Auto-Injectors Market

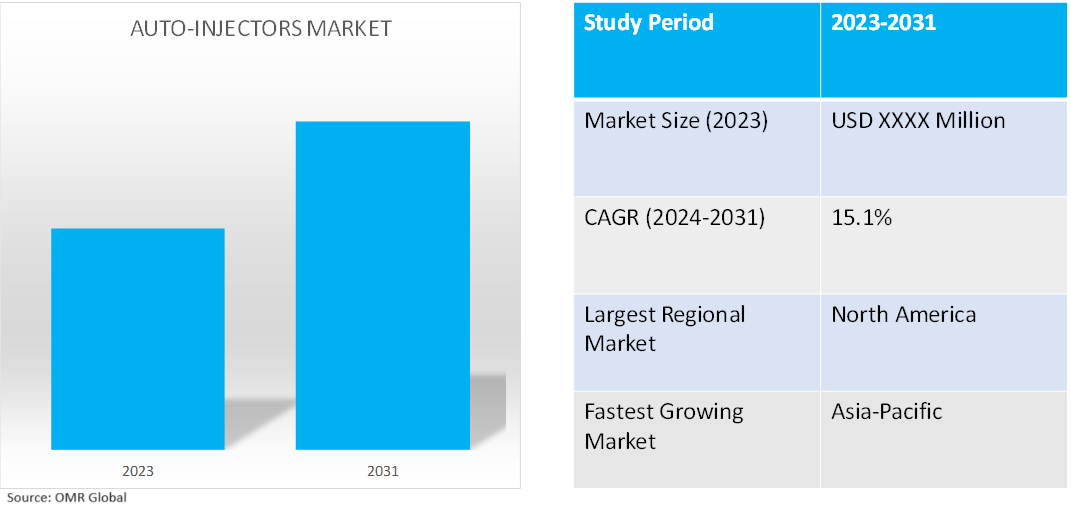

Auto-Injectors Market Size, Share & Trends Analysis Report by Type (Disposable Auto-injectors, and Reusable Auto-injectors), by Application (Rheumatoid Arthritis, Multiple Sclerosis, Anaphylaxis, and Others), and by End-User (Home Care Settings, Hospitals & Clinics, and Others) Forecast Period (2024-2031)

Auto-Injectors market is anticipated to grow at a CAGR of 15.1% during the forecast period (2024-2031). The auto-injector market is driven by factors such as rising allergies, chronic diseases, technological advancements, and patient preference for self-administration. The regulatory support and cost-effectiveness of these auto-injectors further support its adoption. Regulatory support facilitates market entry while emerging markets' healthcare infrastructure development increases access to auto-injectors.

Market Dynamics

Increasing Prevalence of Chronic Diseases

The demand for auto-injectors, that provide a feasible and efficient means of self-administration, has been prompted by the rising incidence of chronic diseases such as diabetes, multiple sclerosis, and rheumatoid arthritis. According to the Centers for Disease Control and Prevention, in February 2024, the US has 129 million individuals with at least one major chronic disease, with five of the top 10 leading causes of mortality being preventable and treatable. Over the past two decades, prevalence has increased, and 42.0% have multiple conditions. Chronic diseases significantly influence the US healthcare system, accounting for 90.0% of annual $4.1 trillion expenditure.

Demand for Self-Administration

The growing preference for self-administered treatments is driven by the convenience and cost-effectiveness they offer to patients. For instance, in October 2023, Altaviz introduced a new auto-injector platform, AltaVISC, which uses Pico-Cylinders for high-volume and high-viscosity drug delivery. The platform can be customized to administer various drug formulations, including shear-sensitive molecules and high-viscosity biologics, and offers precise control over temperature and gas composition.

Market Segmentation

- Based on type, the market is segmented into disposable auto-injectors and reusable auto-injectors.

- Based on application, the market is segmented into rheumatoid arthritis, multiple sclerosis, anaphylaxis, and others (cardiovascular diseases, and anemia).

- Based on the end-user, the market is segmented into home care settings, hospitals & clinics, and others (research laboratories).

Rheumatoid Arthritis to Hold a Considerable Market Share

The increasing prevalence of rheumatoid arthritis, due to its chronic nature and the need for ongoing medication, has increased the demand for auto-injectors. According to the Australian Institute of Health and Welfare, in June 2024, around 514,000 individuals in Australia were estimated to be living with rheumatoid arthritis in 2022, accounting for 2.0% of the population. Rheumatoid arthritis led to 1,322 mortalities, representing 0.7% of all mortalities. In terms of healthcare expenditure, approximately $966.1 million was spent on the treatment and management of rheumatoid arthritis in 2020-21, making up 0.6% of total health system expenditure. Additionally, there were 10,000 hospitalizations with a principal diagnosis of rheumatoid arthritis in 2021-22, equating to 39 hospitalizations per 100,000 population.

