Automotive Automated Parking System Market

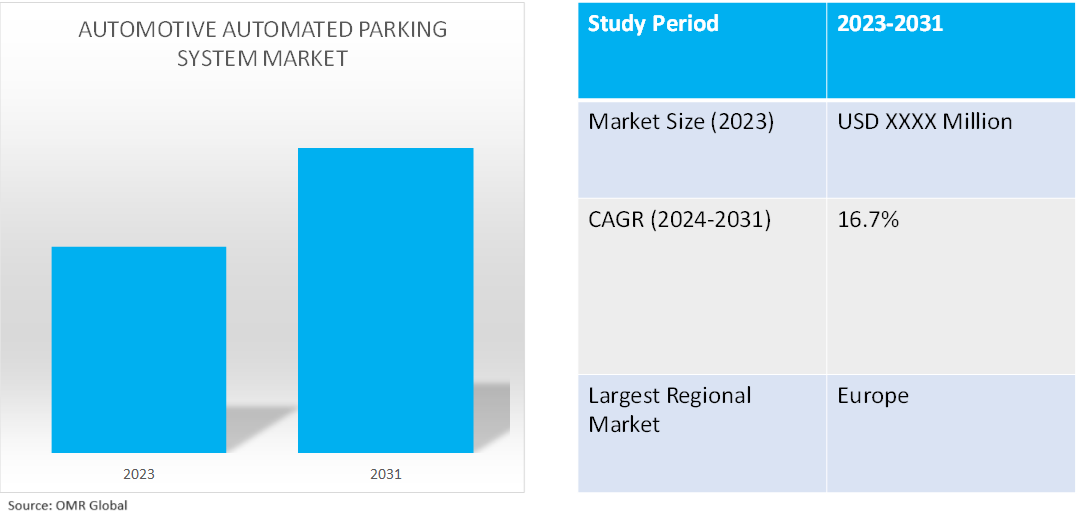

Automotive Automated Parking System Market Size, Share & Trends Analysis Report by Automation Level (Semi-automated, and Fully-automated), by System (Hardware, and Software), and by End-User (Commercial, and Residential) Forecast Period (2024-2031)

Automotive automated parking system (APS) market is anticipated to grow at a CAGR of 16.7% during the forecast period (2024-2031). The growth of the market is driven by factors such as technological advancements, urbanization, and the need for efficient and sustainable parking solutions. It incorporates advanced sensors such as LIDAR, radar, and ultrasonic sensors, which enhance the accuracy and reliability of the parking system. Artificial intelligence and machine learning algorithms further improve performance, resulting in more efficient and safer parking solutions. With the increasing urban population and vehicle ownership, APS can effectively optimize space usage and contribute to improved urban mobility. Government policies and incentives also play a role in encouraging the adoption of APS, which not only reduces emissions but also optimizes land usage and offers a seamless user experience.

Market Dynamics

Consumer Demand for Convenience

Automated parking systems have grown more and more popular as a result of urban individuals' growing preference for convenience. It offers a smooth parking experience and improves urban mobility. According to the World Bank Group, in April 2023, approximately 56.0% of the global population, which amounts to across 4.4 billion individuals, currently reside in urban areas. Projections indicate that this trend is set to persist, with the urban population expected to more than double by 2050, reaching nearly 7 out of 10 individuals globally. Effective management of urbanization has the potential to foster sustainable growth through enhanced productivity and innovation, considering that over 80% of the global GDP is generated in cities.

Technological Advancements in Sensor Technologies

The increasing efficiency and safety of the system owing to advancements in robotics and sensor technologies are satisfying consumer and urban planner demands for automated parking solutions. For instance, in September 2023, Hyundai introduced a one-touch automated Mobis Parking System, allowing owners to park their vehicles and memorize maneuvers. The updated version, MPS 1.0 Premium, includes Memory Parking Assist (MPA), making it easier for owners to park their vehicles. Advanced parking technology, including ADAS and video-based sensors, is advancing towards autonomous parking.

Market Segmentation

- Based on automation level, the market is segmented into semi-automated, fully-automated.

- Based on the system, the market is segmented into hardware and software.

- Based on end-user, the market is segmented into commercial, and residential.

