Architectural Lighting Market

Architectural Lighting Market Size, Share & Trends Analysis Report by Component (Lamp Holders, Ballasts, Lamps, Lenses/Shades, Trims, Wiring, and Reflectors), by Light Source (Incandescent Lights, Fluorescent Lights, Light-Emitting Diode (LED), and High-Intensity Discharge (HID)), by Application (Wall Wash, Cove Lighting, and Backlighting), and by End-User (Commercial, Residential, and Industrial), Forecast Period (2024-2031)

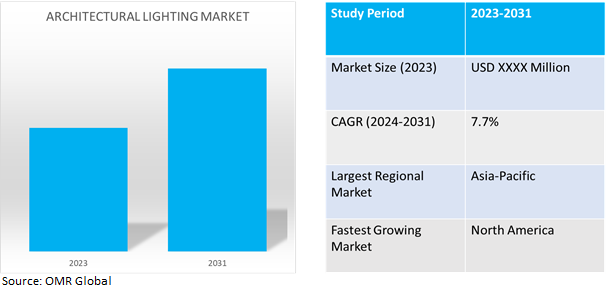

Architectural lighting market is anticipated to grow at a CAGR of 7.7% during the forecast period (2024-2031). This market will be driven by the growing demand for well-lit spaces with attractive lighting to enhance interior artifacts and corners. Architectural lighting has been favored by consumers for its cost savings, reliability, durability, adjustable illumination power, and longer life expectancy. Architectural lighting is increasingly being adopted in both residential and commercial sectors due to the need to illuminate walkways, corridors, staircases, gardens, parking lots, walkways, and other areas.

Market Dynamics

Increasing Technological Advancement

Technological advancements in the field of architectural lighting are a significant factor catalyzing market growth. In line with this, the evolution of light emitting diode (LED) technology, which offers superior energy efficiency, a wide range of colors, and longer lifespans compared to traditional lighting solutions, is supporting the market growth. It has made LED lights highly attractive for architectural applications, where both functionality and aesthetics are important. Moreover, recent innovations in lighting control systems, such as dimming capabilities and color temperature adjustments, which allow for higher customization and flexibility in design, are positively impacting the market growth. Besides this, the introduction of the Internet of Things (IoT)-enabled systems, which has opened up new possibilities for energy management and personalized lighting experiences, is favoring the market growth.

Heightened Energy Efficiency and Safety Concerns

Globally, energy efficiency and sustainability across the globe are becoming increasingly important in all sectors, including architectural lighting. In line with this, the ongoing push towards reducing energy consumption and lowering environmental impact is contributing to the market growth. Besides this, the introduction of energy-efficient lighting solutions, such as LED lights, which consume significantly less energy compared to traditional fluorescent and incandescent lights, is favoring the market growth. This reduction in energy utilization directly translates to lower electricity bills and a smaller carbon footprint, aligning with the growing environmental consciousness among consumers and businesses.

Market Segmentation

Our in-depth analysis of the global architectural lighting market includes the following segments by type, product, and technology:

- Based on components, the market is segmented into lamp holders, ballasts, lamps, lenses/shades, trims, wiring, and reflectors.

- Based on the light source, the market is segmented into incandescent lights, fluorescent lights, light-emitting diode (LED), and high-intensity discharge (HID).

- Based on applicattion, the market is segmented into wall wash, cove lighting, and backlighting.

- Based on end-user, the market is segmented into commercial, residential, and industrial.

Light-Emitting Diode (LED) is Projected to Emerge as the Largest Segment

The light emitting diode (LED) segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes their superior energy efficiency, longer lifespan, and versatility. LEDs work by transmitting an electrical current through a semiconductor, which emits light when the electrons recombine with electron holes. This process generates very little heat compared to other lighting technologies, making LEDs more energy-efficient. LED lights also provide a broad range of color temperatures and high color rendering, making them suitable for various applications, such as accentuating architectural features and providing functional lighting in residential, commercial, and industrial settings. Furthermore, their small size allows for innovative design and integration into various architectural elements.

