Asset Integrity Management Market

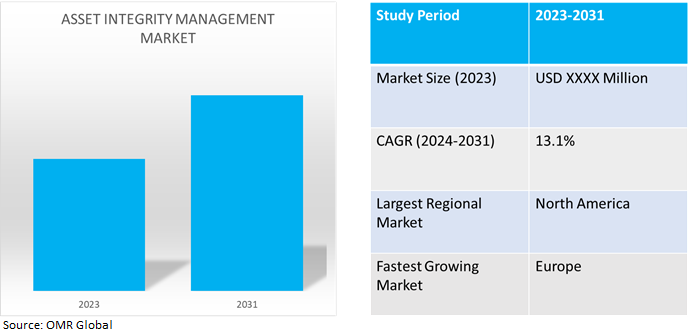

Asset Integrity Management Market Size, Share & Trends Analysis Report by Service Type (Risk-based Inspection (RBI), Non-Destructive Testing (NDT) Inspection, Corrosion Management, Pipeline Integrity Management, Hazard Identification (HAZID) Study, Structural Integrity Management, and Others),and by Industry(Oil & Gas, Power, Mining and Aerospace)Forecast Period (2024-2031)

Asset integrity management market is anticipated to grow at a significant CAGR of 13.1% during the forecast period (2024-2031).The growth of the asset integrity management market is attributed to increasing demand for asset performance management, product life-cycle management, total automation driven by the industrial internet of things (IIoT), and digital transformation globally driving the growth of the market.According to the International Society of Automation, in June 2021, Industry 4.0 and 5.0 introduced a package of innovative asset integrity management technologies, providing visibility across the operation and connecting the plant process, logistics, and supply chain, so all the stakeholders can make proper decisions and act at the right time.

Market Dynamics

Increasing Demand in Risk-Based Industries

Asset integrity management is a growing requirement in risk-based sectors to sustain aging assets. Increased threats to operational dependability and safety arise from the deterioration of aging sinfrastructure and equipment. In sectors where assets are exposed to challenging operating circumstances, such as oil and gas, petrochemicals, and power generation, effective asset integrity management is crucial to reducing risks and guaranteeing regulatory compliance. Proactive maintenance techniques are essential to extend asset lifespan and maximize performance. Risk-based approaches are used to prioritize resources and treatments according to asset criticality and possible failure modes. Market players strive to minimize downtime, enhance safety, and maximize asset value; the increasing focus on maintaining aging assets underscores the significance of asset integrity management solutions in risk-based industries.

Increasing Adoption of Asset Performance Management (APM)

With the specific goal of enhancing the availability and dependability of physical assets, asset performance management (APM) integrates data collection, integration, visualization, and analytics capabilities. A framework aids administrators in making the most use of their physical assets in commercial organizations. Under asset performance management, many techniques are used to increase earnings and lower risk factors in a company. Market players reevaluate their APM approach. Uptime, asset longevity, maintenance costs, and safety can all be further increased with greater adoption of condition monitoring and predictive maintenance systems. Asset failure can be anticipated and predicted using data analytics gathered by APM software. Additionally, it can forecast when an item will require upkeep or repairs.

Market Segmentation

Our in-depth analysis of the global asset integrity management market includes the following segments by service type and industry.

- Based onservice type, the market is sub-segmented intorisk-based inspection (RBI), non-destructive testing (NDT) inspection, corrosion management, pipeline integrity management, hazard identification (HAZID) study, structural integrity management, and others (reliability, availability, and maintainability (RAM) study).

- Based on industry,the market is sub-segmented into oil & gas, power, mining and aerospace.

