Asset Performance Management (APM) Market

Global Asset Performance Management (APM) Market Size, Share & Trends Analysis Report by Deployment (Cloud-based and On-Premises ), By Industry (BFSI, Energy & Utilities, Healthcare, Government, IT & Telecom and Others) and Forecast 2019-2025 Update Available - Forecast 2025-2031

The global market for APM is projected to have considerable CAGR during the forecast period. The market growth is attributed to various pivotal factors such as the growing demand for cloud-based APM services associated with growing demand from small-medium sized enterprises (SMEs) across the globe. Owing to this, various cloud-based APM solution providers are introducing new products to fulfill the growing demand from different verticals. For instance, in October 2019, IBM announced the launch of IBM Maximo Enterprise Asset Management SaaS with an aim to provide the cloud-based asset management experience to global clients with the ability to generate role-based work centers. Further, in November 2018, Nuvolo collaborated with GE Healthcare to offer a cloud-based clinical EAM platform to Healthcare Technology Management (HTM) professionals. In addition, the increasing demand for innovative technologies such as Artificial Intelligence (AI) and machine learning for predicting and preventing system errors and reducing the overall maintenance cost is also driving the demand for EAM products in energy & utility, manufacturing, and IT & telecommunication industry.

Segmental Outlook

The global APM market is segmented based on deployment and industry. Based on the deployment, the market is further classified into cloud-based and on-premises. The cloud based segment is projected to have considerable growth owing to the growing demand of cloud based APM solutions across various enterprises. Cloud-based APM requires no hardware other than mobile devices, tablets, or personal computers and can be easily scalable to fit the demand of an organization. On-premise APM requires a substantial initial investment to purchase and maintain the necessary hardware to run the APM software, whereas, APM Cloud system does not require any investment on specific hardware. On the basis of industry the market is further segregated into BFSI, retail, energy and utility, healthcare, government, IT & telecom, and others.

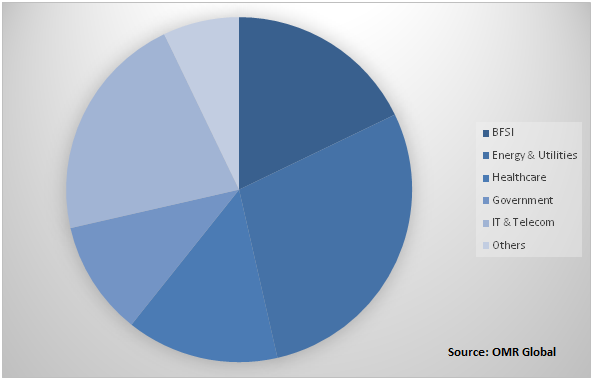

Global APM Market Share by Industry, 2018(%)

Global APM market to be driven by Energy & Utilities

Among Industry, the energy & utilities segment held a considerable share in the market. The market mainly driven due to the growing demand for rapid identification of assets, mapping areas of problem for remediation, decreasing time to resolution, leveraging the efficiency and minimizing cost. Various utility suppliers have deployed APM solutions to ease the maintenance of complex assets in the industry. For instance, Cheniere Energy, Inc., a natural gas company collaborated with Cohesive Solutions for the installation of the IBM Maximo asset management solution. Cheniere installed the solution to transform the maintenance of complex assets at their upgraded Sabine Pass facility in the US. Moreover, IT & telecom industry have considerable growth owing to growing demand to manage IT infrastructure such as data center infrastructure assets. In addition, the growing demand for constant inspection, monitoring, and maintenance of components of the telecommunications network is driving the market growth in IT & telecom industry.

Regional Outlook

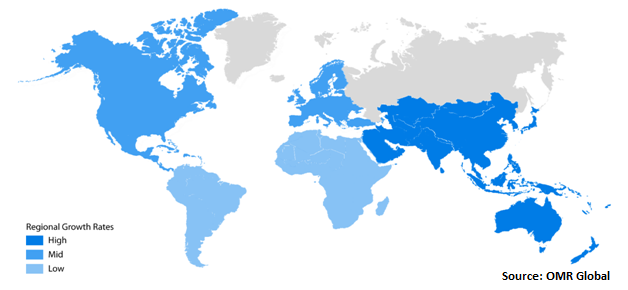

Geographically, the global APM market is further classified into North America, Europe, Asia-Pacific and the Rest of the World. Asia-Pacific is estimated to have considerable market growth in the global market during the forecast period. The market growth is attributed to the significant adoption of APM in economies such as China, Japan, India, South Korea, Thailand, and Australia. Further, growth in the industry vertical in these countries and increasing awareness toward the advantage of asset management is also driving the market growth. Additionally, the increasing demand for power in the region is likely to add significant assets in the country including solar farms, windmills, thermal power plants and others which create scope for the APM market growth in the region in the near future.

