Artificial Intelligence Market

Artificial Intelligence Market Size, Share & Trends Analysis Report by Component (Hardware, Software and Services), by Technology (Natural Language Generation, Speech Recognition, Virtual Agents, Machine Learning, Robotic Process Automation, Biometrics, Text Analytics and Natural Language Processing and AI Optimized Hardware), and by End User Industry (IT and BFSI, Manufacturing, Automobile Sector, Healthcare, Online customer support, Entertainment, Journalism, Online Retail Stores and Home Appliances), Forecast Period (2024-2031)

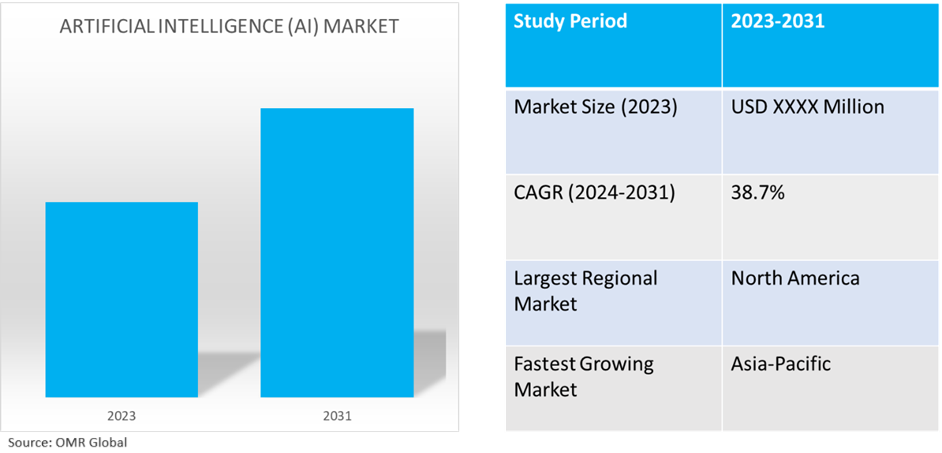

Artificial intelligence (AI) market is anticipated to grow at a significant CAGR of 38.7% during the forecast period (2024-2031). The market growth is attributed to growing AI's ability to boost productivity across a range of industries such as IT and BFSI, manufacturing, the automobile sector, and healthcare resulting in a rise in its use in a wide range of applications. The expansion of big data and the rising use of cloud-based services are further reasons driving the growth of the global AI industry. Additionally, the market has developed greatly owing to the collaboration between AI and the Internet of Things (IoT). According to the Organization for Economic Cooperation and Development (OECD), in 2021, Growth in the deployment of AI applications is evidenced by increased global spending on AI in the private sector, coupled with increased research activity on AI technology. Global spending on AI is forecast to double over the next four years, growing from $50.1 billion in 2020 to more than $110.0 billion in 2024.

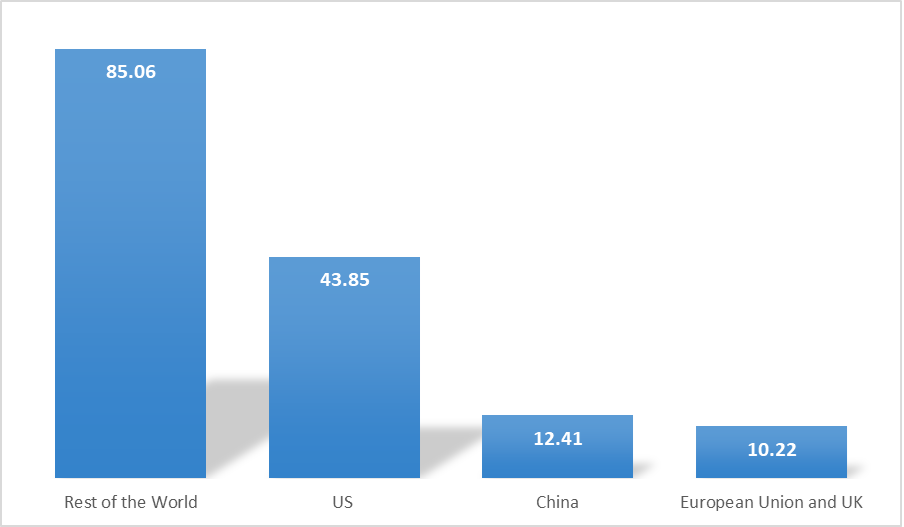

Annual Private Investment in Artificial Intelligence by Country ($ billion) in 2022