Commercial Segment to Hold a Considerable Market Share

The commercial segment represents a considerable market share, driven by the widespread application of architectural lighting in various settings, such as hotels, retail stores, offices, restaurants, and public spaces. Lighting plays a critical role in these settings, not just in functionality but also in creating an ambiance that can enhance customer experience and brand perception. Furthermore, commercial lighting is highly versatile, catering to both aesthetic appeal and practical requirements like energy efficiency and cost-effectiveness. Moreover, commercial spaces often use lighting as a key element of their interior design, using it to highlight products, create inviting atmospheres, and make spaces feel more welcoming and comfortable.

Regional Outlook

The global architectural lighting market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Highest CAGR

In North America, the architectural lighting market is characterized by advanced technology adoption and a strong emphasis on energy-efficient and smart lighting solutions. Additionally, the presence of numerous leading lighting manufacturers, a well-established infrastructure, and high consumer awareness about energy conservation and sustainable practices are contributing to the market growth.

Global Architectural Lighting Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Among all the regions, Asia-Pacific holds a significant share owing to the presence of rapid urbanization with several cities undergoing immense growth and expansion. Architectural lighting is essential for upgrading urban landscapes, improving cityscapes, and creating attractive environments. Many APAC countries are concerned with energy savings and environmental sustainability. LED lighting technology is widely used due to its energy-saving properties and long lifespan. Governments in the region are encouraging the use of LEDs through legislation and incentives. The region has a rich cultural heritage with numerous ancient sites, temples, and landmarks. Architectural lighting is widely used for illuminating and maintaining historic sites, highlighting the architecture, and preserving its cultural relevance. These factors would further drive the growth of the regional market during the forecast period.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global architectural lighting market include ACUITY BRANDS, INC., Cree Lighting USA LLC., OSRAM GmbH, and Signify Holding, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2022, Signify formed a partnership with EDZCOM, a group of Cellnex, and a European market head in Edge Connectivity solutions. Together, the companies aimed to create a creative and long-term personal network project with the image to make the city a better site for its residents to live and work.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global architectural lighting market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. ACUITY BRANDS, INC.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Cree Lighting USA LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. OSRAM GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Signify Holding

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Architectural Lighting Market by Component

4.1.1. Lamp Holders

4.1.2. Ballasts

4.1.3. Lamps

4.1.4. Lenses/Shades

4.1.5. Trims

4.1.6. Wiring

4.1.7. Reflectors

4.2. Global Architectural Lighting Market by Light Source

4.2.1. Incandescent Lights

4.2.2. Fluorescent Lights

4.2.3. Light-Emitting Diode (LED)

4.2.4. High-Intensity Discharge (HID)

4.3. Global Architectural Lighting Market by Application

4.3.1. Wall Wash

4.3.2. Cove Lighting

4.3.3. Backlighting

4.4. Global Architectural Lighting Market by End-User

4.4.1. Commercial

4.4.2. Residential

4.4.3. Industrial

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Current Lighting Solutions, LLC

6.2. Delta Light NV

6.3. Feilo Sylvania Group

6.4. General Electric Company

6.5. Glamox AS

6.6. GrivenS.r.l

6.7. GVA Lighting

6.8. Hubbell Lighting

6.9. Panasonic Corporation

6.10. R. STAHL AG

6.11. Raytec Ltd.

6.12. Samsung Electronics Co., Ltd.

6.13. Seoul Semiconductor Co., Ltd.

6.14. Siteco GmbH

6.15. TCP International Holdings Ltd.

6.16. Toshiba Lightning and Technology Corporation

6.17. TRILUX GmbH & Co. KG

6.18. Zumtobel Group AG

1. GLOBAL ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL ARCHITECTURAL LAMP HOLDERS LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ARCHITECTURAL BALLASTS LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ARCHITECTURAL LAMPS LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ARCHITECTURAL LENSES/SHADES LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL ARCHITECTURAL TRIMS LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL ARCHITECTURAL WIRING LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL ARCHITECTURAL REFLECTORS LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT SOURCE, 2023-2031 ($ MILLION)

