Artificial Lift Market

Artificial Lift Market Size, Share & Trends Analysis Report Market by Type (ESP lift, Gas lift, Plunger lift, Rod lift, and others), and by Application (Onshore, and Offshore) Forecast Period (2025-2035)

Industry Outlook

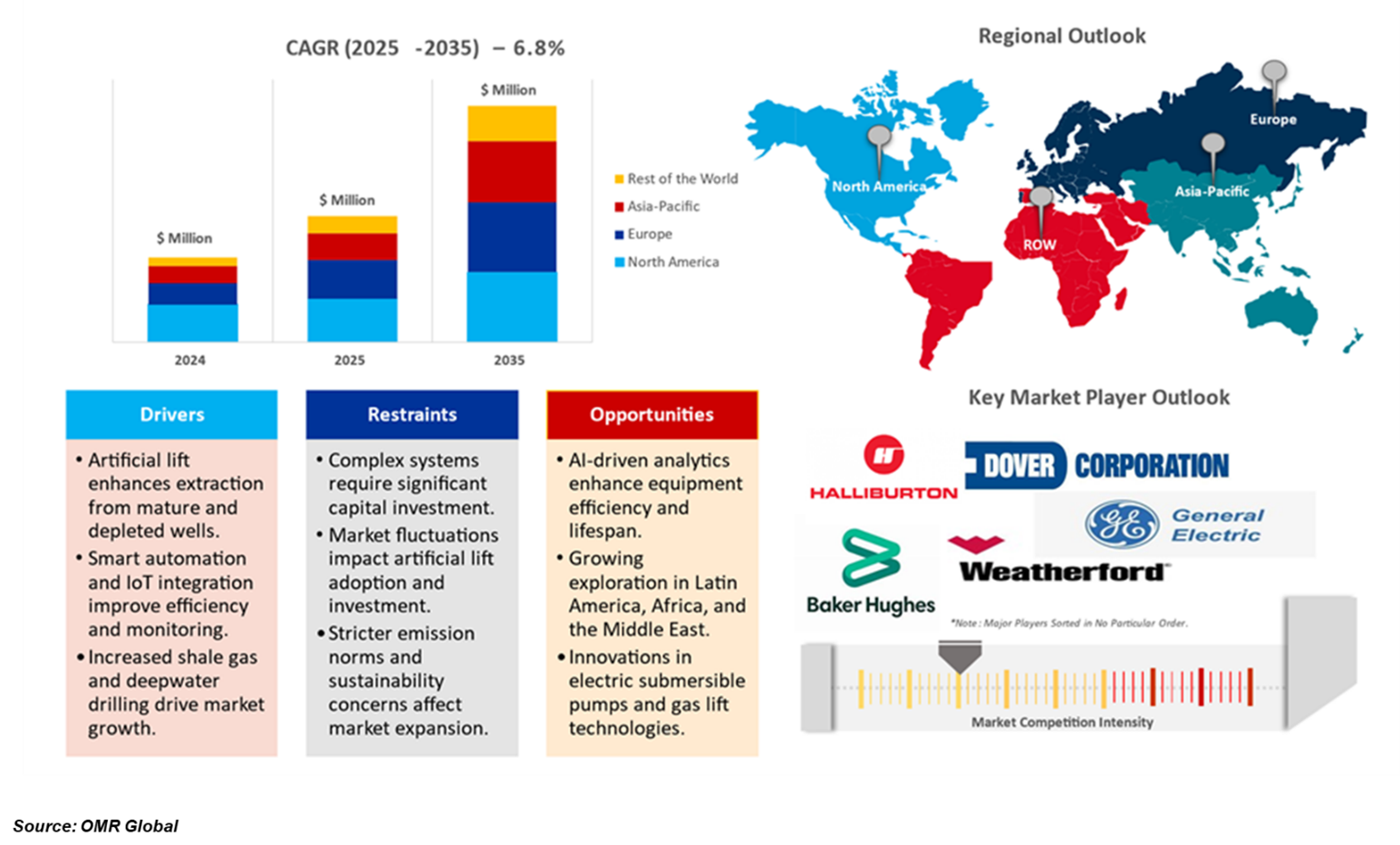

Artificial lift market is estimated to grow at a CAGR of 6.8% during the forecast period (2025–2035). Market expansion is mainly inspired by progress in automation, AI-operated solutions, and future maintenance technologies, which aim to increase operational efficiency and production adaptation. The demand for intelligent artificial lift systems, such as AI-powered well monitoring, automatic gas lift systems, and future maintenance solutions, and human intervention demand to maximize oil recovery by reducing operation time and decreasing human intervention. Similarly, real-time data analytics, machine learning-based failure prediction, and integrating digital twin simulation are changing the industry. These innovations help to remove major challenges, including the demand for fluctuations, equipment failures, and continuous process adaptation, which ensures a more efficient and cost-effective oil extraction process.

Segmental Outlook

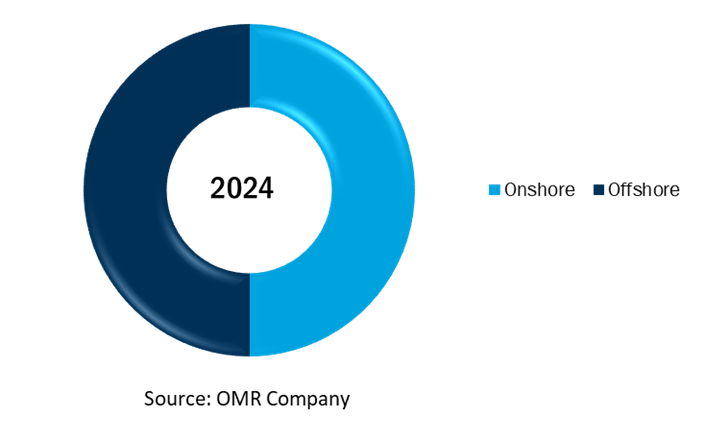

The global artificial lift market is segmented based on type and application. Based on type, the market is segmented into ESP lift, gas lift, plunger lift, rod lift, and others. Based on application, the market is sub-segmented into onshore and offshore. Among the type segment, the Electric Submersible Pump (ESP) segment is estimated to hold a significant share owing to its high efficiency and ability to handle large volumes of fluid along with widespread adoption in both conventional and unconventional oilfields. ESPs are particularly favored in mature oilfields and deepwater operations where maintaining production rates is crucial.

Onshore Segment is Anticipated to Hold a Considerable Share of the Global Artificial Lift Market

The onshore sub-segment is expected to play an important role in market growth during the forecast period, owing to advancements in technologies such as Electric Submersible Pumps (ESPs) and techniques such as rod lift and gas lift, which are important to promote oil recovery, especially in chronic oil areas where production is slowing down. These systems help improve performance well, cut costs, and maximize oil extraction, which requires them for industry