Automotive Lightweight Materials Market

Global Automotive Lightweight Materials Market Size, Share & Trends Analysis Report by Material Type (Metals, Composites, Plastics, and Elastomers), By Vehicle Type (PC, LCV, and HCV), and by Application (Chassis and Suspension, Powertrain, Interiors, Exterior, and Others) and Forecast 2019-2025 Update Available - Forecast 2025-2035

The global automotive lightweight materials market is estimated to grow significantly, at a CAGR of 6.9%, during the forecast period. The major factors contributing to the market growth include the stringent regulations for the emission of fuel and growing initiatives for weight reduction. The government has made it crucial to reduce the weight of engine components and improve heat resistance for decreasing both fuel consumption and CO2 emissions. In order to use materials that are lighter in weight and more heat resistant than Ni-based superalloy, an environmental barrier coating (EBC) is necessary to cover the surface of components for a long period of time.

According to the International Council of Clean Transportation, a large fraction of TTG (Transport Task Group) members have already implemented world-class tailpipe emissions standards for both LDVs (Light delivery vehicles) and HDVs (heavy -duty vehicles), including Canada, the European Union, and its member states, Japan, and the US. These regulations are expected to reduce vehicle emission in the environment prevailing the automotive lightweight materials market. However, the high material and processing cost is one of the major factors that hamper the market growth.

Segmental Outlook

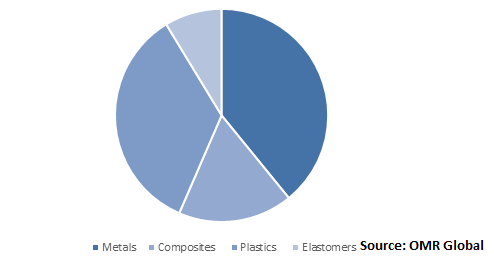

The automotive lightweight materials market is classified on the basis of material type, vehicle type, and application. Based on material type, the market is segmented into metals, composites, plastics, and elastomers. Based on the vehicle type, the market is segmented into PC, LCV, and HCV. On the basis of application, the market is segmented into chassis and suspension, powertrain, interiors, exterior, and others.

Global Automotive Lightweight Materials Market Share by Material Type, 2018 (%)

- Market value data analysis of 2018 and forecast to 2025.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive lightweight materials market. Based on the availability of data, information related to products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Geography

