Automotive Contract Manufacturing Market

Global Automotive Contract Manufacturing Market Size, Share & Trends Analysis Report By Services (Design & Development, Vehicle Assembly, Automotive Electronics, and Component Manufacturing) By Vehicle Type (Two Wheelers, Passenger Cars, Commercial Vehicle, and Construction and Agricultural Vehicle) Forecast 2021-2027 Update Available - Forecast 2025-2035

The global market for automotive contract manufacturing is projected to have a considerable CAGR of around 7.2% during the forecast period. In the automotive sector, contract manufacturing is highly prevalent owing to the ease of manufacturing the final product and increased productivity. The major factors that are augmenting the growth of the market include an increase in automotive sales across the globe, increasing the number of components per vehicle, and the availability of a skilled workforce and technology at a lower cost in emerging economies. For instance, in 2019, in India, around 3.81 million units combined sold in the passenger and commercial vehicles categories. The two-wheelers segment dominates the market in terms of volume owing to a growing middle class and a young population. Additionally, countries such as India, China, Brazil, Mexico are providing a significant infrastructure and cheaper workforce to OEMs for contract manufacturing which is motivating the shifting of component production from their production unit to a contractor.

However, outsourcing risks that arise due to integrating issues between OEMs and contract manufacturers, and the risk of non-compliance with regulations are some of the constraints that challenge the growth of the market. Moreover, the technological advancements in hybrid vehicles, electric vehicles, and self-driving vehicles are estimated to offer lucrative opportunities the US was estimated as the world’s third-largest market in producing electric cars accounting for 326,000. In addition to this, According to NITI Aayog, In India, 70% of all commercial cars, 30% of private cars, 40% of busses, and 80% of two and three-wheeler vehicles are estimated to be electric by 2030.

Impact of COVID-19 on the Global Automotive Contract Manufacturing Market

The global automotive contract manufacturing market is hardly hit by the COVID-19 pandemic since December 2019. The COVID-19 pandemic in the major economies has disrupted the manufacturing and supply of automotive manufacturing across the globe, which resulted in a decrease in market share. This was mainly due to the lockdowns imposed by the governments of several countries due to which many industries were not being operated. Moreover, lack of workforce availability, logistics also hindered the growth of the market. According to the International Organization of Motor Vehicle Manufacturers, in 2020, due to COVID-19, the global automotive production was declined by 16%, which already saw a decline of 5% in world auto production (down to less than 92.2 million cars, trucks, and buses) in 2019.

Segmental Outlook

The global automotive contract manufacturing market is segmented based on service, and vehicle type. On the basis of service, the market is further segmented into design and development, vehicle assembly, automotive electronics, and component manufacturing. Among these, the automotive electronics segment is expected to be the fastest-growing during the forecast period. Automotive Electronics includes everything right from the headlight and LED brake light to the seat control inside the car. The demand for automotive electronics owing to the increasing integration and implementation of advanced safety systems in cars and other automotive vehicles will be expected to drive the market growth. Besides, the increasing adoption of electric vehicles is also expected to propel the demands for automotive electronics during the forecast period. Further, based on the vehicle type, the market is segmented into two-wheelers, passenger cars, commercial vehicles, construction, and agricultural vehicle.

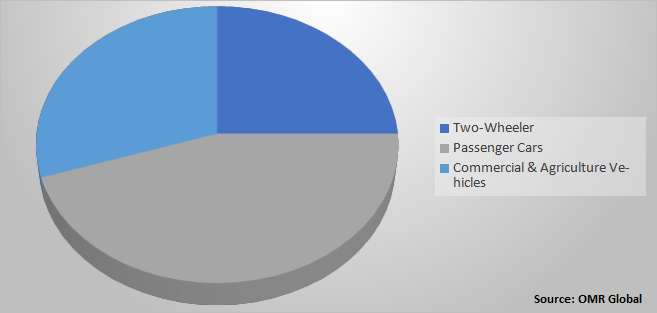

Global Automotive Contract Manufacturing Market Share by Vehicle Type, 2020 (%)

The passenger car segment is projected to hold the largest share in the global automotive contract manufacturing market

Based on vehicle type, the passenger car segment dominated the market by accounting largest market share in 2020, and it is projected to grow at significant CAGR during the forecast period. The increase in automotive sales every year is the major factor driving the growth of the market. According to the IEA estimates, in 2019, in the US there were 17 million cars have been sold. Many contract manufacturers are now adopting contract manufacturing services by collaborating with these companies intending to increase their productivity and sales globally. Further contract manufacturing also supports car manufacturers to enter into new markets or regions.

