Automotive Ceramics Market

Global Automotive Ceramics Market Size, Share & Trends Analysis Report, By Material (Alumina Oxide Ceramics, Zirconia Oxide ceramics, and Others), By Application (Automotive Engine Parts, Automotive Electronics, Automotive Exhaust Systems, and Others) and Forecast, 2020-2026 Update Available - Forecast 2025-2031

The global automotive ceramics market is estimated to grow at a CAGR of 5.5% during the forecast period. Significant demand for passenger vehicles and superior properties associated with ceramic materials are some pivotal factors encouraging the growth of the market. In December 2019, the EU passenger car demand increased 21.7% owing to the surge in the car sales in France (21.7%) and Sweden (109.3%), as per the European Automobile Manufacturers' Association. In 2019, new passenger car registrations increased by 1.2% across the EU. Europe is renowned for vehicle production across the globe. Therefore, the region contributes to the adoption of technical and advanced ceramics for use in automotive applications.

Advanced ceramics materials are integrated into automotive designs while challenging conditions need a material that is reliable and robust. Ceramic materials hold thermal and electrical properties that support its applications in a range of sensors, ceramic bearings, mechanical seals, and valves. In addition, ceramics are more cost-efficient compared to metal and more durable compared to plastic. These features make it beneficial for use in the automotive industry, as developments in car manufacturing need higher complexity in automotive components. Owing to these properties, advanced ceramic materials have crucial importance in enhancing safety, cost-effectiveness, and comfort in automotive and vehicle engineering.

For electronic controls, piezo-ceramic components work as sensors and deliver information regarding quiet engine operation, position, and changes in the direction of vehicles. Based on ceramic substrates, electronic components respond to this information and control safety systems including the anti-lock braking system (ABS) and anti-slip regulation (ASR). It enables to regulate motor management and release the airbag when required. In engines, heat-resistant ceramic parts such as components for water and fuel pumps, valve components, and backings in the crankshaft housing ensure enhanced efficiency, lower noise emission, and less wear. New possibilities have emerged with the use of ceramic-metal composites in light metal construction. For instance, xenon or LED light systems, modern halogen, with ceramic components considerably improve visibility. Emerging demand for electric vehicles and rising focus on autonomous vehicles are expected to offer an opportunity for market growth.

Market Segmentation

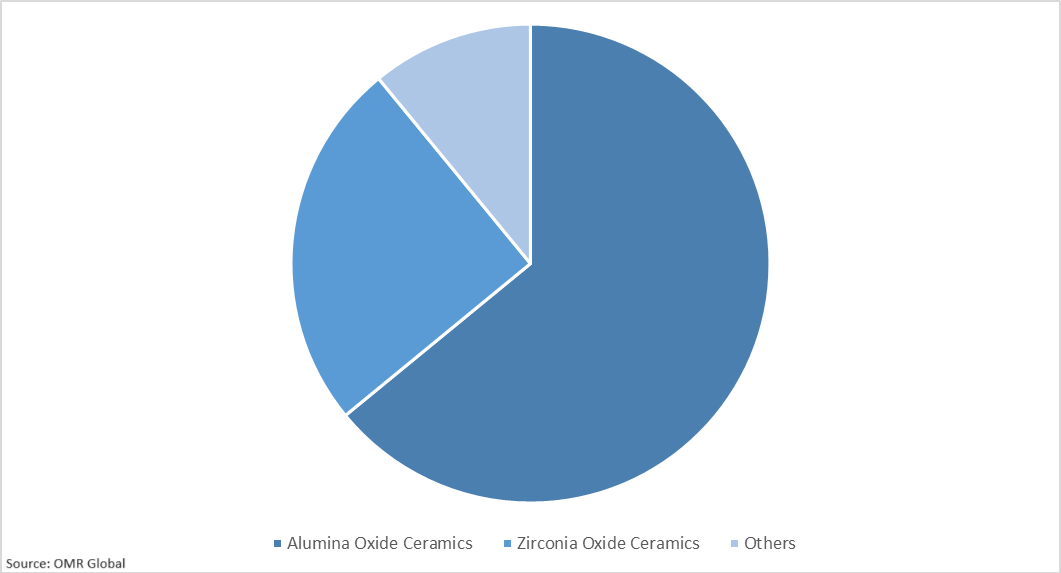

The global automotive ceramics market is segmented based on material and application. Based on material, the market is segmented into alumina oxide ceramics, zirconia oxide ceramics, and others. Based on the application, the market is segmented into automotive engine parts, automotive electronics, automotive exhaust systems, and others.

Alumina Oxide Ceramics Finds Significant Application in the Automotive Industry

Alumina ceramic substrate contains superior comprehensive performance and is an essential material in the automobile industry. It is being widely used in the production of vehicles to improve the performance of vehicles, decrease fuel consumption, and exhaust pollution. It can withstand temperatures of over 1000°C, which encourages the development of new applications for automobiles. For instance, alumina ceramics is a crucial material to minimize the fuel consumption of the diesel engine by over 30%. Alumina ceramic substrate provides the benefits of abrasion resistance, heat resistance, corrosion resistance, and potential fine optical and electromagnetic functions. Owing to the use of extremely sensitive alumina ceramic components, the shock absorber can function in terms of identifying road surface and self-control and can reduce the vibration that occurred due to the rough road surface. Therefore, it may have potential applications in autonomous vehicles and electric vehicles.

