Asia-Pacific Solar Panel Market

Asia-Pacific Solar Panel Market Size, Share & Trends Analysis Report by Panel Type (Monocrystalline, Polycrystalline, And Thin-Film), by End-User (Residential Sector and Commercial Sector), and by Installation (Ground-Mount, and Rooftop) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

The Asia-Pacific solar panel market is estimated to grow at a significant CAGR of 12% during the forecast period. A variety of factors such as environmental concerns, decreasing price of main raw materials (silver, polysilicon), and demand for energy due to the rise in population are driving the Asia-pacific solar panel market. Moreover, increased carbon emissions due to fossil fuel and the need for unlimited clean energy are the other factors that are contributing to the growth of the Asia-pacific solar panel market. The adoption of solar panels in various applications including making rooftop, utility lands, and others are increasing which makes them more demanding. Besides, the governments, as well as other major players, are investing in the market, and strong government support in form of tax rebates, and incentives are further projected to provide significant market growth in the near future.

Impact of COVID-19

COVID-19 has jolted the global economy, and the whole world has been struggling to contain this disease. Due to COVID-19, there were no physical movements owing to the lockdown and government restrictions. Therefore, people started purchasing online to avoid going into crowded places. Following the recovery from the COVID-19 pandemic, the Asia-Pacific government is likely to take regulatory measures to boost the growth of the domestic solar energy market. Renewable energy sources are projected to be promoted by factors such as planned solar projects and government incentives to lessen reliance on fossil fuels. During the forecast period, this is expected to boost demand for solar panels in the region.

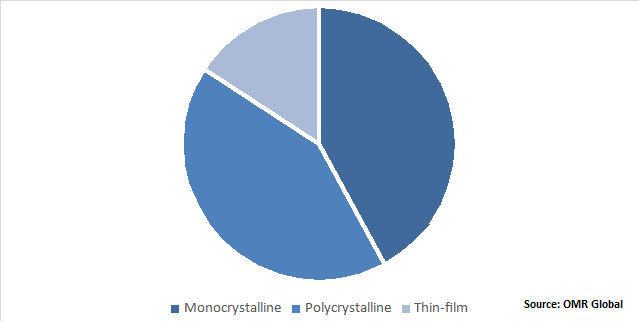

Asia-Pacific Solar Panel Market Growth by Panel Type, 2021 (%)

Monocrystalline Solar Panel Market Dominates the Asia-Pacific Solar Panel Market.

Asia-Pacific Monocrystalline market holds the highest share in 2020. It is also anticipated to grow at a considerable CAGR during the forecast period 2021-2017. Monocrystalline solar panels are widely adopted in residential installation applications. On the other hand, monocrystalline solar panels generated more energy, and have the highest capacity compared to other solar panels. These solar panels have efficiency ranges from 17% to 22%. Apart from this, monocrystalline solar cells in solar panels require less space to reach a given power capacity due to high efficiency. The cost of the monocrystalline solar panel is high compared to polycrystalline and thin-film because of their manufacturing process, which leads to the limited adoption of these solar panels. The incentives provided by the government in the form of subsidies to install a solar panel. This, in turn, is likely to have a positive impact on the adoption of monocrystalline solar panels in the region. On the other hand, the rapid development in technology to produce monocrystalline solar cells with less production cost is boosting the growth and development of the monocrystalline solar panel in the Asia-Pacific region.

Regional Outlooks

Asia-Pacific Solar Panel Market is segregated geographically into China, India, Japan, and the Rest of Asia-Pacific that. China and India are projected to contribute the highest share in the Asia-Pacific solar panel market during the forecast period followed by Japan. The factors contributing to the growth of this region include government initiatives towards renewable energy generation and subsidies for solar panel installations. According to the National Survey Report of PV Power Applications in China, in 2019 the annual photovoltaic power generation capacity was 22.43 billion kWh, accounting for 3.1% of China's total annual power generation (723.41 billion kWh), an increase of 0.5% year-on-year. On the other hand, the factors such as the rising demand for renewable energy sources to curb carbon emission, and the declining cost of photovoltaic cells for solar panels drives the market in this region.

Market Players Outlook

The key market players in the Asia-pacific solar panel market are Canadian Solar Inc., Wuxi Suntech Power Co., Ltd., Tata Power Solar Systems Ltd, First Solar, Inc. SunPower Corporation, Trina Solar Ltd., Juwi AG, Motech Industries, Inc., Hanwha Group, and others. To sustain a strong position in the market, these players adopt different marketing strategies such as merge and acquisitions, R&D, project development, and geographical expansion so on.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the Asia-Pacific solar panel market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Asia-Pacific Solar Panel Market by Panel Type