Home Care Settings to Hold a Considerable Market Share

Regulatory approvals and government policies are promoting market players to introduce advanced auto-injector devices. Thereby, promoting the adoption of biosimilars and their delivery devices as cost-effective treatment options for several chronic disorders. For instance, in May 2023, Coherus BioSciences launched the single-dose, prefilled auto-injector presentation of UDENYCA (pegfilgrastim-cbqv), a pegfilgrastim biosimilar administered after chemotherapy. The AI-based device offers a user-friendly, streamlined delivery option for both in-office and at-home settings, supported by a comprehensive analytical data package and clinical study.

Regional Outlook

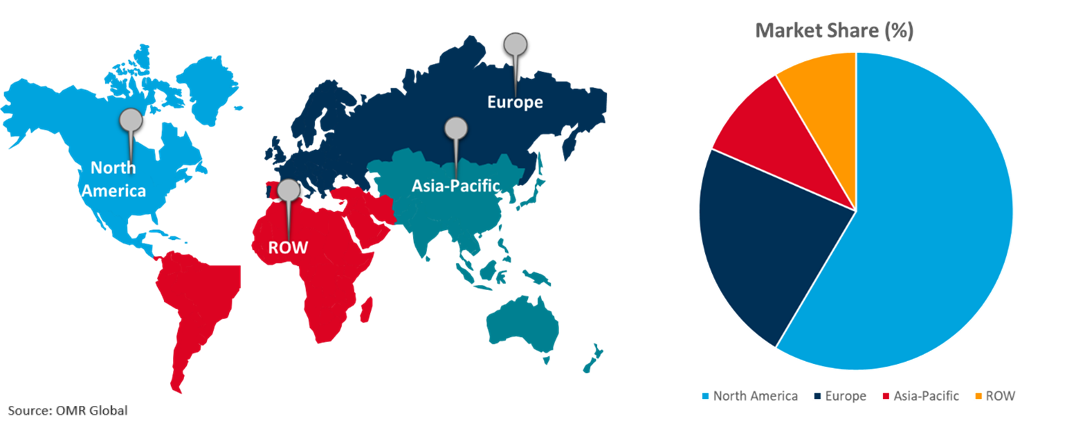

The global auto-injectors market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Increasing Incidence of Allergies In Asia-Pacific Region

The rising global awareness and diagnosis of severe allergic reactions are driving the demand for auto-injectors across the region. Therefore, regional players are introducing new products to meet the regional demand for auto-injectors. For instance, in July, ALK and Grandpharma partnered to market the first adrenaline auto-injector (AAI), Jext, in China. Under an exclusive licensing agreement, Grandpharma managed the registration, import, and commercialization of Jext in Mainland China, Macau, and Taiwan. ALK handled product supply and marketing support. the product is used for emergency treatment of acute allergic reactions.

Global Auto-Injectors Market Growth by Region 2024-2031

North America Holds Major Market Share

The high investment in the development of advanced medical devices such as auto-injectors across the region is a key contributor to the high share of the regional market. According to the American Medical Association, in 2022, health spending in the US reached $4.4 trillion, equivalent to $13,493 per capita, representing a 4.1% increase compared to the previous year. This growth rate is consistent with pre-pandemic levels in 2019. Despite the significant government spending to address the pandemic, expenditures decreased in 2021 while the utilization of medical goods and services returned to pre-pandemic levels by 2022.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the auto-injectors market include Antares Pharma, Inc., Bayer AG, Becton Dickinson and Co., Eli Lilly and Co., and Novartis International AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in March 2023, Coherus BioSciences launched the single-dose, prefilled auto-injector presentation of UDENYCA (pegfilgrastim-cbqv), a pegfilgrastim biosimilar administered after chemotherapy. The AI-based device, which administers pegfilgrastim in less than 10 seconds, has been approved for commercial sale in the US, supported by a comprehensive analytical data package.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global auto-injectors market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Antares Pharma, Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Bayer AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Novartis International AG

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Auto-Injectors Market by Type

4.1.1. Disposable Auto-injectors

4.1.2. Reusable Auto-injectors

4.2. Global Auto-Injectors Market by Application

4.2.1. Rheumatoid Arthritis

4.2.2. Multiple Sclerosis

4.2.3. Anaphylaxis

4.2.4. Others (Cardiovascular Diseases, and Anemia)

4.3. Global Auto-Injectors Market by End-User

4.3.1. Home Care Settings

4.3.2. Hospital & Clinics

4.3.3. Others (Research Laboratories)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ApiJect Systems, Corp.

6.2. AstraZeneca Plc

6.3. Becton Dickinson, and Co.

6.4. Biogen MA Inc.

6.5. Eli Lilly and Co.

6.6. Frederick Furness Publishing Ltd.

6.7. Gerresheimer AG

6.8. Johnson & Johnson Services, Inc.

6.9. Koch Industries, Inc.

6.10. Midas Pharma GmbH

6.11. Novartis International AG

6.12. Otsuka Holdings Co., Ltd.

6.13. Owen Mumford Ltd.

6.14. Recipharm AB

6.15. Sanofi SA

6.16. SHL Medical

6.17. Teva Pharmaceutical Industries Ltd.

6.18. Viatris Inc.

6.19. VisIC Technologies Ltd.

6.20. West Pharmaceutical Services, Inc.

6.21. Ypsomed AG

1. Global Auto-Injectors Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Disposable Auto-Injectors Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Reusable Auto-Injectors Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Auto-Injectors Market Research And Analysis By Application 2023-2031 ($ Million)

