Athleisure Market

Global Athleisure Market Size, Share & Trends Analysis Report by Product Types (Clothing, Footwear), By Distribution Channel (Offline Stores, and Online Stores), By End-User (Men, Women, and Kids) Forecast Period 2022-2028 Update Available - Forecast 2025-2035

The global market for athleisure is projected to have a considerable CAGR of around 8.7% during the forecast period. Athleisure is defined as a mix of athletic and informal leisure activities, and it is a popular category as it taps into several broad trends. Consumers are increasingly incorporating sports and fitness activities into their everyday routines as their health and self-consciousness improve, as well as their desire to live active lifestyles. This increased participation has led to a change in market dynamics, leading to an increased demand for athleisure products. Moreover, the athleisure market is also expected to rise as consumer lifestyles evolve, particularly in developing countries, as a result of rising disposable income levels and the adoption of sporty attractive looks. Furthermore, a long-standing fashion trend, sustainability, has made its way into the athleisure industry. Consumers continue to seek for and buy products that are made of environmentally friendly, long-lasting, and high-quality materials.

Impact of COVID-19 on Athleisure market

The COVID-19 pandemic has had a significant impact on the market. Consumer expenditure for athletic clothing and footwear has dropped, according to brands such as Adidas, Nike, and Puma, as customers cut down or delayed discretionary expenditure in response to the effects of COVID-19, owing to higher unemployment rates and lower consumer confidence. Furthermore, decreasing retail traffic as a result of store closures, reduced operation hours, and social distancing regulations all have an impact on market growth. For instance, Nike's operations were disrupted during Q4 2020, when about 90% of its NIKE Brand stores in North America, EMEA, and APLA, excluding Korea, were closed for almost 8 weeks.

Segmental Outlook

The global Athleisure market is segmented based on product types, distribution channels, and end-user. Based on the product types, the market is further classified into clothing, footwear. Further, based on the distribution channel the market is classified into offline stores, and online stores. Based on end-user, the market is segregated into men, women, and kids.

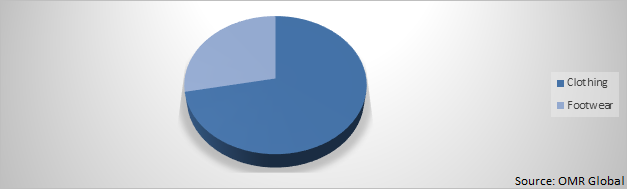

Global Athleisure Market Share by product types, 2021 (%)

The Clothing Segment is Considered as Dominating Segment in the Global Athleisure Market.

Among product types, the clothing segment is estimated as dominating segment during the forecast period owing to factors such as evolving consumer lifestyles throughout developing nations as a result of growing disposable income and a desire to keep up with the latest trends in sports trendy looks. Athletic-casual clothing is growing more popular on a variety of social occasions. Sports-inspired materials like spandex, Lycra, and other synthetic fibers are used in many of the garments that are considered work-appropriate. Consumer focus on the healthy regime and rising level of health-consciousness are making people get selective regarding apparel for gym sessions, personal training, and casual work. The segment is expanding due to rising interest in sports and adventurous activities such as cycling and trekking. Furthermore, fitness influencers' strong efforts to promote activewear and attract consumers have created the athleisure cult, which encourages people to wear activewear to gyms, social gatherings, and runways.

Regional Outlook

Geographically, the global Athleisure market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, and Rest of Europe), Asia-Pacific (India, China, Japan, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Asia Pacific is projected to have a significant CAGR in the Athleisure market. The growth is attributed to the rise in disposable income and health awareness of customers. Furthermore, an increase in the youth and elderly population's interest in physical activities will enhance demand for sports-related commodities, contributing to the market's growth in the region.

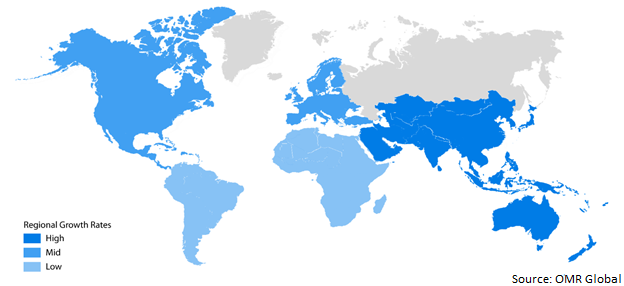

Global Athleisure Market Growth, by region 2021-2027

North America to Hold the Largest Share in the Global Athleisure Market

Geographically, North America is projected to hold a significant share in global athleisure market. The increased awareness about adopting healthy lives is expected to add to the demand for various garments in North American regions, encouraging customers to buy and participate in fitness/strength activities. The majority of consumers in the region consider activewear to be comfortable and flexible, which can be attributed to the materials used to create such clothing or footwear. According to the Outdoor Foundation, nearly 28 million people in the US practice yoga. In the US, fashion searches for yoga apparel increased in 2020, and buyers are selecting more colors in their yoga products as well.

Market Players Outlook

The key players in the Athleisure market contribute significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Nike Inc., Adidas AG, Under Armour, Inc., Lululemon Athletic, Puma SE, among others. These market players adopt various strategies such as product launches, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market. In October 2020, Kohl’s launched a new athleisure brand called FLX as demand for casual attire surges amid the pandemic and the rise of telecommuting and remote work. Kohl's is expanding its footprint in the growing active and casual categories with the launch of this new clothing line. Kohl's developed a vision to more proactively serve as the most trusted store of choice in these categories as customers increasingly purchase for a more comfortable and casual lifestyle.