5.1.1. Monocrystalline

5.1.2. Polycrystalline

5.1.3. Thin-Film

5.1.3.1. Amorphous Silicon (A-SI)

5.1.3.2. Cadmium Telluride (CDTE)

5.1.3.3. Copper Indium Gallium Selenide (CIS/CIGS)

5.2. Asia-Pacific Solar Panel Market byEnd-User

5.2.1. Residential Sector

5.2.2. Commercial Sector

5.3. Asia-pacific Solar Panel Market by Installation

5.3.1. Ground-Mount

5.3.2. Rooftop

6. Country Analysis

6.1. China

6.2. India

6.3. Japan

6.4. Rest of Asia-Pacific

7. Company Profiles

7.1. Canadian Solar Inc.

7.2. Csun Solar Tech

7.3. Evergreen Solar

7.4. First Solar, Inc.

7.5. Hanwha Group

7.6. JA SOLAR Technology Co., Ltd.

7.7. JinkoSolar Holding Co., Ltd.

7.8. Juwi Holding AG

7.9. Motech Industries Inc.

7.10. RISEN ENERGY CO., LTD.

7.11. SoloPower Systems, Inc.

7.12. SunEdison Inc.

7.13. SunPower Corp.

7.14. Wuxi Suntech Power Co., Ltd.

7.15. Tata Power Solar Systems Ltd

7.16. Trina Solar Ltd.

7.17. Yingli Green Energy Holding Co. Ltd.

7.18. Zhongli Talesun Solar Co., Ltd.

1.ASIA-PACIFIC SOLAR PANEL MARKET RESEARCH AND ANALYSIS BY PANEL TYPE, 2021-2028 ($ MILLION)

2.ASIA-PACIFIC MONOCRYSTALLINE SOLAR PANEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3.ASIA-PACIFIC POLYCRYSTALLINE SOLAR PANEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4.ASIA-PACIFIC THIN-FILM SOLAR PANEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5.ASIA-PACIFIC AMORPHOUS SILICON (A-SI) THIN-FILM SOLAR PANEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6.ASIA-PACIFIC CADMIUM TELLURIDE (CDTE) THIN-FILM SOLAR PANEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7.ASIA-PACIFIC COPPER INDIUM GALLIUM SELENIDE (CIS/CIGS) THIN-FILM SOLAR PANEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8.ASIA-PACIFIC SOLAR PANEL MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028 ($ MILLION)

9.ASIA-PACIFIC SOLAR PANEL FOR RESIDENTIAL SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10.ASIA-PACIFIC SOLAR PANEL FOR COMMERCIAL SECTOR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11.ASIA-PACIFIC SOLAR PANEL MARKET RESEARCH AND ANALYSIS BY INSTALLATION, 2021-2028 ($ MILLION)

12.ASIA-PACIFIC SOLAR PANEL BY GROUND-MOUNT INSTALLATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13.ASIA-PACIFIC SOLAR PANEL BY ROOFTOP INSTALLATION MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14.ASIA-PACIFIC SOLAR PANEL MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

1.IMPACT OF COVID-19 ON ASIA-PACIFIC SOLAR PANEL MARKET, 2021-2028 ($ MILLION)

2.IMPACT OF COVID-19 ON ASIA-PACIFIC SOLAR PANEL MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3.RECOVERY OF ASIA-PACIFIC SOLAR PANEL MARKET, 2022-2028 (%)

4.ASIA-PACIFIC SOLAR PANEL MARKET SHARE BY PANEL TYPE, 2021 VS 2028 (%)

5.ASIA-PACIFIC MONOCRYSTALLINE SOLAR PANEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6.ASIA-PACIFIC POLYCRYSTALLINE SOLAR PANEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7.ASIA-PACIFIC THIN-FILM SOLAR PANEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8.ASIA-PACIFIC AMORPHOUS SILICON (A-SI) THIN-FILM SOLAR PANEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9.ASIA-PACIFIC CADMIUM TELLURIDE (CDTE) THIN-FILM SOLAR PANEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10.ASIA-PACIFIC COPPER INDIUM GALLIUM SELENIDE (CIS/CIGS) THIN-FILM SOLAR PANEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

ASIA-PACIFIC SOLAR PANEL MARKET SHARE BY END-USER, 2021 VS 2028 (%)

12.ASIA-PACIFIC SOLAR PANEL FOR RESIDENTIAL SECTOR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13.ASIA-PACIFIC SOLAR PANEL FOR COMMERCIAL SECTOR MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14.ASIA-PACIFIC SOLAR PANEL MARKET SHARE BY INSTALLATION, 2021 VS 2028 (%)

15.ASIA-PACIFIC SOLAR PANEL BY GROUND-MOUNT INSTALLATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

16.ASIA-PACIFIC SOLAR PANEL BY ROOFTOP INSTALLATION MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

17.ASIA-PACIFIC SOLAR PANEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

18.UK SOLAR PANEL MARKET SIZE, 2021-2028 ($ MILLION)

19.GERMANY SOLAR PANEL MARKET SIZE, 2021-2028 ($ MILLION)

20.SPAIN SOLAR PANEL MARKET SIZE, 2021-2028 ($ MILLION)

21.FRANCE SOLAR PANEL MARKET SIZE, 2021-2028 ($ MILLION)

22.ITALY SOLAR PANEL MARKET SIZE, 2021-2028 ($ MILLION)

23.REST OF ASIA-PACIFIC SOLAR PANEL MARKET SIZE, 2021-2028 ($ MILLION)