growth. Automation, real-time monitoring, and increasing use of IoT-operated solutions are further driving onshore artificial lift systems, as companies seek smart methods to customize production and improve efficiency. For instance, in March 2024, Silverwell Technology introduced its DIAL system in the African market to bring advanced digital artificial lift solutions for the oil and gas industry. This innovative gas lift system integrates real-time monitoring with surface analytics, allowing remote production adaptation without the need for physical well intervention. AI, by taking advantage of operating automation, the DIAL system increases operational efficiency, reduces costs, and increases productivity.

Global Artificial Lift Market Share By Application, 2024 (%)

Regional Outlook

The global artificial lift market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, Russia, and others), Asia-Pacific (India, China, Japan, South Korea, ASEAN Countries, Australia & New Zealand and others), and the Rest of the World (the Middle East & Africa and Latin America). By region, North America is expected to dominate the market for the global artificial lift industry, owing to the widespread adoption of advanced technologies such as electric submersible pumps (ESPs), rod lift systems, and gas lift solutions to enhance oil production from mature wells. These technologies enable oil and gas companies to optimize extraction processes, minimize operational costs, and extend the lifespan of aging wells, making them essential for sustaining production levels in the region.

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Artificial Lift Market

The Asia-Pacific region is expected to witness substantial growth, with the highest CAGR among other regional segments during the forecast period. This growth is driven by rising oil and gas exploration activities, increasing investments in energy infrastructure, and the growing adoption of advanced artificial lift technologies. Countries such as China, India, and Australia are focusing on enhancing oil production efficiency by integrating electric submersible pumps (ESPs), gas lift systems, and real-time monitoring solutions to optimize extraction from mature and newly discovered fields. Additionally, government initiatives supporting energy security, increasing foreign investments in the oil & gas sector, and technological advancements in artificial lift solutions are further propelling market growth in the region.

