Atrial Fibrillation Devices Market

Global Atrial Fibrillation Devices Market Size, Share & Trends Analysis Report by Product Type (Electrophysiology Ablation Catheters, Electrophysiology Diagnostic Catheters, Electrophysiology Mapping and Recording Systems, Cardiac Monitors, and Others), By End-Use (Hospitals and Ambulatory Surgery Centers (ASCs) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global atrial fibrillation devices market is estimated to grow significantly at a CAGR of 13.7% during the forecast period. The major factors contributing to the market growth include rising prevalence of atrial fibrillation coupled with the significant incidences of cardiac arrhythmias and rising demand for minimally invasive procedures. Atrial fibrillation is the most common cause of heart arrhythmia, in which, the heart beats very slowly, very fast or in an irregular way. According to the Institute for Health Metrics and Evaluation, the prevalence of atrial fibrillation in 2013 was 33.6 million, which increased up to 37.5 million in 2017. With the significant rise in geriatric population across the globe, this number is expected to increase in the near future.

The two major strategies used for the management of atrial fibrillation include rhythm control and rate control. Rhythm control comprises the use of electrophysiological interventions which intends to convert the arrhythmia concerned with atrial fibrillation to normal sinus rhythm. While diagnosed with atrial fibrillation, the doctor recommends an electrophysiology study to better understand the way electrical signals move in the heart to make it beat. The test enables to understand and map the electrical activity in the heart, which, in turn, contributes to diagnose abnormal heart rhythms.

Segmental Outlook

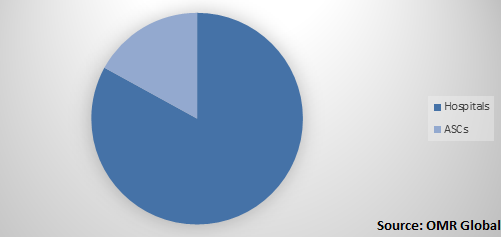

The global atrial fibrillation devices market is segmented on the basis of product type, end-use, and region. On the basis of product type, the market is sub-segmented into electrophysiology ablation catheters, electrophysiology diagnostic catheters, electrophysiology mapping and recording systems, cardiac monitors, and others. Based on the end-use, the market is divided into hospitals and ambulatory surgery centers (ASCs).

Global Atrial Fibrillation Devices Market Share by End-Use, 2018 (%)

- In May 2019, Koninklijke Philips NV announced a collaboration with Medtronic PLC to further advance the treatment of paroxysmal atrial fibrillation, a common heart rhythm disorder. Through the agreement, Medtronic will facilitate sales of products on behalf of Philips to provide an innovative, integrated image guidance solution for cryoablation procedures. Additionally. Philips will bring the novel KODEX-EPD cardiac imaging and navigation system with cryoablation specific features to enable electrophysiologists to perform cryoablation procedures with reduced need for X-ray imaging into the market.

- In February 2019, Johnson & Johnson Institute partners with the electrophysiology community to fight the growing epidemic of atrial fibrillation. This includes more than 900 members of the electrophysiology community with an agenda to reflect the latest developments, research, and perspectives in the diagnosis and treatment of atrial fibrillation. This will enable the company to conduct R&D for the development of much reliable, safer and efficient electrophysiology products.

- In May 2018, Biosense Webster Inc., a subsidiary of Johnson & Johnson Services, Inc. introduced CARTO VIZIGO Bi-directional Guiding Sheath to decrease radiation exposure and augment the efficiency of the ablation procedure. It is the first steerable guiding sheath available commercially and visualized on the CARTO 3 system during a catheter ablation procedure to enable electrophysiologists to decrease dependency on fluoroscopy. With this launch, the company sustained a strong position in the market and offers substantial market opportunities for market growth.

- In March 2017, Abbott Laboratories Inc. declared the US FDA approval for FlexAbility ablation catheter, sensor-enabled to increase the accuracy and versatility during cardiac ablation procedures and for the treatment of atrial flutter. Due to this approval, Abbott has widened its portfolio related to electrophysiology to effectively treat patients suffering from cardiac arrhythmias and supports physicians to solve complex cases.

