Automation Testing Market

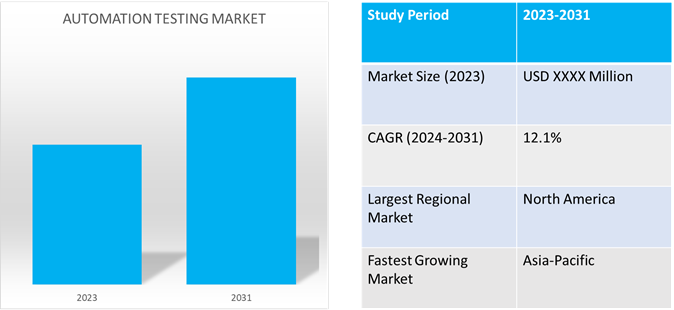

Automation Testing Market Size, Share & Trends Analysis Report by Testing Type (Static Testing and Dynamic Testing), by Organization Size (Small and Medium-Sized Enterprises and Large Enterprises), and by Vertical Industry (Healthcare, IT & Telecommunication, Energy & Utilities, BFSI, Defense and Aerospace and Others) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Automation testing market is anticipated to grow at a significant CAGR of 12.1% during the forecast period (2024-2031). Automation testing is the process of testing software using tools and technologies to minimize testing work and deliver functionality faster and more effectively. It facilitates the production of higher-quality software with less effort. The growing adoption of artificial intelligence (AI) and machine learning (ML) with the improving advanced automation testing techniques is the key factor supporting the growth of the market globally. The introduction of advanced automation testing software solutions such as DevOps and Agile further bolster the market growth.

Market Dynamics

Continuous Integration (CI) and Continuous Delivery (CD)

CI/CD keeps a continuous cycle of software development and upgrades while aiding enterprises in avoiding defects and code failures. Features of CI/CD can aid in reducing complexity, improving productivity, and streamlining workflows as apps grow larger. Increasing adoption of CI/CD in software development drives the growth of the automation testing market.

Scalable and Adaptable Delivery Model

An important phase in the Software Development Life Cycle (SDLC) process is testing. On-demand testing resources require dynamic distribution. The platform for automated testing has shown to be an effective tool for managing data and time. The storage capacity of automation testing can be increased or decreased based on the demands and specifications of the user. The automation testing platform's flexibility is extremely scalable, allowing it to be contracted or expanded as needed in response to changes in client demand and demographics. The growth of software services and scalability are made possible by automation testing.

Market Segmentation

Our in-depth analysis of the global automation testing market includes the following segments by testing type, organization size, and vertical industry:

- Based on testing type, the market is sub-segmented into static testing and dynamic testing.

- Based on organization size, the market is sub-segmented into small and medium-sized enterprises and large enterprises.

- Based on vertical industry, the market is sub-segmented into healthcare, IT & telecommunication, energy & utilities, BFSI, defense and aerospace and others (government).

Large Enterprisesare Projected to Emerge as the Largest Segment

Based on the organization size, the global automation testing market is sub-segmented into small and medium-sized enterprises and large enterprises. Among these, the large enterprisessub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the increasing adoption of automation testing in large enterprises to improve efficiency, enhance software quality and reduce cost. In large enterprises with several applications, complicated systems, and a high number of test cases, automation testing is essential. It contributes to increased test coverage, decreased manual labor, increased efficiency, and software application quality assurance.

Static Testing Sub-segment to Hold a Considerable Market Share

A variety of techniques are used in static testing, including AI software-based inspection, organized walkthroughs, and technical reviews. Static testing makes use of both static analysis and review. Usually, the purpose of static review is to find and eliminate mistakes and ambiguities in supporting documentation. For instance, in October 2022, Datadog, Inc. introduced a unified end-to-end static testing platform. The monitoring and security platform for cloud applications, the general availability of Datadog Continuous Testing, a new product that helps developers and quality engineers quickly create, manage and run end-to-end tests for their web applications.

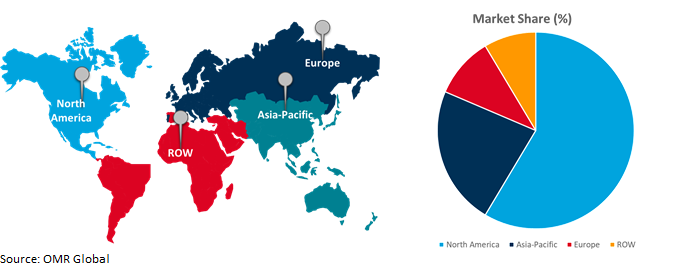

Regional Outlook

The global automation testing market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

Asia-Pacific Countries to invest in Automation Testing Technology

- Growing expansion and digital adoption resulted in the growth of automation testing.

- Governments are enacting laws to speed up the uptake of innovative technologies such as cloud-based services, mobile and online apps, automation, artificial intelligence, machine learning, and other advancements.

