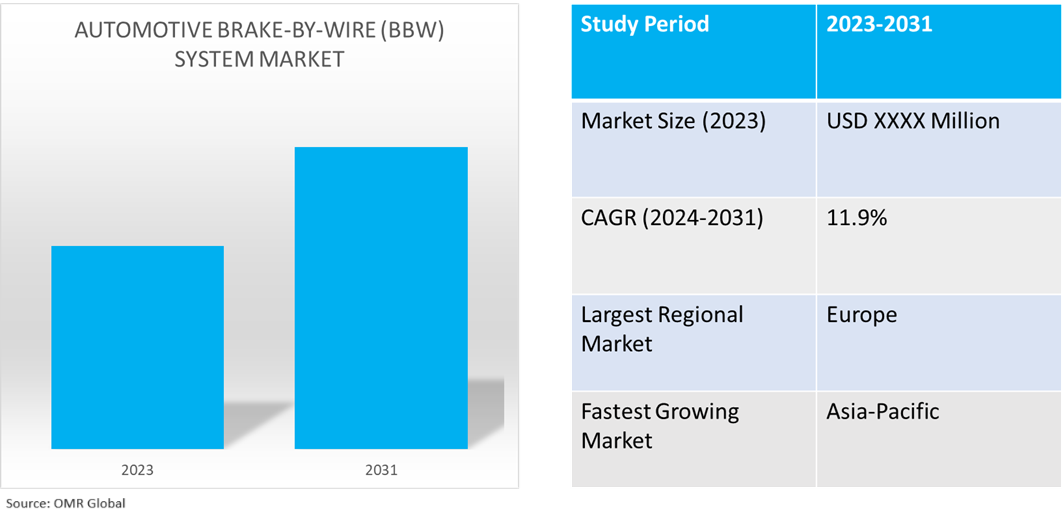

Automotive Brake-By-Wire System Market

Automotive Brake-By-Wire System Market Size, Share & Trends Analysis Report by Type (Electro-Hydraulic Brakes (EHB), Electro-Mechanical Brakes (EMB) and Electric Parking Brakes (EPB), by Component (Brake Pedal Sensor, Electronic Control Unit (ECU), Brake Actuators, Wheel Speed Sensors, Steering Wheel Angle Sensors, Pressure Sensor and Others), and by Vehicle Type (Passenger Cars, Commercial Vehicles and Off-Highway Vehicles) Forecast Period (2024-2031)

Automotive Brake-By-Wire (BBW) system market is anticipated to grow at a significant CAGR of 11.9% during the forecast period (2024-2031). The industry growth is attributed to pivotal factors such as increased awareness of vehicle safety, expanding use of BBW systems in modern cars, component downsizing, and laws requiring the integration of advanced safety systems. Automotive BBW systems complement the region's focus on safety regulations by providing improved braking performance, stability, and control. Additionally, the demand for Automotive BBW systems is being driven by the increasing uptake of electric cars (EVs) globally. According to the International Energy Agency (IEA), electric car sales in 2023 were 3.5 million higher than in 2022, a 35.0% year-on-year increase.

Market Dynamics

Increasing Integration with ADAS and Autonomous Driving

Autonomous driving technologies and Advanced Driver Assistance Systems (ADAS) are being increasingly combined with BBW systems. Vehicle performance and safety are improved, and precise braking control is provided. The need for BBW systems is increasing due to the popularity of electric and hybrid automobiles. The efficient and lightweight design of BBW systems benefits these vehicles by improving overall performance and efficiency. An essential component of the continuous transition to electrification and autonomous driving is BBW systems. Electro-mechanical brakes (EMB) do not require hydraulic fluid, in contrast to traditional Electro-Hydraulic Braking (EHB) systems. Developments in sensor technology, including accelerometers and pressure sensors with high resolution, are improving the responsiveness and dependability of BBW systems.

Rising Consumer Demand for Safety

The safety features of vehicles have grown increasingly apparent to consumers. The need for automobiles with innovative braking systems, such as BBW, is growing. The use of BBW systems is expanding for both Original Equipment Manufacturers (OEMs) and the aftermarket industry. Manufacturers are adding BBW systems to their latest models of cars, while the aftermarket industry is upgrading and retrofitting cars that already exist. The increasing demand for automotive with ADAS, the rising focus on improving rider safety, and the growing preference for electric cars are major factors driving the market growth. Additionally, the integration of advanced technologies such as Electric Parking Brakes (EPB) and traction control systems into the BBW system is also expected to contribute to the market expansion.