Regional Outlook

Geographically, the global automotive contract manufacturing market is classified into four major regions including North America (the US and Canada), Europe (UK, Germany, France, Italy, Spain, Russia, and Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and Rest of the World (Latin America and the Middle East and Africa (MEA)). Among these, North America is expected to show considerable growth during the forecast period. In North America, the US is estimated to be the significant market in global automotive contract manufacturing in terms of revenue. The presence of the majority of automotive contract manufacturers, availability of skilled workforce, and high majority sales of the vehicles in the country are some of the factors that fuel the growth of the market in the US. Canada is estimated to be one of the fastest-growing countries owing to its high population base adopting for automotive vehicles.

Global Automotive Contract Manufacturing Market Growth, by Region 2021-2027

Asia-Pacific Dominates the global Automotive Contract Manufacturing Market

Geographically, Asia-Pacific dominated the market in 2020, and it is projected to further maintain its dominance in the global Automotive Contract Manufacturing market during the forecast period. Factor augmenting the growth of the market is increasing automotive sales in the region. China, Japan, and India are the major automotive markets in the region. Emerging countries such as India and China are providing a significant infrastructure and cheaper workforce to OEMs for contract manufacturing. This motivates the shifting of component production from their production unit to a contractor in these economies. Additionally, an initiative by the government to increase production in their countries is also augmenting the market. As an instance, India is working toward “Make in India” whereas China is enforcing its “Make in China” initiative.

Market Players Outlook

The key players in the global Automotive Contract Manufacturing market contributing significantly by providing different types of services and increasing their geographical presence across the globe. The key players of the market are PDF, Inc., HYUNDAI TRANSYS, Lear Corp., Magna International Inc., Faurecia, NHK SPRING Co., Ltd, Valmet Automotive Inc., ZF Friedrichshafen AG, among others. These market players adopt different marketing strategies such as mergers & acquisitions, R&D, product launches, FDA approvals, and geographical expansions to generated more revenue and to remain competitive in the market. For instance, in May 2020, ZF Friedrichshafen AG had completed the acquisition of commercial vehicle technology supplier WABCO. With the acquisition of WABCO, ZF Friedrichshafen AG expanded its commercial vehicle service portfolio and on operating customer business.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Automotive Contract Manufacturing market. Based on the availability of data, information related to pipeline products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

• Impact of COVID-19 on the Global Automotive Contract Manufacturing Industry

• Recovery Scenario of Global Automotive Contract Manufacturing Industry

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.2. Key Strategy Analysis

3.3. Impact of COVID-19 on key players

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Automotive Contract Manufacturing Market, By Services

