Armored Vehicles Market

Global Armored Vehicles Market Size, Share & Trends Analysis Report by Vehicle Type (Armored Personnel Carrier, Infantry Fighting Vehicle, Mine-resistant Ambush Protected, Main Battle Tank, and Others), by Drive Type (Wheel, and Track), and by Application (Defense, and Commercial) Forecast Period (2022-2028) Update Available - Forecast 2025-2031

The global armored vehicles market is anticipated to grow at a significant CAGR of 6.1% during the forecast period. One of the major factors that are contributing to market growth is the growing demand for the tensions between the nations in recent years. Countries such as China, India, the US, Russia, and others have been continuously raising the demand for armored vehicles for safety. For instance, in September 2019, Thailand received 10 US-made armored vehicles. Thailand’s government planned to acquire 120 US-made armored vehicles by the end of 2020.

Impact of COVID-19 Pandemic on Global Armored Vehicles Market

COVID-19 pandemic had impacted most of the industries owing to the nationwide lockdowns in most of the countries across the globe. However, the armored vehicle market did not get affected much owing to the ongoing procurement projects being on track at the time, and sales and revenues of the market players of armored vehicles increased steadily. As per the annual report of BAE Systems, the company generated $22.04 billion in revenue in 2020, which was $1.14 billion more than the revenue of the company in 2019.

Segmental Outlook

The global armored vehicles market is segmented based on the vehicle type, drive type, and application. Based on the vehicle type, the market is segmented into armored personnel carrier (APC), infantry fighting vehicle (IFV), mine-resistant ambush-protected (MRAP), main battle tank (MBT), and others. Other type of vehicle is segmented into light-protected vehicle and armored mortar carrier. Based on the drive type, the market is sub-segmented into the wheel and track. Based on the application, the market is sub-segmented into defense, and commercial. The above-mentioned segments can be customized as per the requirements. Based on vehicle type, infantry fighting vehicle (IFV) holds the major share in the market owing to the tactical advantage to provide direct-fire support along with infantry troop carrying capabilities.

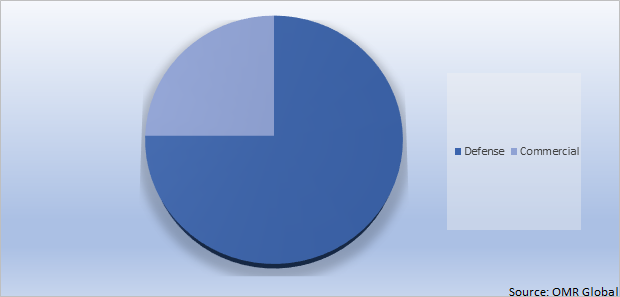

Global Armored Vehicles Market Share by Application, 2021 (%)

The Defense Segment Holds the Major Share in the Global Armored Vehicles Market

Based on Application, the defense segment holds the major share in the global armored vehicle market and is projected to dominate the market during the forecast period. National defense systems are the biggest users of armored vehicles. They need a highly armed vehicle for defense and for an attack on rival countries which costs a lot, while armored vehicles in commercial are mostly used for protection such as bulletproof cars. Highly armed vehicles are not allowed for commercial in most countries since they can be used to harm others. For instance, in November 2019, INKAS launched Ford F-550-based SUV, Sentry Civilian which has BR6-level armor. It meant, the vehicle can take firepower up to 7.62X51 mm lead round from an assault rifle. Additionally, the SUV can protect occupants from a blast the equivalent of two German DM51 hand grenades. There's also an air purifier system to give occupants even more security.

Regional Outlooks

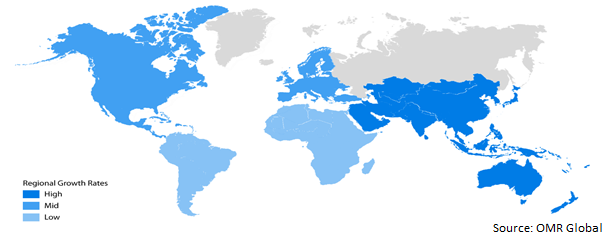

The global Armored Vehicles market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. Europe is anticipated to grow significantly during the forecast period owing to the growing tensions such as Russia-Ukraine in the region in the recent time has increased the demand for armored vehicles.