Market Segmentation

- Based on the type, the market is segmented into Electro-Hydraulic Brakes (EHB), Electro-Mechanical Brakes (EMB), and Electric Parking Brakes (EPB).

- Based on the components, the market is segmented into brake pedal sensors, Electronic Control Units (ECU), brake actuators, wheel speed sensors, steering wheel angle sensors, pressure sensors, and others (yaw sensors).

- Based on the vehicle type, the market is segmented into passenger cars, commercial vehicles, and off-highway vehicles.

The Electric Parking Brakes (EPB) Segment is Projected to Hold the Largest Market Share

The primary factors supporting the growth include the growing demand for innovative automotive parts and components driven by an expansion in vehicle manufacturing, resulting in increased demand for automotive electronic parking brakes. Convenience, space-saving advantages, and interoperability with innovative vehicle control systems are all provided by EPB systems. They are gaining popularity in a variety of vehicle categories, such as commercial trucks, SUVs, and passenger automobiles. An electronic control switch or button takes the role of the traditional handbrake or foot-operated parking brake, with EPB systems. The EPB system provides safe and dependable parking brake functionality by employing electric motors or actuators to actuate the brakes when it is engaged. For instance, in November 2023, ADVICS, in advanced braking technology, is expanding its brake system product offerings by adding new EPB actuator kits, which attach to the vehicle’s caliper and automatically engage the parking brake. Electric parking brakes (EPB) are extremely common among new cars.

Passenger Cars to Hold a Considerable Market Share

The factors supporting segment growth include the increasing adoption of control, safety, and braking efficiency of passenger cars with the widespread usage of BBW systems. Benefits from BBW system integration in passenger cars include enhanced stability, responsiveness, and optimum brake force distribution. The growing need for advanced safety features and better driving experiences in passenger automobiles is the reason for expansion. BBW systems improve overall vehicle safety by providing improved braking efficacy, reactivity, and control. The passenger automobiles sector in the BBW systems market includes a variety of car models, such as sedans, hatchbacks, SUVs, and luxury vehicles. According to the International Organization of Motor Vehicle Manufacturers (OICA), the registrations and sales of new vehicles - passenger cars reached 6,52,72,367 in 2023.

Regional Outlook

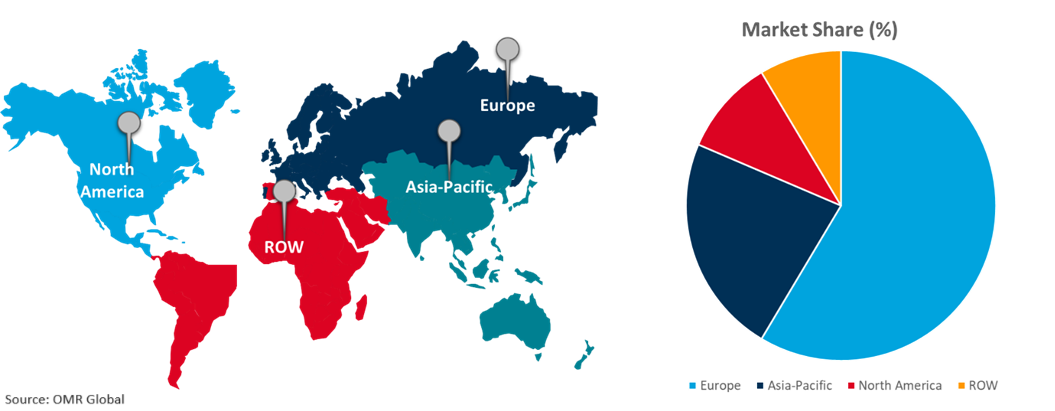

The global automotive brake-by-wire system market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Automotive Brake-By-Wire Systems in Asia-Pacific

The regional growth is attributed to increasing demand for both commercial and passenger automobiles. Growing automobile sales are a result of developing infrastructure in countries such as South Korea, China, and India. Better safety, performance, and control are provided by automotive BBW systems, which are in line with the region's emphasis on raising driving standards and driving experience.

