Automotive Collision Repair Market

Automotive Collision Repair Market Size, Share & Trends Analysis Report by Product (Paints & coatings, Consumables, and Spare parts), by Vehicle Type (Light-duty vehicle and Heavy-duty vehicle), and by Service (DIY, DIFM, and OE) Forecast Period (2024-2031)

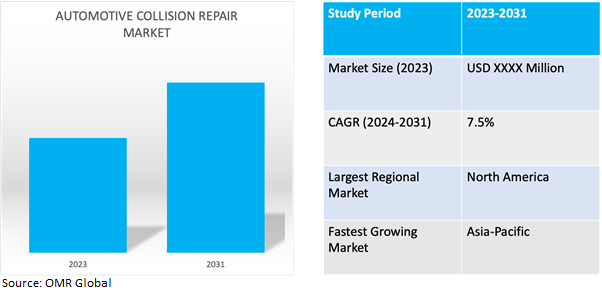

Automotive collision repair market is anticipated to grow at a CAGR of 7.5% during the forecast period (2024-2031). Automotive collision repair refers to the process of restoring vehicles to their pre-accident condition after they have sustained damage from collisions, accidents, or other incidents. This includes repairing structural damage, replacing damaged components, and refinishing the vehicle's exterior to match its original appearance. Collision repair technicians use specialized tools and equipment to assess the extent of the damage and perform necessary repairs, ensuring the vehicle is safe to drive and meets industry standards for quality and integrity.

Market Dynamics

Navigating Technological Advancements and Strategic Ventures in the Collision Repair Industry

Rapid advancements in automotive technology have revolutionized the collision repair industry. Modern vehicles are equipped with sophisticated safety features and complex electronic systems, making repairs more intricate and specialized. Collision repair technicians must stay abreast of the latest technologies and undergo continuous training to effectively diagnose and repair these advanced systems. Furthermore, emerging technologies like 3D printing and augmented reality are gradually being integrated into repair processes, offering innovative solutions for repairing damaged components and streamlining workflow efficiency. As vehicles continue to evolve technologically, the collision repair industry must adapt and invest in cutting-edge tools and techniques to meet the demands of modern vehicle repair. For instance, in July 2023, Palladium Equity Partners initiated the establishment of the Collision Auto Parts platform through the acquisition of NAP San Diego, National Auto Parts, USA, and National Auto Parts-Oakland. This strategic move aims to leverage non-organic growth strategies to bolster the market presence and product portfolios of these entities. The overarching objective is to solidify the company's position as a leading distributor of value-added collision repair parts.

Navigating the Impact of Global Vehicle Ownership on the Automotive Collision Repair Market

The surge in vehicle ownership globally has significantly impacted the automotive collision repair market. With more vehicles on the road, the frequency of accidents and collisions naturally rises, driving the demand for repair services. This trend is particularly pronounced in emerging economies experiencing rapid urbanization and rising disposable incomes, leading to greater affordability and accessibility of vehicle ownership. As a result, collision repair shops are faced with a growing volume of repair requests, necessitating efficient workflow management and skilled labor to meet the demand. The steady increase in vehicle ownership underscores the resilience and enduring need for automotive collision repair services in the global market.

Market Segmentation

Our in-depth analysis of the global Automotive Collision Repair market includes the following segments by product, vehicle type, and service:

- Based on product, the market is sub-segmented into paints & coatings, consumables, and spare parts.

- Based on vehicle type, the market is sub-segmented into light-duty vehicles and heavy-duty vehicles.

- Based on service, the market is sub-segmented into DIY, DIFM, and OE.

Paints & Coatings is Projected to Emerge as the Largest Segment

Based on the product, the global automotive collision repair market is sub-segmented into paints & coatings, consumables, and spare parts. Among these, the paints & coatings sub-segment is expected to hold the largest share of the market. The primary factor supporting the segment's growth includes the demand for high-quality finishes and aesthetic appeal in vehicle repairs. As vehicles become more sophisticated and technologically advanced, consumers expect flawless repairs that seamlessly restore the appearance of their vehicles. Paints & coatings play a crucial role in achieving this by providing durable finishes that match the original paint color and texture of the vehicle. For instance, In March 2022, Akzo Nobel N.V., a prominent entity in the coating and paints industry, unveiled an innovative iteration of clearcoats designed to offer heightened scratch resistance. This advancement is geared towards enhancing the durability and protective capabilities of coatings utilized in automotive refinish applications.

Regional Outlook

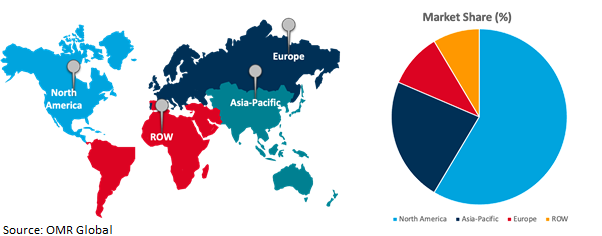

The global automotive collision repair market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Global Automotive Collision Repair Market Growth by Region 2024-2031