The Report Covers

- Market value data analysis of 2022 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Athleisure market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying 'who-stands-where in the market.

1. Report Summary

1.1. Research Methods and Tools

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Athleisure Industry

• Recovery Scenario of Global Athleisure Industry

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.4. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Athleisure Market by Product Types

5.1.1. Clothing

5.1.2. Footwear

5.2. Global Athleisure Market by Distribution Channel

5.2.1. Offline Stores

5.2.2. Online Stores

5.3. Global Athleisure Market by End-User

5.3.1. Men

5.3.2. Women

5.3.3. Kids

6. Regional Analysis

6.1. North America

6.1.1. US

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. ASEAN

6.3.5. South Korea

6.3.6. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Adidas AG

7.2. ASICS Corp

7.3. Columbia Sportswear Co

7.4. Corporation

7.5. Eileen Fisher

7.6. Gap Inc.

7.7. Hanes Brands, Inc.

7.8. Hennes & Mauritz AB

7.9. Lululemon Athletica Inc

7.10. New Balance Athletics Inc.

7.11. Nike Inc.

7.12. Outerknown

7.13. Patagonia, Inc.

7.14. PUMA SE

7.15. Ten Thousand, Inc.

7.16. TEREZ

7.17. The North Face

7.18. Under Armour Inc.

7.19. Vuori, Inc.

7.20. Wear Pact, LLC

1. GLOBAL ATHLEISURE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2021-2028($ MILLION)

2. GLOBAL CLOTHING ATHLEISURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028($ MILLION)

3. GLOBAL FOOTWEAR ATHLEISURE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028($ MILLION)

4. GLOBAL ATHLEISURE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028($ MILLION)

5. GLOBAL ATHLEISURE IN OFFLINE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028($ MILLION)

6. GLOBAL ATHLEISURE IN ONLINE STORES MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028($ MILLION)

7. GLOBAL FLEET MANAGEMENTMARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028($ MILLION)

8. GLOBAL ATHLEISURE FOR MEN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028($ MILLION)

9. GLOBAL ATHLEISURE FOR WOMEN MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028($ MILLION)

10. GLOBAL ATHLEISURE FOR KIDS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028($ MILLION)

11. GLOBAL ATHLEISURE MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028($ MILLION)

12. NORTH AMERICAN ATHLEISURE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028($ MILLION)

13. NORTH AMERICAN ATHLEISURE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2021-2028($ MILLION)

14. NORTH AMERICAN ATHLEISURE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028($ MILLION)

15. NORTH AMERICAN ATHLEISURE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028($ MILLION)

16. EUROPEAN ATHLEISURE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028($ MILLION)

17. EUROPEAN ATHLEISURE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2021-2028($ MILLION)

18. EUROPEAN ATHLEISURE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028($ MILLION)

19. EUROPEAN FLEET MANAGEMENTMARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028($ MILLION)

20. ASIA-PACIFIC ATHLEISURE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028($ MILLION)

21. ASIA-PACIFIC ATHLEISURE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2021-2028($ MILLION)

22. ASIA-PACIFIC ATHLEISURE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028($ MILLION)

23. ASIA-PACIFIC FLEET MANAGEMENTMARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028($ MILLION)

24. REST OF THE WORLD ATHLEISURE MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPES, 2021-2028($ MILLION)

25. REST OF THE WORLD ATHLEISURE MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028($ MILLION)

26. REST OF THE WORLD ATHLEISURE MARKET RESEARCH AND ANALYSIS BY END-USER, 2021-2028($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL ATHLEISURE MARKET, 2021-2028(% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL ATHLEISURE MARKET BY SEGMENT, 2021-2028(% MILLION)

3. RECOVERY OF GLOBAL ATHLEISURE MARKET, 2021-2028(%)

4. GLOBAL ATHLEISURE MARKET SHARE BY PRODUCT TYPES, 2021 VS 2028 (%)

5. GLOBAL ATHLEISURE MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

6. GLOBAL ATHLEISURE MARKET SHARE BY END-USER, 2021 VS 2028 (%)

1. GLOBAL ATHLEISURE MARKET SHARE BY SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

2. GLOBAL CLOTHING ATHLEISURE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

3. GLOBAL FOOTWEAR ATHLEISURE MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

4. GLOBAL ATHLEISURE IN OFFLINE STORES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

5. GLOBAL ATHLEISURE IN ONLINE STORES MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL ATHLEISURE IN MEN END USER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL ATHLEISURE IN WOMEN END USER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

8. GLOBAL ATHLEISURE IN KIDS END USER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. US ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

8. CANADA ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

9. UK ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

10. FRANCE ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

11. GERMANY ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

12. ITALY ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

13. SPAIN ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

14. ROE ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

15. INDIA ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

16. CHINA ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

17. JAPAN ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

18. ASEAN ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

19. SOUTH KOREA ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

20. REST OF ASIA-PACIFIC ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)

21. REST OF THE WORLD ATHLEISURE MARKET SIZE, 2021-2028($ MILLION)