Service Type is Projected to Emerge as the Largest Segment

Based on the service type,the global asset integrity management market is sub-segmented intorisk-based inspection (RBI), non-destructive testing (NDT) inspection, corrosion management, pipeline integrity management, hazard identification (HAZID) study, structural integrity management, and others (reliability, availability, and maintainability (RAM) study).Among thiscorrosion management, the sub-segment is expected to hold the largest share of the market.The primary factors supporting the segment's growth include the increasing demand for corrosion management in industries such as oil & gas, manufacturing, Mining, and others.A robust asset integrity program has many individual elements, such as chemical treatments, corrosion monitoring, inspection, and data management and interpretation. It also provides a record of accomplishmentindevising bespoke corrosion control, corrosion monitoring, and data management programs to mitigate risk and support safer oil and gas operations.For instance, in August 2022, SLB introduced a Comprehensive portfolio of solutions for corrosion inhibition, bacteria management, and H2S removal for Oil & gas asset integrity. Preventing corrosion and preserving the integrity of upstream, midstream, and downstream oil and gas facilities is essential to their safe operation, reliable production, and protection of personnel and the environment.

Power Sub-segment to Hold a Considerable Market Share

Based on the industry,the global asset integrity management market is sub-segmented intooil & gas, power, mining, and aerospace.Among these, the powersub-segment is expected to hold a considerable share of the market. The increasing demand for asset integrity management in the power industry to optimize operation, maintenance, capital improvement, and cost of cycling evaluations which include power generation equipment testing, high energy piping inspection, and laboratory analysis for power plants. For instance, in December 2023, Antea and TEAM collaborated for next-generation asset integrity management. The partnership combines the strength of both companies to create a “one-stop-shop” AIM solution for operators in asset-intensive industries such as oil and gas, aerospace, petrochemical, power, nuclear, mining, and pharmaceutical.

Regional Outlook

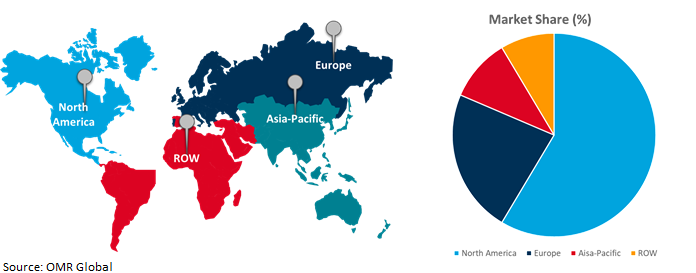

The globalasset integrity management market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Asset Integrity Management Adoptionin Europe

- The region's rapid industrialization and infrastructure development are fueling the demand for reliable asset integrity management solutions to ensure operational safety and reliability across diverse sectors.

- The rising adoption of advanced technologies like IoT and Al in industries such as oil and gas, manufacturing, and power generation presents opportunities for real-time monitoring and predictive maintenance, driving further growth in the market.

Global Asset Integrity Management Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to numerous prominent companies and asset integrity management providers.The growth is attributed to thegrowing demand for asset integrity management solutions in applications such as manufacturing, aerospace, oil & gas, and power generation driving the growth of the market in the region. Market players introducing asset integrity management (AIM) software for risk-based inspection, maintenance strategy optimization, and pipeline integrity. For instance, in October 2023, Cenosco introduced asset integrity management (AIM) software for the oil & gas and petrochemical industries. Cenosco’s software suite of solutions is designed to streamlineoperations and create a safer and more efficient work environment. Cenosco recognizes the need for process-intensive industries to meet and exceed safety, compliance, and efficiency standards while delivering industry expertise.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global asset integrity managementmarket include Baker Hughes Company, DNV AS, General Electric Company, Oceaneering International, Inc., and Siemens AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in March 2024, Oceaneering International, Inc. its Integrity Management and Digital Solutions (IMDS) group signed a strategic collaboration agreement with Aberdeen technology and engineering services provider Global Design Innovation, Ltd. (GDi) to deliver innovative digital asset management solutions for asset-intensive industries such as oil and gas, utilities, and power generation.

Recent Development

- In October 2023, Hitachi Energy launched the Next Generation of its Asset Performance Management Solution, Lumada APM. The release builds on the strength of its proven asset health prediction offering and expands with two additional APM modules – Lumada APM reliability and Lumada APM optimization.

