Automotive Light Emitting Diode (LED) Market

Automotive Light Emitting Diode (LED) Market Size, Share & Trends Analysis Report Market by Vehicle Type (Passenger Vehicle, and Commercial Vehicle), by Position (Front, Rear, Side, and Interior), and by Propulsion Type (Internal Combustion Engine (ICE), Electric, and Others) Forecast Period (2023-2030) Update Available - Forecast 2025-2031

Automotive LED Market is anticipated to grow at a CAGR of 7.3% during the forecast period (2023-2030). Automotive LED is essential in cars to improve the vision of drivers which helps for detecting uneven road tracks, other vehicle movements, and road hazards. Globally increasing production and sale of vehicles is the driving factor of the global automotive LED market For Instance, China continues to be the world’s largest vehicle market by both annual sales and manufacturing output, with domestic production expected to reach 35 million vehicles by 2025. According to the International Trade Administration (ITA), over 26 million vehicles were sold in 2021, including 21.5 million passenger vehicles, an increase of 7.1% from 2020. Commercial vehicle sales reached 4.8 million units, down 6.6% from 2020. Improvement in lifestyle with the purchasing power of consumers is a changing preference that has positively impacted the sale of premium cars with the increasing demand for premium segment cars the automotive LED market also transforming and launching advanced lighting technology and providing better lighting performance and improved energy efficiency that Consume less power and have long service life then other lights for instance, Hyundai Mobis had developed 'lighting grille' technology, which implements an LED lighting function in the front grille of the car. This helps determine the first impression and also integrates the other new 'grille integral active air flap' technology. on High performance and high standards, lighting electronics feature a high-performance 32-bit chip for these diverse tasks Continental pursues a platform strategy comprising ASIC and ASSP solutions that are under advanced development in close collaboration with semiconductor manufacturers. Due to their integration into assistance systems and the AUTOSAR operating system, LED light control units also require higher functional safety standards and are certified by ISO 26262 for safety class ASIL B.

Segmental Outlook

The global automotive LED Market is segmented based on vehicle type, position, and propulsion type. Based on vehicle type, the market is sub-segmented into passenger vehicles, and commercial vehicles. Based on position, the market is sub-segmented into front, rear, side, and interior. Based on propulsion type, the market is sub-segmented into ICE, electric, and others (hybrid). Among the propulsion type, the electric sub-segment is projected to grow at a exponential CAGR during the forecast period owing to thw rising demand for electric vehicles (EVs) along with several government initiatives to adopt electric cars.

The Passenger Vehicle Sub-Segment is Anticipated to Hold a Considerable Share of the Global Automotive LED Market

Among the vehicle type, passenger vehicles sub-segment is expected to hold a considerable share of the global automotive LED market. Some factor bolstering the segment’s growth includes the rising demand and sale of passenger cars coupled with the introduction of several technological advancements in lighting technology. For instance, in August 2020, Czech vehicle manufacturer Skoda Auto has teased online the headlight and taillight design of its first all-electric SUV Enyaq iV. The LED matrix lighting technology of Skoda Enyaq iV is inspired by Bohemian Crystal art. The SUV is Skoda's first production all-electric vehicle, which is based on Volkswagen’s modular electrification toolkit (MET) architecture.

Regional Outlook

The global automotive LED Market is further segmented based on geography, including North America (the US and Canada), Europe (Italy, Spain, Germany, France, and others), Asia-Pacific (India, China, Japan, South Korea, and others), and the Rest of the World (the Middle East & Africa and Latin America). Among these, Europe is anticipated to hold a prominent share of the market across the globe, oowing to the strong presence of several automakersalong with decreased price compared to headlights.

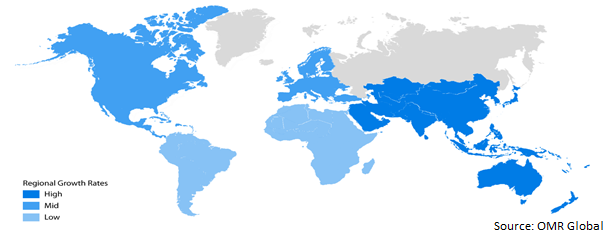

Global Automotive Light Emitting Diode (LED) Market Growth by Region 2023-2030

The Asia-Pacific Region is Expected to Grow at a Significant CAGR in the Global Automotive LED Market

Among all regions, the Asia-Pacific region is anticipated to grow at a considerable CAGR over the forecast period. Countries such as China, Japan, and India are the most popular countries worldwide for mass production of passenger vehicle and commercial vehicle.s According to the International Council on Clean Transportation (ICCT), the commercial vehicle manufacturing industry boomed in China in recent decades, and this was especially pronounced in the heavy truck segments. China has also become the largest heavy-duty vehicle (HDV) market in the world. The rising demand for energy-efficient lighting is the driving factor of this region that boosts work productivity.

Market Players Outlook

The major companies serving the global automotive LED market include Stanley Electric Co., Ltd, NXP Semiconductors, Koito Manufacturing Co., HELLA GmbH & Co. KGaA Ltd., Grupo Antolin Irausa, S.A., and others. The market players are considerably contributing to the market growth by the adoption of various strategies, including mergers and acquisitions, partnerships, collaborations, and new product launches, to stay competitive in the market. For instance, in March 2022, Plastic Omnium acquired (Automotive Lighting Systems) AMLS business from the Group to acquire 100% of AMLS. This acquisition represents an important milestone in Plastic Omnium. AMLS offers the technological brick that will provide Plastic Omnium with cutting-edge expertise in lighting technologies, electronics, and software to develop innovative smart lighting solutions for the automotive industry.

