Automotive Battery Market

Global Automotive Battery Market by Type (Lead Acid Battery, Lithium-Ion Battery, and Others), By Fuel Type (Internal Combustion (IC) Engine Vehicle and Electric Vehicle), By Vehicle Type (Passenger Cars and Commercial Vehicles) - Global Industry Share, Growth, Competitive Analysis and Forecast Period 2021-2027 Update Available - Forecast 2025-2035

The Automotive Battery Market is expected to grow at a CAGR of 5.4% during the forecast period 2021-2027. With rising sales of automobiles such as electric vehicles, manufacturers of automotive batteries are focusing on extending the capacity of these batteries by adopting newer technologies and advancements. In parallel to the advent of battery technologies that enable quick recharging and power-saving options, automobile manufacturers and Original Equipment Manufacturer (OEMs) are also being compelled to develop vehicle components & systems with optimized power consumption.

The major factor that augments the global automotive battery market includes the increasing automobile sales, rising adoption of vehicle electrification, growing battery sales in the replacement market, and growing lead-acid battery usage in the automobile sector. In addition, growing fuel cell-based batteries, R&D on newer battery technologies such as aluminum ion and aluminum-air batteries, and rising sales of electric vehicles in the forecast year act as an opportunity and may augment the global automotive battery market in the near future. However, some factors such as lack of charging stations for electric vehicles, the heavy weight of batteries used in electric vehicles, and environmental concerns related to batteries used in an automobile such as lead-acid batteries are hindering the market growth.

Segmental Outlook

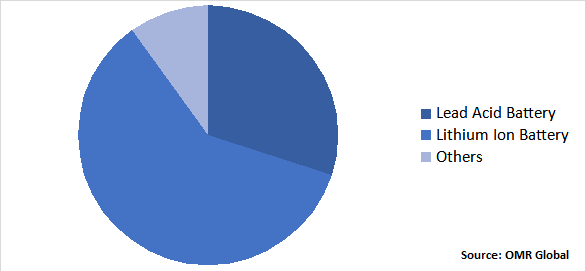

The global automotive battery market is segmented on the basis of type, fuel type, and vehicle type. On the basis of type, the market is further diversified into lead-acid batteries, lithium-ion batteries, and others. On the basis of fuel type, the market is bifurcated into internal combustion (IC) engine vehicles, electric vehicles. Further, on the basis, vehicle type, the market is sub-divided into passenger cars and commercial vehicles.

Global Automotive Battery Market Share by Type, 2020 (%)

Lithium-ion batteries dominated the market in 2020 owing to their high application in demand of high-energy-density solutions such as hybrid and electric automobiles. In addition, lithium-ion batteries charge faster and have a higher power density for more battery life in a lighter package. Moreover, the lithium-ion battery for automotive application has emerged as an eco-friendly, rechargeable power source compared to conventional batteries such as lead-acid and nickel-metal hydride batteries.

Regional Outlooks

The global automotive battery is analyzed on the basis of the geographical regions that are contributing significantly towards the growth of the market. On the basis of geography, the market is divided into North America, Europe, Asia-Pacific, and the Rest of the World. Europe is estimated to exhibit considerable growth in the next five years owing to the widespread production of automobiles in countries such as Germany, Italy, Sweden, and the UK. The presence of major automotive manufacturers, such as Jaguar, Volkswagen, Volvo, Audi, BMW, Mercedes-Benz, and Fiat, in the region is anticipated to aid in market expansion.

The Asia-Pacific is divided into China, India, Japan, and the Rest of Asia Pacific. The region is growing at a significant pace and is expected to occupy a prominent share in the market. China is the major country in this region owing to overgrowing automobile sales and technological advancement. India is anticipated to become one of the leading economies globally in the coming decades.

Market Players Outlook

Some of the key players of the automotive battery market include A123 Systems, LLC, BYD Co., Ltd., East Penn Manufacturing Company, EnerSys, Exide Technologies, and GS Yuasa Corp. In order to survive in the market, these players adopt different marketing strategies such as a merger, acquisitions, product launch, and geographical expansion.

