Automatic Pill Dispenser Market

Global Automatic Pill Dispenser Market Size, Share & Trends Analysis Report by Product (Vertical Carousel Automated Dispensing Systems, Robots/Robotic Automated Dispensing Systems, and Decentralized Automated Dispensing Systems), and by Application (Hospital Pharmacy, Retail Pharmacy, and Home Healthcare) Forecast (2022-2028) Update Available - Forecast 2025-2035

The global automatic pill dispenser market is anticipated to grow at a significant CAGR of 8% during the forecast period. The rising incidences of various chronic illnesses such as Alzheimer and osteoarthritis is a prospective driver for the growth of the global automatic pill dispenser market. Remembering to take right medication on right time every day is huge concern for people living with condition such as Alzheimer’s disease or dementia. Especially seniors who live alone and find it difficult to take right medication due to complex medication regimens might benefit from using an automatic pill dispenser. According to Alzheimer’s Association 2019 report related to Alzheimer’s disease, out of the total US population, one in 10 people (10%) aged 65 years and above are suffering with Alzheimer’s dementia. The percentage of people with Alzheimer’s dementia increases with age: 3% of people aged between 65years to 74 years, 17 % of people aged 75 years to 84 years, and 32% of people aged 85 years and older have Alzheimer’s dementia. Keeping in mind the need of senior and chronically ill population, many manufactures are working towards serving their demand. For instance, in 2020, MedMinder introduced automatic pill dispenser with telemedicine capabilities focused on the elderly and chronically ill. The smart pill dispenser comprises of pre-organized daily tray that slides directly into the smart pill dispenser which unlocks only one capsule at the prescribed time. In case of ignorance from patient after receiving alerts, a family member is also notified. The MedMinder dispenser also allows users to connect with medical professionals, view information about their medication, and connect devices such as blood pressure machines, scales, and thermometers via Bluetooth.

Impact of COVID-19 Pandemic on Global Automatic Pill Dispenser Market

The COVID-19 pandemic has cause complete disorder in global supply chains which resulted in several trade barriers all over the world. However, the increased prevalence of infection upsurges the burden on healthcare facilities which resulted in more use of automated pill dispensers in hospitals and other healthcare settings. The increased demand for the automatic pill dispenser during COVID 19 pandemic was attributed towards the requirement for less human interaction, increased workload in hospitals and to avoiding prescription errors such as dose miscalculations. The increased need of patient safety during COVID-19 pandemic further added to the growth of market.

Segmental Outlook

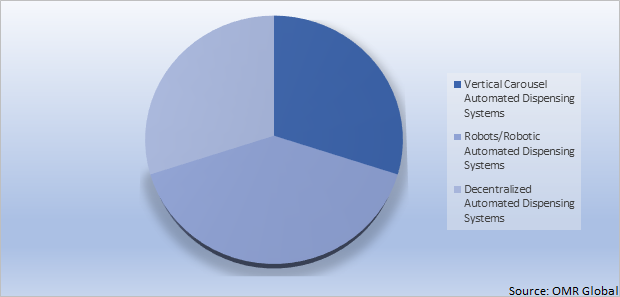

The global automatic pill dispenser market is segmented based on the product and application. Based on the product, the market is segmented vertical carousel automated dispensing systems, robots/robotic automated dispensing systems, and decentralized automated dispensing systems. Based on the application, the market is sub-segmented into the hospital pharmacy, retail pharmacy and home healthcare. The above-mentioned segments can be customized as per the requirements.

Global Automatic Pill Dispenser Market Share by Product, 2021 (%)

The Robots/Robotic Automated Dispensing Systems Segment Is Anticipated to Hold a Prominent Share in the Global Automatic Pill Dispenser Market

The increasing demand for robotic automated dispensing systems is majorly attributed due to its ability to eliminate the task of sorting numerous pills into individual slots. Along with the capabilities of automatically dispensing the medications and eliminating drug mistakes, theses robotic systems tend to assist in managing complex medication regimens. These features of robotic automated dispensing systems are ideal for hospitals pharmacy workflows as they support the critical process of medication and supply management. Thus, several major companies are inclining towards manufacturing these systems for healthcare setting. For instance, in 2021, Omnicell unveiled its latest robotic dispensing system, at 2021 Dubai International Pharmaceuticals & Technologies Conference and Exhibition (DUPHAT). The robotic dispensing system promises to reduce the potential for errors by simplifying the dispensing process and reducing the number of human interactions. This robot frees up staff from tasks such as unpacking medication, stock management, searching for medication and is also able to generate real time reports on stock usage.

Regional Outlooks

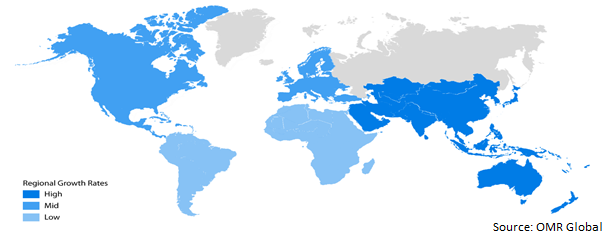

The global automatic pill dispenser market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East &Africa, and Latin America). The market can be analyzed for region or country level as per the requirement.

Global Automatic Pill Dispenser Market Growth, by Region 2021-2028

The North American Region is Estimated to Hold Prominent Share in the Global Automatic Pill Dispenser Market

The North America region is estimated to hold a prominent share in the global automatic pill dispenser market owing to increased up gradation of healthcare system coupled up with adoption of technologically advanced devices. People in this region are found to be more aware and earlier adopter of advance home medication devices such as automatic pill dispenser. Manufacturers in this region are inclining their efforts towards introduction of smart medication devices to make multiple medications an easy job for patients. For instance, in 2020, HAP Innovations and Catalyst Healthcare entered a partnership for the distribution of the spencer in Canada. Spencer is an innovative countertop in-home medication dispensing device which is already available in 32 states across the US. Through this partnership, Spencer made dispensing devices available to Canadian patients, pharmacies, and assisted/independent-living care facilities.

