Automotive Carbon Fiber Market

Global Automotive Carbon Fiber Market Size, Share & Trends Analysis Report by Raw Material (Polyacrylonitrile (PAN) and Petroleum Pitch & Rayon), By Fiber Type (Virgin Carbon Fiber and Recycled Carbon Fiber), By Application (Interior, Exterior, Structural Assembly, and Others), and Forecast 2020-2026 Update Available - Forecast 2025-2035

The global market for automotive carbon fiber is projected to have a considerable CAGR of over 8.5% during the forecast period. The market is mainly driven by the increasing application of carbon fiber materials in automotive components, growing g adoption of lightweight vehicles across the globe. Advanced materials are essential for boosting the fuel economy of modern automobiles while maintaining safety and performance. Lightweight composites are crucial to boost the fuel economy and maintain the set safety standards and performance of modern automobiles. To accelerate a lighter object, less energy is needed rather than acceleration of heavier one, therefore lightweight composite materials, such as carbon fiber, deliver a significant potential to increase the efficiency of vehicles. Further, the carbon fiber material is increasingly used in EVs (electric vehicles) that will further provide a significant opportunity to the market.

Segmental Outlook

The global automotive carbon fiber market is segmented based on raw material, fiber type, and application. On the basis of raw material, the market is sub-segmented into PAN and petroleum pitch & rayon. Among these PAN segment is estimated to hold a significant share in the global automotive carbon fiber market. The low cost and high productivity of the PAN as a precursor for the production of carbon fiber is a key factor for the high share of the PAN in the raw material segment. Based on the fiber type, the market is further classified into virgin carbon fiber and recycled carbon fiber. Based on application the market is further segregated into the interior, exterior, structural assembly, and others.

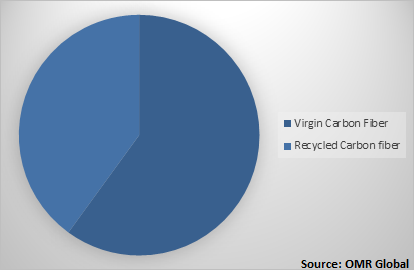

Global automotive carbon fiber Market Share by Fiber Type, 2019 (%)

Global Automotive Carbon Fiber Market to be Driven by Virgin Carbon Fiber

Among fiber types, the virgin carbon fiber segment held a considerable share in the market owing to high tensile strength and other mechanical properties of the virgin carbon fiber. Virgin carbon fiber can be used to produce Class A surface finish on the panels. Virgin carbon fiber is known to have long-term performance potential, in terms of wear & tear and environmental effects. Therefore, the virgin carbon fiber has found extensive applications in the automotive industry owing to its demanding thermo-structural requirements. The improved strength to weight ratio and considerable stiffness of virgin carbon fiber is another key factor for the growing application of the virgin carbon fiber in the automotive industry.

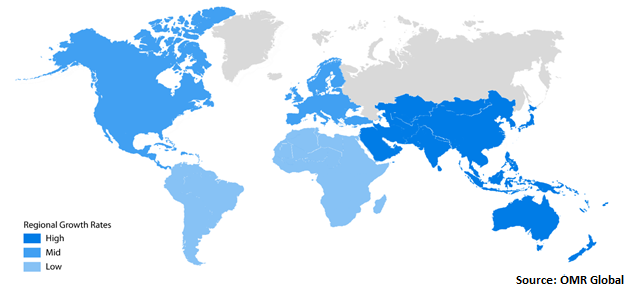

Regional Outlook

Geographically, the global automotive carbon fiber market is further classified into North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific is projected to exhibit significant market growth in the global automotive carbon fiber market during the forecast period. Major economies that are anticipated to contribute to the Asia-Pacific automotive carbon fiber market include China, India Japan, and others. The major factors contributing to the growth of the market in the region include the rising demand for composites materials such as carbon fiber in the automotive industry coupled with the growing EV industry in the region.

Global automotive carbon fiber Market Growth by Region, 2020-2026

Europe to Hold a Considerable Share in the Global Automotive Carbon Fiber Market

Geographically, Europe has a significant share in the global automotive carbon fiber market. The advancement of the technological infrastructure of the automotive industry in major economies of Europe such as the UK, Germany, and France coupled with significant adoption of carbon fiber in the automotive sector is further making a considerable contribution towards the market in the region. The countries in Europe are the leading automotive manufacturers across the globe that are considerably providing the demand for carbon fibers. Major homegrown automotive companies in the region include Volkswagen AG, BMW AG, Daimler AG, Groupe PSA, Jaguar Land Rover Ltd., and Groupe Renault. These companies also export a significant number of automobiles all across the globe creating a demand for carbon fiber in the region. Moreover, the growing adoption of the carbon fiber composites in the EV industry provides significant opportunity to the regional market.

