Antiviral Drug Market

Antiviral Drug Market Size, Share & Trends Analysis Report, by Application (Influenza (Flu) Antiviral Drugs, Hepatitis Antiviral Drugs, HIV Antiviral Drugs, Herpes Antiviral Drugs, and Others), By Type (Branded and Generic), and Forecast Period 2019-2025 Update Available - Forecast 2025-2031

The global antiviral drug market is estimated to grow at a CAGR of over 4% during the forecast period. Increasing viral infections such as Human immune deficiency virus (HIV), influenza A & B, hepatitis B & C, herpes, chickenpox, and papilloma, among others is the major driving factor of the global antiviral drug market. HIV is among one of the major viral infectious disease. According to the World Health Organization (WHO), HIV has claimed over 32 million lives and 37.9 million people are living with HIV in 2018. One of the chronic viral diseases is Hepatitis B. According to data published by WHO, in 2015, an estimated 257 million people were living with Hepatitis B, and it caused the death of over 8,87,000 people. Moreover, a large amount of investment in this sector is also driving the market. For instance, as per the new study by WHO, 67 low- and middle-income countries invest $6 billion per year for eliminating hepatitis.

Patients with viral disease, such as HIV, influenza A & B, hepatitis B & C, herpes and so on are treated with antiviral drugs. Antiviral drugs can be used for the treatment of a broad range of virus affected diseases. Much biological company’s R&D on drugs for the treatment of human immune deficiency virus (HIV) infection are in the pipeline. Moreover, recent pandemic Corona (COVID-19) infection treatment’s R&D on its drugs are also in the pipeline. However, high costs involved in R&D,demand for alternative medicines such as naturopathy and homeopathy, huge time effort in R&D and sometimes it slow success rate of treatment are some factors that are restraining market growth.

Moreover, competitive market and frequent fluctuation drug prices, lack of safety awareness about infections among the public are also restraining the market growth. Although, increasing awareness among the people in both rural and urban areas about viral infections and its treatment is one of the major opportunities of the global antiviral drug market. For instance, according to WHO,in 2016, an estimated 10.5% of all Hepatitis B infected people were aware of their disease and among them, 16.7% of people diagnosed were on treatment.

Segmentation

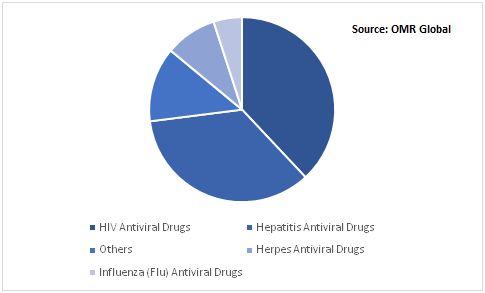

The global antiviral drug market is segmented based on application, and type. Based on the application, the market is segmented into Influenza (Flu) Antiviral Drugs, Hepatitis Antiviral Drugs, HIV Antiviral Drugs, Herpes Antiviral Drugs, and others. Based on types it is segmented into branded drugs and generic drugs. Branded drugs hold the highest market share in 2018 and are estimated to maintain its dominance during the forecast period. The growth of the branded drug segment is attributed to the major contribution of key market players

HIV antiviral drugs held a significant share in the application segment

One of the major viral diseases is HIV and it continues to be a major public health issue. According to the World Health Organization (WHO), only in 2018, 7 million people were died due to HIV related causes and 1.7 million people got infected. Although increasing awareness among people about HIV is one of the reasons that driving the HIV drug market. At the end of 2018, an estimated 79% of the HIV infected patient were aware of it and among them, 62% received antiretroviral therapy (ART). As of now,HIV antiviral drugs are dominating the market. Some of the major antiviral drugs for HIV infection include Pifeltro, Edurant, Isentress HD, Trogarzo, Biktarvy, Symtuza and many more.