Market Players Outlook

The major companies serving the artificial lift market include Baker Hughes Co., Halliburton Energy Services, Inc., Weatherford International PLC, Dover Corp., and others. These market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market.

Recent Development

- In April 2024, Tenaris introduced AlphaRod 2.0 at the Southwestern Petroleum Short Course (SWPSC) Conference. This advanced sucker rod is designed to enhance oil and gas extraction processes, particularly in unconventional wells in regions like the Permian and Williston basins. The AlphaRod 2.0 features improved surface treatment and metallurgical properties, aiming to set a new standard in the artificial lift market.

- In April 2024, SLB announced the acquisition of ChampionX Corporation in an all-stock deal to enhance its production sector capabilities. This acquisition initiative integrates ChampionX’s production of chemicals and artificial lift technologies, improving equipment life and optimizing production efficiency.

The Report Covers

- Market value data analysis of 2025 and forecast to 2035.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global artificial lift market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1 Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Global Artificial Lift Market Sales Analysis – Type | Application ($ Million)

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baker Hughes Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Dover Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Halliburton Energy Services, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Artificial Lift Market by Type ($ Million)

4.1.1. ESP Lift

4.1.2. Gas Lift

4.1.3. Plunger Lift

4.1.4. Rod Lift

4.1.5. Others (Jet Pumps, Sucker Rod Pumps (SRP)

4.2. Global Artificial Lift Market by Application ($ Million)

4.2.1. Onshore

4.2.2. Offshore

5. Regional Analysis

5.1. North America Artificial Lift Market Sales Analysis – Type | Application ($ Million)

5.1.1. United States

5.1.2. Canada

5.2. Europe Artificial Lift Market Sales Analysis – Type | Application ($ Million)

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Russia

5.2.7. Rest of Europe

5.3. Asia-Pacific Artificial Lift Market Sales Analysis – Type | Application ($ Million)

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Australia & New Zealand

5.3.6. ASEAN Countries (Thailand, Indonesia, Vietnam, Singapore, And others)

5.3.7. Rest of Asia-Pacific

5.4. Rest of the World Artificial Lift Market Sales Analysis – Type | Application ($ Million)

5.4.1. Latin America

5.4.2. Middle East and Africa

6 Company Profiles

6.1 Baker Hughes Co.

6.2 Cairn Oil & Gas, Vedanta Ltd.

6.3 ChampionX Corp.

6.4 DNow, Inc.

6.5 Dover Corp.

6.6 Endurance Lift Solutions, LLC

6.7 General Electric Co.

6.8 Halliburton Energy Services, Inc.

6.9 J&J Technical Services, LLC.

6.10 Levare International Ltd.

6.11 Liberty Lift Solutions LLC.

6.12 Lift Well International, LLC

6.13 NOV Inc.

6.14 Novomet Group

6.15 Penguin Petroleum Services Pvt. Ltd.

6.16 PetroLift Systems, Inc.

6.17 Schlumberger Ltd.

6.18 Tenaris S.A.

6.19 Valiant Artificial Lift Solutions.

6.20 Weatherford International Plc.

1. Global Artificial Lift Market Research And Analysis By Type, 2024-2035 ($ Million)

2. Global Artificial ESP Lift Market Research And Analysis By Region,2024-2035 ($ Million)

3. Global Artificial Gas Lift Market Research And Analysis By Region, 2024-2035 ($ Million)

4. Global Artificial Plunger Lift Market Research And Analysis By Region, 2024-2035 ($ Million)

5. Global Artificial Rod Lift Market Research And Analysis By Region, 2024-2035 ($ Million)

6. Global Other Artificial Lift Type Market Research And Analysis By Region, 2024-2035 ($ Million)

7. Global Artificial Lift Market Research And Analysis By Application, 2024-2035 ($ Million)