Source: OurWorldInData

Market Dynamics

Increasing Use of AI in Customer Service

The application of AI technology to improve and expedite customer assistance procedures is the focus of the market for AI for customer service. AI for client service is typified by the combination of automation, natural language processing, and machine learning. Its goal is to maximize client interactions by offering tailored and effective solutions. Responding to consumer inquiries, handling problems, and future needs, entails the use of chatbots, virtual assistants, and predictive analytics. Improving customer happiness, cutting down on response times, and improving the entire customer experience are the main objectives. Organizations may increase resource allocation, scale their customer service operations, and obtain insightful data about customer behavior, preferences, and trends by utilizing AI. For instance, in August 2023, Fujitsu deployed an AI customer service solution for field trials at a supermarket chain in Japan. To address issues like labor shortages through automation and tailor service to different customers’ unique needs with innovative, yet practical AI solutions.

Growth Adoption of AI in the Industrial Sector

AI is extensively employed in the industrial sector to automate production processes, increase efficiency, and reduce costs. It has led to a significant shift in the ways that industrial sectors operate and carry out their output. AI is used in many industries, including aviation, power, healthcare, logistics, and autos. In the upcoming years, developments in the subject should have a big influence on a lot of different sectors. AI can minimize a company's environmental effects by minimizing electricity usage. It can be used, to improve a building's power consumption by assessing and tracking sensor data, as well as adjusting lighting and temperature settings. This might help businesses cut their energy expenses and greenhouse gas emissions. For instance, in May 2023, SAS announced a $1.0 billion investment in AI-powered industry solutions over the next three years to further develop advanced analytics solutions targeted at the unique needs of specific industries in banking, government, insurance, health care, retail, manufacturing, energy, telecom/media, and others.

Market Segmentation

- Based on the component, the market is segmented into hardware, software, and services.

- Based on the technology, the market is segmented into natural language generation, speech recognition, virtual agents, machine learning, robotic process automation, biometrics, text analytics, natural language processing, and AI-optimized hardware.

- Based on the end-user industry, the market is segmented into IT and BFSI, manufacturing, automobile sector, healthcare, online customer support, entertainment, journalism, online retail stores, and home appliances.

Software is Projected to Hold the Largest Segment

The software segment is expected to hold the largest share of the market. The primary factors supporting the growth include rising demand for Al-powered software solutions to improve operational efficiency, customer service, risk management, and compliance. The solutions include chatbots, predictive analytics systems, robotic process automation (RPA) tools, and customer relationship management (CRM) systems. Market players delivering a cost-effective and rapid time-to-market solution for industries seeking a full end-to-end platform (‘front-to-back’). It helps provide an improved experience for both customers and employees, allowing a sharp focus on efficiency and productivity. For instance, in August 2023, Firstsource Solutions Ltd. introduced a new AI platform – FirstSenseAI – that enables companies to capture real-time customer data and use it to power intelligent, personalized interactions with instant insights and decision-making. With its ability to understand and respond to a customer’s needs in seconds, FirstSenseAI elevates the human experience, boosting customer loyalty while improving process efficiency.

