Architectural Flat Glass Market

Architectural Flat Glass Market Size, Share & Trends Analysis Report by Product (Basic, Tempered, Laminated, and Insulated) and by Application (Residential, Non-residential, and Industrial) Forecast Period (2024-2031)

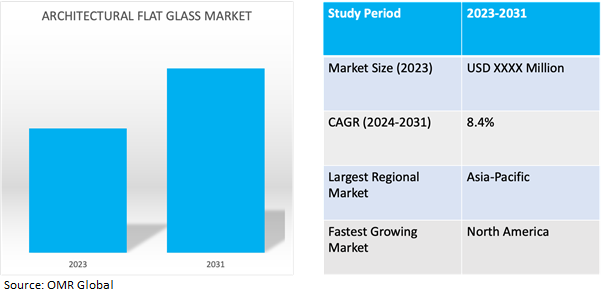

Architectural flat glass market is anticipated to grow at a CAGR of 8.4% during the forecast period (2024-2031). Architectural flat glass refers to a type of glass that is specifically designed for use in architectural applications such as windows, doors, facades, partitions, and other structural elements of buildings. Unlike curved or specialty glass, architectural flat glass is manufactured in large flat sheets, making it suitable for a wide range of construction purposes.

Market Dynamics

Sustainable Building Practices Drive Demand for Innovative Architectural Flat Glass

The rising demand for sustainable construction materials stems from heightened awareness of environmental issues and a global shift towards eco-friendly building practices. Architectural flat glass, known for its energy efficiency and recyclability, aligns with these sustainability objectives. As regulations tighten and green building certifications gain prominence, there's a greater emphasis on using materials that reduce energy consumption and environmental impact. This trend is driving the adoption of architectural flat glass with advanced coatings and technologies that enhance thermal insulation, solar control, and overall building performance. For instance, in June 2022 the introduction of MIRASTAR REFLECT, a new highly reflective glass by Saint Gobain. With minimal light transmission of barely 0.1% and 55.0% light reflection, this product excels in high-humidity environments, ideal for mirror-fixed wall applications.

Driving Growth: Urbanization and Infrastructure Development Fuel Architectural Flat Glass Market

Urbanization and infrastructure development, particularly in rapidly growing economies, are catalysts for the architectural flat glass market. As populations migrate to urban areas, there's a surge in construction activity to accommodate housing, commercial spaces, and infrastructure projects. Architectural flat glass is integral to modern urban architecture, used in skyscrapers, office buildings, residential complexes, and transportation hubs. This trend is driven by the need for efficient and visually appealing structures that optimize natural light, reduce energy consumption, and create comfortable living and working environments. For instance, in April 2023, Cardinal Glass Industries Inc. announced a $40.0 million expansion anticipating the creation of approximately 30 new jobs, thus augmenting employment in the park by 10.0%.

Market Segmentation

Our in-depth analysis of the global architectural flat glass market includes the following segments by product, and application:

- Based on product, the market is segmented into basic, tempered, laminated, and insulated.

- Based on application, the market is segmented into residential, non-residential, and industrial.

Tempered Glass is Projected to Emerge as the Largest Segment

The tempered glass segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes its exceptional strength and safety features. Tempered glass undergoes a specialized thermal treatment process that increases its strength compared to regular glass, making it highly resistant to breakage and impact. This property is particularly valued in architectural applications where safety is paramount, such as glass doors, windows, partitions, and balustrades.

Non-Residential Segment to Hold a Considerable Market Share

The non-residential segment is set to command a significant share in the global architectural flat glass market due to the expanding commercial and institutional construction sectors. With a focus on modern architectural designs, non-residential buildings extensively utilize glass facades and curtain walls, driving demand for architectural flat glass. Additionally, the increasing emphasis on energy efficiency and sustainability in construction projects, along with advancements in glass technologies, further bolsters the market share of this segment. Regulatory compliance and stringent standards also play a role, making high-performance architectural flat glass indispensable for meeting safety, insulation, and environmental requirements in commercial and institutional buildings.

Regional Outlook

The global architectural flat glass market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Driving Forces Behind North America's Growth in Architectural Flat Glass Market

North America emerges as the fastest-growing market in the global architectural flat glass market due to a resurgence in construction activity, driven by economic stability and recovery. Continuous technological advancements in glass manufacturing result in high-performance products that meet evolving industry needs, such as enhanced thermal insulation and solar control. Stringent energy efficiency regulations and a growing preference for green building practices further boost demand for energy-efficient architectural flat glass solutions. For instance, the Occupational Safety and Health Administration (OSHA) guidelines outline safety standards for glass manufacturing, complemented by local or national building codes regulating glass usage in construction. These codes specify criteria such as glass thickness, strength, and type to ensure safety compliance.

