Automotive Electronics Market

Global Automotive Electronics Market Size, Share & Trends Analysis Report by Distribution Channel (OEM and Aftermarket), By Component Type (Sensor, Electronic Control Unit, and Current-Carrying Device), By Application (Advanced Driver-Assistance Systems (ADAS), Infotainment, Powertrain, Safety System, and Body Electronics), and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global automotive electronics market is estimated to grow significantly, at a CAGR of over 7%, during the forecast period. The automotive industry is involved in the design, development, manufacturing, marketing, and trading of motor vehicles. Electronic components, from basic wave radars to temperature sensors are playing prominent roles in new car models. Automotive makers are implementing smart technologies with each model year. Cameras and automotive radar chipsets are being used in newer car models. These components can sense objects in front as well as rear and convey caution message and also activate signals to another set of systems within the car, such as the ABS (Automatic Braking System), to avoid accidents.

The rising demand for autonomous vehicles and electric vehicles is expected to boost the automotive electronics market during the forecast period. An autonomous vehicle is an electronically assisted vehicle; therefore, its functionality is developed with the interconnection of various electronic devices in restricted space and flexible design with various software technologies. Along with this, the increasing demand for safety and comfort features in the automotive further act as a driving factor for the growth of the global automotive electronics market. Despite several driving factors of the market, there are several factors that hamper the market growth, such as high prices of ADAS and increasing risk for data breaches in connected cars.

Segmental Outlook

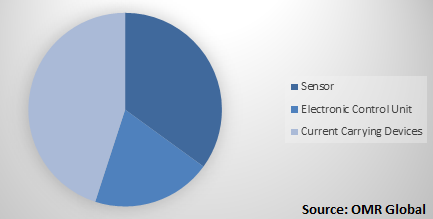

The global automotive electronics market is classified on the basis of distribution channel, component type, and application. Based on the distribution channel, the market is bifurcated into OEM and aftermarket. Based on component type, the market is segmented into the sensor, electronic control unit, and current-carrying device. On the basis of application, the market is segregated into ADAS, infotainment, powertrain, safety system, and body electronics.

Global Automotive Electronics Market Share by Component Type, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive electronics market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. Robert Bosch GmbH

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Aptiv PLC

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. Texas Instruments Inc.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. Continental AG

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Fujitsu Group

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Automotive Electronics Market by Distribution Channel

5.1.1. OEM

5.1.2. Aftermarket

5.2. Global Automotive Electronics Market by Component Type

5.2.1. Sensor

5.2.2. Electronic Control Unit

5.2.3. Current Carrying Devices

5.3. Global Automotive Electronics Market by Application

5.3.1. Advanced driver-assistance systems (ADAS)

5.3.2. Infotainment

5.3.3. Powertrain

5.3.4. Safety System

5.3.5. Body Electronics

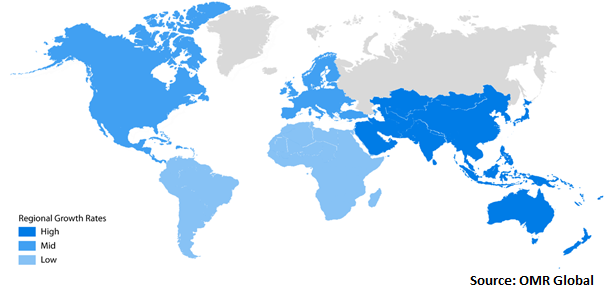

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Aptiv PLC

7.2. Atlas Copco Group

7.3. Blaupunkt GmbH

7.4. Continental AG

7.5. Delphi Technologies PLC

7.6. DENSO Corp.

7.7. Fujitsu Group

7.8. Garmin Ltd.

7.9. Harman International Industries, Inc.

7.10. Hitachi, Ltd.

7.11. Jabil, Inc.

7.12. Keihin Corp.

7.13. LACROIX Group

7.14. Mitsubishi Electric Corp.

7.15. Nidec Corp.

7.16. NXP Semiconductors N.V.

7.17. Panasonic Corp.

7.18. Pioneer Corp.

7.19. Robert Bosch GmbH

7.20. Texas Instruments Inc.

7.21. Visteon Corp.

- GLOBAL AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2018-2025 ($ MILLION)

- GLOBAL OEM AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AFTERMARKET AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE ELECTRONIC CONTROL UNIT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE CURRENT CARRYING DEVICES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE ELECTRONICS FOR ADAS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE ELECTRONICS FOR INFOTAINMENT MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE ELECTRONICS FOR POWERTRAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE ELECTRONICS FOR SAFETY SYSTEM MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE ELECTRONICS FOR BODY ELECTRONICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- NORTH AMERICAN AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- NORTH AMERICAN AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2018-2025 ($ MILLION)

- NORTH AMERICAN AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2018-2025 ($ MILLION)

- NORTH AMERICAN AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

- EUROPEAN AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- EUROPEAN AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2018-2025 ($ MILLION)

- EUROPEAN AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2018-2025 ($ MILLION)

- EUROPEAN AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

- ASIA-PACIFIC AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2018-2025 ($ MILLION)

- ASIA-PACIFIC AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2018-2025 ($ MILLION)

- ASIA-PACIFIC AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

- REST OF THE WORLD AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY DISTRIBUTION CHANNEL, 2018-2025 ($ MILLION)

- REST OF THE WORLD AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY COMPONENT TYPE, 2018-2025 ($ MILLION)

- REST OF THE WORLD AUTOMOTIVE ELECTRONICS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE ELECTRONICS MARKET SHARE BY DISTRIBUTION CHANNEL, 2018 VS 2025 (%)

- GLOBAL AUTOMOTIVE ELECTRONICS MARKET SHARE BY COMPONENT TYPE, 2018 VS 2025 (%)

- GLOBAL AUTOMOTIVE ELECTRONICS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

- GLOBAL AUTOMOTIVE ELECTRONICS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

- US AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- CANADA AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- UK AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- FRANCE AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- GERMANY AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- ITALY AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- SPAIN AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- ROE AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- INDIA AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- CHINA AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- JAPAN AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF ASIA-PACIFIC AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF THE WORLD AUTOMOTIVE ELECTRONICS MARKET SIZE, 2018-2025 ($ MILLION)