The Report Covers

- Market value data analysis of 2022 and forecast to 2030.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive LED Market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. Grupo Antolin Irausa, S.A.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. HELLA GmbH & Co. KGaA

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. Koito Manufacturing Co., Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. NXP Semiconductors

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. Stanley Electric Co., Ltd.

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Light Emitting Diode (LED) Market by Vehicle Type

4.1.1. Passenger Vehicle

4.1.2. Commercial Vehicle

4.2. Global Automotive Light Emitting Diode (LED) Market by Position

4.2.1. Front

4.2.2. Rear

4.2.3. Side

4.2.4. Interior

4.3. Global Automotive Light Emitting Diode (LED) Market by Propulsion Type

4.3.1. Internal Combustion Engine (ICE)

4.3.2. Electric

4.3.3. Others (Hybrid)

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Continental AG

6.2. General electric company

6.3. Hyundai Mobis Co., Ltd.

6.4. Koninklijke Philips N.V

6.5. Magneti marelli S.P.A

6.6. Namyung Lighting Co., Ltd.

6.7. Nichia corporation

6.8. OSRAM GmbH

6.9. Seoul Semiconductor Co., Ltd.

6.10. Texas Instruments Inc.

6.11. VALEO

6.12. Varroc Engineering Ltd.

6.13. ZKW

1. GLOBAL AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

2. GLOBAL AUTOMOTIVE LED FOR PASSENGER VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION,2022-2030 ($ MILLION)

3. GLOBAL AUTOMOTIVE LED FOR COMMERCIAL VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

4. GLOBAL AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY POSITION, 2022-2030 ($ MILLION)

5. GLOBAL FRONT AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

6. GLOBAL REAR AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 ($ MILLION)

7. GLOBAL SIDE AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY REGION 2022-2030 ($ MILLION)

8. GLOBAL INTERIOR AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY REGION 2022-2030 ($ MILLION)

9. GLOBAL AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2022-2030 ($ MILLION)

10. GLOBAL ICE AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS, 2022-2030 BY REGION, ($ MILLION)

11. GLOBAL ELECTRIC AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 BY REGION, ($ MILLION)

12. GLOBAL OTHER PROPULSION TYPE AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 BY REGION, ($ MILLION)

13. GLOBAL AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY REGION, 2022-2030 BY REGION, ($ MILLION)

14. NORTH AMERICAN AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

15. NORTH AMERICAN AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

16. NORTH AMERICAN AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY POSITION, 2022-2030 ($ MILLION)

17. NORTH AMERICAN AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2022-2030 ($ MILLION)

18. EUROPEAN AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

19. EUROPEAN AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

20. EUROPEAN AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY POSITION, 2022-2030 ($ MILLION)

21. EUROPEAN AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2022-2030 ($ MILLION)

22. ASIA-PACIFIC AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2022-2030 ($ MILLION)

23. ASIA-PACIFIC AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

24. ASIA- PACIFIC AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY POSITION, 2022-2030 ($ MILLION)

25. ASIA-PACIFIC AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2022-2030 ($ MILLION)

26. REST OF THE WORLD AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2022-2030 ($ MILLION)

27. REST OF THE WORLD AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY POSITION, 2022-2030 ($ MILLION)

28. REST OF TGE WORLD AUTOMOTIVE LED MARKET RESEARCH AND ANALYSIS BY PROPULSION TYPE, 2022-2030 ($ MILLION)

1. GLOBAL AUTOMOTIVE LED MARKET SHARE BY VEHICLE TYPE, 2022 VS 2030 (%)

2. GLOBAL AUTOMOTIVE LED FOR PASSENGER VEHICLE MARKET SHARE BY REGION, 2022 VS 2030 (%)

3. GLOBAL AUTOMOTIVE LED FOR COMMERCIAL VEHICLE MARKET SHARE BY REGION, 2022 VS 2030 (%)

4.

5. GLOBAL AUTOMOTIVE LED MARKET SHARE BY POSITION 2022 VS 2030 (%)

6. GLOBAL FRONT AUTOMOTIVE LED MARKET SHARE BY REGION, 2022 VS 2030 (%)

7. GLOBAL REAR AUTOMOTIVE LED MARKETSHARE BY REGION, 2022 VS 2030 (%)

8. GLOBAL SIDE AUTOMOTIVE LED MARKET SHARE BY REGION, 2022 VS 2030 (%)

9. GLOBAL INTERIOR AUTOMOTIVE LED MARKET SHARE BY REGION, 2022 VS 2030 (%)

10. GLOBAL AUTOMOTIVE LED MARKET SHARE BY PROPULSION 2022 VS 2030 (%)

11. GLOBAL ICE AUTOMOTIVE LED MARKET SHARE BY REGION, 2022 VS 2030 (%)

12. GLOBAL ELECTRIC AUTOMOTIVE LED MARKET SHARE BY REGION, 2022 VS 2030 (%)

13. GLOBAL AUTOMOTIVE LED MARKET SHARE BY REGION, 2022 VS 2030 (%)

14. US AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

15. CANADA AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

16. UK AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

17. FRANCE AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

18. GERMANY AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

19. ITALY AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

20. SPAIN AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

21. REST OF EUROPE AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

22. INDIA AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

23. CHINA AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

24. JAPAN AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

25. SOUTH KOREA AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

26. REST OF ASIA-PACIFIC AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)

27. REST OF THE WORLD AUTOMOTIVE LED MARKET SIZE, 2022-2030 ($ MILLION)