API intermediate Market

Global API Intermediate Market Size, Share & Trends Analysis Report by Product (Chemical Intermediates and Biotech Intermediates), by Type of Intermediate (Patent Intermediates and Non-Patent Intermediates), by Therapeutic Application (Oncology, Diabetes, Cardiovascular Disease, CNS & Neurological Disorders, Endocrinology, and Others) Forecast 2022-2028 Update Available - Forecast 2025-2035

The global API intermediate market is anticipated to grow at a significant CAGR of 7.5% during the forecast period 2022-2028. API intermediates are chemicals or agents that are employed in the manufacture of active pharmaceutical ingredients and are used as raw materials (API). Amination, hydrogenation, alkoxylation, hydroformylation, electrochemistry, acetylene chemistry, and phosgene chemistry are few of the methods employed to make these intermediates. The expanding usage of generic pharmaceuticals, increase in abbreviated new drug applications, together with the growing geriatric population, are the primary drivesr of market growth.

For instance, in 2019, the US Food and Drug Administration (FDA) granted provisional approval to more than 1,000 generic medications, according to the FDA. As a result, demand for API intermediates for generic medication manufacture is increasing. Furthermore, the Department of Economic and Social Affairs estimates that there were 703 million individuals aged 65 and up in the world in 2019, with that number expected to quadruple to 1.5 billion by 2050. Because the geriatric population is more prone to neurological illnesses and chronic diseases, the demand for API intermediates in the manufacture of medications to treat these problems is increasing. During the projection period, however, the worldwide API intermediate market would be hampered by strict government restrictions.

Some major players in the market include BASF SE, Sanofi S.A., and Pfizer Inc., among others. To stay competitive in the market, market players are using a variety of strategies such as mergers and acquisitions, regional expansion, partnerships and collaborations, and new product releases to contribute significantly to market growth. For instance, in February 2020, Sanofi SA announced the formation of a separate company by consolidating Sanofi's API sales and development activities at six of its European manufacturing sites. The spin-off firm, EUROAPI, will be launched in 2022, according to the corporation.

Impact of COVID-19 on Global API Intermediate Market

The Covid-19 had impacted the global API intermediate market significantly owning to the lockdown in most of the nations to control the spread of the virus. Due to lockdown in several areas, there has been a huge scarcity regarding APIs which are very much integral parts to make medicine or medical products. These lockdowns had a massive negative impact on the international supply and export-import of goods. Additionally, the COVID-19 situation resulted in immense cost increases in drugs. For instance, Penicillin's raw material became 40% costlier in a few months. According to data from the Pharmaceutical Export Promotion Council, which functions under the Ministry of Commerce and Industry, in October 2020, the cost of API Penicillin had increased to $8.69 per unit which was $6.16 per unit in January 2020.

Segmental Outlook

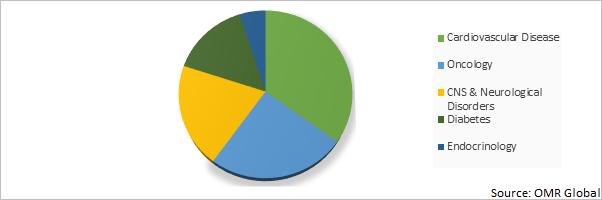

The global API intermediate market is segmented based on the product, type of intermediate, and therapeutic application. Based on the product, the market is sub-segmented into chemical intermediates and biotech intermediates. Based on the type of intermediate, the global API intermediate market is divided into patent intermediates and non-patent intermediates. Based on therapeutic application, the market is sub-segmented into oncology, diabetes, cardiovascular disease, CNS & Neurological disorders, endocrinology, and others. Among these, the cardiovascular disease segment is expected to propel the growth of the market, due to the rising prevalence of cardiovascular diseases and increasing adoption of cardio vascular APIs such as cardiac glycosides, vasodilators, and vasoconstrictors used in the treatment of heart failure and disorders of vascular tension.

Global API Intermediate Market Share by Therapeutic Application, 2021 (%)

The Cardiovascular Disease Segment is Anticipated to Hold a Prominent Share in the Global API Intermediate Market

The cardiovascular segment holds the major market share and is anticipated to grow significantly during the forecast period in the global API intermediate market in the therapeutic application segment. One of the major reasons for this segment to hold a significant market share is the prevalence of cardiovascular diseases globally. For instance, in June 2021, according to data given by the World Health Organization (WHO), Out of the 17 million premature deaths (under the age of 70) due to noncommunicable diseases in 2019, 38% were caused by CVDs. Cardiovascular diseases (CVDs) are the leading cause of death globally. An estimated 17.9 million people died from CVDs in 2019, representing 32% of all global deaths. Of these deaths, 85% were due to heart attack and stroke. Due to this prevalence, the demand for Cardio APIs to estimate the cardiovascular risk of users based on data collected from their medical history, is also increasing, thereby leading to the market growth.

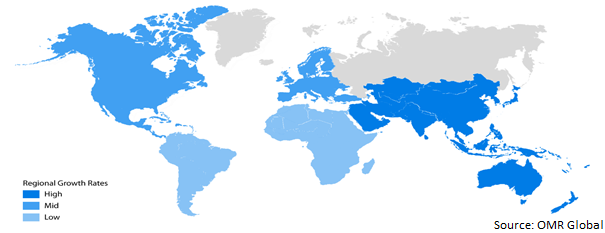

Regional Outlooks

The global API intermediate market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Among the regions, the Asia Pacific region in the global API intermediate market is expected to hold a prominent market share due to the increasing cases of disease and rising ageing population. pharmaceutical sector.

