Automatic and Smart Pet Feeder Market

Global Automatic and Smart Pet Feeder Market Size, Share & Trends Analysis Report by Product (Automatic Pet Feeder and Smart Pet Feeder), by Application (Dogs, Cats, and Others), and by Distribution Channel (Online and Offline) Forecast (2022-2028) Update Available - Forecast 2025-2035

The global automatic and smart pet feeder market is anticipated to grow at a significant CAGR of 21.0% during the forecast period. Rising health and well-being concern of pets among owners coupled up with increasing adoption of multiple pets are the major factor contributing to the growth of automatic and smart pet feeder market. Pet obesity is leading health threat and common chronic disease in pets which is leading to serious health conditions including heart and respiratory disease and kidney disease that can shorten pets’ lives. According to Association for Pet Obesity Prevention 2018 clinical survey, 55.8% of dogs and 59.5% of cats were classified as clinically overweight or obese. The growing stress for the health of pets has resulted in surge in demand for automatic pet feeders as they help to offer proper weight management by giving the pet the portioned feedings timely. Manufacturers of automatic and smart pet feeder have started promoting their offerings with features including weight management in their products. For instance, Vet Innovations offers PortionPro Rx as a tool for veterinarians and pet owners to boost compliance with weight-loss recommendations. Launched in 2018, this device uses proprietary access-control technology to help pets lose weight by controlling both portions and access. The product ensures that dogs and cats follow prescription diets and prevent food theft between pets in multi-pet households.

Impact of COVID-19 Pandemic on Global Automatic and Smart Pet Feeder Market

Automatic and Smart Pet Feeder industry had a great impact of COVID 19 pandemic, even after supply chain disruptions, shut down of facilities, restrictions on movement, the smart pet feeders experienced rising demand. This was mainly attributed due to higher adoption of pets during pandemic and rise in online shopping of pet products. According to The American Kennel Club, large number people decided to add new pets to their house during the pandemic and number of U.S. households that have at least one dog (69 million homes) increased to 54% in 2020 from 50% in 2018. Along with this, Pet owners shopping online increased by almost 20%, up to 86% and in-person shopping dropped to 41%. As a result, the decision by owner to add new pets to their household was majorly influenced by the pandemic.

Segmental Outlook

The global automatic and smart pet feeder market is segmented based on the product, application, and distribution channel. Based on the product, the market is segmented into Automatic Pet Feeder, Smart Pet Feeder. Based on the application, the market is sub-segmented into the dogs, cats, and others. Based on the distribution channel, the market is further segmented into online and offline. The above-mentioned segments can be customized as per the requirements.

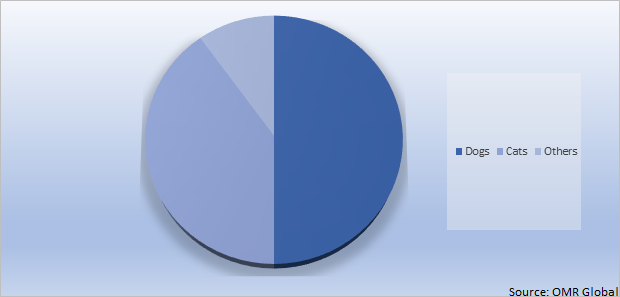

Global Automatic and Smart Pet Feeder Market Share by Application, 2020 (%)

The Dogs Segment is estimated to hold prominent Share in the Global Automatic and Smart Pet Feeder Market

Due to rising number of dog owners as compared to cats and other pet owners, the population of dog is expected to support industry growth as well as market growth over the forecast period. According to the American Veterinary Medical Association, in 2020, 45% of households owned dogs and the population of pet dogs was estimated to be between 83.7 million and 88.9 million. In 2020, 26% of households owned cats and the population of pet cats was estimated to be between 60 million and 61.9 million last year. The rising disposable income of the owners is increasing their spending on smart and digitalized products such as automatic and smart pet feeder. These smart feeders provide convince to both dogs as well as dog owners that are unable to maintain proper schedule to feed their dogs.

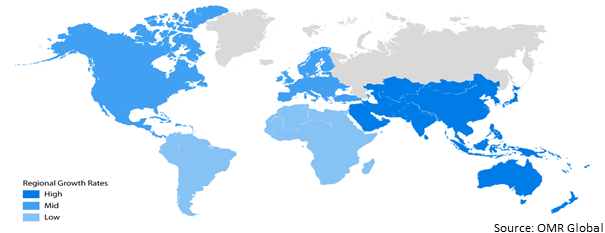

Regional Outlooks

The global automatic and smart pet feeder market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for region or country level as per the requirement.

