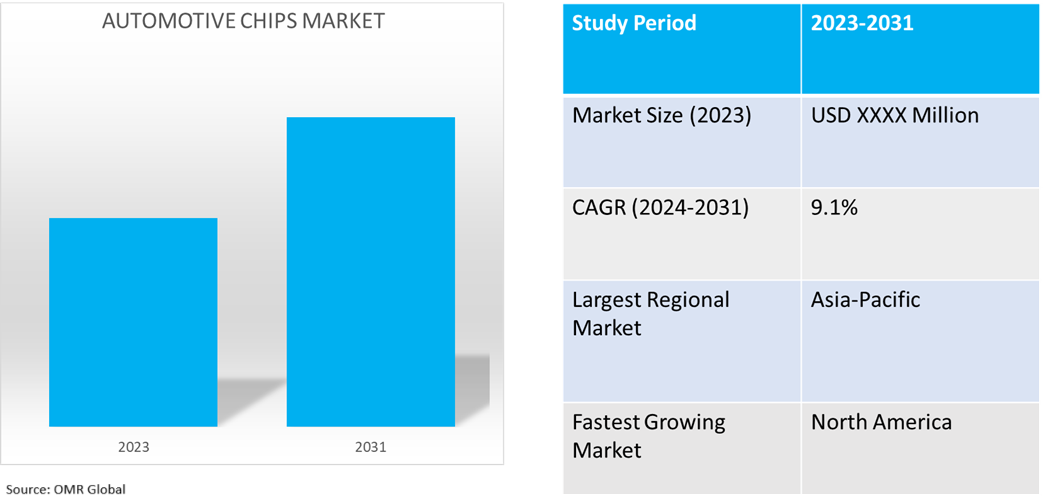

Automotive Chips Market

Automotive Chips Market Size, Share & Trends Analysis Report by Product Type (Logic ICs, Analog ICs, and Microcontrollers & Microprocessors), By Application (Chassis, Powertrain, Safety Telematics & Infotainment, and Body Electronics), and by Vehicle Type (Passenger Vehicles, and Commercial Vehicles) Forecast Period (2024-2031)

Automotive chips market is anticipated to grow at a significant CAGR of 9.1% during the forecast period (2024-2031). The adoption of electric vehicles (EVs) globally is developing a huge demand for power management and charging system chips. Government incentives and battery management systems play an essential role in EV battery management. High demand is additionally seen for advanced driver-assistance systems (ADAS) owing to the safety features. The increasing use of ADAS technologies such as adaptive cruise control, automatic emergency braking, and lane-keeping assist necessitates the use of high-performance chips for sensor data processing and decision-making. The automotive system-on-chip design is necessary for real-time processing and decision-making in autonomous vehicles. IoT and connected cars require connectivity and infotainment-related chips.

Market Dynamics

Increased Connectivity and IoT Integration

The use of the latest automotive chips for Vehicle-to-everything (V2X) communication and infotainment systems further enhance the connectivity of the vehicles and the user experience, which in turn promotes market growth as manufacturers such as Bosch adopt intelligent platforms that enable real-time data exchange, ADAS, and seamless in-car entertainment. For instance, in January 2024, Bosch introduced a new vehicle computer platform at CES, uniting driver assistance and infotainment functions. A system on a chip, it has integrated a powerful processor that can indeed support intelligent parking, detection of lanes, intelligent navigation, and voice assistants.

Rising Adoption of Autonomous and Semi-Autonomous Vehicles

The increasing adoption of autonomous and semi-autonomous vehicles necessitates high-performance processors to support extensive features such as sensor fusion, AI-driven safety, and autonomous navigation. For instance, in January 2024, MD indicated automotive innovation at CES 2024 through the introduction of two new devices: the Versal AI Edge XA adaptive SoC and the Ryzen Embedded V2000A Series processor. The former is for infotainment, and the latter is for driver safety and autonomous driving. Versal AI Edge XA adaptive SoCs is the first AMD 7nm device to be auto-qualified and will provide security and hardened IP for automotive applications. The Ryzen Embedded V2000A Series powers the next generation of automotive digital cockpits.

Market Segmentation

- Based on the product type, the market is segmented into logic ICs and analog ICs, and microcontrollers & microprocessors.