Text Analytics and Natural Language Processing Segment to Hold a Considerable Market Share

The text analytics and natural language processing segment is expected to hold a considerable share of the market. The factors supporting segment growth include improvements in text-analyzing computer programs, the growing demand for enterprise solutions to improve customer experience through streamlined business operations, the surge in demand for cloud-based NLP solutions to lower overall costs and increase scalability, and the need for predictive analytics to lower risks and spot growth opportunities. For instance, in May 2023, Altimetrik Corp. expanded the ease and utility of text analytics and natural language processing. The influx of advanced machine learning approaches influencing natural language technologies makes textual analysis more accessible to the enterprise. Statistical model techniques also produce the benefit of accelerating traditional natural language processing (NLP) methods to reduce their time-to-value.

Regional Outlook

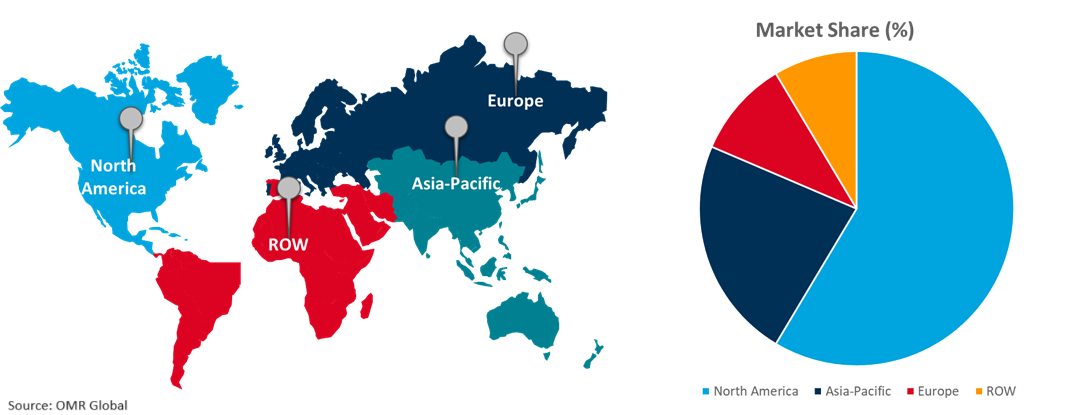

Global AI market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Digitalization with AI Solutions in Asia-Pacific

- The regional growth is attributed to the existence of numerous multinational IT giants and innovative startups that are driving the advancement and use of Al technologies. As early users of technology, the IT and BFSI, manufacturing, automobile sector, and healthcare in the region have embraced Al with an initiative to increase risk management, lower operating costs, improve services, and keep a competitive edge.

- The AI industry in Asia-Pacific is well established and highly digitalized, creating a favorable environment for the integration and use of cloud and AI infrastructure solutions. Furthermore, regional regulatory organizations have shown that they are open to working with Al in the BFSI sector, recognizing that it enhances customer service and operational efficiency while upholding the integrity of the financial system. For instance, in April 2024, Microsoft announced investing $1.7 billion over the next four years in new cloud and AI infrastructure in Indonesia, as well as AI skilling opportunities for 840,000 people, and support for the nation is growing developer community. Together, these initiatives help achieve the Indonesian government’s Golden Indonesia 2045 Vision, which aims to transform the nation into a global economic powerhouse.

Global Artificial Intelligence Market Growth by Region 2024-2031

North America Holds Major Market Share

North America holds a significant share owing to numerous prominent artificial intelligence companies and providers such as IBM Corporation, Intel Corporation, Microsoft Corporation, and NVIDIA Corporation in the region. The market growth is attributed to the increasing adoption of AI, with significant advances and applications in a range of industries. The increasing demand for AI in business, government, and academic partnerships, has made Al's research, development, and commercialization highly productive. Governments in the region integrating AI to streamline administrative processes, improve decision-making with data-driven insights, and create agile, citizen-centric services. This technology enables smarter governance, fostering innovation in public service delivery. For instance, in May 2024, the US Government announced a $3.3 billion investment by Microsoft to build a new artificial intelligence (AI) data center in Racine. Microsoft also provides skilling opportunities for thousands more Wisconsinites in the digital economy. Microsoft pairs its data center investment with a commitment to investing in innovation and workforce in Racine and statewide.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the artificial intelligence market include Amazon Web Services, Inc., Google LLC, IBM Corporation, Microsoft Corporation, and NVIDIA Corporation, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In May 2024, IBM Corporation and Salesforce expanded their partnership to advance open, trusted AI and data ecosystems. IBM Watsonx platform and IBM Granite series models bring even larger language models to power generative AI use cases, pre-built actions, and prompts across the Salesforce Einstein 1 Platform.