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

2.3. Rules & Regulations

3. Competitive Landscape

3.1. Company Share Analysis

3.2. Key Strategy Analysis

3.3. Key Company Analysis

3.3.1. BASF SE

3.3.1.1. Overview

3.3.1.2. Financial Analysis

3.3.1.3. SWOT Analysis

3.3.1.4. Recent Developments

3.3.2. Covestro AG

3.3.2.1. Overview

3.3.2.2. Financial Analysis

3.3.2.3. SWOT Analysis

3.3.2.4. Recent Developments

3.3.3. LyondellBasell Industries Holdings B.V.

3.3.3.1. Overview

3.3.3.2. Financial Analysis

3.3.3.3. SWOT Analysis

3.3.3.4. Recent Developments

3.3.4. SABIC

3.3.4.1. Overview

3.3.4.2. Financial Analysis

3.3.4.3. SWOT Analysis

3.3.4.4. Recent Developments

3.3.5. Toray Industries, Inc.

3.3.5.1. Overview

3.3.5.2. Financial Analysis

3.3.5.3. SWOT Analysis

3.3.5.4. Recent Developments

4. Market Determinants

4.1. Motivators

4.2. Restraints

4.3. Opportunities

5. Market Segmentation

5.1. Global Automotive Lightweight Materials Market by Material Type

5.1.1. Metals

5.1.2. Composites

5.1.3. Plastics

5.1.4. Elastomers

5.2. Global Automotive Lightweight Materials Market by Vehicle Type

5.2.1. Passenger Cars (PC)

5.2.2. Light Commercial Vehicle (LCV)

5.2.3. Heavy Commercial Vehicle (HCV)

5.3. Global Automotive Lightweight Materials Market by Application

5.3.1. Chassis and Suspension

5.3.2. Powertrain

5.3.3. Interiors

5.3.4. Exterior

5.3.5. Others (Body in white)

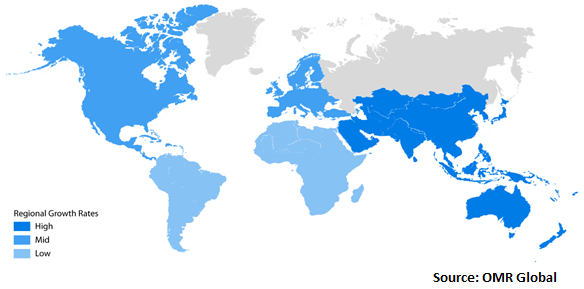

6. Regional Analysis

6.1. North America

6.1.1. United States

6.1.2. Canada

6.2. Europe

6.2.1. UK

6.2.2. Germany

6.2.3. Italy

6.2.4. Spain

6.2.5. France

6.2.6. Rest of Europe

6.3. Asia-Pacific

6.3.1. China

6.3.2. India

6.3.3. Japan

6.3.4. Rest of Asia-Pacific

6.4. Rest of the World

7. Company Profiles

7.1. Alcoa Corp.

7.2. ArcelorMittal

7.3. BASF SE

7.4. Bayer AG

7.5. Covestro AG

7.6. DuPont de Nemours, Inc.

7.7. Grupo Antolin Irausa, S.A.

7.8. Hexcel Corp.

7.9. LANXESS AG

7.10. LyondellBasell Industries Holdings B.V.

7.11. Novelis Deutschland GmbH

7.12. Owens Corning

7.13. PPG Industries, Inc.

7.14. SABIC

7.15. Stratasys Ltd.

7.16. Tata Steel Ltd.

7.17. ThyssenKrupp AG

7.18. Toray Industries, Inc.

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT METALS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT COMPOSITES MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT PLASTICS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT ELASTOMERS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS FOR PC MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS FOR LCV MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS FOR HCV MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS FOR CHASSIS AND SUSPENSION MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS FOR POWERTRAIN MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS FOR INTERIORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS FOR EXTERIORS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS FOR OTHER APPLICATIONS MARKET RESEARCH AND ANALYSIS BY REGION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY GEOGRAPHY, 2018-2025 ($ MILLION)

- NORTH AMERICAN AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- NORTH AMERICAN AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2018-2025 ($ MILLION)

- NORTH AMERICAN AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

- NORTH AMERICAN AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

- EUROPEAN AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- EUROPEAN AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2018-2025 ($ MILLION)

- EUROPEAN AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

- EUROPEAN AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

- ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2018-2025 ($ MILLION)

- ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2018-2025 ($ MILLION)

- ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

- ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

- REST OF THE WORLD AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY MATERIAL TYPE, 2018-2025 ($ MILLION)

- REST OF THE WORLD AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY VEHICLE TYPE, 2018-2025 ($ MILLION)

- REST OF THE WORLD AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET RESEARCH AND ANALYSIS BY APPLICATION, 2018-2025 ($ MILLION)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SHARE BY MATERIAL TYPE, 2018 VS 2025 (%)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SHARE BY VEHICLE TYPE, 2018 VS 2025 (%)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SHARE BY APPLICATION, 2018 VS 2025 (%)

- GLOBAL AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SHARE BY GEOGRAPHY, 2018 VS 2025 (%)

- US AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- CANADA AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- UK AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- FRANCE AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- GERMANY AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- ITALY AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- SPAIN AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- ROE AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- INDIA AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- CHINA AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- JAPAN AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF ASIA-PACIFIC AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)

- REST OF THE WORLD AUTOMOTIVE LIGHTWEIGHT MATERIALS MARKET SIZE, 2018-2025 ($ MILLION)