- Based on application, the market is segmented into chassis, powertrain, safety, telematics & infotainment, and body electronics.

- Based on the vehicle type, the market is segmented into passenger vehicles and commercial vehicles.

Microcontrollers & Microprocessors Segment is Projected to Hold the Largest Market Share

The increasing necessity for connected vehicles with advanced infotainment systems, along with seamless integration with smartphones and cloud services, and growing IoT, is driving the advancement of automotive chips market growth. For instance, in May 2024, Mindgrove Technologies, a semiconductor startup supported by Peak XV Partners, introduced commercial high-performance SoC (system on chip) dubbed Secure IoT. The RISC-V-based chip is aimed at Indian Original Equipment Manufacturers (OEMs) who are looking for feature-rich yet affordable solutions for Internet of Things devices. Secure IoT offers advanced capabilities without reducing performance, and it is 30% less expensive than rivals. Secure IoT is a flexible microcontroller that may be used with a wide range of connected devices, including wearables, smart city infrastructure, and EV management systems. It is designed to run at 700 MHz. Furthermore, in May 2024, Infineon Technologies launched the PSoC 4 HVPA-144K, a high-precision analog and high-voltage subsystem specifically designed for automotive battery management. The ISO26262-compliant system offers an entirely integrated embedded system for monitoring and collecting automotive 12 V lead-acid batteries, which are essential for most vehicle electrical systems.

Passenger Vehicles Segment to Hold a Considerable Market Share

Advanced electronic systems for vehicle safety and infotainment are required. Automotive chips are therefore necessary for safety, connectivity, infotainment, and performance. It further plays an essential role in the advanced driver assistance system and infotainment system and is part of the electric vehicle components such as motor and power electronics. The demand for high-performance automotive chips, especially in passenger cars, is rising as electric vehicles (EVs) and connected cars gain popularity, propelling the market's growth. Another application of automotive chips is that are being used in engine control units, powertrain systems, lighting systems, V2X communication, climate control systems, and many more. Vehicles are indeed becoming smart, safe, and economical by using electronic features.

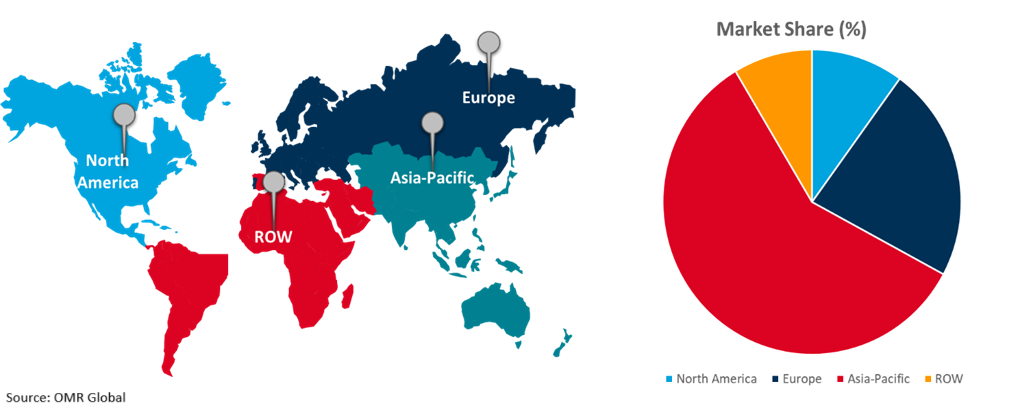

Regional Outlook

The global automotive chips market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Autonomous Vehicle Growth and Government Investments and Incentives in the North America Region

Government investments and incentives, such as the CHIPS Act, are stimulating growth in semiconductor production, especially in automotive chips, thus driving market growth. For instance, in November 2024, the Biden-Harris Administration negotiated with the US Department of Commerce and the Semiconductor Research Corporation Manufacturing Consortium Corporation to provide $285 million to establish a Manufacturing USA institute in Durham, North Carolina. The new institute named SMART US, focused on building, validating, and exploiting digital twins that improve domestic semiconductor design, manufacture, package name, assembly, and testing processes. The investment enabled the start of the first-in-nation CHIPS Manufacturing USA Institute, which expanded into a network of seventeen institutes toward increasing US manufacturing competitiveness while promoting a strong R&D infrastructure.