- In September 2023, EY announced the introduction of the artificial intelligence platform EY.ai following a $1.4 billion investment. EY investment has provided the foundation for deep experience in strategy, transactions, transformation, risk, assurance, and tax, all augmented by a robust AI ecosystem.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global artificial intelligence market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Amazon Web Services, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Google LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corporation

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Microsoft Corporation

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. NVIDIA Corporation

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Artificial Intelligence Market by Component

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. Global Artificial Intelligence Market by Technology

4.2.1. Natural Language Generation

4.2.2. Speech Recognition

4.2.3. Virtual Agents

4.2.4. Machine Learning

4.2.5. Robotic Process Automation

4.2.6. Biometrics

4.2.7. Text Analytics and Natural Language Processing

4.2.8. AI Optimized Hardware

4.3. Global Artificial Intelligence Market by End-User Industry

4.3.1. IT and BFSI

4.3.2. Manufacturing

4.3.3. Automobile Sector

4.3.4. Healthcare

4.3.5. Online Customer Support

4.3.6. Entertainment

4.3.7. Journalism

4.3.8. Online Retail Stores

4.3.9. Home Appliances

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East & Africa

6. Company Profiles

6.1. Accenture PLC

6.2. Avaamo, Inc.

6.3. Boston Consulting Group, Inc.

6.4. Brighterion Inc.

6.5. C3.ai, Inc.

6.6. Capgemini SE

6.7. DataRobot, Inc.

6.8. Finastra

6.9. H2O.ai, Inc.

6.10. HCLTech Ltd.

6.11. HighRadius Corporation

6.12. Inbenta Technologies Inc.

6.13. Intel Corporation

6.14. Kasisto, Inc.

6.15. Ocrolus Inc.

6.16. OpenAI OpCo, LLC

6.17. Palantir Technologies Inc.

6.18. Persistent Systems Ltd.

6.19. SAP SE

6.20. Signifyd, Inc.

6.21. Simplifai AS

6.22. Temenos AG

6.23. Upstart Network, Inc.

6.24. ZestFinance Inc.

1. GLOBAL ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

2. GLOBAL ARTIFICIAL INTELLIGENCE HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL ARTIFICIAL INTELLIGENCE SOFTWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL ARTIFICIAL INTELLIGENCE SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

6. GLOBAL NATURAL LANGUAGE GENERATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL SPEECH RECOGNITION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL VIRTUAL AGENTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL MACHINE LEARNING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL ROBOTIC PROCESS AUTOMATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL BIOMETRICS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL TEXT ANALYTICS AND NATURAL LANGUAGE PROCESSING E MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ARTIFICIAL INTELLIGENCE OPTIMIZED HARDWARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY END USER INDUSTRY, 2023-2031 ($ MILLION)

15. GLOBAL ARTIFICIAL INTELLIGENCE FOR IT AND BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL ARTIFICIAL INTELLIGENCE FOR MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. GLOBAL ARTIFICIAL INTELLIGENCE FOR AUTOMOBILE SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

18. GLOBAL ARTIFICIAL INTELLIGENCE FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

19. GLOBAL ARTIFICIAL INTELLIGENCE FOR ONLINE CUSTOMER SUPPORT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

20. GLOBAL ARTIFICIAL INTELLIGENCE FOR ENTERTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

21. GLOBAL ARTIFICIAL INTELLIGENCE FOR JOURNALISM MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

22. GLOBAL ARTIFICIAL INTELLIGENCE FOR ONLINE RETAIL STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

23. GLOBAL ARTIFICIAL INTELLIGENCE FOR HOME APPLIANCES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

24. GLOBAL ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. NORTH AMERICAN ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. NORTH AMERICAN ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

