Artificial Intelligence (AI) in Banking Market

Artificial Intelligence (AI) in Banking Market Size, Share & Trends Analysis Report by Technology (Natural Language Processing (NLP), Machine Learning & Deep Learning, Computer Vision and Others by Component (Software and Services and Hardware), and by Application (AI-Powered chatbot, Mobile Banking, Customer Service, Risk Management Compliance & Security, and Others), Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Artificial intelligence (AI) in banking market is anticipated to grow at a CAGR of 25.1% during the forecast period (2023-2030). The Rising digital transformation in finance sectors globally are the key factors factor global artificial intelligence (AI) in banking market. According to DBS bank, The world of banking has been transforming in the past few years owing to a technological revolution in the global banking sector. Today, almost all banks worldwide, including Indian banks have an online presence, thus catering to their customer’s needs. The demonetization of 2016 and the onset of Covid-19 pandemic played a significant role in making digitalization in banking more mainstream.

Segmental Outlook

The global artificial intelligence (AI) in banking market is segmented on the technology, Component, and application. Based on the technology, the market is sub-segmented into natural language processing (NLP), machine learning & deep learning, computer vision and others. Based on the Component, the market is sub-segmented into, software and services, and Hardware. based on application the market is sub-segmented into AI-Powered chatbot, mobile banking, customer service, risk management compliance & security, and others. Among the all the AI-Powered chatbot sub-segment is anticipated to hold a considerable share of the market which communicate with the customer to support. For instance, in July 2022, Glia launched virtual assistant (GVAs) to assist business.

The Mobile Banking Sub-Segment is Anticipated to Hold a Considerable Share of the Global Artificial Intelligence (AI) in Banking Market

Among the application, the mobile banking sub-segment is expected to hold a considerable share of the global artificial intelligence (AI) in banking market. The segmental growth is attributed to increasing demand for mobile banking service offered by bank services that enables customers to do financial transaction remotely with using mobile devices such as smartphone phone and tablet. For instance, in march 2021, according to a US based payment company ACI worldwide inc., in 2020 there were 102.7 billion transactions and, by 2025 that number is predicted to rise to 2,582.8 billion

Regional Outlook

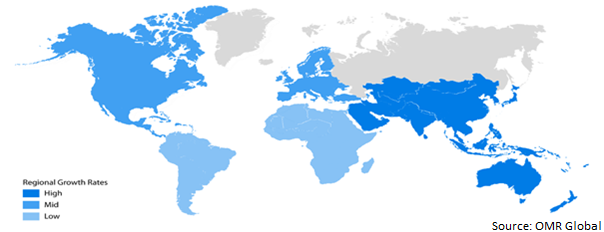

The global artificial intelligence (AI) in banking market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America. Among these, North America is anticipated to hold a prominent share of the market across the globe, due to increasing focus of banks in country and enhancing banking operation by using advance technology.

Global Artificial Intelligence (AI) in Banking Market Growth, by Region 2023-2030

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Artificial Intelligence (AI) in Banking Market

Among all regions, the Asia-Pacific regions is anticipated to grow at a considerable CAGR over the forecast period. Regional growth is attributed to growing government policies and initiatives to increase the adoption of artificial intelligence (AI) across various sectors, including banking and adoption of innovative technology in developing countries such as China and India. various organizations towards the adoption of artificial intelligence are boosting the demand for artificial intelligence technology. For instance, Baidu Incorporation, a tech giant based in China has entered into agreements with investors for the divestiture of financial services group providing consumer credit, wealth management, and other services related to business.

Market Players Outlook

The major companies serving the global artificial intelligence (AI) in banking market include bigML, Inc., hewlett packard enterprise development LP, intel corp., amazon web services Inc., cisco systems, Inc. and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in December 2022, deutsche bank partners with NVIDIA to embed AI into financial services With NVIDIA Omniverse, the bank’s teams have developed an early concept of a 3D virtual avatar aimed at helping employees navigate internal systems and respond to HR-related questions. Future use cases will explore immersive experiences with banking clients.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global artificial intelligence (AI) in banking market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BigML, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Hewlett Packard Enterprise Development LP

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Intel Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Programmatic Advertising Market by Technology

4.1.1. Natural Language Processing (NLP)

4.1.2. Machine Learning & Deep Learning

4.1.3. Computer Vision

4.1.4. Others (Reinforcement Learning, Generative Adversarial Networks)

4.2. Global Programmatic Advertising Markey by Component

4.2.1. Software and Services

4.2.2. Hardware

4.3. Global Programmatic Advertising Market by Application

4.3.1. AI-Powered chatbot

4.3.2. Mobile Banking

4.3.3. Customer Service

4.3.4. Risk Management Compliance & Security

4.3.5. Others (Financial advisory, back office and operations)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Amazon Web Services Inc.

6.2. Cisco Systems, Inc.

6.3. comply advantage ltd

6.4. Daraminr

6.5. Darktrace Holdings Ltd.

6.6. Datarobot Inc.

6.7. Feedzai

6.8. FICO

6.9. Google LLC

6.10. IBM Corp.

6.11. JPmorgan Chase & Co.

6.12. Kasisto

6.13. Microsoft Corp.

6.14. Oracle corp

6.15. RapidMiner, Inc.

6.16. Salesforce, Inc

6.17. SAP SE

6.18. SAS Institute Inc.

1. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

2. GLOBAL NATURAL LANGUAGE PROCESSING (NLP) BASED ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL MACHINE LEARNING AND DEEP LEARNING BASED ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL COMPUTER VISION BASED ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

5. GLOBAL OTHERS BASED ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

6. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

7. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING FOR SOFTWARE AND SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING FOR HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

10. GLOBAL AI-POWERED CHATBOT BY ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

11. GLOBAL MOBILE BANKING BY ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

12. GLOBAL CUSTOMER SERVICE BY ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

13. GLOBAL OTHERS BY ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

14. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

15. NORTH AMERICAN ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

16. NORTH AMERICAN ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

17. NORTH AMERICAN ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

18. EUROPEAN ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

19. EUROPEAN ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

20. EUROPEAN ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

21. ASIA- PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

22. ASIA- PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

23. ASIA- PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

24. REST OF THE WORLD ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2022-2030 ($ MILLION)

25. REST OF THE WORLD ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

26. REST OF THE WORLD ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY TECHNOLOGY, 2022 VS 2030 (%)

2. GLOBAL NATURAL LANGUAGE PROCESSING (NLP) BASED ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL MACHINE LEARNING AND DEEP LEARNING BASED ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL COMPUTER VISION BASED ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

5. GLOBAL OTHERS BASED ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET GLOBAL OTHERS BASED ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY COMPONENT, 2022 VS 2030 ($ MILLION)

7. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING FOR SOFTWARE AND SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING FOR HARDWARE MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY APPLICATION, 2022-2030 ($ MILLION)

10. GLOBAL AI-POWERED CHATBOT BY ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

11. GLOBAL MOBILE BANKING BY ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL CUSTOMER SERVICE BY ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL OTHERS BY ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. GLOBAL ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SHARE BY REGION, 2022 VS 2030 (%)

15. US ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

16. CANADA ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

17. UK ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

18. FRANCE ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

19. GERMANY ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

20. ITALY ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

21. SPAIN ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF EUROPE ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

23. INDIA ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

24. CHINA ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

25. JAPAN ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

26. SOUTH ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)

28. REST OF THE WORLD ARTIFICIAL INTELLIGENCE (AI) IN BANKING MARKET SIZE, 2022-2030 ($ MILLION)