Furthermore, the market for automotive chips is expanding as a result of several autonomous vehicle developers entering the US market. High-performance chips that can interpret real-time data from cameras, LIDAR, radar, and other sensors are essential to autonomous driving systems. For instance, in October 2024, Wayve launched operations in the US with the opening of a new office in Silicon Valley and the start of a driver assistance testing program in San Francisco and the Bay Area. This is Wayve's first time testing on the road outside of the UK. To increase the safety and convenience of driving in cities and on highways, the US testing will concentrate on ADAS, which will provide drivers with improved functionality.

Global Automotive Chips Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

This exponential growth of the Indian electric vehicle market has been fueling a growing demand for automotive semiconductors as chips are required to manage the essential components of an EV such as BMS, inverters, motor controllers, and onboard chargers, playing an essential role in enabling India's transition toward sustainable mobility. According to the India Brand Equity Foundation (IBEF), India 2030 will focus on achieving a level of at least 80 million vehicles on the road by August 2024; the targets for electric vehicles include up to 30% in private cars, 70% in commercial vehicles, 40% in buses, and up to 80% for both two-wheeler and three-wheeler vehicles. The Indian EV market has grown by 49.25% in 2023, which is at 1.52 million units, and is expected to grow from $3.21 billion in 2022 to US$ 113.99 billion by 2029.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the automotive chips market include Intel Corp., NVIDIA Corp., NXP Semiconductors N.V., Infineon Technologies AG, and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers and acquisitions to stay competitive in the market.

Recent Developments

- In November 2024, Tessolve acquired German semiconductor design company Dream Chip Technologies for $45.8 Million. It will help Tessolve to improve its global presence and capability in System on Chip design.

- In May 2023, Qualcomm acquired Israel-based auto-chip maker Autotalks, designer of V2X communications technology for manned and driverless vehicles towards improving road safety and the automotive industry.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive chips market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Industry Trends

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Intel Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. NVIDIA Corp.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. NXP Semiconductors N.V.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Infineon Technologies AG

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Chips Market by Product Type

4.1.1. Logic ICs

4.1.2. Analog ICs

4.1.3. Microcontrollers & Microprocessors

4.2. Global Automotive Chips Market by Application

4.2.1. Chassis

4.2.2. Powertrain

4.2.3. Safety

4.2.4. Telematics & Infotainment

4.2.5. Body Electronics

4.3. Global Automotive Chips Market by Vehicle Type

4.3.1. Passenger Vehicles

4.3.2. Commercial Vehicles

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Advanced Micro Devices, Inc.

6.2. Arm Ltd.

6.3. Broadcom Inc

6.4. MediaTek Inc.

6.5. Micron Technology, Inc.

6.6. Mitsubishi Electric Corp.

6.7. Qualcomm Technologies, Inc.

6.8. Renesas Electronics Corp.

6.9. Robert Bosch GmbH

6.10. ROHM Co., Ltd

6.11. Sanken Electric Co., Ltd.

6.12. Semiconductor Components Industries, LLC

6.13. STMicroelectronics

6.14. Texas Instruments Inc.

6.15. Toshiba Electronic Devices & Storage Corp.

6.16. Vishay Intertechnology, Inc.

1. Global Automotive Chips Market Research And Analysis By Product Type, 2023-2031 ($ Million)

2. Global Logic ICs Automotive Chips Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Analog ICs Automotive Chips Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Microcontrollers & Microprocessors Automotive Chips Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Automotive Chips Market Research And Analysis By Application, 2023-2031 ($ Million)

6. Global Automotive Chips For Chassis Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Automotive Chips For Powertrain Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Automotive Chips For Safety Market Research And Analysis By Region, 2023-2031 ($ Million)