Commercial Sub-Segment To Hold a Considerable Market Share

The adoption of automated systems in commercial space is driven by environmental concerns, particularly in reducing urban pollution and carbon footprints. For instance, in April 2024, Hyderabad launched India's largest automated car parking structure, a 15-story facility that operates entirely on automation. This innovative solution aims to address parking issues in urban centers, reducing traffic jams and pollution.

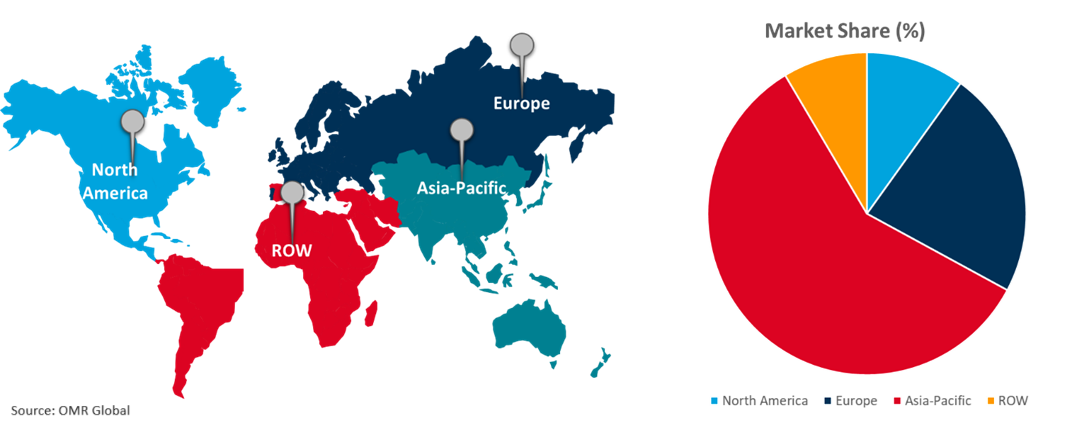

Regional Outlook

The global automotive automated parking system market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Automotive Automated Parking System Market Growth by Region 2024-2031

Europe Holds Major Share in the Global Automotive Automated Parking System Market

The growing number of vehicles in the EU demands effective parking solutions, especially automated parking systems (APS), that can manage large vehicle volumes and maximize available space. According to the ACEA (Association des Constructeurs Européens d’Automobiles), in February 2024, The number of cars on EU roads in 2022 was reported to be 252 million, indicating a 1.% increase compared to the previous year. Battery-electric sales reached record highs, although they account for only 1.2% of the total number of cars. Vans in circulation also saw a 1.5% increase, with France having the highest number. Trucks, on the other hand, remain the oldest vehicle type, with an average age of 14 years. Buses make up a significant portion of the vehicles on EU roads, with over 720,000 in total. Battery-electric models are most prevalent in Ireland, Luxembourg, and the Netherlands, where they comprise over 10.0% of the buses. In terms of cars per 1,000 inhabitants, Poland ranks the highest, while Latvia has the lowest number.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global automotive automated parking system market include Bosch GmbH, Continental AG, Robotic Parking Systems, Inc., Unitronics (1989) (R” G) Ltd., and ZF Friedrichshafen AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market. For instance, in November 2023, ECARX Holdings Inc. launched a series of Advanced Driver Assistance System (ADAS) enabled products, starting with the ECARX Skyland Pro. The platform, powered by two Black Sesame Huashan-2 A1000 automotive-grade SoCs, offers exceptional performance and a sophisticated safety system, enabling L2+ advanced driving and parking.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive automated parking system market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Bosch GmbH

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Continental AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Robotic Parking Systems, Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Automated Parking System Market by Automation Level

4.1.1. Semi-Automated

4.1.2. Fully-Automated

4.2. Global Automotive Automated Parking System Market by System

4.2.1. Hardware

4.2.2. Software

4.3. Global Automotive Automated Parking System Market by End-User

4.3.1. Commercial

4.3.2. Residential

5. Market Segmentation

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. AISIN CORP.

