Automotive Lighting Market

Automotive Lighting Market Size, Share & Trends Analysis Report by Application Type (Front, Side, Rear, and Interior), by Technology (Light Emitting Diode (LED), Halogen, and Xenon), and by Vehicle Type (Passenger Car and Commercial Vehicle) Forecast Period (2022-2028) Update Available - Forecast 2025-2035

Automotive lighting market is anticipated to grow at a CAGR of 10.1% during the forecast period. Increasing global production of commercial and passenger vehicles is likely to propel the automotive lighting market during the forecast period. According to the International Organization of Motor Vehicle Manufacturers (OICA), South Africa recorded a 3.5% increase in vehicle production in 2019 as compared to 2018. An automotive lighting system provides enhanced visibility in low-light areas and ensures the safety of pedestrians and other drivers which is another major factor bolstering the integration of lighting systems in vehicles. Furthermore, key players are continuously contributing to the growth of the market by launching new products in the market. For instance, in April 2021, Lumileds Holding B.V. launched Philips X-tremeUltinon LED headlight bulbs and fog light bulbs. The LED Headlights are white and bright compared to standard headlights, thus illuminating the road clearly without blinding oncoming drivers. Moreover, the product is designed with safe beam technology which creates a uniform and accurate beam pattern with the right cut-off point to reduce night-time glare. Philips X-tremeUltinon LED bulbs are designed for popular cars, trucks, SUVs, and vans.

Segmental Outlook

The global automotive lighting market is segmented based on application type, technology, and vehicle type. Based on the application type, the market is segmented into front, side, rear, and interior. Based on the technology, the market is further sub-segmented into LED, halogen, and xenon. Based on the vehicle type, the market is divided into passenger cars and commercial vehicles. Among the vehicle type, the passenger car sub-segment is expected to hold a considerable share of the market due to the rising disposable income coupled with the rising sales and production of passenger cars in developing countries such as Japan, China, and others.

Among the technology, the LED sub-segment is expected to hold a prominent share of the automotive lighting market over the forecast period. The low energy consumption and excellent power output drive the LED segment over the forecast period. Key manufacturers are focusing to launch advanced LED lights to cater to the demand. For instance, in January 2019, Valeo and Cree, Inc. jointly developed the first complete high-definition (HD) LED array solution for automotive lighting systems named Valeo PictureBeam Monolithic. It provides both glare-free and high beam road marking functions together with high-performance low beam and high beam in a single compact solution. The solution incorporates a scalable LED array in which the pixels of the light beam are formed directly at the light source. The module is therefore smaller and weighs less than other HD lighting systems.

Regional Outlooks

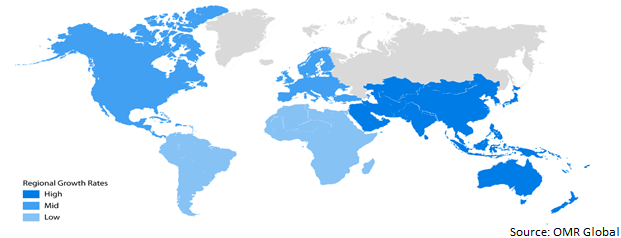

The global automotive lighting market is further segmented based on geography including North America (the US, and Canada), Europe (Italy, Spain, Germany, France, and Others), Asia-Pacific (India, China, Japan, South Korea, and Others), and the Rest of the World (the Middle East & Africa, and Latin America). The market can be analyzed for a particular region or country level as per the requirement. The European region is expected to hold a considerable share of the automotive lighting market during the forecast period, owing to the increasing government regulations to use daytime running lights (DRLs) in the region.

Global Automotive Lighting Market Growth, by Region 2022-2028

The Asia-Pacific Region is Expected to Hold a Significant Share in the Global Automotive Lighting Market

Among all regions, the Asia-Pacific region is expected to hold a significant market share during the forecast period. Some of the major factors driving the automotive lighting market in the region include the increasing demand for luxury cars coupled with a rise in the production of vehicles in countries such as Japan, China, and others. Key automotive vehicle manufacturers including BMW, Audi, Skoda, and others are also inclined towards establishing their manufacturing units in these countries to fulfil the rising demand. For instance, in March 2022, Triton announced its plans to establish a manufacturing plant in Gujrat, India. The company is a key electric vehicle manufacturer with enhanced features such as lighting systems, and others. For instance, in February 2021, Triton launched an EV in India including solar panels, battery technology, and a portable lighting system.

Market Players Outlook

The major companies serving the global automotive lighting market include Continental AG, DENSO Corp., Hyundai Motor Group, Koito Manufacturing Co. Ltd, Koninklijke Philips N.V., Magneti Marelli S.P.A, and others. The market players are considerably contributing to the market growth by the adoption of various strategies including mergers and acquisitions, partnerships, collaborations, funding, and new product launches, to stay competitive in the market. For instance, in January 2021, Hella, Inc. launched a flat and compact LED work lamp that can be mounted directly on the vehicle wall. The LED design is directed downwards toward the ground to ensure a homogeneous illumination of the work area. The LED work lamp has a CoroSafe coating for improved corrosion resistance. It is also certified for protection classes IP 6K7 and IP 6K9K, which require protection from dust and water penetration.

