Automotive Image Sensors Market

Automotive Image Sensors Market Size, Share & Trends Analysis Report by Application (Passenger Cars and Commercial Cars), and by Type (Charge-Coupled Devices (CCD) and Complementary Metal-Oxide-Semiconductor (CMOS)) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Automotive image sensors market is anticipated to grow at a CAGR of 11.3% during the forecast period (2023-2030). With the growing demand for smart features and autonomous driving in automobile sectors, the demand for image sensors in the automotive industry is also growing at a significant scale. In the automobile industry, image sensors have a critical role in applications such as advanced driver-assistance systems (ADAS) and autonomous driving and are also used to improve safety and functionality. The usage of image sensors represents a significant advancement in making vehicles safer, more efficient, and capable of handling complex driving situations.

Segmental Outlook

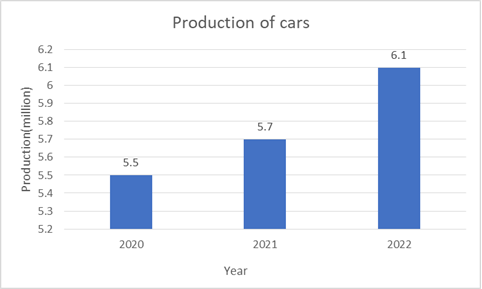

The global automotive image sensors market is segmented by application and type. By application, the market is sub-segmented into passenger cars and commercial cars. By type, the market is sub-segmented into charge-coupled device (CCD) and complementary metal-oxide-semiconductor (CMOS). Among the sensors, CMOS sensors are known for their energy efficiency and compact design, while CCD sensors excel in low-light scenarios. When integrated with lidar and radar systems, these sensors together offer vehicles a comprehensive environmental perspective. Among the applications, the demand for image sensors is expected to grow significantly in passenger cars owing to factors such as technological advancements, increasing production of passenger cars globally, and increasing demand for safety features among consumers. According to the data published by the International Organization of Motor Vehicle Manufacturers, the total production of cars has grown by 8.0% from 2021 to 2022. Considering the growing demand for image sensors, the companies are also exploring use cases of image sensors in vehicles from safety features to multipurpose. For instance, In February 2021, Samsung Electronics released the ISOCELL Auto 4AC, an automotive image sensor with 120 decibels (dB) of high dynamic range (HDR) and LED flicker mitigation (LFM). The sensor is particularly designed for surround-view monitors (SVM) or rear-view cameras (RVC) with high-definition resolution (1280 x 960).

Source: International Organization of Motor Vehicle Manufacturers

The Demand for Image Sensors Is Expected to Grow in the Commercial Vehicles

According to the data from the International Organization of Motor Vehicle Manufacturers, the total production of commercial vehicles has increased by 6.0% from 2021 to 2022. With the growth of end-user industries such as transportation and supply chain and growing demand for ADAS such as blind spot monitoring, and lane departure warning among commercial vehicles, the demand for image sensors is also growing in commercial vehicles. Apart from this, the growing technological advancements in image sensor technology are also helping to grow the overall demand for image sensors in the commercial vehicles industry. For instance, in April 2022, A team of researchers from the Harvard John A. Paulson School of Engineering and Applied Sciences (SEAS) developed the first in-sensor processor that can be integrated into commercial silicon imaging sensor chips, also known as CMOS image sensors. These sensors are used in nearly all commercial devices and automobiles to capture visual information.

Regional Outlook

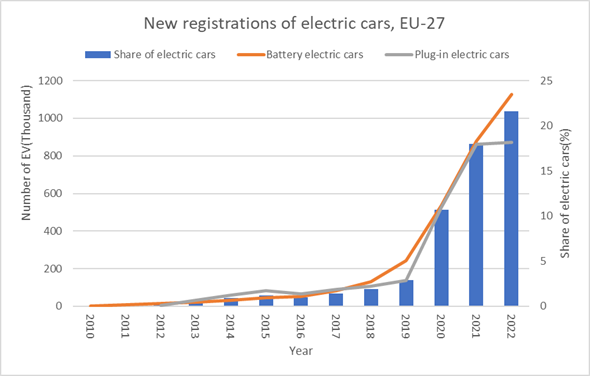

The global automotive image sensors market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia), and the Rest of the World (the Middle East & Africa, and Latin America). Among these, the market is expected to grow significantly in the European region more steadily owing to factors including the growing demand for electric vehicle (EV) and ADAS in the region. Additionally, the region also holds onto a strong presence of giant automotive companies such as Mercedes-Benz Group, Volkswagen Group, and others.

