Artificial Pancreas Device System Market

Global Artificial Pancreas Device System Market Size, Share & Trends Analysis Report by Type (Threshold Suspended Device System, Insulin-Only System, and Bi-Hormonal Control System) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global artificial pancreas device system market is estimated to grow at an impressive growth rate of 55% during the forecast period. The artificial pancreas device system consists of two types of devices for diabetes monitoring; namely, continuous glucose monitoring (CGM) system and insulin infusion pump. As of 2019, the artificial pancreas device system has not been commercialized and is still in the development phase.

Diabetes has been a major epidemic across the globe. The adult diabetic population was 425 million in 2018 with the prevalence rate reaching 8.5% as per the World Health Organization (WHO). Over 1.6 million mortality occurred due to diabetes in 2018 across the globe. The increasing prevalence of diabetes and its burden coupled with the rising need for advanced and innovative diabetic care devices is acting as a driving factor for the growth of the market in the near future. Moreover, increasing awareness among the population towards diabetes and the growing focus of organizations towards the efficacy and R&D of artificial pancreas device systems across the globe is augmenting the market growth.

Segmental Outlook

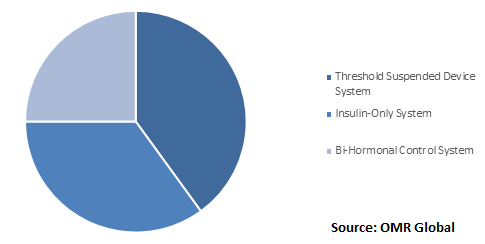

The global artificial pancreas device system market is segmented on the basis of type and region. On the basis of type, the market is sub-segmented into a threshold suspended device system, insulin-only system, and bi-hormonal control system. The threshold suspended device system serves as a potential back-up when a patient is unable to respond to low blood sugar (hypoglycemia) event. Owing to this, the threshold suspended device system segment is poised to hold significant potential during the forecast period.

Global Artificial Pancreas Device System Market Share by Type, 2018 (%)

- In February 2019, the US FDA announced the approval of Tandem Diabetes Care’s t: slim X2 pumps. These pumps can make a reliable and secure communication with digitally connected devices such as insulin dosing software, to receive, execute, and confirm command from these devices.

- In 2018, Dexcom acquired TypeZero Technologies, a company that has a system designed to manage and regulate insulin delivery from insulin pumps. With the acquisition, Dexcom aims to be one of the major players in the development of artificial pancreas technology.

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global artificial pancreas device system market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Medtronic PLC

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Johnson & Johnson Services Inc.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Insulet Corp.

3.3.3.1. Overview

3.3.3.2. SWOT Analysis

3.3.3.3. Recent Developments

3.3.4. Pancreum, Inc.

3.3.4.1. Overview

3.3.4.2. SWOT Analysis

3.3.4.3. Recent Developments

3.3.5. Tandem Diabetes Care, Inc.

3.3.5.1. Overview

3.3.5.2. SWOT Analysis

3.3.5.3. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Artificial Pancreas Device System Market by Type

5.1.1. Threshold Suspended Device System

5.1.2. Insulin-Only System

5.1.3. Bi-Hormonal Control System

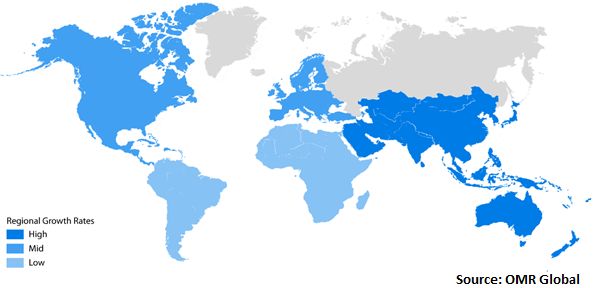

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Admetsys Corp.

7.2. Beta Bionics

7.3. Beta-O2 Technologies Ltd.

7.4. Bigfoot Biomedical Inc.

7.5. Companion Medical Inc.

7.6. Defymed SAS

7.7. Dexcom Inc.

7.8. Eli Lilly and Co.

7.9. Inreda Diabetic BV

7.10. Insulet Corp.

7.11. Johnson & Johnson Services Inc.

7.12. Medtronic PLC

7.13. Pancreum, Inc.

7.14. Tandem Diabetes Care, Inc.

- GLOBAL ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- GLOBAL THRESHOLD SUSPENDED ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL INSULIN-ONLY ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL BI-HORMONAL CONTROL ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- NORTH AMERICAN ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- NORTH AMERICAN ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- EUROPEAN ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- EUROPEAN ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- ASIA-PACIFIC ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- REST OF THE WORLD ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET RESEARCH AND ANALYSIS BY TYPE, 2018-2025 ($ MILLION)

- GLOBAL ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SHARE BY TYPE, 2018 VS 2025 (%)

- GLOBAL ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

- US ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- CANADA ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- UK ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- FRANCE ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- GERMANY ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- ITALY ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- SPAIN ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- ROE ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- CHINA ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- JAPAN ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- INDIA ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF ASIA-PACIFIC ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF THE WORLD ARTIFICIAL PANCREAS DEVICE SYSTEM MARKET SIZE, 2018-2025 ($ MILLION)