6.2. APS Group

6.3. Automated Parking Corp.

6.4. City Lift India Ltd

6.5. EITO&GLOBAL INC.

6.6. Expert Parking Systems.

6.7. FATA Automation

6.8. fehr Lagerlogistik AG

6.9. Magna International Inc.

6.10. Mitsubishi Electric Corp.

6.11. Nidec Corp.

6.12. OMRON Corp.

6.13. Park Plus, Inc.

6.14. Robert Bosch GmbH

6.15. Siemens AG

6.16. Skyline Parking AG

6.17. Unitronics (1989) (R”G) Ltd.

6.18. Valeo

6.19. YW Parking Trading Co.

6.20. ZF Friedrichshafen AG

1. Global Automotive Automated Parking System Market Research And Analysis By Automation Level, 2023-2031 ($ Million)

2. Global Automotive Semi-Automated Parking System Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Automotive Fully-Automated Parking System Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Automotive Automated Parking System Market Research And Analysis By System, 2023-2031 ($ Million)

5. Global Hardware In Automotive Automated Parking System Market Research And Analysis By Region, 2023-2031 ($ Million)

6. Global Software In Automotive Automated Parking System Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Automotive Automated Parking System Market Research And Analysis By End-User, 2023-2031 ($ Million)

8. Global Automotive Automated Parking System For Commercial Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Automotive Automated Parking System For Residential Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Automotive Automated Parking System Market Research And Analysis By Region, 2023-2031 ($ Million)

11. North American Automotive Automated Parking System Market Research And Analysis By Country, 2023-2031 ($ Million)

12. North American Automotive Automated Parking System Market Research And Analysis By Automation Level, 2023-2031 ($ Million)

13. North American Automotive Automated Parking System Market Research And Analysis By System, 2023-2031 ($ Million)

14. North American Automotive Automated Parking System Market Research And Analysis By End-User, 2023-2031 ($ Million)

15. European Automotive Automated Parking System Market Research And Analysis By Country, 2023-2031 ($ Million)

16. European Automotive Automated Parking System Market Research And Analysis By Automation Level, 2023-2031 ($ Million)

17. European Automotive Automated Parking System Market Research And Analysis By System, 2023-2031 ($ Million)

18. European Automotive Automated Parking System Market Research And Analysis By End-User, 2023-2031 ($ Million)

19. Asia-Pacific Automotive Automated Parking System Market Research And Analysis By Country, 2023-2031 ($ Million)

20. Asia-Pacific Automotive Automated Parking System Market Research And Analysis By Automation Level, 2023-2031 ($ Million)

21. Asia-Pacific Automotive Automated Parking System Market Research And Analysis By System, 2023-2031 ($ Million)

22. Asia-Pacific Automotive Automated Parking System Market Research And Analysis By End-User, 2023-2031 ($ Million)

23. Rest Of The World Automotive Automated Parking System Market Research And Analysis By Region, 2023-2031 ($ Million)

24. Rest Of The World Automotive Automated Parking System Market Research And Analysis By Automation Level, 2023-2031 ($ Million)

25. Rest Of The World Automotive Automated Parking System Market Research And Analysis By System, 2023-2031 ($ Million)

26. Rest Of The World Automotive Automated Parking System Market Research And Analysis By End-User, 2023-2031 ($ Million)

1. Global Automotive Automated Parking System Market Share By Automation Level, 2023 Vs 2031 (%)

2. Global Automotive Semi-Automated Parking System Market Share By Region, 2023 Vs 2031 (%)

3. Global Automotive Fully-Automated Parking System Market Share By Region, 2023 Vs 2031 (%)

4. Global Automotive Automated Parking System Market Share By System, 2023 Vs 2031 (%)

5. Global Hardware In Automotive Automated Parking System Market Share By Region, 2023 Vs 2031 (%)

6. Global Software In Automotive Automated Parking System Market Share By Region, 2023 Vs 2031 (%)

7. Global Automotive Automated Parking System Market Share By End-User, 2023 Vs 2031 (%)

8. Global Automotive Automated Parking System For Commercial Market Share By Region, 2023 Vs 2031 (%)

9. Global Automotive Automated Parking System For Residential Market Share By Region, 2023 Vs 2031 (%)

10. Global Automotive Automated Parking System Market Share By Region, 2023 Vs 2031 (%)

11. US Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

12. Canada Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

13. UK Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

14. France Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

15. Germany Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

16. Italy Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

17. Spain Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

18. Rest Of Europe Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

19. India Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

20. China Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

21. Japan Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

22. South Korea Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

23. Rest Of Asia-Pacific Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

24. Latin America Automotive Automated Parking System Market Size, 2023-2031 ($ Million)

25. Middle East And Africa Automotive Automated Parking System Market Size, 2023-2031 ($ Million)