The Report Covers

- Market value data analysis of 2021 and forecast to 2028.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive lighting market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.1.1. Overview

3.1.2. Financial Analysis

3.1.3. SWOT Analysis

3.1.4. Recent Developments

3.2. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Lighting Market by Application Type

4.1.1. Front

4.1.2. Side

4.1.3. Rear

4.1.4. Interior

4.2. Global Automotive Lighting Market by Technology

4.2.1. Light Emitting Diode (LED)

4.2.2. Halogen

4.2.3. Xenon

4.3. Global Automotive Lighting Market by Vehicle Type

4.3.1. Passenger Car

4.3.2. Commercial Vehicle

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

6. Company Profiles

6.1. Continental AG

6.2. DENSO Corp

6.3. Hella, Inc.

6.4. Hyundai Motor Group

6.5. Koito Manufacturing Co. Ltd.

6.6. Koninklijke Philips N.V.

6.7. Magneti Marelli S.P.A

6.8. Marelli Holdings Co., Ltd.

6.9. Maxxima

6.10. Mercedes-Benz AG

6.11. Mobis India Ltd.

6.12. Optronics International LLC

6.13. Osram Licht AG

6.14. Robert Bosch GmbH

6.15. SpyderAuto

6.16. Stanley Electric Co.Ltd

6.17. Tata Motors Ltd.

6.18. Toyota Motor Corp

6.19. TYC/GENERA Corp.

6.20. Valeo

6.21. Varroc Engineering Ltd.

6.22. ZKW Zizala Lichtsysteme GmbH

1. GLOBAL AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATION TYPE, 2021-2028 ($ MILLION)

2. GLOBAL FRONT AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

3. GLOBAL SIDE AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

4. GLOBAL REAR AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

5. GLOBAL INTERIOR AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

6. GLOBAL AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

7. GLOBAL LED AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

8. GLOBAL HALOGEN AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION

9. GLOBAL XENON AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

10. GLOBAL AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

11. GLOBAL AUTOMOTIVE LIGHTING IN PASSENGER CAR MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

12. GLOBAL AUTOMOTIVE LIGHTING IN COMMERCIAL VEHICLE MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

13. GLOBAL AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY REGION, 2021-2028 ($ MILLION)

14. NORTH AMERICAN AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

15. NORTH AMERICAN AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATION TYPE, 2021-2028 ($ MILLION)

16. NORTH AMERICAN AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

17. NORTH AMERICAN AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

18. EUROPEAN AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

19. EUROPEAN AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATION TYPE, 2021-2028 ($ MILLION)

20. EUROPEAN AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

21. EUROPEAN AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

22. ASIA-PACIFIC AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

23. ASIA-PACIFIC AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATION TYPE, 2021-2028 ($ MILLION)

24. ASIA-PACIFIC AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

25. ASIA-PACIFIC AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

26. REST OF THE WORLD AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2021-2028 ($ MILLION)

27. REST OF THE WORLD AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY APPLICATION TYPE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY TECHNOLOGY, 2021-2028 ($ MILLION)

29. REST OF THE WORLD AUTOMOTIVE LIGHTING MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2021-2028 ($ MILLION)

1. GLOBAL AUTOMOTIVE LIGHTING MARKET SHARE BY COMPONENT, 2021 VS 2028 (%)

2. GLOBAL AUTOMOTIVE LIGHTING BY SOFTWARE MARKET SHARE BY REGION, 2021 VS 2028 (%)

3. GLOBAL AUTOMOTIVE LIGHTING BY SERVICES MARKET SHARE BY REGION, 2021 VS 2028 (%)

4. GLOBAL AUTOMOTIVE LIGHTING MARKET SHARE BYApplication Type, 2021 VS 2028 (%)

5. GLOBAL FRONT AUTOMOTIVE LIGHTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

6. GLOBAL SIDE AUTOMOTIVE LIGHTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

7. GLOBAL AUTOMOTIVE LIGHTING MARKET SHARE BY TECHNOLOGY, 2021 VS 2028 (%)

8. GLOBAL LED AUTOMOTIVE LIGHTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

9. GLOBAL HALOGEN AUTOMOTIVE LIGHTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

10. GLOBAL XENON AUTOMOTIVE LIGHTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

11. GLOBAL AUTOMOTIVE LIGHTING MARKET SHARE BY VEHICLE TYPE, 2021 VS 2028 (%)

12. GLOBAL AUTOMOTIVE LIGHTING FOR PASSENGER CAR MARKET SHARE BY REGION, 2021 VS 2028 (%)

13. GLOBAL AUTOMOTIVE LIGHTING FOR COMMERCIAL VEHICLE MARKET SHARE BY REGION, 2021 VS 2028 (%)

14. GLOBAL AUTOMOTIVE LIGHTING MARKET SHARE BY REGION, 2021 VS 2028 (%)

15. US AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

16. CANADA AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

17. UK AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

18. FRANCE AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

19. GERMANY AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

20. ITALY AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

21. SPAIN AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

22. REST OF EUROPE AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

23. INDIA AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

24. CHINA AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

25. JAPAN AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

26. SOUTH KOREA AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

27. REST OF ASIA-PACIFIC AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)

28. REST OF THE WORLD AUTOMOTIVE LIGHTING MARKET SIZE, 2021-2028 ($ MILLION)