Global Architectural Flat Glass Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share due to rapid urbanization, economic growth, and government initiatives driving construction activity. With a surge in urban population, there's a heightened demand for residential, commercial, and infrastructure projects, necessitating architectural flat glass for modern urban structures. Additionally, increasing disposable income levels and government policies promoting sustainable construction further fuel market growth. Asia-Pacific's status as a manufacturing hub for architectural flat glass, coupled with technological advancements tailored to regional needs, enhances accessibility and affordability. For instance, in March 2023, Keda Industrial Group unveiled intentions to invest $86.8 million towards the establishment of an architectural glass plant in Tanzania. This strategic move aims to diversify building material options within the African market while enhancing Keda Industrial's market presence. The company envisions either setting up a local subsidiary or forming a partnership with a domestic entity to oversee the construction of the plant. Anticipated to boast an annual production capacity of 600.0 tons of architectural glass, the venture underscores Keda Industrial's commitment to bolstering regional infrastructure and economic development.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global architectural flat glass market include AGC Inc., ?i?ecam, Xinyi Glass Holdings Ltd., Trulite Glass and Aluminum Solutions, Vitro Architectural Glass, and VITRUM™ Glass Group, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, Press Glass disclosed plans for a substantial $155.2 million investment to expand its glass manufacturing facility situated in Ridgeway, Virginia. The initiative is set to result in the creation of 335 new job opportunities and entails the construction of a 360,000-square-foot addition to the existing site. With a focus on producing architectural glass tailored for the commercial construction sector, Press Glass aims to meet the escalating demand for high-quality glass solutions in the market. This expansion project underscores the company's dedication to innovation, growth, and contributing to the local economy through job creation and enhanced manufacturing capabilities.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global architectural flat glass market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AGC Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. ?i?ecam

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Xinyi Glass Holdings Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Architectural Flat Glass Market by Product

4.1.1. Basic

4.1.2. Tempered

4.1.3. Laminated

4.1.4. Insulated

4.2. Global Architectural Flat Glass Market by Application

4.2.1. Residential

4.2.2. Non-residential

4.2.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Asahi India Glass Ltd.

6.2. CARDINAL GLASS INDUSTRIES, INC

6.3. Central Glass Co. Ltd.

6.4. Corning Incorporated

6.5. Dillmeier Glass Co.

6.6. Fuyao Glass Industry Group Co., Ltd.

6.7. Guardian Industries

6.8. iEcam Group

6.9. Nippon Sheet Glass Co., Ltd.

6.10. Paragon Tempered Glass, LLC

6.11. Phoenicia

6.12. Saint-Gobain

6.13. Schott

6.14. Syracuse Glass Co.

6.15. TAIWAN GLASS IND. CORPORATION

6.16. Trulite Glass and Aluminum Solution

6.17. Vitro Architectural Glass

6.18. VITRUM™ Glass Group

1. GLOBAL ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL BASIC ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL TEMPERED ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL LAMINATED ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL INSULATED ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

7. GLOBAL ARCHITECTURAL FLAT GLASS FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ARCHITECTURAL FLAT GLASS FOR NON-RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ARCHITECTURAL FLAT GLASS FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. NORTH AMERICAN ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

12. NORTH AMERICAN ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

13. NORTH AMERICAN ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

14. EUROPEAN ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

15. EUROPEAN ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

16. EUROPEAN ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

17. ASIA-PACIFIC ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. ASIA-PACIFIC ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. ASIA-PACIFIC ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. REST OF THE WORLD ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. REST OF THE WORLD ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

22. REST OF THE WORLD ARCHITECTURAL FLAT GLASS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL ARCHITECTURAL FLAT GLASS MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL BASIC ARCHITECTURAL FLAT GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL TEMPERED ARCHITECTURAL FLAT GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL LAMINATED ARCHITECTURAL FLAT GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL INSULATED ARCHITECTURAL FLAT GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ARCHITECTURAL FLAT GLASS MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

7. GLOBAL ARCHITECTURAL FLAT GLASS FOR RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ARCHITECTURAL FLAT GLASS FOR NON-RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ARCHITECTURAL FLAT GLASS FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ARCHITECTURAL FLAT GLASS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. US ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

12. CANADA ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

13. UK ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

14. FRANCE ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

15. GERMANY ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

16. ITALY ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

17. SPAIN ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

18. REST OF EUROPE ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

19. INDIA ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

20. CHINA ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

21. JAPAN ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

22. SOUTH KOREA ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF ASIA-PACIFIC ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

24. LATIN AMERICA ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)

25. MIDDLE EAST AND AFRICA ARCHITECTURAL FLAT GLASS MARKET SIZE, 2023-2031 ($ MILLION)