Automotive Human Machine Interface (HMI) Market

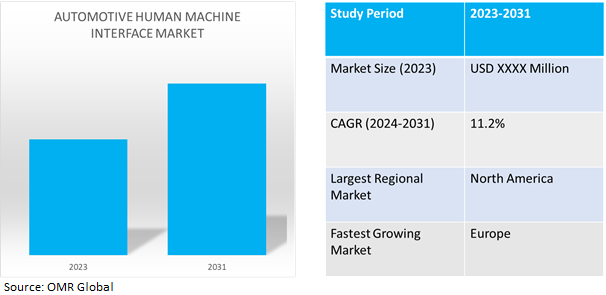

Automotive Human Machine Interface (HMI) Market Size, Share & Trends Analysis Report by Product Type (Voice Control System, Central Displays, Heads-up Displays, and Others), by Technology (Mechanical Interfaces, Acoustic Interfaces, Visual Interfaces, and Others), and by Vehicle Type (Passenger Vehicle and Commercial Vehicle) Forecast Period (2024-2031) Update Available - Forecast 2025-2035

Automotive Human Machine Interface market is anticipated to grow at a CAGR of 11.2% during the forecast period (2024-2031). Automotive Human Machine Interface (HMI) is transforming the transportation industry by integrating technologies that provide seamless on-the-go experiences such as advanced navigation, connectivity, and smart safety. It also provides customization across car segments, which is driving the need for personalized solutions.

Market Dynamics

Integrating HMI technology to boost instrument cluster & user experience

An essential component of the driver's connection with the vehicle is the instrument clusters, which display vital information about the car. With the advancement of display technologies, they have transitioned from analog to digital displays and are now more interactive and informative. 3D technology, navigation systems, and advanced driver assistance systems (ADAS) are combined to improve the driving experience, the usage of HMI in instrument clusters is now improving the driving experience. For instance, in March 2024, Visteon launched a new cockpit technology, integrating ADAS. This new technology integration is anticipated to promote the automotive human machine interface market.

Advancements in AI Based Technologies

Developments in technologies such as artificial intelligence (AI) enable advanced features like predictive maintenance, automated route optimization, and autonomous driving, further enhancing efficiency and safety.The HMI platform provides the driver with a real-time augmented reality experience. Technological Advancements help by assisting drivers in making educated decisions and anticipating other cars ‘actions on the road, such as changing speed limits and cornering techniques. Furthermore, there has been a notable surge in the market demand for connected automobiles, driven by consumers growing preference for comfort and security in their vehicles as well as the expanding number of tech-savvy individuals.For instance, in March 2024, Arm, a tech company has launched a suite of new automotive technologies aimed at accelerating the development of AI-powered vehicles by up to two years. This includes next-generation Armv9 processors specifically designed for the demand of autonomous driving, along with the introduction of server-class processing power and virtual prototyping tools to streamline development cycle.

Market Segmentation

Our in-depth analysis of the global automotive HMI market includes the following segments by product type, technology, and vehicle type:

- Based on product type, the market is sub-segmented into voice control systems, central displays, heads-up displays, and others (steering-mounted controls, rear-seat entertainment).

- Based on technology type, the market is sub-segmented into mechanical interface, acoustic interface, visual interface, and others(haptic interface).

- Based on the vehicle type, the market is sub-segmented into passenger vehicles and commercial vehicles.

Visual Technology Holds Major Share in the Market

The visual technology segment holds major share in the market and is projected to be the faster-growing segment during the forecast period. This is due to the growing demand for convenient features, and adaptive solutions, and the increasing focus of carmakers on eliminating distractions by offering visuals such as instrument clusters and touch-screen displays. Thus, the rising applications of visuals for automotive HMI is driving the growth of this market segment. In June 2022 Epic Games collaborated with Volvo Cars real-time 3D content which will revolutionize the role of the in-car HMI has brought. This initiative has further broadened the growth opportunity for the Automotive HMI industry.

Regional Outlook

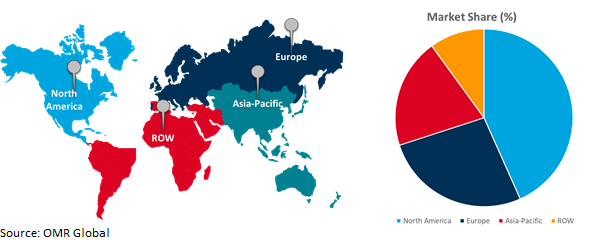

The global automotive HMI market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America).

North America Holds Major Market Share

- The higher adoption rate of HMI in developed countries of North America, such as the US and Canada, coupled with advanced infrastructure.

- Increasing demand for efficient logistics and transportation services due to the expanding commercial sector.