Global Automotive Brake-By-Wire System Market Growth by Region 2024-2031

Europe Holds Major Market Share

Europe holds a significant market share owing to the presence of automotive brake-by-wire system offering companies such as Continental AG, Robert Bosch GmbH, ZF Friedrichshafen AG, and others. The market growth is attributed to the increasing demand for strict safety requirements, technological advances, and the presence of top automakers, which are driving the growth of the automotive BBW systems market in Europe. The growing demand for advanced safety systems and features in cars is one driving element that is unique to the area. Automotive BBW systems complement the region's emphasis on vehicle safety by providing better braking performance, reactivity, and control. Additionally, the use of electric vehicles has increased quickly in Europe, which increases demand for Automotive BBW systems. The development of autonomous vehicles, the increasing trend of vehicle electrification, and the incorporation of ADAS all support the expansion of the automotive BBW systems market in Europe. For instance, in May 2023, Continental AG's new generation of conventional electronic brake systems, the MK 120 ESC, was first put into production in the Chinese market. The compact and efficient electronic brake system meets the needs of electrification and automated driving with cyber security features and over-the-air functionality.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the automotive brake-by-wire system market include AISIN CORP., Continental AG, Hitachi Astemo, Ltd., Robert Bosch GmbH, and ZF Friedrichshafen AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Development

- In October 2022, Sensata Technologies introduced a new brake pedal force sensor that enables safer brakes for next-generation cars. Automotive electrification and autonomy are powering the trend toward electro-mechanical brakes in next-generation cars, especially in hybrid and Electric Vehicles (EVs). As electronics replace legacy hydraulic components in brake-by-wire systems, there is a need for new sensing topologies in the pedal assemblies

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive brake-by-wire system market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AISIN CORP.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Continental AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Hitachi Astemo, Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Robert Bosch GmbH

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. ZF Friedrichshafen AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Brake-By-Wire System Market by Type

4.1.1. Electro-Hydraulic Brakes (EHB)

4.1.2. Electro-Mechanical Brakes (EMB)

4.1.3. Electric Parking Brakes (EPB)

4.2. Global Automotive Brake-By-Wire System Market by Component

4.2.1. Brake Pedal Sensor

4.2.2. Electronic Control Unit (ECU)

4.2.3. Brake Actuators

4.2.4. Wheel Speed Sensors

4.2.5. Steering Wheel Angle Sensors

4.2.6. Pressure Sensor

4.2.7. Others (Yaw Sensor)

4.3. Global Automotive Brake-By-Wire System Market by Vehicle Type

4.3.1. Passenger Cars

4.3.2. Commercial Vehicles

4.3.3. Off-Highway Vehicles

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ADVICS CO., LTD.

6.2. AKEBONO BRAKE INDUSTRY CO., LTD.

6.3. Brembo N.V.

6.4. Carlisle Brake & Friction

6.5. Denso Corp.

6.6. EFI Automotive

6.7. FUTEK Advanced Sensor Technology, Inc.

6.8. Haldex Group

6.9. HL Mando

6.10. HYUNDAI MOBIS

6.11. Johnson Electric Holdings Ltd.

6.12. Knorr-Bremse AG

6.13. LSP Innovative Automotive Systems GmbH

6.14. RAICAM Industrie S.r.l.

6.15. Sensirion AG

6.16. Standex Electronics, Inc.

6.17. STMicroelectronics

6.18. TMD Friction Group GmbH

6.19. Valeo Powertrain GmbH

1. Global Automotive Brake-By-Wire System Market Research And Analysis By Type, 2023-2031 ($ Million)

2. Global Automotive Electro-Hydraulic Brakes (EHB) Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Automotive Electro-Mechanical Brakes (EMB)Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Automotive Electric Parking Brakes (EPB) Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Automotive Brake-By-Wire System Market Research And Analysis By Component, 2023-2031 ($ Million)

6. Global Automotive Brake Pedal Sensor Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Automotive Electronic Control Unit (ECU) Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Automotive Brake Actuators Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Automotive Wheel Speed Sensors Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Automotive Steering Wheel Angle Sensors Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Automotive Pressure Sensor Market Research And Analysis By Region, 2023-2031 ($ Million)

12. Global Other Automotive Brake-By-Wire System Type Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Automotive Brake-By-Wire System Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

14. Global Automotive Brake-By-Wire System For Passenger Cars Market Research And Analysis By Region, 2023-2031 ($ Million)