- In July 2023, BlackRock and Jio Financial Services Ltd. (JFS) announced an agreement to form Jio BlackRock, a joint venture that combines the respective strengths and trusted brands of BlackRock and JFS to deliver tech-enabled access to affordable, innovative investment solutions for millions of investors in India. The partnership aims to transform India’s asset management industry through a digital-first offering and democratize access to investment solutions for investors in India.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global asset integrity management market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Baker Hughes Company

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. General Electric Company

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Siemens AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Asset Integrity Management Market by Service Type

4.1.1. Risk-based Inspection (RBI)

4.1.2. Non-Destructive Testing (NDT) Inspection

4.1.3. Corrosion Management

4.1.4. Pipeline Integrity Management

4.1.5. Hazard Identification (HAZID) Study

4.1.6. Structural Integrity Management

4.1.7. Others (Reliability, Availability and Maintainability (RAM) Study)

4.2. Global Asset Integrity Management Market by Industry

4.2.1. Oil & Gas

4.2.2. Power

4.2.3. Mining

4.2.4. Aerospace

4.2.5. Others

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ABS Group

6.2. Asset Guardian

6.3. Bilfinger Region Nordics

6.4. Cenosco B.V.

6.5. DNV AS

6.6. EM&I Group

6.7. EnerMech

6.8. FORCE Technology

6.9. Intertek Group plc

6.10. Metegrity Inc.

6.11. MISTRAS Group

6.12. Oceaneering International, Inc.

6.13. Onstream Pipeline Inspection Services Inc.

6.14. Penspen Group

6.15. Petrofac Ltd.

6.16. Ramco Systems

6.17. SGS Société Générale de Surveillance SA

6.18. TEAM, Inc.

6.19. TÜV SÜD

6.20. Zoho Corporation Pvt. Ltd.

1. GLOBAL ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2023-2031 ($ MILLION)

2. GLOBAL RISK-BASED INSPECTION (RBI) ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL NON-DESTRUCTIVE TESTING (NDT) INSPECTION ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL CORROSION ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL PIPELINE ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL HAZARD IDENTIFICATION (HAZID) STUDY ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL STRUCTURAL ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL OTHER ASSET INTEGRITY MANAGEMENT SERVICE TYPE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

10. GLOBAL ASSET INTEGRITY MANAGEMENT FOR OIL & GAS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL ASSET INTEGRITY MANAGEMENT FOR POWER MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL ASSET INTEGRITY MANAGEMENT FOR MINING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL ASSET INTEGRITY MANAGEMENT FOR AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

18. EUROPEAN ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

19. EUROPEAN ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

24. REST OF THE WORLD ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY SERVICE TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD ASSET INTEGRITY MANAGEMENT MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL ASSET INTEGRITY MANAGEMENT MARKET SHARE BY SERVICE TYPE, 2023 VS 2031 (%)

2. GLOBAL RISK-BASED INSPECTION (RBI) ASSET INTEGRITY MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL NON-DESTRUCTIVE TESTING (NDT) INSPECTION ASSET INTEGRITY MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL CORROSION ASSET INTEGRITY MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL PIPELINE ASSET INTEGRITY MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL HAZARD IDENTIFICATION (HAZID) STUDY ASSET INTEGRITY MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL STRUCTURAL ASSET INTEGRITY MANAGEMENT MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL OTHERS ASSET INTEGRITY MANAGEMENT SERVICE TYPE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL ASSET INTEGRITY MANAGEMENT MARKET SHARE BY INDUSTRY, 2023 VS 2031 (%)

10. GLOBAL ASSET INTEGRITY MANAGEMENT FOR OIL & GAS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL ASSET INTEGRITY MANAGEMENT FOR POWER MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL ASSET INTEGRITY MANAGEMENT FOR MINING MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL ASSET INTEGRITY MANAGEMENT FOR AEROSPACE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. US ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

15. CANADA ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

16. UK ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

17. FRANCE ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

18. GERMANY ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

19. ITALY ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

20. SPAIN ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

21. REST OF EUROPE ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

22. INDIA ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

23. CHINA ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

24. JAPAN ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

25. SOUTH KOREA ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

26. REST OF ASIA-PACIFIC ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

27. LATIN AMERICA ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)

28. MIDDLE EAST AND AFRICA ASSET INTEGRITY MANAGEMENT MARKET SIZE, 2023-2031 ($ MILLION)