Automotive E-axle Market

Automotive E-axle Market Size, Share & Trends Analysis Report by Vehicle Type (Passenger Cars and Commercial Vehicles), by Propulsion Type (Battery Electric Vehicles (BEV) and Hybrid Electric Vehicles (HEV)), by Application (Front E-Axle, Rear E-Axle, and All-wheel-drive E-Axle) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

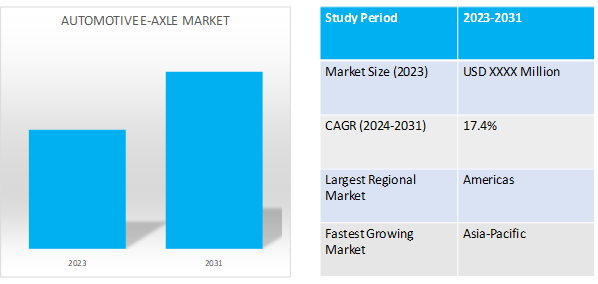

Automotive e-axle market is anticipated to grow at a significant CAGR of 17.4% during the forecast period (2024-2031). An automotive e-axle, or electric axle, is a consolidated propulsion system present in electric vehicles (EVs) that combines the electric motor, power electronics, and gearbox into a single unit.

Market Dynamics

Ongoing Electrification Trends to Drive Global Market

Growing demand for electric vehicles (EVs) is a primary driver, pushing the adoption of e-axle systems as a key component in electric propulsion. Electric car markets are seeing exponential growth as sales exceeded 10 million in 2022. A total of 14.0% of all new cars sold were electric in 2022, up from around 9.0% in 2021 and less than 5.0% in 2020. Three markets dominated global sales. China was the frontrunner once again, accounting for around 60.0% of global electric car sales. More than half of the electric cars on roads worldwide are now in China and the country has already exceeded its 2025 target for new energy vehicle sales.

Market Segmentation

Our in-depth analysis of the global automotive e-axle market includes the following segments by vehicle type, propulsion type, and application:

- Based on vehicle type, the market is sub-segmented into passenger cars and commercial vehicles.

- Based on propulsion type, the market is bifurcated into BEV and HEV.

- Based on application, the market is augmented into front e-axle, rear e-axle, and AWD e-axle.

AWD E-axle is Projected to Grow During the Forecast Period

Based on the application, the global automotive e-axle market is sub-segmented into front e-axle, rear e-axle, and AWD e-axle. Among these, the AWD e-axle sub-segment is expected to exhibit highest CAGR during the forecast period. The growing adoption of this e-axle owing to the improving traction, stability, and handling, especially in challenging road conditions is a key factor driving the growth of this mkt segment.

Passenger Cars Holds Major Market Share

By vehicle type, the passenger cars segment holds the majority market share during the forecast period.The increasing adoption of E-axle systems for passenger cars is driven by the demandfor the specific requirements of these vehicles, considering factors such as size, weight, and performance characteristics, which cater to the demand for individual or family transportation.The focus is on providing a substantial driving experience for individual consumers or families.Passenger cars have the highest production volume compared to other vehicle segments, resulting in a larger market size for e-axle systems in this sub-segment.According to the International Organization of Motor Vehicle Manufacturers (OICA), passenger car production increased from 55.9 million in 2020 to 61.6million in 2022.

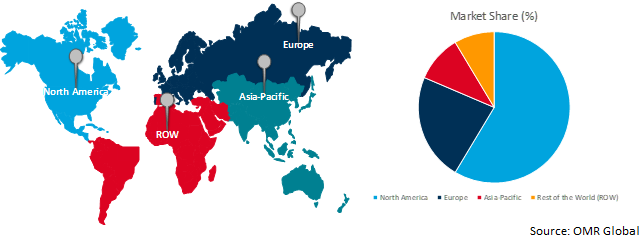

Regional Outlook

The global automotive e-axle market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

European countries to invest in EVs

- Europe is investing in charging infrastructure to support the widespread adoption of EVs.

- In volume terms, Germany is the biggest market in Europe with sales of 830,000in 2022, followed by the UK with 370 000 and France with 330 000.

- Collaboration between automotive OEMs, suppliers, and technology companies in Europe is accelerating the development and commercialization of e-axle systems.

Global Automotive E-axle Market Growth by Region 2024-2031

Asia-pacific dominates the Automotive E-axle Market

Among all regions, Asia-Pacific holds a significant share in the automotive e-axle market. The increased demand for automotive e-axle from major automotive manufacturers including Toyota, Honda, Hyundai, and BYD is a key contributor to the regional market share. According to the Global EV Outlook 2023, China leads global electric car sales, accounting for approximately 60.0% of the market, surpassing its 2025 target for new energy vehicle sales. Additionally, government incentives, strict emissions regulations, and rising environmental awareness are all contributing to the increased adoption of e-axle systems in EVs. The Government of India has taken some steps to give incentives/ subsidies on EVsto address structural challenges such as high vehicle costs, inadequate charging and maintenance infrastructure, and consumer concerns regarding battery performance. In June 2023, the government reduced the EV subsidy for e-2Ws to 15.0% of the ex-factory price from 40.0% under FAME India Scheme Phase-II due to the expanding EV market. Such developments are further contributing to the regional market growth