Global Automatic and Smart Pet Feeder Market Growth, by Region 2022-2028

The North America Region is Estimated to Holds Prominent Share in the Global Automatic and Smart Pet Feeder Market

The increase in pet ownership and spending on pet service product are expected to support automatic and smart pet feeder industry growth in North America region. According to the 2021-2022 National Pet Owners Survey conducted by the American Pet Products Association (APPA), 70% of the US households, or about 90.5 million families, own a pet in which dogs hold 69 million and cats hold 45.3 million. The rising disposable income of the people and spending on technologically advanced products in countries such as the US and Canada are creating various opportunities for the growth of pet feeder market. North American countries is anticipated to be early adopter of automatic and smart pet feeders pet owners and pet owners can spend more food and products to minimize the risk animal diseases among their pets. According to the APPA, total pet industry expenditures in the US has been estimated around $103 billion in 2020. These aspects are expected to motivate the automatic and smart pet feeder in North America.

Market Players Outlook

The major companies serving the global automatic and smart pet feeder market include Arf Pets, Inc., Blueroad RE s.r.o., Qpets Inc., Shenzhen E-lirking Net Tech Co., Ltd., Tuya Global Inc., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in 2019, Sure Petcare launched SureFeed Microchip Pet Feeder Connect. The smart feeder monitors the eating behavior of pets and sends real-time updates directly to the pet owner’s phone. The product is also incorporated with integrated scales, which supports owners to provide accurate food portions and personalize their pet’s feeding.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automatic and smart pet feeder market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Automatic and Smart Pet FeederMarket

• Recovery Scenario of Global Automatic and Smart Pet FeederMarket

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Arf Pets, Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Blueroad RE s.r.o.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Qpets Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Shenzhen E-lirking Net Tech Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Tuya Global Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Automatic and Smart Pet Feeder Market by Product

4.1.1. Automatic Pet Feeder

4.1.2. Smart Pet Feeder

4.2. Global Automatic and Smart Pet FeederMarket by Application

4.2.1. Dogs

4.2.2. Cats

4.2.3. Others (Goat, Horse, and Cow)

4.3. Global Automatic and Smart Pet FeederMarket By Distribution Channel

4.3.1. Offline

4.3.2. Online

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Autopet

6.2. Doskocil Manufacturing Company, Inc.

6.3. Electric-collars.com

6.4. KT Contribution Inc

6.5. OWON Technology Inc.

6.6. PawboInc

6.7. Petcube, Inc

6.8. Petica

6.9. Petlibro

6.10. PETKIT

6.11. Pets at Home Ltd.

6.12. Radio Systems Corp. (PetSafe)

6.13. Rolf C. Hagen, Inc.

6.14. SkyRC Technology Co.,LTD

6.15. Smartpaw Pet Online Store

6.16. SureFlap LLC

6.17. Tomofun Co. Ltd

6.18. Vet Innovations, Inc.

6.19. Wagz Inc.

6.20. Wear Idol

6.21. Xiaomi Inc.

1. GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL AUTOMATIC PET FEEDER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

5. GLOBAL AUTOMATIC AND SMART PET FEEDER FOR DOGS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL AUTOMATIC AND SMART PET FEEDER FOR CATS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL AUTOMATIC AND SMART PET FEEDER FOR OTHERS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

9. GLOBAL AUTOMATIC AND SMART PET FEEDER BY ONLINE CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL AUTOMATIC AND SMART PET FEEDER BY OFFLINE CHANNEL MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

11. GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

12. NORTH AMERICAN AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

13. NORTH AMERICAN AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

14. NORTH AMERICAN AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

15. NORTH AMERICAN AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

16. EUROPEAN AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. EUROPEAN AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

18. EUROPEAN AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. EUROPEAN AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

20. ASIA-PACIFIC AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

21. ASIA-PACIFIC AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

24. REST OF THE WORLD AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

25. REST OF THE WORLD AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

27. REST OF THE WORLD AUTOMATIC AND SMART PET FEEDER MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET, 2022-2028 (%)

4. GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET SHARE BY PRODUCT TYPE, 2021 VS 2028 (%)

5. GLOBAL AUTOMATIC PET FEEDER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

6. GLOBAL SMART PET FEEDER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

7. GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET SHARE BY APPLICATION, 2021 VS 2028 (%)

8. GLOBAL AUTOMATIC AND SMART PET FEEDER FOR DOGS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

9. GLOBAL AUTOMATIC AND SMART PET FEEDER FOR CATS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

10. GLOBAL AUTOMATIC AND SMART PET FEEDER FOR OTHERS MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

11. GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET SHARE BY DISTRIBUTION CHANNEL, 2021 VS 2028 (%)

12. GLOBAL AUTOMATIC AND SMART PET FEEDER BY ONLINE CHANNEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

13. GLOBAL AUTOMATIC AND SMART PET FEEDER BY OFFLINE CHANNEL MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

14. GLOBAL AUTOMATIC AND SMART PET FEEDER MARKET SHARE BY GEOGRAPHY, 2021 VS 2028 (%)

15. US AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

17. UK AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF EUROPE AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

26. SOUTH KOREA AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF ASIA-PACIFIC AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD AUTOMATIC AND SMART PET FEEDER MARKET SIZE, 2021-2028 ($ MILLION)