North America Holds Major Market Share

Among all the regions, North America holds a significant share due to the high concentration of vehicles per capita and higher frequency of accidents and collisions, driving demand for collision repair services. The presence of established collision repair chains and networks further contributes to market dominance, providing consumers with easy access to professional repair services. For instance, In April 2022, 3M revealed its acquisition of the technology assets belonging to LeanTec, a provider of digital inventory management solutions tailored for the automotive aftermarket sector in the United States and Canada. This strategic move underscores 3M's dedication to advancing its "connected bodyshop” platform. LeanTec’s technology is set to complement ‘3M RepairStack Performance Solutions’, a comprehensive hardware and software system designed to ensure the availability of on-hand materials for dependable and secure repairs.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global automotive collision repair market include 3M, Aisin Corp., Robert Bosch GmbH, ZF Friedrichshafen AG, Denso Corp., and others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, In March 2023, DENSO Products and Services Americas, Inc. unveiled an extension of its aftermarket ignition coils portfolio, introducing nine new part numbers. This expansion encompasses a broad spectrum, catering to over 9 million vehicles currently in operation. With this strategic move, DENSO aims to enrich its selection of premium replacement ignition coils, catering to a diverse array of Buick, BMW, Cadillac, GMC, Infiniti, Lincoln, Ford, Nissan, Chevrolet, and Volvo models.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive collision repair market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. 3M Co.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. ZF Friedrichshafen AG.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Robert Bosch GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Collision Repair Market by Product

4.1.1. Paints & coatings

4.1.2. Consumables

4.1.3. Spare parts

4.2. Global Automotive Collision Repair Market by Vehicle Type

4.2.1. Light-duty vehicle

4.2.2. Heavy-duty vehicle

4.3. Global Automotive Collision Repair Market by Service

4.3.1. DIY (Do It Yourself)

4.3.2. DIFM (Do It For Me)

4.3.3. OE (Original Equipment)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Aisin Corp

6.2. Akzo Nobel N.V.

6.3. Axalta Coating System, LLC

6.4. BASF SE

6.5. Denso Corp.

6.6. DuPont de Nemours, Inc.

6.7. Futaba Industrial CO. Ltd.

6.8. Honeywell International, Inc.

6.9. International Automotive Components Group

6.10. Kansai Paint Co., Ltd.

6.11. Magna International Inc

6.12. Mann+Hummel Group

6.13. Marelli Holdings COCo. Ltd.

6.14. Martinea International Inc.

6.15. Mitsuba Corp.

6.16. Nippon Paint Holdings Co., Ltd.

6.17. PPG Industries, Inc.

6.18. Robert Bosch GmbH

6.19. Valeo SA

1. GLOBAL AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

2. GLOBAL PAINTS & COATINGS FOR AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CONSUMABLES FOR AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL SPARE PARTS FOR AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

6. GLOBAL AUTOMOTIVE COLLISION REPAIR FOR LIGHT-DUTY VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AUTOMOTIVE COLLISION REPAIR FOR HEAVY-DUTY VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

9. GLOBAL DIY AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL DIFM AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL OE AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

14. NORTH AMERICAN AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

15. NORTH AMERICAN AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

16. NORTH AMERICAN AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

17. EUROPEAN AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. EUROPEAN AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

19. EUROPEAN AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

20. EUROPEAN AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

21. ASIA-PACIFIC AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. ASIA-PACIFIC AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

25. REST OF THE WORLD AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

26. REST OF THE WORLD AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY PRODUCT, 2023-2031 ($ MILLION)

27. REST OF THE WORLD AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD AUTOMOTIVE COLLISION REPAIR MARKET RESEARCH AND ANALYSIS BY SERVICE, 2023-2031 ($ MILLION)

1. GLOBAL AUTOMOTIVE COLLISION REPAIR MARKET SHARE BY PRODUCT, 2023 VS 2031 (%)

2. GLOBAL PAINTS & COATINGS FOR AUTOMOTIVE COLLISION REPAIR MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CONSUMABLES FOR AUTOMOTIVE COLLISION REPAIR MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL SPARE PARTS FOR AUTOMOTIVE COLLISION REPAIR MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL AUTOMOTIVE COLLISION REPAIR MARKET SHARE BY VEHICLE TYPE, 2023 VS 2031 (%)

6. GLOBAL AUTOMOTIVE COLLISION REPAIR FOR LIGHT-DUTY VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AUTOMOTIVE COLLISION REPAIR FOR HEAVY-DUTY VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AUTOMOTIVE COLLISION REPAIR MARKET SHARE BY SERVICE, 2023 VS 2031 (%)

9. GLOBAL DIY AUTOMOTIVE COLLISION REPAIR MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL DIFM AUTOMOTIVE COLLISION REPAIR MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL OE AUTOMOTIVE COLLISION REPAIR MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL AUTOMOTIVE COLLISION REPAIR MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. US AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

14. CANADA AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

15. UK AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

16. FRANCE AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

17. GERMANY AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

18. ITALY AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

19. SPAIN AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

20. REST OF EUROPE AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

21. INDIA AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

22. CHINA AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

23. JAPAN AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

24. SOUTH KOREA AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

25. REST OF ASIA-PACIFIC AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

26. LATIN AMERICA AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)

27. MIDDLE EAST AND AFRICA AUTOMOTIVE COLLISION REPAIR MARKET SIZE, 2023-2031 ($ MILLION)