Furthermore, the EV supply chain is expanding, but manufacturing remains highly concentrated in certain regions, with China being the main player in battery and EV component trade. In 2022, 35.0% of exported electric cars came from China, compared with 25.0% in 2021. Europe is China’s largest trade partner for both electric cars and their batteries. In 2022, the share of electric cars manufactured in China and sold in the European market increased to 16.0%, up from about 11.0% in 2021.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global Automotive E-axle market include Continental AG, ZF Friedrichshafen AG, Melrose Industries PLC, Dana Ltd., Robert Bosch GmbH, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in September 2023, Tresa Motors revealed the first e-axle DAX1 and its upgraded version of the medium and heavy electric truck platform Model V0.1, capable of carrying a load capacity ranging from 18 to 55 tons. DAX-1 was powered by its FLUX350 platform motors and operated within the range of 150Kw to 350Kw.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive e-axle market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Continental AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Dana Inc.

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Melrose Industries PLC

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Robert Bosch GmbH

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. ZF Friedrichshafen AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive E-axle Market by Vehicle Type

4.1.1. Passenger Cars

4.1.2. Commercial Vehicles

4.2. Global Automotive E-axle Market by Propulsion Type

4.2.1. Battery Electric Vehicles (BEV)

4.2.2. Hybrid Electric Vehicles (HEV)

4.3. Global Automotive E-axle Market by Application

4.3.1. Front E-Axle

4.3.2. Rear E-Axle

4.3.3. All-wheel-drive (AWD) E-Axle

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Aisin Seiki Co., Ltd.

6.2. American Axle & Manufacturing, Inc. (AAM)

6.3. AVL List GmbH

6.4. BorgWarner Inc.

6.5. Bosch Ltd.

6.6. Continental AG

6.7. Geely Technology Group

6.8. GKN Automotive Ltd.

6.9. Hitachi Automotive Systems, Ltd.

6.10. Magna International Inc.

6.11. Nidec Corp.

6.12. Protean Electric

6.13. Schaeffler Group

6.14. Siemens AG

6.15. YASA Ltd.

1. GLOBAL AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

2. GLOBAL AUTOMOTIVE E-AXLE IN PASSENGER CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL AUTOMOTIVE E-AXLE IN COMMERCIAL VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

5. GLOBAL AUTOMOTIVE E-AXLE IN BEV MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AUTOMOTIVE E-AXLE IN HEV MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

7. GLOBAL AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

8. GLOBAL AUTOMOTIVE E-AXLE FOR FRONT E-AXLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AUTOMOTIVE E-AXLE FOR REAR E-AXLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBALAUTOMOTIVE E-AXLE FOR AWD E-AXLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. NORTH AMERICAN AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

13. NORTH AMERICAN AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

14. NORTH AMERICAN AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

15. NORTH AMERICAN AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

16. EUROPEAN AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

17. EUROPEAN AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

18. EUROPEAN AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

20. ASIA-PACIFIC AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

21. ASIA-PACIFICAUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

22. ASIA-PACIFICAUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFICAUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

24. REST OF THE WORLD AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

25. REST OF THE WORLD AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

26. REST OF THE WORLD AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE,2023-2031 ($ MILLION)

27. REST OF THE WORLD AUTOMOTIVE E-AXLE MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2023-2031 ($ MILLION)

1. GLOBAL AUTOMOTIVE E-AXLE MARKET SHARE BY VEHICLE TYPE, 2023 VS 2031 (%)

2. GLOBAL AUTOMOTIVE E-AXLE IN PASSENGER CARS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL AUTOMOTIVE E-AXLE IN COMMERCIAL VEHICLES MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL AUTOMOTIVE E-AXLE MARKET SHARE BY PROPULSION TYPE, 2023 VS 2031 (%)

5. GLOBAL AUTOMOTIVE E-AXLE IN BEV MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL AUTOMOTIVE E-AXLE IN HEV MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AUTOMOTIVE E-AXLE MARKET SHARE BY APPLICATION, 2023 VS 2031 (%)

8. GLOBAL AUTOMOTIVE E-AXLE FOR FRONT E-AXLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AUTOMOTIVE E-AXLE FOR REAR E-AXLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL AUTOMOTIVE E-AXLE FOR AWD MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL AUTOMOTIVE E-AXLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. US AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

13. CANADA AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

14. UK AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

15. FRANCE AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

16. GERMANY AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

17. ITALY AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

18. SPAIN AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

19. REST OF EUROPE AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

20. INDIA AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

21. CHINA AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

22. JAPAN AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

23. SOUTH KOREA AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

24. REST OF ASIA-PACIFIC AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

25. LATIN AMERICA AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)

26. MIDDLE EAST AND AFRICA AUTOMOTIVE E-AXLE MARKET SIZE, 2023-2031 ($ MILLION)