9. Global Automotive Chips for Telematics & Infotainment Market Research And Analysis By Region, 2023-2031 ($ Million)

10. Global Automotive Chips for Body Electronics Market Research And Analysis By Region, 2023-2031 ($ Million)

11. Global Automotive Chips Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

12. Global Passenger Vehicles Automotive Chips Market Research And Analysis By Region, 2023-2031 ($ Million)

13. Global Commercial Vehicles Automotive Chips Market Research And Analysis By Region, 2023-2031 ($ Million)

14. Global Automotive Chips Market Research And Analysis By Region, 2023-2031 ($ Million)

15. North American Automotive Chips Market Research And Analysis By Country, 2023-2031 ($ Million)

16. North American Automotive Chips Market Research And Analysis By Product Type, 2023-2031 ($ Million)

17. North American Automotive Chips Market Research And Analysis By Application, 2023-2031 ($ Million)

18. North American Automotive Chips Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

19. European Automotive Chips Market Research And Analysis By Country, 2023-2031 ($ Million)

20. European Automotive Chips Market Research And Analysis By Product Type, 2023-2031 ($ Million)

21. European Automotive Chips Market Research And Analysis By Application, 2023-2031 ($ Million)

22. European Automotive Chips Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

23. Asia-Pacific Automotive Chips Market Research And Analysis By Country, 2023-2031 ($ Million)

24. Asia-Pacific Automotive Chips Market Research And Analysis By Product Type, 2023-2031 ($ Million)

25. Asia-Pacific Automotive Chips Market Research And Analysis By Application, 2023-2031 ($ Million)

26. Asia-Pacific Automotive Chips Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

27. Rest Of The World Automotive Chips Market Research And Analysis By Region, 2023-2031 ($ Million)

28. Rest Of The World Automotive Chips Market Research And Analysis By Product Type, 2023-2031 ($ Million)

29. Rest Of The World Automotive Chips Market Research And Analysis By Application, 2023-2031 ($ Million)

30. Rest Of The World Automotive Chips Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

1. Global Automotive Chips Market Share By Product Type, 2023 Vs 2031 (%)

2. Global Logic ICs Automotive Chips Market Share By Region, 2023 Vs 2031 (%)

3. Global Analog ICs Automotive Chips Market Share By Region, 2023 Vs 2031 (%)

4. Global Microcontrollers & Microprocessors Automotive Chips Market Share By Region, 2023 Vs 2031 (%)

5. Global Automotive Chips Market Share By Application, 2023 Vs 2031 (%)

6. Global Automotive Chips For Chassis Market Share By Region, 2023 Vs 2031 (%)

7. Global Automotive Chips For Powertrain Market Share By Region, 2023 Vs 2031 (%)

8. Global Automotive Chips For Safety Market Share By Region, 2023 Vs 2031 (%)

9. Global Automotive Chips For Telematics & Infotainment Market Share By Region, 2023 Vs 2031 (%)

10. Global Automotive Chips For Body Electronics Market Share By Region, 2023 Vs 2031 (%)

11. Global Automotive Chips Market Share By Vehicle Type, 2023 Vs 2031 (%)

12. Global Passenger Vehicles Automotive Chips Market Share By Region, 2023 Vs 2031 (%)

13. Global Commercial Vehicles Automotive Chips Market Share By Region, 2023 Vs 2031 (%)

14. Global Automotive Chips Market Share By Region, 2023 Vs 2031 (%)

15. US Automotive Chips Market Size, 2023-2031 ($ Million)

16. Canada Automotive Chips Market Size, 2023-2031 ($ Million)

17. UK Automotive Chips Market Size, 2023-2031 ($ Million)

18. France Automotive Chips Market Size, 2023-2031 ($ Million)

19. Germany Automotive Chips Market Size, 2023-2031 ($ Million)

20. Italy Automotive Chips Market Size, 2023-2031 ($ Million)

21. Spain Automotive Chips Market Size, 2023-2031 ($ Million)

22. Rest Of Europe Automotive Chips Market Size, 2023-2031 ($ Million)

23. India Automotive Chips Market Size, 2023-2031 ($ Million)

24. China Automotive Chips Market Size, 2023-2031 ($ Million)

25. Japan Automotive Chips Market Size, 2023-2031 ($ Million)

26. South Korea Automotive Chips Market Size, 2023-2031 ($ Million)

27. Rest Of Asia-Pacific Automotive Chips Market Size, 2023-2031 ($ Million)

28. Latin America Automotive Chips Market Size, 2023-2031 ($ Million)

29. Middle East And Africa Automotive Chips Market Size, 2023-2031 ($ Million)