10. GLOBAL INCANDESCENT LIGHTS ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL FLUORESCENT LIGHTS ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL LIGHT-EMITTING DIODE (LED) ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL HIGH-INTENSITY DISCHARGE (HID) ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

15. GLOBAL ARCHITECTURAL LIGHTING FOR WALL WASH MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL ARCHITECTURAL LIGHTING FOR COVE LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL ARCHITECTURAL LIGHTING FOR BACKLIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL ARCHITECTURAL LIGHTING ACCENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

20. GLOBAL ARCHITECTURAL LIGHTING FOR COMMERCIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL ARCHITECTURAL LIGHTING FOR RESIDENTIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL ARCHITECTURAL LIGHTING FOR INDUSTRIAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. GLOBAL ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. NORTH AMERICAN ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

25. NORTH AMERICAN ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

26. NORTH AMERICAN ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT SOURCE, 2023-2031 ($ MILLION)

27. NORTH AMERICAN ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

28. NORTH AMERICAN ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

29. EUROPEAN ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

30. EUROPEAN ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

31. EUROPEAN ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT SOURCE, 2023-2031 ($ MILLION)

32. EUROPEAN ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

33. EUROPEAN ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

35. ASIA-PACIFIC ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

36. ASIA-PACIFIC ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT SOURCE, 2023-2031 ($ MILLION)

37. ASIA-PACIFIC ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

38. ASIA-PACIFIC ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

39. REST OF THE WORLD ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

40. REST OF THE WORLD ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

41. REST OF THE WORLD ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY LIGHT SOURCE, 2023-2031 ($ MILLION)

42. REST OF THE WORLD ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

43. REST OF THE WORLD ARCHITECTURAL LIGHTING MARKET RESEARCH AND ANALYSIS BY END-USER, 2023-2031 ($ MILLION)

1. GLOBAL ARCHITECTURAL LIGHTING MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL ARCHITECTURAL LAMP HOLDERS LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ARCHITECTURAL BALLASTS LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ARCHITECTURAL LAMPS LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ARCHITECTURAL LENSES/SHADES LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL ARCHITECTURAL TRIMS LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL ARCHITECTURAL WIRING LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL ARCHITECTURAL REFLECTORS LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ARCHITECTURAL LIGHTING MARKET SHARE BY LIGHT SOURCE, 2023 VS 2031 (%)

10. GLOBAL INCANDESCENT LIGHTS ARCHITECTURAL LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL FLUORESCENT LIGHTS ARCHITECTURAL LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL LIGHT-EMITTING DIODE (LED) ARCHITECTURAL LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL HIGH-INTENSITY DISCHARGE (HID) ARCHITECTURAL LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL ARCHITECTURAL LIGHTING MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

15. GLOBAL ARCHITECTURAL LIGHTING FOR WALL WASH MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL ARCHITECTURAL LIGHTING FOR COVE LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL ARCHITECTURAL LIGHTING FOR BACKLIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL ARCHITECTURAL LIGHTING AMBIENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL ARCHITECTURAL LIGHTING TASK MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL ARCHITECTURAL LIGHTING ACCENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL ARCHITECTURAL LIGHTING MARKET SHARE BY END-USER, 2023 VS 2031 (%)

22. GLOBAL ARCHITECTURAL LIGHTING FOR COMMERCIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

23. GLOBAL ARCHITECTURAL LIGHTING FOR RESIDENTIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

24. GLOBAL ARCHITECTURAL LIGHTING FOR INDUSTRIAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

25. GLOBAL ARCHITECTURAL LIGHTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

26. US ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

27. CANADA ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

28. UK ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

29. FRANCE ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

30. GERMANY ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

31. ITALY ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

32. SPAIN ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

33. REST OF EUROPE ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

34. INDIA ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

35. CHINA ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

36. JAPAN ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

37. SOUTH KOREA ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

38. REST OF ASIA-PACIFIC ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

39. LATIN AMERICA ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)

40. MIDDLE EAST AND AFRICA ARCHITECTURAL LIGHTING MARKET SIZE, 2023-2031 ($ MILLION)