Recent Development

In December 2020, LG Chem Ltd announced its plans to more than double the production capacity of battery cells it makes in China for Tesla Inc. electric vehicles (EV) in 2021 to keep up with its US client's growth in the biggest car market. The firm, a supplier for Tesla's Shanghai-built Model 3, would also ship its increased output from China and Korea to Tesla's factories in Germany and the United States.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive battery market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Automotive Battery Market

• Recovery Scenario of Global Automotive Battery Market

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

3.3. Impact of Covid-19 on Key Players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Automotive Battery, By Types

5.1.1. Lead Acid Battery

5.1.2. Lithium-Ion Battery

5.1.3. Others

5.2. Global Automotive Battery Market by Fuel Type

5.2.1. Internal Combustion (IC) Engine Vehicle

5.2.2. Electric Vehicle

5.3. Global Automotive Battery Market by Vehicle Type

5.3.1. Passenger Cars

5.3.2. Commercial Vehicles

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. A123 Systems LLC

7.2. Acumuladores Moura SA

7.3. BYD Co. Ltd.

7.4. C&D Technologies Inc.

7.5. CSB Enetrgy Technology Co. Ltd

7.6. EAST PENN Manufacturing Co.

7.7. Enersys

7.8. EXIDE Technologies

7.9. First National Battery

7.10. GS Yuasa Corp.

7.11. Hitachi Ltd.

7.12. MidacSPA

7.13. Northstar Battery

7.14. Panasonic Corp.

7.15. Robert Bosch GmBH

1. GLOBAL AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL AUTOMOTIVE BATTERY MARKET BY TYPE, 2020-2027 ($ MILLION)

3. GLOBAL LEAD-ACID BATTERY MARKET BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL LITHIUM-ION BATTERY MARKET BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL OTHER AUTOMOTIVE BATTERY MARKET BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL AUTOMOTIVE BATTERY MARKET BY FUEL TYPE INDUSTRY, 2020-2027 ($ MILLION)

7. GLOBAL INTERNAL COMBUSTION (IC) ENGINE VEHICLE BATTERY MARKET BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL ELECTRIC VEHICLE BATTERY MARKET BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL AUTOMOTIVE BATTERY MARKET BY VEHICLE TYPE, 2020-2027 ($ MILLION)

10. GLOBAL PASSENGER CAR BATTERY MARKET BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL COMMERCIAL VEHICLE BATTERY MARKET BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

14. NORTH AMERICAN AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2020-2027 ($ MILLION)

15. NORTH AMERICAN AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

16. NORTH AMERICAN AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. EUROPEAN AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

18. EUROPEAN AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2020-2027 ($ MILLION)

19. EUROPEAN AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

20. EUROPEAN AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

22. ASIA-PACIFIC AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2020-2027 ($ MILLION)

23. ASIA-PACIFIC AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

24. ASIA-PACIFIC AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

25. REST OF THE WORLD AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY TYPE, 2020-2027 ($ MILLION)

26. REST OF THE WORLD AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY FUEL TYPE, 2020-2027 ($ MILLION)

27. REST OF THE WORLD AUTOMOTIVE BATTERY MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

1. GLOBAL AUTOMOTIVE BATTERY MARKET SHARE BY TYPE, 2020 VS 2027 (%)

2. GLOBAL AUTOMOTIVE BATTERY MARKET SHARE BY FUEL TYPE, 2020 VS 2027 (%)

3. GLOBAL AUTOMOTIVE BATTERY MARKET SHARE BY VEHICLE TYPE, 2020 VS 2027 (%)

4. GLOBAL AUTOMOTIVE BATTERY MARKET SHARE BY GEOGRAPHY, 2020 VS 2027, (%)

5. GLOBAL LEAD-ACID BATTERY MARKET BY REGION, 2020 VS 2027 (%)

6. GLOBAL LITHIUM-ION BATTERY MARKET BY REGION, 2020 VS 2027 (%)

7. GLOBAL OTHER AUTOMOTIVE BATTERY MARKET BY REGION, 2020 VS 2027 (%)

8. GLOBAL INTERNAL COMBUSTION (IC) ENGINE VEHICLE BATTERY MARKET BY REGION, 2020 VS 2027 (%)

9. GLOBAL ELECTRIC VEHICLE BATTERY MARKET BY REGION, 2020 VS 2027 (%)

10. GLOBAL PASSENGER CAR BATTERY MARKET BY REGION, 2020 VS 2027 (%)

11. GLOBAL COMMERCIAL VEHICLE BATTERY MARKET BY REGION, 2020 VS 2027 (%)

12. US AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

13. CANADA MARKET AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

14. UK AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

15. GERMANY AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

16. SPAIN AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

17. FRANCE AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

18. ITALY AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

19. REST OF EUROPE AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

20. INDIA AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

21. CHINA AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

22. JAPAN AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

23. REST OF ASIA-PACIFIC AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)

24. REST OF WORLD AUTOMOTIVE BATTERY MARKET SIZE, 2020-2027 ($ MILLION)