Automotive Digital Mapping Market

Automotive Digital Mapping Market Size, Share & Trends Analysis Report, by Component (Solution & Services), and by Application (Autonomous Cars, Fleet Management, and Advance Driver Assistance Systems (ADAS)), Forecast Period (2023-2030) Update Available - Forecast 2025-2035

Automotive digital mapping market is anticipated to grow at a considerable CAGR of 12.5% during the forecast period. The growing adoption of autonomous vehicles or connected vehicles with intelligent devices and advanced features, like GPS, used mainly for digital mapping or navigation in the automotive industry is driving the growth of the global market. The European Transport Safety Council (ETSC) has advocated for a variety of connected and autonomous driving aids, such as 5G network-linked automobiles, driverless vehicles, and ride-hailing services, all of which may be accomplished with connected cars. The navigational maps and real-time traffic information have been invaluable resources for drivers. With the growing market V2V connectivity this information has became more valuable than ever.

In March 2020, Toyota researchers had developed a method to create highly detailed maps to guide self-driving cars using satellite imagery, potentially eliminating the need for special survey vehicles. The researchers at Toyota Research Institute-Advanced Development (TRI-AD), the unit tasked with developing self-driving technology at Toyota, created maps using data from cameras mounted to existing vehicles and from satellite imagery, which is expected to provide accuracy within 50 centimeters, meeting the level required for self-driving cars. Such developments are further contributing to the market growth.

Segmental Outlook

The global automotive digital mapping market is segmented based on component and application. Based on component, the market is segmented into solutions and services. Based on application, the market is segmented into autonomous cars, fleet management, and ADAS.

ADAS Held Considerable Share in Global Automotive digital mapping Market

ADAS is a rapidly emerging technology and is anticipated to find a significant growth in the automotive industry to increase safety, comfort, and tracking. Major factors augmenting the growth of the market segment include the high number of road accidents globally. Most of the road accidents involve human errors which can be reduced by the use of the ADAS system. Due to this, a number of government regulations are introduced in favor of ADAS. For instance, the individual New Car Assessment Program (NCAP) has been introduced by various countries such as Euro NCAP, Chinese C-NCAP, ASEAN NCAP other than Global NCAP. Earlier the technology was employed for high-end cars to provide better comfort. With the increasing focus on safety, the market potential for ADAS has been extended to mid-range cars as well. A major restraint to the market is the additional cost associated with the ADAS. Moreover, the trade war between major automotive export countries such as the US & China, and Japan and South Korea are also expected to increase the manufacturing cost of the component, which will increase the market value.

Regional Outlook

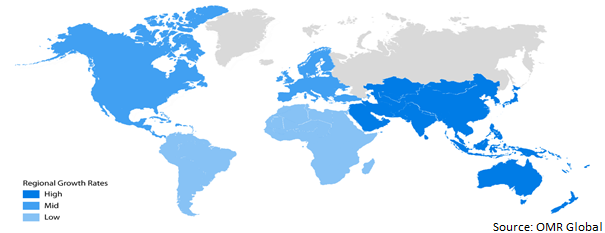

The global automotive digital mapping market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, North America held considerable share in the global market. High disposable income, cohesive government regulation, and awareness of the people towards road safety are some of the major factors augmenting the market in these regions.

Global Automotive Digital Mapping Market Growth, by Region 2023-2030

Asia-Pacific to Exhibit Fastest Growth in the Global Automotive Digital Mapping Market

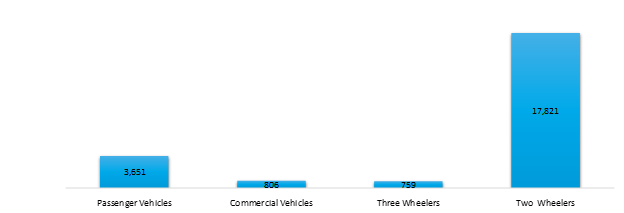

The growing focus of Asian car maker towards increasing the safety of passengers in automobiles has driven the growth of this market segment. According to the International Organization of Motor Vehicle Manufacturers, India is currently the fifth largest producer of passenger cars after China, Japan, the United States, Germany, and South Korea.