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global atrial fibrillation devices market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Abbott Laboratories Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Boston Scientific Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Koninklijke Philips NV

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Siemens AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Medtronic PLC

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Atrial Fibrillation Devices Market by Product Type

5.1.1. Electrophysiology Ablation Catheters

5.1.2. Electrophysiology Diagnostic Catheters

5.1.3. Electrophysiology Mapping and Recording Systems

5.1.4. Cardiac Monitors

5.1.5. Others (Intracardiac Echocardiography (ICE) Systems)

5.2. Global Atrial Fibrillation Devices Market by End-Use

5.2.1. Hospitals and Clinics

5.2.2. Ambulatory Surgery Centers (ASCs)

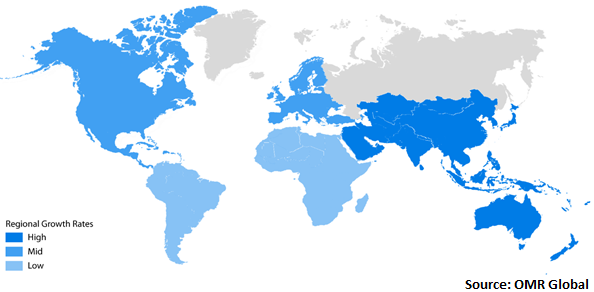

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. Japan

6.3.3. India

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Abbott Laboratories Inc.

7.2. Advanced Cardiac Therapeutics, Inc.

7.3. AliveCor, Inc.

7.4. AtriCure, Inc.

7.5. AuriGen Medical

7.6. BIOTRONIK SE & Co. KG

7.7. Boston Scientific Corp.

7.8. CardioFocus, Inc.

7.9. CathRx Ltd.

7.10. General Electric Co.

7.11. Hansen Medical Inc.

7.12. Japan Lifeline Co.

7.13. Johnson and Johnson Services Inc. (Biosense Webster)

7.14. Koninklijke Philips NV

7.15. Medtronic PLC

7.16. MicroPort Scientific Corp.

7.17. Osypka AG

7.18. Siemens AG

7.19. Stereotaxis, Inc.

7.20. Vanguard AG

7.21. Verily Life Sciences LLC

- GLOBAL ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

- GLOBAL ELECTROPHYSIOLOGY ABLATION CATHETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ELECTROPHYSIOLOGY DIAGNOSTIC CATHETERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ELECTROPHYSIOLOGY MAPPING AND RECORDING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL CARDIAC MONITORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL OTHER ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

- GLOBAL ATRIAL FIBRILLATION DEVICES IN HOSPITALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ATRIAL FIBRILLATION DEVICES IN ASC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- NORTH AMERICAN ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- NORTH AMERICAN ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

- NORTH AMERICAN ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

- EUROPEAN ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- EUROPEAN ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

- EUROPEAN ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

- ASIA-PACIFIC ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

- ASIA-PACIFIC ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

- REST OF THE WORLD ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2018-2025 ($ MILLION)

- REST OF THE WORLD ATRIAL FIBRILLATION DEVICES MARKET RESEARCH AND ANALYSIS BY END-USE, 2018-2025 ($ MILLION)

- GLOBAL ATRIAL FIBRILLATION DEVICES MARKET SHARE BY PRODUCT TYPE, 2018 VS 2025 (%)

- GLOBAL ATRIAL FIBRILLATION DEVICES MARKET SHARE BY END-USE, 2018 VS 2025 (%)

- GLOBAL ATRIAL FIBRILLATION DEVICES MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

- US ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- CANADA ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- UK ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- FRANCE ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- GERMANY ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- ITALY ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- SPAIN ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- ROE ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- CHINA ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- JAPAN ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- INDIA ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF ASIA-PACIFIC ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF THE WORLD ATRIAL FIBRILLATION DEVICES MARKET SIZE, 2018-2025 ($ MILLION)