Market Players Outlook

Some of the key players in the automotive carbon fiber market contributing significantly by providing different types of products and increasing their geographical presence across the globe. The key players of the market include Hexcel Corp., Teijin Ltd., Mitsubishi Chemical Holdings Corp., SGL Carbon SE, Toray Industries, Inc., and others. These market players adopt various strategies such as product launch, partnerships, collaborations, mergers, and acquisitions to sustain a strong position in the market.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive carbon fiber market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Hexcel Corp.

3.1.1.1. Overview

3.1.1.2. Financial Analysis

3.1.1.3. SWOT Analysis

3.1.1.4. Recent Developments

3.1.2. Teijin Ltd.

3.1.2.1. Overview

3.1.2.2. Financial Analysis

3.1.2.3. SWOT Analysis

3.1.2.4. Recent Developments

3.1.3. Mitsubishi Chemical Holdings Corp.

3.1.3.1. Overview

3.1.3.2. Financial Analysis

3.1.3.3. SWOT Analysis

3.1.3.4. Recent Developments

3.1.4. SGL Cabon SE

3.1.4.1. Overview

3.1.4.2. Financial Analysis

3.1.4.3. SWOT Analysis

3.1.4.4. Recent Developments

3.1.5. Toray Industries, Inc.

3.1.5.1. Overview

3.1.5.2. Financial Analysis

3.1.5.3. SWOT Analysis

3.1.5.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Automotive Carbon Fiber Market by Raw Material

5.1.1. Polyacrylonitrile (PAN)

5.1.2. Petroleum Pitch & Rayon

5.2. Global Automotive Carbon Fiber Market by Fiber Type

5.2.1. Virgin Carbon Fiber

5.2.2. Recycled Carbon fiber

5.3. Global Automotive Carbon Fiber Market by Application

5.3.1. Interior

5.3.2. Exterior

5.3.3. Structural Assembly

5.3.4. Others (Powertrain Components)

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Carbon Revolution Ltd.

7.2. DowAksa Advanced Composites Holdings BV

7.3. Formosa Plastics Corp.

7.4. Hexcel Corp.

7.5. Hyosung Corp.

7.6. Jiangsu Hengshen Co. Ltd.

7.7. Mitsubishi Chemical Holdings Corp.

7.8. Muhr Und Bender KG

7.9. Nippon Carbon Co. Ltd.

7.10. Polar Manufacturing Ltd.

7.11. RTP Co.

7.12. Solvay SA

7.13. SGL Carbon SE

7.14. Sigmatex Ltd.

7.15. Taekwang Industrial Co. Ltd.

7.16. Toray Industries, Inc.

7.17. Teijin Ltd.

7.18. UMATEX, ROSATOM State Corp.

7.19. Weihai Guangwei Composites Co., Ltd.

7.20. ZHONGFU SHENYING CARBON FIBER CO., LTD.

1. GLOBAL AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL POLYACRYLONITRILE (PAN) FOR AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL PETROLEUM PITCH & RAYON FOR AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

5. GLOBAL VIRGIN CARBON FIBER FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

6. GLOBAL RECYCLED CARBON FIBER FOR AUTOMOTIVE MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

8. GLOBAL AUTOMOTIVE INTERIOR CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL AUTOMOTIVE EXTERIOR CARBON FIBER MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL AUTOMOTIVE CARBON FIBER IN STRUCTURAL ASSEMBLY MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

11. GLOBAL AUTOMOTIVE CARBON FIBER IN OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

12. GLOBAL AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

14. NORTH AMERICAN AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

15. NORTH AMERICAN AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

16. NORTH AMERICAN AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. EUROPEAN AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. EUROPEAN AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

19. EUROPEAN AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

20. EUROPEAN AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

21. ASIA-PACIFIC AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

22. ASIA-PACIFIC AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

23. ASIA-PACIFIC AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

24. ASIA-PACIFIC AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

25. REST OF THE WORLD AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY RAW MATERIAL, 2019-2026 ($ MILLION)

26. REST OF THE WORLD AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY FIBER TYPE, 2019-2026 ($ MILLION)

27. REST OF THE WORLD AUTOMOTIVE CARBON FIBER MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL AUTOMOTIVE CARBON FIBER MARKET SHARE BY RAW MATERIAL, 2019 VS 2026 (%)

2. GLOBAL AUTOMOTIVE CARBON FIBER MARKET SHARE BY FIBER TYPE, 2019 VS 2026 (%)

3. GLOBAL AUTOMOTIVE CARBON FIBER MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

4. GLOBAL AUTOMOTIVE CARBON FIBER MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

5. US AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

6. CANADA AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

7. UK AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

8. FRANCE AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

9. GERMANY AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

10. ITALY AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

11. SPAIN AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

12. ROE AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

13. INDIA AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

14. CHINA AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

15. JAPAN AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF ASIA-PACIFIC AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)

17. REST OF THE WORLD AUTOMOTIVE CARBON FIBER MARKET SIZE, 2019-2026 ($ MILLION)