New registrations of EVs, 2010-2022 (Thousand)

Source: European Environment Agency

Global Automotive Image Sensors Market Growth by Region 2023-2030

The Asia-Pacific Region is Expected to Grow Significantly in the Market Over the Forecast Period

The demand for automotive image sensors is expected to grow considerably in the Asia-Pacific. Major economies such as India, China, and Japan are among the top 5 automobile producers globally. Additionally, the region holds a considerable share of global EV sales. According to the Global EV outlook, China accounts for 60% of global EV sales and is expected to be the largest market for EV sales by 2030. Apart from this, the demand for ADAS and vehicle safety systems is growing among regional consumers, which is another factor fueling the market demand in the region.

Another factor supporting the regional market growth includes the rising number of road accidents in countries like India. According to the World Health Organization (WHO), at least 1 out of 10 people slain on roads across the globe is from India. With growing concern for vehicle safety, automakers in the region are focusing on improving safety standards by using sensors such as image sensors. Considering growing demand in the region, image sensor developers are also expanding into the Asia-Pacific market. For instance, in November 2022, Sony Group invested $70.7 million to set up a semiconductor plant in Thailand for manufacturing image sensors for cars. This development will help the company to reduce production costs and improve its presence in the region.

Market Players Outlook

The major companies serving the global automotive image sensors market are Infineon Technologies AG, NXP Semiconductors NV, Semiconductor Components Industries, LLC, and PIXELPLUS Co. Ltd. among others. The market players focus on technological advancements and collaboration to stay competitive and fulfill market demand. For instance, in August 2023, Tower Semiconductor and TriEye launched SWIR sensors for the ADAS and industrial markets. The sensor is equipped with a 1.3Mp 7um pixel array and is to be integrated into a CMOS chip.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the automotive image sensors market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Canon Inc.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.3. Continental AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. DENSO Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Image Sensors Market by Application

4.1.1. Passenger Cars

4.1.2. Commercial Cars

4.2. Global Automotive Image Sensors Market by Type

4.2.1. Charge-Coupled Device (CCD)

4.2.2. Complementary Metal-Oxide-Semiconductor (CMOS)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. ams-OSRAM AG

6.2. DENSO Corp.

6.3. Gentex Corp.

6.4. Infineon Technologies AG

6.5. NXP Semiconductors NV

6.6. PixArt Imaging Inc.

6.7. PIXELPLUS Co. Ltd.

6.8. Samsung Electronics Co. Ltd.

6.9. Semiconductor Components Industries, LLC

6.10. Sharp Corp.

6.11. SK hynix Co. Ltd.

6.12. SmartSens technology

6.13. Sony Group Corp.

6.14. STMicroelectronics NV

6.15. Taiwan Semiconductor Manufacturing Co. Ltd.

6.16. Teledyne Technologies Inc.

6.17. Texas Instruments Inc.

6.18. Toshiba Corp.

1. GLOBAL AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

2. GLOBAL AUTOMOTIVE IMAGE SENSORS FOR PASSENGER CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

3. GLOBAL AUTOMOTIVE IMAGE SENSORS FOR COMMERCIAL CARS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

5. GLOBAL CCD AS AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL CMOS AS AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

8. NORTH AMERICAN AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

9. NORTH AMERICAN AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

10. NORTH AMERICAN AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

11. EUROPEAN AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

12. EUROPEAN AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

13. EUROPEAN AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

14. ASIA-PACIFIC AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. ASIA-PACIFIC AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

16. ASIA-PACIFIC AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

17. REST OF THE WORLD AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2022-2030 ($ MILLION)

18. REST OF THE WORLD AUTOMOTIVE IMAGE SENSORS MARKET RESEARCH AND ANALYSIS BY TYPE, 2022-2030 ($ MILLION)

1. GLOBAL AUTOMOTIVE IMAGE SENSORS MARKET SHARE BY APPLICATION, 2022 VS 2030 (%)

2. GLOBAL AUTOMOTIVE IMAGE SENSORS FOR PASSENGER CARS MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL AUTOMOTIVE IMAGE SENSORS FOR COMMERCIAL CARS MARKET SHARE BY REGION, 2022 VS 2030 (%)

4. GLOBAL AUTOMOTIVE IMAGE SENSORS MARKET SHARE BY TYPE, 2022 VS 2030 (%)

5. GLOBAL CCD AS AUTOMOTIVE IMAGE SENSORS MARKET SHARE BY REGION, 2022 VS 2030 (%)

6. GLOBAL CMOS AS AUTOMOTIVE IMAGE SENSORS MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL AUTOMOTIVE IMAGE SENSORS MARKET SHARE BY REGION, 2022 VS 2030 (%)

8. US AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

9. CANADA AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

10. UK AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

11. FRANCE AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

12. GERMANY AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

13. ITALY AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

14. SPAIN AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

15. REST OF EUROPE AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

16. INDIA AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

17. CHINA AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

18. JAPAN AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

19. SOUTH KOREA AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

20. REST OF ASIA-PACIFIC AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF THE WORLD AUTOMOTIVE IMAGE SENSORS MARKET SIZE, 2022-2030 ($ MILLION)