8. Global Artificial Lift For Onshore Market Research And Analysis By Region, 2024-2035 ($ Million)

9. Global Artificial Lift For Offshore Market Research And Analysis By Region, 2024-2035 ($ Million)

10. Global Artificial Lift Market Research And Analysis By Region, 2024-2035 ($ Million)

11. North American Artificial Lift Market Research And Analysis By Country, 2024-2035 ($ Million)

12. North American Artificial Lift Market Research And Analysis By Type, 2024-2035 ($ Million)

13. North American Artificial Lift Market Research And Analysis By Application, 2024-2035 ($ Million)

14. European Artificial Lift Market Research And Analysis By Country, 2024-2035 ($ Million)

15. European Artificial Lift Market Research And Analysis By Type, 2024-2035 ($ Million)

16. European Artificial Lift Market Research And Analysis By Application, 2024-2035 ($ Million)

17. Asia-Pacific Artificial Lift Market Research And Analysis By Country, 2024-2035 ($ Million)

18. Asia-Pacific Artificial Lift Market Research And Analysis By Type, 2024-2035 ($ Million)

19. Asia-Pacific Artificial Lift Market Research And Analysis By Application, 2024-2035 ($ Million)

20. Rest Of The World Artificial Lift Market Research And Analysis By Region, 2024-2035 ($ Million)

21. Rest Of The World Artificial Lift Market Research And Analysis By Type, 2024-2035 ($ Million)

22. Rest Of The World Artificial Lift Market Research And Analysis By Application, 2024-2035 ($ Million)

1. Global Artificial Lift Market Share By Type, 2024 Vs 2035 (%)

2. Global Artificial ESP Lift Market Share By Region, 2024 Vs 2035 (%)

3. Global Artificial Gas Lift Market Share By Region, 2024 Vs 2035 (%)

4. Global Artificial Plunger Lift Market Share By Region, 2024 Vs 2035 (%)

5. Global Artificial Rod Lift Market Share By Region, 2024 Vs 2035 (%)

6. Global Other Artificial Lift Type Market Share By Region, 2024 Vs 2035 (%)

7. Global Artificial Lift Market Share By Application, 2024 Vs 2035 ($ Million)

8. Global Artificial Lift For Onshore Market Share By Region, 2024 Vs 2035 (%)

9. Global Artificial Lift For Offshore Market Share By Region, 2024 Vs 2035 (%)

10. Global Artificial Lift Market Share By Region, 2024 Vs 2035 (%)

11. US Artificial Lift Market Size, 2024-2035 ($ Million)

12. Canada Artificial Lift Market Size, 2024-2035 ($ Million)

13. UK Artificial Lift Market Size, 2024-2035 ($ Million)

14. France Artificial Lift Market Size, 2024-2035 ($ Million)

15. Germany Artificial Lift Market Size, 2024-2035 ($ Million)

16. Italy Artificial Lift Market Size, 2024-2035 ($ Million)

17. Spain Artificial Lift Market Size, 2024-2035 ($ Million)

18. Russia Artificial Lift Market Size, 2024-2035 ($ Million)

19. Rest Of Europe Artificial Lift Market Size, 2024-2035 ($ Million)

20. India Artificial Lift Market Size, 2024-2035 ($ Million)

21. Australia & New Zealand Artificial Lift Market Size, 2024-2035 ($ Million)

22. ASEAN Countries Artificial Lift Market Size, 2024-2035 ($ Million)

23. China Artificial Lift Market Size, 2024-2035 ($ Million)

24. Japan Artificial Lift Market Size, 2024-2035 ($ Million)

25. South Korea Artificial Lift Market Size, 2024-2035 ($ Million)

26. Rest Of Asia-Pacific Artificial Lift Market Size, 2024-2035 ($ Million)

27. Rest Of The World Artificial Lift Market Size, 2024-2035 ($ Million)

FAQS

The size of the Artificial Lift market in 2024 is estimated to be around USD 13.9 billion.

Asia-Pacific holds the largest share in the Artificial Lift market.

Leading players in the AMOLED display market include Baker Hughes Co., Halliburton Energy Services, Inc., Weatherford International PLC, Dover Corp., and others.

Artificial Lift market is expected to grow at a CAGR of 6.8% from 2025 to 2035.

The artificial lift market is growing due to increasing oil & gas exploration, rising demand for enhanced production efficiency, and advancements in lift technologies.