VS 2028 (%)

15. GLOBAL ANTISEPTICS AND DISINFECTANTS FOR CLINICMARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL ANTISEPTICS AND DISINFECTANTS FOR HOSPITALS MARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL ANTISEPTICS AND DISINFECTANTS FOR OTHERSMARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. GLOBAL ANTISEPTICS AND DISINFECTANTS MARKETSHARE BY GEOGRAPHY, 2021 VS 2028 (%)

19. US ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

20. CANADA ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

21. UK ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

22. FRANCE ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

23. GERMANY ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

24. ITALY ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

25. SPAIN ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF EUROPE ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

27. INDIA ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

28. CHINA ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

29. JAPAN ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

30. SOUTH KOREA ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

31. REST OF ASIA-PACIFIC ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)

32. REST OF THE WORLD ANTISEPTICS AND DISINFECTANTS MARKET SIZE, 2021-2028 ($ MILLION)