Australian Cyber Security Market

Australian Cyber Security Market - Global Industry Share, Growth, Competitive Analysis and Forecast, 2019-2025 Update Available - Forecast 2025-2035

Cyber security is referred to as the prevention of computer systems from any type of damage or stealing sensitive information. With the advancements in technologies adopted globally, attackers too have upgraded their crime techniques in order to create more severe consequences. These cyber attacks can be targeted on different platforms such as networks, clouds, mobile devices, and others. Cyber security plays an important role in various industries including financial, government, medical, and several others. The Australian cybersecurity market is anticipated to grow at a significant rate during the forecast period. Increasing IT industries, rising digital threats such as cyber attacks in the country, and presence of various multinational technology players in the market, are some of the key factors contributing to the growth of the Australian cybersecurity market during the forecast period. Moreover, increasing trend of bring your own devices (BYOD), artificial intelligence (AI) machine learning in cybersecurity solutions is estimated to provide substantial growth opportunities in the Australian cyber security market.

Segmental Outlook

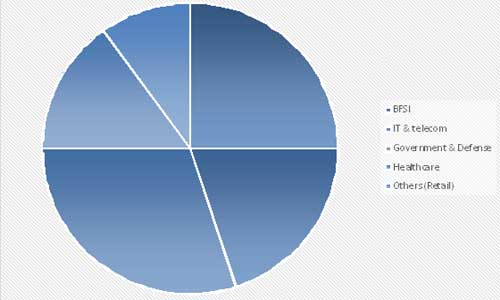

The Australian cyber security market is segmented on the basis of security type and verticals. Based on the security type, the Australian cyber security market is further classified into network security, cloud security, application security, mobile security, and others such as end-point security, content security. Based on the verticals, the Australian cybersecurity market is further segmented into BFSI, IT & telecom government & defense, healthcare, and others.

Australian Cybersecurity Market Share by Verticals, 2018 (%)

Mobile Security Segment Has Significant Growth in the Australian Cyber Security Market

Mobile security segment is projected to have a significant market growth in the Australian cyber security market during the forecast period. Rising trends of BYOD culture in the corporate world has motivated workers to be more productive and connected. Mobile security has become more vital in mobile computing due to rising security concerns of business and personal data stored on smartphones. These technologies are creating substantial variations in enterprises of information systems and have become the foundation of new risks. The smartphones compile and gather a large quantity of sensitive data that can be controlled to guard the intellectual property privacy of an enterprise and user by the mobile security solutions.

Government & Defense segment have Substantial Market Share in the Australian Cyber Security Market

Among verticals, cyber security for the government & defense vertical is anticipated to have significant market share during the forecast period. Security threats have been increasing at an alarming rate in the government and defense industry. The presence of big data and increased digitalization in almost every aspect of the armed forces result in high risk of being attacked by cybercriminals. This makes the protection of the data and applications, a high priority, in the government and defense industry. Moreover, the government of Australia is focusing on dealing with these threats. For instance, in April 2019, the government of Australia decided to spend $38.7 billion on national security, out of which some of the spendings will be used to defend against cyber attacks as part of its Cyber Security Strategy. This is aimed at protecting the government IT systems against targeted attacks. Such spending by the government of the country further, gives a boost to the growth of the Australian cyber security market.

Market Players Outlook

The major players that contribute to the growth of the Australian cybersecurity market include Cisco Systems Inc., Symantec Corp., Palo Alto Networks, Inc., McAfee LLC, IBM Corp., Vectra Corp. Ltd., NTT Security GmbH, Nuix Pty Ltd. and many others. The players operating in the market adopt various strategies such as mergers and acquisitions, partnerships and collaborations, product launch, and geographical expansion. For instance, In February 2019 NTT Security GmbH expanded its action center in Sydney to enhance Australia’s cyber defenses. With this operation center network, the company defended over 150 million attacks annually for its clients across the globe.

Recent Development

In January 2019, Nuix Pty Ltd. collaborated with KPMG Spain to offer anti-fraud technology. This is intended to combine the technological capabilities of Nuix with KPMG’s expertise in supporting clients to manage fraud investigations, regulatory compliance, and mergers and acquisitions.

The Report Covers

- Annualized market revenues ($ Million) for each market segment.

- Market value data analysis of 2018 and forecast to 2025.

- Company profiles of key players operating in the Australian cyber security market. Based on the availability of data for the category and country, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

- Understand the key distribution channels and identifying the most preferred mode of product distribution.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

1.2.3. By Stakeholders

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Competitive Dashboard

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Cisco Systems Inc.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. Swot Analysis

3.3.1.4. Recent Developments

3.3.2. Symantec Corp.

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. Swot Analysis

3.3.2.4. Recent Developments

3.3.3. Palo Alto Networks, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. Swot Analysis

3.3.3.4. Recent Developments

3.3.4. McAfee LLC

3.3.4.1. Overview

3.3.4.2. Swot Analysis

3.3.4.3. Recent Developments

3.3.5. IBM Corp.

3.3.5.1. Overview

3.3.5.2. Swot Analysis

3.3.5.3. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Australian Cyber Security Market by Security Type

5.1.1. Network Security

5.1.2. Cloud Security

5.1.3. Application Security

5.1.4. Mobile Security

5.1.5. Others (End-Point Security, Content Security)

5.2. Australian Cyber Security Market by Verticals

5.2.1. BFSI

5.2.2. IT & telecom

5.2.3. Government & Defense

5.2.4. Healthcare

5.2.5. Others (Retail)

6. Company Profiles

6.1. Capgemini SE

6.2. Check Point Software Technologies Ltd.

6.3. Cisco Systems, Inc.

6.4. CrowdStrike, Inc.

6.5. Forcepoint LLC

6.6. Fortinet, Inc.

6.7. IBM Corp.

6.8. McAfee, LLC

6.9. NTT Security GmbH

6.10. Nuix Pty Ltd.

6.11. Palo Alto Networks, Inc.

6.12. PTC Inc.

6.13. QuintessenceLabs Pty. Ltd.

6.14. Red Piranha Ltd.

6.15. RSA Security LLC

6.16. Senetas Corp.

6.17. Shearwater Solutions Pty. Ltd.

6.18. Symantec Corp.

6.19. Thales Group

6.20. Trend Micro, Inc.

6.21. TrustWave Holdings, Inc

6.22. Vectra Corp. Ltd.

6.23. Verint Systems Inc.