15. Global Automotive Brake-By-Wire System For Commercial Vehicles Market Research And Analysis By Region, 2023-2031 ($ Million)

16. Global Automotive Brake-By-Wire System For Off-Highway Vehicles Market Research And Analysis By Region, 2023-2031 ($ Million)

17. Global Automotive Brake-By-Wire System Market Research And Analysis By Region, 2023-2031 ($ Million)

18. North American Automotive Brake-By-Wire System Market Research And Analysis By Country, 2023-2031 ($ Million)

19. North American Automotive Brake-By-Wire System Market Research And Analysis By Type, 2023-2031 ($ Million)

20. North American Automotive Brake-By-Wire System Market Research And Analysis By Component, 2023-2031 ($ Million)

21. North American Automotive Brake-By-Wire System Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

22. European Automotive Brake-By-Wire System Market Research And Analysis By Country, 2023-2031 ($ Million)

23. European Automotive Brake-By-Wire System Market Research And Analysis By Type, 2023-2031 ($ Million)

24. European Automotive Brake-By-Wire System Market Research And Analysis By Component, 2023-2031 ($ Million)

25. European Automotive Brake-By-Wire System Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

26. Asia-Pacific Automotive Brake-By-Wire System Market Research And Analysis By Country, 2023-2031 ($ Million)

27. Asia-Pacific Automotive Brake-By-Wire System Market Research And Analysis By Type, 2023-2031 ($ Million)

28. Asia-Pacific Automotive Brake-By-Wire System Market Research And Analysis By Component, 2023-2031 ($ Million)

29. Asia-Pacific Automotive Brake-By-Wire System Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

30. Rest Of The World Automotive Brake-By-Wire System Market Research And Analysis By Region, 2023-2031 ($ Million)

31. Rest Of The World Automotive Brake-By-Wire System Market Research And Analysis By Type, 2023-2031 ($ Million)

32. Rest Of The World Automotive Brake-By-Wire System Market Research And Analysis By Component, 2023-2031 ($ Million)

33. Rest Of The World Automotive Brake-By-Wire System Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

1. Global Automotive Brake-By-Wire System Market Research And Analysis By Type, 2023 Vs 2031 (%)

2. Global Automotive Electro-Hydraulic Brakes (EHB) Market Share By Region, 2023 Vs 2031 (%)

3. Global Automotive Electro-Mechanical Brakes (EMB) Market Share By Region, 2023 Vs 2031 (%)

4. Global Automotive Electric Parking Brakes (EPB) Market Share By Region, 2023 Vs 2031 (%)

5. Global Automotive Brake-By-Wire System Market Research And Analysis By Component, 2023 Vs 2031 (%)

6. Global Automotive Brake Pedal Sensor Market Share By Region, 2023 Vs 2031 (%)

7. Global Automotive Electronic Control Unit (ECU) Market Share By Region, 2023 Vs 2031 (%)

8. Global Automotive Brake Actuators Market Share By Region, 2023 Vs 2031 (%)

9. Global Automotive Wheel Speed Sensors Market Share By Region, 2023 Vs 2031 (%)

10. Global Automotive Steering Wheel Angle Sensors Market Share By Region, 2023 Vs 2031 (%)

11. Global Automotive Pressure Sensor Market Share By Region, 2023 Vs 2031 (%)

12. Global Other Automotive Brake-By-Wire System Type Market Share By Region, 2023 Vs 2031 (%)

13. Global Automotive Brake-By-Wire System Market Research And Analysis By Vehicle Type, 2023 Vs 2031 (%)

14. Global Automotive Brake-By-Wire System For Passenger Cars Market Share By Region, 2023 Vs 2031 (%)

15. Global Automotive Brake-By-Wire System For Commercial Vehicles Market Share By Region, 2023 Vs 2031 (%)

16. Global Automotive Brake-By-Wire System For Off-Highway Vehicles Market Share By Region, 2023 Vs 2031 (%)

17. Global Automotive Brake-By-Wire System Market Share By Region, 2023 Vs 2031 (%)

18. US Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

19. Canada Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

20. UK Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

21. France Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

22. Germany Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

23. Italy Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

24. Spain Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

25. Rest Of Europe Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

26. India Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

27. China Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

28. Japan Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

29. South Korea Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

30. Rest Of Asia-Pacific Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

31. Latin America Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)

32. Middle East And Africa Automotive Brake-By-Wire System Market Size, 2023-2031 ($ Million)