Global Automotive Human Machine Interface (HMI) Market Growth by Region 2024-2031

Europe is the Fastest Growing Automotive Human Machine Interface(HMI) Market

The European region is the fastest-growing automotive HMI market owing to the growing awareness and regulations of road safety. The growth is further anticipated to increase due to the early adoption of ADAS features, increased awareness of traffic safety laws, and the high rate of use of smart trucks in Europe. Strict government regulations about comfort and safety on the roads will further increase demand for HMI in this area. As a result, a lot of businesses are making market investments. For instance, in June 2022, Valeo signeda contract with the BMW Group to develop and produce the ADAS domain controller, which is capable of managing all data flows from all ADAS sensors in BMW Group vehicles based on the “Neue Klasse” platform.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the global automotive HMI market include Robert Bosch GmbH, Continental AG, Denso Corp, Aptiv Global Operations Ltd., and Infineon Technologies AG, among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market. For instance, in June 2022,Volvo Cars and Epic Games collaborated for a real-time photorealistic visualization inside next-generation Volvo cars with Unreal Engine. This provides its customers with the best possible user experience by providing unparalleled high-quality graphics inside the cabin.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global Automotive Human Machine Interface market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Continental AG

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Infineon Technologies AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Robert Bosch GmbH

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Human Machine Interface (HMI) Market by Product Type

4.1.1. Voice Control System

4.1.2. Central Displays

4.1.3. Heads-Up Display

4.1.4. Others (Steering-Mounted Controls, Rear-Seat Entertainment)

4.2. Global Automotive Human Machine Interface (HMI) Market by Technology

4.2.1. Mechanical Interfaces

4.2.2. Acoustic Interfaces

4.2.3. Visual Interface

4.2.4. Others (Haptic Interface)

4.3. Global Automotive Human Machine Interface (HMI) Market by Vehicle Type

4.3.1. Passenger Vehicle

4.3.2. Commercial Vehicle

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. 3M

6.2. Alpine Electronics, Inc.

6.3. Aptiv Global Operations Ltd.

6.4. Denso Corp

6.5. Forciot Ltd.

6.6. Harman International

6.7. Luxoft

6.8. Marelli Holdings Co., Ltd.

6.9. Panasonic Holdings Corp.

6.10. Synaptics Inc.

6.11. Tata Elxsi

6.12. Valeo

6.13. Visteon Corp.

1. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

2. GLOBAL VOICE CONTROL SYSTEM IN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL CENTRAL DISPLAYS IN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL HEADS-UP DISPLAY IN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL OTHER PRODUCT TYPES IN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

7. GLOBAL AUTOMOTIVE MECHANICAL HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBAL AUTOMOTIVE ACOUSTIC HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AUTOMOTIVE VISUAL HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL OTHER TECHNOLOGY-BASED AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

11. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

12. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) FOR PASSENGER VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) FOR COMMERCIAL VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. NORTH AMERICAN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

16. NORTH AMERICAN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

17. NORTH AMERICAN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

19. EUROPEAN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

20. EUROPEAN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

22. EUROPEAN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

23. ASIA-PACIFIC AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

24. ASIA-PACIFIC AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

26. ASIA-PACIFIC AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

27. REST OF THE WORLD AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

28. REST OF THE WORLD AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2023-2031 ($ MILLION)

30. REST OF THE WORLD AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2023-2031 ($ MILLION)

1. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

2. GLOBAL VOICE CONTROL SYSTEM IN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL CENTRAL DISPLAYS IN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL HEADS-UP DISPLAY IN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL OTHER PRODUCT TYPES IN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY REGION, 2023 VS 2031 (%)

6. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY TECHNOLOGY, 2023 VS 2031 (%)

7. GLOBAL AUTOMOTIVE MECHANICAL HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AUTOMOTIVE ACOUSTIC HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AUTOMOTIVE VISUAL HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY REGION, 2023 VS 2031 (%)

10. GLOBAL OTHER TECHNOLOGY-BASED AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY VEHICLE TYPE, 2023 VS 2031 (%)

12. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) FOR PASSENGER VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) FOR COMMERCIAL VEHICLE MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. US AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

16. CANADA AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

17. UK AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

18. FRANCE AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

19. GERMANY AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

20. ITALY AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

21. SPAIN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

22. REST OF EUROPE AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

23. INDIA AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

24. CHINA AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

25. JAPAN AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

26. SOUTH KOREA AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

27. REST OF ASIA-PACIFIC AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF THE WORLD AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)

30. THE MIDDLE EAST AND AFRICA AUTOMOTIVE HUMAN MACHINE INTERFACE (HMI) MARKET SIZE, 2023-2031 ($ MILLION)