Global Automation Testing Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share owing to the increasing adoption of smart consumer electronics in the US, including laptops, smart TVs, and home appliances. Smart consumer electronics are intimately tied to software, online applications, and operating systems (OS). As these smart consumer devices become more widely accepted, there is an increasing demand for test automation services in the field.There has been an increase in the use of agile development environments for testing and quality assurance, as well as in the consumption of mobile applications.Market players provide access to visual testing capabilities as testers may automate visual regression testing without writing an automation script. For instance, in November 2023, SmartBear, a provider of software development and visibility tools, integrated VisualTest, its AI-driven automated regression visual testing tool. Before a website or app is deployed, VisualTest uses artificial intelligence (AI) to detect visual flaws and ignore false positives, delivering the possible user experience.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global automation testing market include Accenture plc, Capgemini SE, Cigniti Technologies Ltd., IBM Corp., Keysight Technologies, Inc.,among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in November 2023, Keysight Technologies, Inc. launched the new Keysight Elastic Network Generator (KENG) software is an agile, modular network test platform built on an open, vendor-neutral API and intended for continuous integration (CI). It represents a first-in-class innovation in network testing.

Further, in December 2022, Luxoft, a DXC Technology company collaborated with MicroVision for a new generation of testing and simulation environments. The algorithms used in modern autonomous drive (AD) and advanced driver assistance systems (ADAS) must be verified and evaluated utilizing ground truth (GT) data. MicroVision develops lidar sensors for automobiles and offers high-quality GT data generation that is automated.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automation testing market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Accenture plc

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Capgemini SE

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. IBM Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automation Testing Market by Testing Type

4.1.1. Static Testing

4.1.2. Dynamic Testing

4.2. Global Automation Testing Market by Organization Size

4.2.1. Small And Medium-Sized Enterprises

4.2.2. Large Enterprises

4.3. Global Automation Testing Market by Vertical Industry

4.3.1. Healthcare

4.3.2. IT & Telecommunication

4.3.3. Energy & Utilities

4.3.4. BFSI

4.3.5. Defense And Aerospace

4.3.6. Others (Government)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Cigniti Technologies Ltd.

6.2. Keysight Technologies, Inc.

6.3. BrowserStack, Inc.

6.4. SmartBear Software Inc.

6.5. Open Text Corp.

6.6. Katalon, Inc.

6.7. Idera, Inc.

6.8. Velotio Technologies Pvt. Ltd.

6.9. Robot Framework

6.10. Perforce Software, Inc.

6.11. Tricentis

6.12. Postman, Inc.

6.13. Testrig Technologies Pvt Ltd.

6.14. Sauce Labs Inc.

6.15. Applitools Ltd.

6.16. QMetry Inc.

6.17. LeapworkApS

6.18. Infostretch Corp., dba Apexon

1. GLOBAL AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY TESTING TYPE, 2023-2031 ($ MILLION)

2. GLOBAL STATIC AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL DYNAMIC AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE,2023-2031 ($ MILLION)

5. GLOBAL AUTOMATION TESTING FOR SMALL AND MEDIUM-SIZED ENTERPRISES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AUTOMATION TESTING FOR LARGE ENTERPRISESMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY VERTICAL INDUSTRY,2023-2031 ($ MILLION)

8. GLOBAL AUTOMATION TESTING FOR HEALTHCARE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AUTOMATION TESTING FOR IT & TELECOMMUNICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AUTOMATION TESTING FOR ENERGY & UTILITIES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL AUTOMATION TESTING FOR BFSI MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AUTOMATION TESTING FOR DEFENSE AND AEROSPACE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL AUTOMATION TESTING FOR OTHER INDUSTRIAL VERTICAL MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY TESTING TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE,2023-2031 ($ MILLION)

18. NORTH AMERICAN AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY VERTICAL INDUSTRY,2023-2031 ($ MILLION)

19. EUROPEAN AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY TESTING TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE,2023-2031 ($ MILLION)

22. EUROPEAN AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY VERTICAL INDUSTRY,2023-2031 ($ MILLION)

23. ASIA-PACIFIC AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFICAUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY TESTING TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFICAUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2023-2031 ($ MILLION)

26. ASIA-PACIFICAUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY VERTICAL INDUSTRY, 2023-2031 ($ MILLION)

27. REST OF THE WORLD AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY TESTING TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY ORGANIZATION SIZE, 2023-2031 ($ MILLION)

30. REST OF THE WORLD AUTOMATION TESTING MARKET RESEARCH AND ANALYSIS BY VERTICAL INDUSTRY, 2023-2031 ($ MILLION)

1. GLOBAL AUTOMATION TESTING MARKET SHARE BY TESTING TYPE, 2023 VS 2031 (%)

2. GLOBAL STATIC AUTOMATION TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL DYNAMIC AUTOMATION TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AUTOMATION TESTING MARKET SHAREBY ORGANIZATION SIZE,2023 VS 2031 (%)

5. GLOBAL AUTOMATION TESTING FOR SMALL AND MEDIUM-SIZED ENTERPRISESMARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL AUTOMATION TESTING FOR LARGE ENTERPRISESMARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AUTOMATION TESTING MARKET SHAREBY VERTICAL INDUSTRY,2023 VS 2031 (%)

8. GLOBAL AUTOMATION TESTING FOR HEALTHCARE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AUTOMATION TESTING FOR IT & TELECOMMUNICATIONMARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL AUTOMATION TESTING FOR ENERGY & UTILITIESMARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL AUTOMATION TESTING FOR BFSI MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL AUTOMATION TESTING FOR DEFENSE AND AEROSPACE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL AUTOMATION TESTING FOR OTHER INDUSTRIAL VERTICAL MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL AUTOMATION TESTING MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

17. UK AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC AUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

28. LATIN AMERICAAUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)

29. MIDDLE EAST AND AFRICAAUTOMATION TESTING MARKET SIZE, 2023-2031 ($ MILLION)