Indian Auto-Production 2021-2022, (in ’000)

Source: International Organization of Motor Vehicle Manufacturers (OICA)

Indian startups are focusing on development of fully autonomous cars. For instance, in June 2023, Minus Zero, an artificial intelligence (AI) startup, has unveiled India’s first autonomous vehicle based on a camera-sensor suite. The concept vehicle named zPod was designed and developed by the proprietary technological innovative concepts of Nature Inspired AI (NIA) and True Vision Autonomy. Such developments across the country are anticipated to create lucrative opportunities to the regional market growth.

Market Players Outlook

The major companies serving the global automotive digital mapping market including Apple Inc., MapQuest Inc., Google LLC, TomTom International BV, and HERE Technologies among others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in October 2023, Opus IVS introduced ADAS Map, a comprehensive software platform designed to identify ADAS systems, their components, precise component locations, necessary calibrations and the underlying reasons for these calibrations. This state-of-the-art technology automatically reviews CCC or Mitchell estimates and provides a detailed presentation of a specific vehicle's ADAS requirements. Seamlessly integrated with CCC, Mitchell, Opus IVS DriveSafe and the Opus IVS CoPilot platforms, ADAS Map streamlines the entire calibration process with unprecedented efficiency.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive digital mapping market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Apple Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Goggle LLC

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Here Technologies Inc.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. MapQuest Inc.

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. TomTom NV

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Digital Mapping Market by Component

4.1.1. Solution

4.1.2. Services

4.2. Global Automotive Digital Mapping Market by Application

4.2.1. Autonomous Cars

4.2.2. Fleet Management

4.2.3. Advance Driver Assistance Systems (ADAS)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ARC Aerial Imaging Inc.

6.2. CE Info Systems Ltd.

6.3. ESRI Inc.

6.4. INRIX Inc.

6.5. Maxar Technologies Inc.

6.6. Meta Platforms Inc.

6.7. Micello Inc.

6.8. MiTAC Holdings Corp.

6.9. Nearmap Ltd.

6.10. NVIDIA Corp.

6.11. ServiceNow Inc.

6.12. ThinkGeo LLC

1. GLOBAL AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

2. GLOBAL AUTOMOTIVE DIGITAL MAPPING SOLUTIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL AUTOMOTIVE DIGITAL MAPPING SERVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

5. GLOBAL AUTOMOTIVE DIGITAL MAPPING FOR AUTONOMOUS CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL AUTOMOTIVE DIGITAL MAPPING FOR FLEET MANAGEMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL AUTOMOTIVE DIGITAL MAPPING FOR ADAS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. GLOBAL AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

9. NORTH AMERICAN AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

10. NORTH AMERICAN AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

11. NORTH AMERICAN AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

12. EUROPEAN AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

13. EUROPEAN AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

14. EUROPEAN AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

15. ASIA-PACIFIC AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

17. ASIA-PACIFIC AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

18. REST OF THE WORLD AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

19. REST OF THE WORLD AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY COMPONENT, 2022-2030 ($ MILLION)

20. REST OF THE WORLD AUTOMOTIVE DIGITAL MAPPING MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

1. GLOBAL AUTOMOTIVE DIGITAL MAPPING MARKET SHARE BY COMPONENT, 2022 VS 2030 (%)

2. GLOBAL AUTOMOTIVE DIGITAL MAPPING SOLUTIONS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL AUTOMOTIVE DIGITAL MAPPING SERVICES MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL AUTOMOTIVE DIGITAL MAPPING MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

5. GLOBAL AUTOMOTIVE DIGITAL MAPPING FOR AUTONOMOUS CARS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL AUTOMOTIVE DIGITAL MAPPING FOR FLEET MANAGEMENT MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL AUTOMOTIVE DIGITAL MAPPING FOR ADAS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL AUTOMOTIVE DIGITAL MAPPING MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. US AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

10. CANADA AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

11. UK AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

12. FRANCE AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

13. GERMANY AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

14. ITALY AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

15. SPAIN AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

16. REST OF EUROPE AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

17. INDIA AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

18. CHINA AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

19. JAPAN AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

20. SOUTH KOREA AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF ASIA-PACIFIC AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)

22. REST OF THE WORLD AUTOMOTIVE DIGITAL MAPPING MARKET SIZE, 2022-2030 ($ MILLION)