5.1.1. Design and Development

5.1.2. Vehicle Assembly

5.1.3. Automotive Electronics

5.1.4. Component Manufacturing

5.2. Global Automotive Contract Manufacturing Market, By Vehicle Type

5.2.1. Two Wheelers

5.2.2. Passenger Cars

5.2.3. Commercial Vehicle

5.2.4. Construction and Agricultural Vehicle

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Russia

6.2.7. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. South Korean

6.3.5. Rest of Asia-Pacific

6.4. Rest of the World

6.4.1. Latin America

6.4.2. Middle East& Africa

7. Company Profiles

7.1. Adient plc.

7.2. Advanced Auto Trends, Inc.

7.3. Automotive Spare Parts AG

7.4. AVTECH Ltd.

7.5. Boston Centerless

7.6. DNA Group, Inc.

7.7. ELO Engineering, Inc.

7.8. Faurecia SE

7.9. Flex Ltd.

7.10. GAZ International LLC

7.11. G&M Manufacturing Corp.

7.12. Grunewald GmbH & Co. KG

7.13. HM Manufacturing, Inc.

7.14. HPL Stampings Inc.

7.15. HYUNDAI TRANSYS

7.16. International Automotive Components (IAC) Group

7.17. Lear Corp.

7.18. Magna International Inc.

7.19. Manz AG

7.20. MES, Inc.

7.21. NHK SPRING Co., Ltd

7.22. PDF, Inc.

7.23. TeleTec Electronics Corp.

7.24. MiQ Partners

7.25. Turner Bellows, Inc.

7.26. TyTek Group

7.27. Valmet Automotive Inc.

7.28. VDL Nedcar BV

7.29. Videoton Group

7.30. Weichai Power Co. Ltd.

7.31. Yazaki Corp.

7.32. ZF Friedrichshafen AG

1. GLOBAL AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS, 2020-2027 ($ MILLION)

2. GLOBAL AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

3. GLOBAL DESIGN AND DEVELOPMENT IN AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

4. GLOBAL VEHICLE ASSEMBLY IN AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

5. GLOBAL AUTOMOTIVE ELECTRONICS CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

6. GLOBAL COMPONENT CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

7. GLOBAL AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

8. GLOBAL TWO WHEELER CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL PASSENGER CARS CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL COMMERCIAL VEHICLE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL CONSTRUCTION AND AGRICULTURAL VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2020-2027 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

14. NORTH AMERICAN AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES,2020-2027 ($ MILLION)

15. NORTH AMERICAN AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

16. EUROPEAN AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

17. EUROPEAN AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES,2020-2027 ($ MILLION)

18. EUROPEAN AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2020-2027 ($ MILLION)

19. ASIA-PACIFIC AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

20. ASIA-PACIFIC AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY SERVICES, 2020-2027 ($ MILLION)

21. ASIA-PACIFIC AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE,2020-2027 ($ MILLION)

22. REST OF THE WORLD AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2020-2027 ($ MILLION)

23. REST OF THE WORLD AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BYSERVICES, 2020-2027 ($ MILLION)

24. REST OF THE WORLD AUTOMOTIVE CONTRACT MANUFACTURING MARKET RESEARCH AND ANALYSIS BYVEHICLE TYPE,2020-2027 ($ MILLION)

1. IMPACT OF COVID-19 ON GLOBAL AUTOMOTIVE CONTRACT MANUFACTURING MARKET, 2020-2027 (% MILLION)

2. IMPACT OF COVID-19 ON GLOBAL AUTOMOTIVE CONTRACT MANUFACTURING MARKET BY SEGMENT, 2020-2027 (% MILLION)

3. RECOVERY OF GLOBAL AUTOMOTIVE CONTRACT MANUFACTURING MARKET, 2020-2027 (%)

4. GLOBAL AUTOMOTIVE CONTRACT MANUFACTURING MARKET SHARE BY SERVICES, 2020 VS 2027 (%)

5. GLOBAL AUTOMOTIVE CONTRACT MANUFACTURING MARKET SHARE BYVEHICLE TYPE, 2020 VS 2027 (%)

6. GLOBAL AUTOMOTIVE CONTRACT MANUFACTURING MARKET SHARE BY GEOGRAPHY, 2020 VS 2027 (%)

7. GLOBAL DESIGN AND DEVELOPMENT IN AUTOMOTIVE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

8. GLOBAL VEHICLE ASSEMBLY IN AUTOMOTIVE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

9. GLOBAL AUTOMOTIVE ELECTRONICS IN AUTOMOTIVE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

10. GLOBAL COMPONENT MANUFACTURING IN AUTOMOTIVE CONTRACT MANUFACTURING MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

11. GLOBAL TWO WHEELERS MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

12. GLOBAL PASSENGER CARS MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

13. GLOBAL COMMERCIAL VEHICLE MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

14. GLOBAL CONSTRUCTION AND AGRICULTURAL VEHICLE MARKET SHARE BY REGION, 2020-2027 ($ MILLION)

15. US AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

16. CANADA AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

17. UK AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

18. FRANCE AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

19. GERMANY AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

20. ITALY AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

21. SPAIN AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

22. REST OF EUROPE AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

23. INDIA AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

24. CHINA AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

25. JAPAN AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

26. SOUTH KOREA AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

27. REST OF ASIA-PACIFIC AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2020-2027 ($ MILLION)

28. REST OF THE WORLD AUTOMOTIVE CONTRACT MANUFACTURING MARKET SIZE, 2021-2027($ MILLION