Global Armored Vehicles Market Growth, by Region 2022-2028

The Asia-Pacific Anticipated to Grow Fastest in the Global Armored Vehicles Market

Based on region, Asia-Pacific is anticipated to grow fastest during the forecast period owing to the growing geopolitical tension between the countries such as China, India, Australia, South Korea, Japan, Singapore, and others. These countries have been investing significantly in the procurement of new armored vehicles to increase border security and replace an aging fleet that has been in operation for several decades. For instance, in March 2021, the Indian Ministry of Defense granted Mahindra Defence Systems (MDS) an agreement worth USD 146 million to supply Light Specialist Vehicles (LSVs). Moreover, in March 2021, the Acquisition, Technology & Logistics Agency (ATLA) of Japan planned to replace the Light Armoured Vehicles (LAV) owing to their issue of lower cabin space and high emissions from engines.

Market Players Outlook

The major companies serving the global Armored Vehicles market include BAE Systems, General Dynamics Corp., Nexter group KNDS, Oshkosh Corp., Rheinmetall Landsysteme GmbH, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in July 2019, BAE Systems and Rheinmetall launched a new, independent UK-based joint venture (JV) for military vehicle manufacture, design, and support – known as Rheinmetall BAE Systems Land (RBSL).

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global armored vehicles market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Armored Vehicles Market

• Recovery Scenario of Global Armored Vehicles Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. BAE Systems

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. General Dynamics Corp.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Nexter group KNDS

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. Oshkosh Corp.

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Rheinmetall Landsysteme GmbH

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on Key Players

4. Market Segmentation

4.1. Global Armored Vehicles Market by Vehicle Type

4.1.1. Armored Personnel Carrier (APC)

4.1.2. Infantry Fighting Vehicle (IFV)

4.1.3. Mine-resistant Ambush Protected (MRAP)

4.1.4. Main Battle Tank (MBT)

4.1.5. Others (Light Protected Vehicle, and Armored Mortar Carrier)

4.2. Global Armored Vehicles Market by Drive Type

4.2.1. Wheel

4.2.2. Track

4.3. Global Armored Vehicles Market by Application

4.3.1. Defense

4.3.2. Commercial

5. Regional Analysis

5.1. North America

5.1.1. US

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Denel Vehicle Systems

6.2. INKAS Armored Vehicle Manufacturing

6.3. International Armored Group

6.4. Iveco Defence Vehicles

6.5. Krauss-Maffei Wegmann GmbH & Co.

6.6. Lenco Armored Vehicles

6.7. Lockheed Martin Corp.

6.8. Otokar, a Koç Group

6.9. STREIT Group

6.10. Textron Inc.

6.11. UkrOboronProm

1. GLOBAL ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

2. GLOBAL ARMORED PERSONNEL CARRIER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL INFANTRY FIGHTING VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL MINE-RESISTANT AMBUSH PROTECTED MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL MAIN BATTLE TANK MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY DRIVE TYPE, 2021-2028 ($ MILLION)

8. GLOBAL WHEEL ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL TRACK ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

11. GLOBAL DEFENSE ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL COMMERCIAL ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

14. NORTH AMERICAN ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

16. NORTH AMERICAN ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY DRIVE TYPE, 2021-2028 ($ MILLION)

17. NORTH AMERICAN ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

18. EUROPEAN ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

20. EUROPEAN ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY DRIVE TYPE, 2021-2028 ($ MILLION)

21. EUROPEAN ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY DRIVE TYPE, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

26. REST OF THE WORLD ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. REST OF THE WORLD ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY DRIVE TYPE, 2021-2028 ($ MILLION)

29. REST OF THE WORLD ARMORED VEHICLES MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ARMORED VEHICLES MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ARMORED VEHICLES MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL ARMORED VEHICLES MARKET, 2022-2028 (%)

4. GLOBAL ARMORED VEHICLES MARKET SHARE BY VEHICLE TYPE, 2021 VS 2028 (%)

5. GLOBAL ARMORED PERSONNEL CARRIER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL INFANTRY FIGHTING VEHICLE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL MINE-RESISTANT AMBUSH PROTECTED MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL MAIN BATTLE TANK MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL OTHERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL ARMORED VEHICLES MARKET SHARE BY DRIVE TYPE, 2021 VS 2028 (%)

11. GLOBAL WHEEL ARMORED VEHICLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

12. GLOBAL TRACK ARMORED VEHICLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL ARMORED VEHICLES MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

14. GLOBAL DEFENSE ARMORED VEHICLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. GLOBAL COMMERCIAL ARMORED VEHICLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16. GLOBAL ARMORED VEHICLES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17. US ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

18. CANADA ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

19. UK ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

20. FRANCE ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

21. GERMANY ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

22. ITALY ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

23. SPAIN ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

24. REST OF EUROPE ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

25. INDIA ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

26. CHINA ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

27. JAPAN ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

28. SOUTH KOREA ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

29. REST OF ASIA-PACIFIC ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)

30. REST OF THE WORLD ARMORED VEHICLES MARKET SIZE, 2021-2028 ($ MILLION)