Global API Intermediate Market Growth, by Region 2022-2028

The Asia-Pacific Region is Estimated to Hold a Considerable Share in the Global API Intermediate Market

The APAC region is anticipated to hold a considerable share in the market as the majority of API requirements are met through imports from the Asian markets. The US trade statistics suggest that nearly 75% to 80% of the APIs imported to the United States are from China and India, as these countries have well-established manufacturing facilities and an abundant talent pool serving the pharmaceutical sector. Additionally, the major players in the industry are from countries falling under the Asia-Pacific region, are showing significant growth in mergers and collaborations, and new product launches. Apart from these, the rise in number of CMOs in India and China is further likely to create significant scope for the market growth during the forecast period.

Market Players Outlook

The major companies serving the global API intermediate market include BASF SE., Sanofi S.A., Novartis International AG, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2021, PI Industries executed a business transfer agreement with Ind Swift Laboratories Ltd. (ISLL) and certain identified promoters of ISLL for the acquisition of the API business division of ISLL by way of a slump sale on a going concern basis.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global API intermediate market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on The Global API Intermediate Market

• Recovery Scenario of Global API Intermediate Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Ami Lifesciences Pvt. Ltd.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. AMPAC Fine Chemicals

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. A.R. Life Sciences Pvt. Ltd.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. BASF SE

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Cambrex Corp.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global API Intermediate Market by Product

4.1.1. Chemical Intermediates

4.1.2. Biotech Intermediates

4.2. Global API Intermediate Market by Type of Intermediate

4.2.1. Patent Intermediates

4.2.2. Non-Patent Intermediates

4.3. Global API Intermediate Market by Therapeutic Application

4.3.1. Oncology

4.3.2. Diabetes

4.3.3. Cardiovascular Disease

4.3.4. CNS & Neurological Disorders

4.3.5. Endocrinology

4.3.6. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Hipharma Ltd.

6.2. Jigs Chemical Ltd

6.3. Pfizer Inc.

6.4. Sanofi Winthrop Industrie SA

6.5. Novartis International AG

6.6. Teva Pharmaceutical Industries Ltd.

6.7. Merck & Co., Inc.

6.8. Dragon Hwa ChemPharm. Co., Ltd.

6.9. Shandong Jiulong Fine Chemical Co., Ltd.

1. GLOBAL API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL CHEMICAL API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL BIOTECH API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY TYPE OF INTERMEDIATES, 2021-2028 ($ MILLION)

5. GLOBAL PATENT API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL NON-PATENT API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC APPLICATION, 2021-2028 ($ MILLION)

8. GLOBAL API INTERMEDIATE IN ONCOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL API INTERMEDIATE IN DIABETES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL API INTERMEDIATE IN CARDIOVASCULAR DISEASE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL API INTERMEDIATE IN CNS & NEUROLOGICAL DISORDERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL API INTERMEDIATE IN ENDOCRINOLOGY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL API INTERMEDIATE IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. GLOBAL API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

16. NORTH AMERICAN API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

17. NORTH AMERICAN API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY TYPE OF INTERMEDIATE, 2021-2028 ($ MILLION)

18. NORTH AMERICAN API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC APPLICATION, 2021-2028 ($ MILLION)

19. EUROPEAN API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. EUROPEAN API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

21. EUROPEAN API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY TYPE OF INTERMEDIATES, 2021-2028 ($ MILLION)

22. EUROPEAN API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC APPLICATION, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY TYPE OF INTERMEDIATES, 2021-2028 ($ MILLION)

26. ASIA-PACIFIC API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC APPLICATION, 2021-2028 ($ MILLION)

27. REST OF THE WORLD API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

28. REST OF THE WORLD API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

29. REST OF THE WORLD API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY TYPE OF INTERMEDIATES, 2021-2028 ($ MILLION)

30. REST OF THE WORLD API INTERMEDIATE MARKET RESEARCH AND ANALYSIS BY THERAPEUTIC APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL API INTERMEDIATE MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL API INTERMEDIATE MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL API INTERMEDIATE MARKET, 2021-2028 (%)

4. GLOBAL API INTERMEDIATE MARKET SHARE BY PRODUCT, 2021 VS 2027 (%)

5. GLOBAL CHEMICAL API INTERMEDIATE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL BIOTECH API INTERMEDIATE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL API INTERMEDIATE MARKET SHARE BY TYPE OF INTERMEDIATES, 2021 VS 2028 (%)

8. GLOBAL PATENT API INTERMEDIATE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL NON-PATENT API INTERMEDIATE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL API INTERMEDIATE MARKET SHARE BY THERAPEUTIC APPLICATION, 2021 VS 2028 (%)

11. GLOBAL API INTERMEDIATE IN ONCOLOGY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL API INTERMEDIATE IN DIABETES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL API INTERMEDIATE IN CARDIOVASCULAR DISEASE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL API INTERMEDIATE IN CNS & NEUROLOGICAL DISORDERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL API INTERMEDIATE IN ENDOCRINOLOGY MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL API INTERMEDIATE IN OTHER APPLICATIONS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. GLOBAL API INTERMEDIATE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18. US API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

19. CANADA API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

20. UK API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

21. FRANCE API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

22. GERMANY API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

23. ITALY API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

24. SPAIN API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF EUROPE API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

26. INDIA API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

27. CHINA API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

28. JAPAN API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF THE ASIA-PACIFIC API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD API INTERMEDIATE MARKET SIZE, 2021-2028 ($ MILLION)