Global Automotive Ceramics Market Share by Material, 2019 (%)

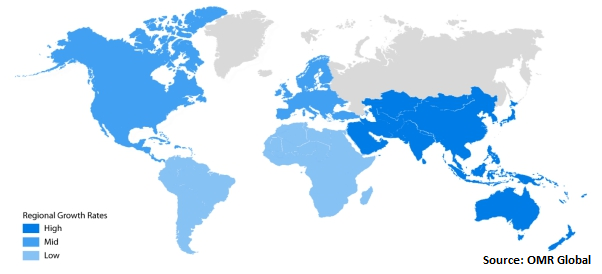

Regional Outlook

The global automotive ceramics market is classified based on geography, including North America, Europe, Asia-Pacific, and the Rest of the World. Asia-Pacific is estimated to witness potential growth during the forecast period owing to the potential manufacturing base of technical ceramics and the expansion of global automobile manufacturers in the region. China is the major producer of ceramics across the globe. Therefore, it is expected that the country exports a potential amount of ceramics to other countries. In addition, cost-effectiveness is the major factor contributing to the rising demand for the country’s ceramic materials. BMW Group, Fiat-Chrysler, and other major automobile giants are expanding their business in the region, owing to the low cost of labor and availability of raw material. This, in turn, is further driving the demand for automotive ceramics in the region.

Global Automotive Ceramics Market Growth, by Region 2020-2026

Market Players Outlook

The major players in the global automotive ceramics market include Kyocera Corp., CeramTec GmbH, CoorsTek, Inc., Morgan Advanced Materials plc, and NGK Spark Plug Co., Ltd. The market players are adopting some key strategies, including partnerships and collaboration, geographical expansion, and product launches, to expand their market share. For instance, in November 2019, 3M Co. introduced the new Automotive Window Film Ceramic IR Series. Nano-ceramic technology was used to develop this series that offers an extreme level of infrared heat rejection and restrict interference with electronics. It is designed to offer style and comfort with an attractive neutral color. Apart from comfort and visibility benefits, the series blocks up to 99.9% of ultraviolet (UV) light and offers a total sun protection factor (SPF) up to 1000+. The Ceramic IR Series is developed with a metal-free design to eliminate the risk of interference with electronics, including satellite radio, GPS, or mobile devices, including 5G.

The Report Covers

- Market value data analysis of 2019 and forecast to 2026.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive ceramics market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusions

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Kyocera Corp.

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. CeramTec GmbH

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. CoorsTek, Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Morgan Advanced Materials plc

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. NGK Spark Plug Co., Ltd.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1 Motivators

4.2 Restraints

4.3 Opportunities

5. Market Segmentation

5.1. Global Automotive Ceramics Market by Material

5.1.1. Alumina Oxide Ceramics

5.1.2. Zirconia Oxide Ceramics

5.1.3. Others

5.2. Global Automotive Ceramics Market by Application

5.2.1. Automotive Engine Parts

5.2.2. Automotive Electronics

5.2.3. Automotive Exhaust Systems

5.2.4. Others

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. 3M Co.

7.2. Applied Ceramics, Inc.

7.3. Blasch Precision Ceramics, Inc.

7.4. Ceramdis GmbH

7.5. CeramTec GmbH

7.6. Compagnie de Saint-Gobain S.A.

7.7. CoorsTek, Inc.

7.8. Corning, Inc.

7.9. Dyson Technical Ceramics, Ltd.

7.10. Elan Technology, Inc. (ET)

7.11. Ibiden Co., Ltd.

7.12. INMATEC Technologies GmbH

7.13. International Syalons (Newcastle), Ltd.

7.14. Kyocera Corp.

7.15. McDanel Advanced Ceramic Technologies, LLC

7.16. Morgan Advanced Materials plc

7.17. Murugappa Morgan Thermal Ceramics, Ltd.

7.18. NGK Spark Plug Co., Ltd.

7.19. Ortech, Inc.

7.20. Rauschert GmbH

7.21. Vinayak Techno Ceramics

1. GLOBAL AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

2. GLOBAL ALUMINA OXIDE CERAMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

3. GLOBAL ZIRCONIA OXIDE CERAMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

4. GLOBAL OTHER AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

5. GLOBAL AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

6. GLOBAL AUTOMOTIVE CERAMICS IN ENGINE PARTS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

7. GLOBAL AUTOMOTIVE CERAMICS IN ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

8. GLOBAL AUTOMOTIVE CERAMICS IN EXHAUST SYSTEMS MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

9. GLOBAL AUTOMOTIVE CERAMICS IN OTHER APPLICATION MARKET RESEARCH AND ANALYSIS BY REGION, 2019-2026 ($ MILLION)

10. GLOBAL AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2019-2026 ($ MILLION)

11. NORTH AMERICAN AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

12. NORTH AMERICAN AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

14. EUROPEAN AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

15. EUROPEAN AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

16. EUROPEAN AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

17. ASIA-PACIFIC AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2019-2026 ($ MILLION)

18. ASIA-PACIFIC AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

19. ASIA-PACIFIC AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

20. REST OF THE WORLD AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY MATERIAL, 2019-2026 ($ MILLION)

21. REST OF THE WORLD AUTOMOTIVE CERAMICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2019-2026 ($ MILLION)

1. GLOBAL AUTOMOTIVE CERAMICS MARKET SHARE BY MATERIAL, 2019 VS 2026 (%)

2. GLOBAL AUTOMOTIVE CERAMICS MARKET SHARE BY APPLICATION, 2019 VS 2026 (%)

3. GLOBAL AUTOMOTIVE CERAMICS MARKET SHARE BY GEOGRAPHY, 2019 VS 2026 (%)

4. US AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

5. CANADA AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

6. UK AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

7. FRANCE AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

8. GERMANY AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

9. ITALY AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

10. SPAIN AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

11. ROE AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

12. INDIA AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

13. CHINA AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

14. JAPAN AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

15. REST OF ASIA-PACIFIC AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)

16. REST OF THE WORLD AUTOMOTIVE CERAMICS MARKET SIZE, 2019-2026 ($ MILLION)