5. Global Auto-Injectors For Rheumatoid Arthritis Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Auto-Injectors For Multiple Sclerosis Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Auto-Injectors For Anaphylaxis Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Auto-Injectors For Other Applications Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Auto-Injectors Market Research And Analysis By End-User, 2023-2031 ($ Million)

10. Global Auto-Injectors For Home Care Settings Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Auto-Injectors For Hospital & Clinics Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Auto-Injectors For Other End-Users Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Auto-Injectors Market Research And Analysis By Region, 2023-2031 ($ Million)

14. North American Auto-Injectors Market Research And Analysis By Country, 2023-2031 ($ Million)

15. North American Auto-Injectors Market Research And Analysis By Type, 2023-2031 ($ Million)

16. North American Auto-Injectors Market Research And Analysis By Application, 2023-2031 ($ Million)

17. North American Auto-Injectors Market Research And Analysis By End-User, 2023-2031 ($ Million)

18. European Auto-Injectors Market Research And Analysis By Country, 2023-2031 ($ Million)

19. European Auto-Injectors Market Research And Analysis By Type, 2023-2031 ($ Million)

20. European Auto-Injectors Market Research And Analysis By Application, 2023-2031 ($ Million)

21. European Auto-Injectors Market Research And Analysis By End-User, 2023-2031 ($ Million)

22. Asia-Pacific Auto-Injectors Market Research And Analysis By Country, 2023-2031 ($ Million)

23. Asia-Pacific Auto-Injectors Market Research And Analysis By Type, 2023-2031 ($ Million)

24. Asia-Pacific Auto-Injectors Market Research And Analysis By Application, 2023-2031 ($ Million)

25. Asia-Pacific Auto-Injectors Market Research And Analysis By End-User, 2023-2031 ($ Million)

26. Rest Of The World Auto-Injectors Market Research And Analysis By Region, 2023-2031 ($ Million)

27. Rest Of The World Auto-Injectors Market Research And Analysis By Type, 2023-2031 ($ Million)

28. Rest Of The World Auto-Injectors Market Research And Analysis By Application, 2023-2031 ($ Million)

29. Rest Of The World Auto-Injectors Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Auto-Injectors Market Share By Type, 2023 Vs 2031 (%)

2. Global Disposable Auto-Injectors Market Share By Region, 2023 Vs 2031 (%)

3. Global Reusable Auto-Injectors Market Share By Region, 2023 Vs 2031 (%)

4. Global Auto-Injectors Market Share By Application, 2023 Vs 2031 (%)

5. Global Auto-Injectors For Rheumatoid Arthritis Market Share By Region, 2023 Vs 2031 (%)

6. Global Auto-Injectors For Multiple Sclerosis Market Share By Region, 2023 Vs 2031 (%)

7. Global Auto-Injectors For Anaphylaxis Market Share By Region, 2023 Vs 2031 (%)

8. Global Auto-Injectors For Other Applications Market Share By Region, 2023 Vs 2031 (%)

9. Global Auto-Injectors Market Share By End-User, 2023 Vs 2031 (%)

10. Global Auto-Injectors For Home Care Settings Market Share By Region, 2023 Vs 2031 (%)

11. Global Auto-Injectors For Hospital & Clinics Market Share By Region, 2023 Vs 2031 (%)

12. Global Auto-Injectors For Other End-User Market Share By Region, 2023 Vs 2031 (%)

13. Global Auto-Injectors Market Share By Region, 2023 Vs 2031 (%)

14. US Auto-Injectors Market Size, 2023-2031 ($ Million)

15. Canada Auto-Injectors Market Size, 2023-2031 ($ Million)

16. UK Auto-Injectors Market Size, 2023-2031 ($ Million)

17. France Auto-Injectors Market Size, 2023-2031 ($ Million)

18. Germany Auto-Injectors Market Size, 2023-2031 ($ Million)

19. Italy Auto-Injectors Market Size, 2023-2031 ($ Million)

20. Spain Auto-Injectors Market Size, 2023-2031 ($ Million)

21. Rest Of Europe Auto-Injectors Market Size, 2023-2031 ($ Million)

22. India Auto-Injectors Market Size, 2023-2031 ($ Million)

23. China Auto-Injectors Market Size, 2023-2031 ($ Million)

24. Japan Auto-Injectors Market Size, 2023-2031 ($ Million)

25. South Korea Auto-Injectors Market Size, 2023-2031 ($ Million)

26. Rest Of Asia-Pacific Auto-Injectors Market Size, 2023-2031 ($ Million)

27. Latin America Auto-Injectors Market Size, 2023-2031 ($ Million)

28. Middle East And Africa Auto-Injectors Market Size, 2023-2031 ($ Million)