Market Players Outlook

The major companies serving the global automatic pill dispenser market include Hero Health, Inc., Medipense Inc., Omnicell, Inc, PharmAdva, LLC., RescueDose Ltd., and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers & acquisitions, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in February 2022, Dignio AS, announced that it has integrated AceAge Inc. product Karie - smart pill dispenser, into its Dignio Connected Care solution. With the Karie smart pill dispenser combined with Dignio Connected Care, the company will be able to provide a secure and safe medication delivery to patient.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automatic pill dispenser market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Automatic Pill Dispenser Market

• Recovery Scenario of Global Automatic Pill Dispenser Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. BY Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Hero Health, Inc.

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Medipense Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Omnicell, Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. PharmAdva, LLC.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. RescueDose Ltd.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

3.7. Impact of Covid-19 on Key Players

4. Market Segmentation

4.1. Global Automatic Pill Dispenser Market by Product

4.1.1. Vertical Carousel Automated Dispensing Systems

4.1.2. Robots/ Robotic Automated Dispensing Systems

4.1.3. Decentralized Automated Dispensing Systems

4.2. Global Automatic Pill Dispenser Market by Application

4.2.1. Hospital Pharmacy

4.2.2. Retail Pharmacy

4.2.3. Home Healthcare

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. AceAge Inc. (Karie Health)

6.2. ARxIUM, Inc.

6.3. Catalyst Healthcare Ltd.

6.4. ConnectAmerica.com, LLC (Philips Lifeline)

6.5. e-pill Medication Reminders

6.6. LiveFine, Inc.

6.7. Med-E-Lert

6.8. Medminder Systems, Inc.

6.9. PharmRight Corporation

6.10. Reizen, Inc.

6.11. ScriptPro LLC

6.12. Seniority Pvt. Ltd.

6.13. Swisslog Healthcare

6.14. Stanley Black & Decker, Inc.

6.15. Tabtime Ltd.

6.16. Talyst, LLC.

6.17. TechSilver Ltd.

6.18. Tunstall Group

6.19. Wellness Pharmacy

1. GLOBAL AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

2. GLOBAL VERTICAL CAROUSEL AUTOMATED DISPENSING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL ROBOTS/ROBOTIC AUTOMATED DISPENSING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL DECENTRALIZED AUTOMATED DISPENSING SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

6. GLOBAL AUTOMATIC PILL DISPENSER IN HOSPITAL PHARMACY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

7. GLOBAL AUTOMATIC PILL DISPENSER IN RETAIL PHARMACY MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL AUTOMATIC PILL DISPENSER IN HOME HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

9. GLOBAL AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2021-2028 ($ MILLION)

10. NORTH AMERICAN AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

11. NORTH AMERICAN AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

12. NORTH AMERICAN AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

13. EUROPEAN AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

14. EUROPEAN AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

15. EUROPEAN AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

16. ASIA-PACIFIC AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

17. ASIA-PACIFIC AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

18. ASIA-PACIFIC AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

19. REST OF THE WORLD AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

20. REST OF THE WORLD AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2021-2028 ($ MILLION)

21. REST OF THE WORLD AUTOMATIC PILL DISPENSER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2021-2028 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AUTOMATIC PILL DISPENSER MARKET, 2021-2028 ($ MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AUTOMATIC PILL DISPENSER MARKET BY SEGMENT, 2021-2028 ($ MILLION)

3. RECOVERY OF GLOBAL AUTOMATIC PILL DISPENSER MARKET, 2022-2028 (%)

4. GLOBAL AUTOMATIC PILL DISPENSER MARKET SHARE BY PRODUCT, 2021VS 2028 (%)

5. GLOBAL VERTICAL CAROUSEL AUTOMATED DISPENSING SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021VS 2028 (%)

6. GLOBAL ROBOTS/ROBOTIC AUTOMATED DISPENSING SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021VS 2028 (%)

7. GLOBAL DECENTRALIZED AUTOMATED DISPENSING SYSTEMS MARKET SHARE BY GEOGRAPHY, 2021VS 2028 (%)

8. GLOBAL AUTOMATIC PILL DISPENSER MARKET SHARE BY B, 2021VS 2028 (%)

9. GLOBAL AUTOMATIC PILL DISPENSER IN HOSPITAL PHARMACY MARKET SHARE BY GEOGRAPHY, 2021VS 2028 (%)

10. GLOBAL AUTOMATIC PILL DISPENSER IN RETAIL PHARMACY MARKET SHARE BY GEOGRAPHY, 2021VS 2028 (%)

11. GLOBAL AUTOMATIC PILL DISPENSER IN HOME HEALTHCARE MARKET SHARE BY GEOGRAPHY, 2021VS 2028 (%)

12. GLOBAL AUTOMATIC PILL DISPENSER MARKET SHARE BY GEOGRAPHY, 2021VS 2028 (%)

13. US AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

14. CANADA AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

15. UK AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

16. FRANCE AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

17. GERMANY AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

18. ITALY AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

19. SPAIN AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

20. REST OF EUROPE AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

21. INDIA AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

22. CHINA AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

23. JAPAN AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

24. SOUTH KOREA AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

25. REST OF ASIA-PACIFIC AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD AUTOMATIC PILL DISPENSER MARKET SIZE, 2021-2028 ($ MILLION)