Global Antiviral Drugs Market Share by Application, 2018 (%)

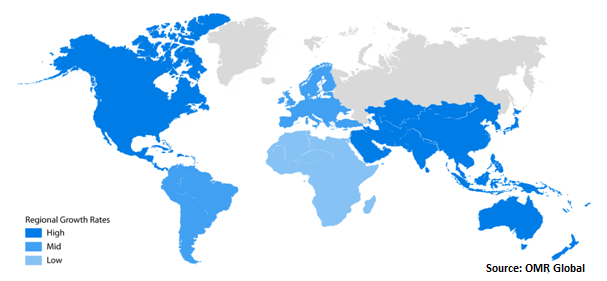

Regional outlook

North America is expected to have a significant market share in the global antiviral drug market. Key factors that are driving the North American antiviral drug market are the availability of proper healthcare infrastructures and the presence of the major players offering innovative antiviral drugs in the market. Moreover, the market in Asia-Pacific region is growing considerably owing to large numbers of the patient, the presence of established generic drug market and increasing health awareness. Moreover, the government-sponsored awareness program about generic medicine in the Asia-Pacific region is one of the major drivers for antiviral drugs market growth. For instance, in 2016 the Government of India’s Department of Pharmaceuticals launched ‘Pradhan Mantri Bhartiya Janaushadhi Pariyojana’ (PMBJP) campaign to provide quality medicines at an affordable price. For that, the government setup stores to provide quality generic medicines, also government made a public-private partnership.

Global Antiviral Drugs Market Growth,by Region 2019-2025

Competitive Landscape

The major players providing antiviral drugs that include AbbVie Inc., Johnson & Johnson Services, Inc., Merck & Co., Inc., Bristol-Myers Squibb Co., GlaxoSmithKline PLC., Sino Biopharmaceutical Ltd., and others. Range of drugs manufactured by these key players including Varilrix (For chickenpox), Zovirax (for herpes simplex virus infections), Ambirix (For hepatitis A & B), Cervarix (Papillomavirus vaccine), Engerix-B (hepatitis B Vaccine), Fendrix (hepatitis B (rDNA) vaccine), and so on.

Mergers and acquisitions and product launches are considered as crucial strategies adopted by the market players to expand market share and gain a competitive advantage. For instance,in February 2020, Johnson & Johnson launched a Multi-Pronged response to Coronavirus. In January 2019, Bristol-Myers Squibb Co. acquired Celgene Corp for worth $74 billion, in the same year AbbVie acquired Irish Botox maker Allergan for $63 billion, this acquisition will help the company to expand its psoriasis drug Humira. In August 2017, AbbVie received US FDA approval of MAVYRET for the treatment of Hepatitis-C.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global antiviral drug market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusions

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. AbbVie Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Bristol-Myers Squibb Company

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. GlaxoSmithKline PLC

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Johnson & Johnson Services, Inc.

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Merck & Co., Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Antiviral Drug Market by Application

5.1.1. Influenza (Flu) Antiviral Drugs

5.1.2. Hepatitis Antiviral Drugs

5.1.3. HIV Antiviral Drugs

5.1.4. Herpes Antiviral Drugs

5.1.5. Others

5.2. Global Antiviral Drug Market by Type

5.2.1. Branded

5.2.2. Generic

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. AbbVie, Inc.

7.2. Arbutus Biopharma Corp.

7.3. Aurobindo Pharma, Ltd.

7.4. BioCryst Pharmaceuticals, Inc.

7.5. Bristol-Myers Squibb Co.

7.6. Cipla, Inc.

7.7. Dr. Reddy’s Laboratories, Ltd.

7.8. F. Hoffmann-La Roche AG

7.9. Gilead Sciences, Inc.

7.10. GlaxoSmithKline PLC

7.11. Johnson & Johnson Services, Inc.

7.12. Merck & Co., Inc.

7.13. Pfizer, Inc.

7.14. Sanofi S.A.

7.15. Sino Biopharmaceutical, Ltd.

1. GLOBAL ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

2. GLOBAL ANTIVIRAL DRUG FOR INFLUENZA (FLU) MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ANTIVIRAL DRUG FOR HEPATITIS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL ANTIVIRAL DRUG FOR HIV RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

5. GLOBAL ANTIVIRAL DRUG FOR HERPES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL ANTIVIRAL DRUG FOR OTHER MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

8. GLOBAL BRANDED ANTIVIRAL DRUG IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL GENERIC ANTIVIRAL DRUG IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

11. NORTH AMERICAN ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

13. NORTH AMERICAN ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

14. EUROPEAN ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

15. EUROPEAN ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

16. EUROPEAN ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

17. ASIA-PACIFIC ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

20. REST OF THE WORLD ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

21. REST OF THE WORLD ANTIVIRAL DRUG MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

1. GLOBAL ANTIVIRAL DRUG MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

2. GLOBAL ANTIVIRAL DRUG MARKET SHARE BY TYPE, 2018 VS 2025 (%)

3. GLOBAL ANTIVIRAL DRUG MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

6. UK ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD ANTIVIRAL DRUG MARKET SIZE, 2018-2025 ($ MILLION)