27. NORTH AMERICAN ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

28. NORTH AMERICAN ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY END USER INDUSTRY, 2023-2031 ($ MILLION)

29. EUROPEAN ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

30. EUROPEAN ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

31. EUROPEAN ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

32. EUROPEAN ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY END USER INDUSTRY, 2023-2031 ($ MILLION)

33. ASIA-PACIFIC ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

34. ASIA-PACIFIC ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

35. ASIA-PACIFIC ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

36. ASIA-PACIFIC ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY END USER INDUSTRY, 2023-2031 ($ MILLION)

37. REST OF THE WORLD ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

38. REST OF THE WORLD ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2023-2031 ($ MILLION)

39. REST OF THE WORLD ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

40. REST OF THE WORLD ARTIFICIAL INTELLIGENCE MARKET RESEARCH AND ANALYSIS BY END-USER INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL ARTIFICIAL INTELLIGENCE MARKET SHARE BY COMPONENT, 2023 VS 2031 (%)

2. GLOBAL ARTIFICIAL INTELLIGENCE HARDWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL ARTIFICIAL INTELLIGENCE SOFTWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL ARTIFICIAL INTELLIGENCE SERVICES MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL ARTIFICIAL INTELLIGENCE MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

6. GLOBAL NATURAL LANGUAGE GENERATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL SPEECH RECOGNITION MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL VIRTUAL AGENTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL MACHINE LEARNING MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL ROBOTIC PROCESS AUTOMATION MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL BIOMETRICS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL TEXT ANALYTICS AND NATURAL LANGUAGE PROCESSING MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL ARTIFICIAL INTELLIGENCE OPTIMIZED HARDWARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL ARTIFICIAL INTELLIGENCE MARKET SHARE BY END-USER INDUSTRY, 2023 VS 2031 (%)

15. GLOBAL ARTIFICIAL INTELLIGENCE FOR IT AND BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. GLOBAL ARTIFICIAL INTELLIGENCE FOR MANUFACTURING MARKET SHARE BY REGION, 2023 VS 2031 (%)

17. GLOBAL ARTIFICIAL INTELLIGENCE FOR AUTOMOBILE SECTOR MARKET SHARE BY REGION, 2023 VS 2031 (%)

18. GLOBAL ARTIFICIAL INTELLIGENCE FOR HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

19. GLOBAL ARTIFICIAL INTELLIGENCE FOR ONLINE CUSTOMER SUPPORT MARKET SHARE BY REGION, 2023 VS 2031 (%)

20. GLOBAL ARTIFICIAL INTELLIGENCE FOR ENTERTAINMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

21. GLOBAL ARTIFICIAL INTELLIGENCE FOR JOURNALISM MARKET SHARE BY REGION, 2023 VS 2031 (%)

22. GLOBAL ARTIFICIAL INTELLIGENCE FOR ONLINE RETAIL STORES MARKET SHARE BY REGION, 2023 VS 2031 (%)

23. GLOBAL ARTIFICIAL INTELLIGENCE FOR HOME APPLIANCES MARKET SHARE BY REGION, 2023 VS 2031 (%)

24. GLOBAL ARTIFICIAL INTELLIGENCE MARKET SHARE BY REGION, 2023 VS 2031 (%)

25. US ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

26. CANADA ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

27. UK ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

28. FRANCE ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

29. GERMANY ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

30. ITALY ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

31. SPAIN ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

32. REST OF EUROPE ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

33. INDIA ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

34. CHINA ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

35. JAPAN ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

36. SOUTH KOREA ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

37. REST OF ASIA-PACIFIC ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

38. REST OF THE WORLD ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

39. LATIN AMERICA ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)

40. MIDDLE EAST AND AFRICA ARTIFICIAL INTELLIGENCE MARKET SIZE, 2023-2031 ($ MILLION)