Global APM Market Growth, by Region 2019-2025

North America to hold a considerable share in the global APM market

Geographically, North America is projected to hold a significant market share in the global APM market. Major economies which are anticipated to contribute to the North America APM market are the US and Canada. North America is dominating the APM market owing to wide adoption of APM solutions, significant presence of APM vendors and growing government support. Additionally, the surging demand for APM solutions by various industry verticals such as BFSI, energy & power, government and utilities, and IT & telecom, which are growing significantly in the region, is further driving the market growth. Furthermore, the well-established energy and power sector of the country is also providing a significant thrust to the adoption of APM solutions within the region. The US is one of the leading economies in the energy and power sector, which is under a transition with more focus on renewable sources of energy over non-renewable sources of energy.

Market Players Outlook

The key players in the APM market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include ABB Ltd., General Electric Co., IBM Corp., SAP SE, Bentley Systems, Inc., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. For instance, in November 2019, IBM introduced a Maximo Asset Monitor, a new AI-powered monitoring solution designed to enable end-user to improve maintenance and performance of their high-value physical assets.

The Report Covers

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global APM market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. ABB Ltd.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. General Electric Co.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. IBM Corp.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. SAP SE

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Bentley Systems, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global APM Market by deployment

5.1.1. Cloud-based

5.1.2. On-Premises

5.2. Global APM Market by Industry

5.2.1. BFSI

5.2.2. Energy &Utilities

5.2.3. Healthcare

5.2.4. Government

5.2.5. IT & Telecom

5.2.6. Others(Food & Beverages)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. ABB Ltd.

7.2. Aspen Technology, Inc.

7.3. Aptean Group

7.4. AVEVA Group plc

7.5. Accruent

7.6. Bentley Systems, Inc.

7.7. DNV GL AS

7.8. eMaint Enterprises, LLC

7.9. General Electric Co.

7.10. IBM Corp.

7.11. Infor

7.12. Intelligent Process Solutions GmbH

7.13. Microsoft Corp.

7.14. Nexus Global Business Solutions, Inc.

7.15. OSIsoft, LLC

7.16. Oracle Corp.

7.17. Rockwell Automation, Inc.

7.18. SAP SE

7.19. Siemens AG

7.20. Uptake Technologies Inc.

1. GLOBAL APM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2018-2025 ($ MILLION)

2. GLOBAL CLOUD BASED APM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

3. GLOBAL ON-PREMISES APM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

4. GLOBAL APM MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

5. GLOBAL APM IN BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

6. GLOBAL APM IN ENERGY & UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

7. GLOBAL APM IN HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

8. GLOBAL APM IN GOVERNMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

9. GLOBAL APM IN IT & TELECOM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

10. GLOBAL APM IN OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

11. GLOBAL APM MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

12. NORTH AMERICAN APM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

13. NORTH AMERICAN APM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2018-2025 ($ MILLION)

14. NORTH AMERICAN APM MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

15. EUROPEAN APM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

16. EUROPEAN APM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2018-2025 ($ MILLION)

17. EUROPEAN APM MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

18. ASIA-PACIFIC APM MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

19. ASIA-PACIFIC APM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2018-2025 ($ MILLION)

20. ASIA-PACIFIC APM MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

21. REST OF THE WORLD APM MARKET RESEARCH AND ANALYSIS BY DEPLOYMENT, 2018-2025 ($ MILLION)

22. REST OF THE WORLD APM MARKET RESEARCH AND ANALYSIS BY INDUSTRY, 2018-2025 ($ MILLION)

1. GLOBAL APM MARKET SHARE BY DEPLOYMENT, 2018 VS 2025 (%)

2. GLOBAL APM MARKET SHARE BY INDUSTRY, 2018 VS 2025 (%)

3. GLOBAL APM MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

4. US APM MARKET SIZE, 2018-2025 ($ MILLION)

5. CANADA APM MARKET SIZE, 2018-2025 ($ MILLION)

6. UK APM MARKET SIZE, 2018-2025 ($ MILLION)

7. FRANCE APM MARKET SIZE, 2018-2025 ($ MILLION)

8. GERMANY APM MARKET SIZE, 2018-2025 ($ MILLION)

9. ITALY APM MARKET SIZE, 2018-2025 ($ MILLION)

10. SPAIN APM MARKET SIZE, 2018-2025 ($ MILLION)

11. ROE APM MARKET SIZE, 2018-2025 ($ MILLION)

12. INDIA APM MARKET SIZE, 2018-2025 ($ MILLION)

13. CHINA APM MARKET SIZE, 2018-2025 ($ MILLION)

14. JAPAN APM MARKET SIZE, 2018-2025 ($ MILLION)

15. REST OF ASIA-PACIFIC APM MARKET SIZE, 2018-2025 ($ MILLION)

16. REST OF THE WORLD APM MARKET SIZE, 2018-2025 ($ MILLION)