Automotive Lubricants Market

Automotive Lubricants Market Size, Share & Trends Analysis Report by Oil Type (Synthetic Lubricants, Semisynthetic Lubricants, Bio-Based Lubricants, and Conventional Lubricants) by Vehicle Type (Passenger Vehicles, Commercial Vehicles, and Two-Wheelers) and by Product Type (Engine Oil, Gear and Brake Oil, Transmission Fluids, Greases, and Coolant) Forecast Period (2024-2031)

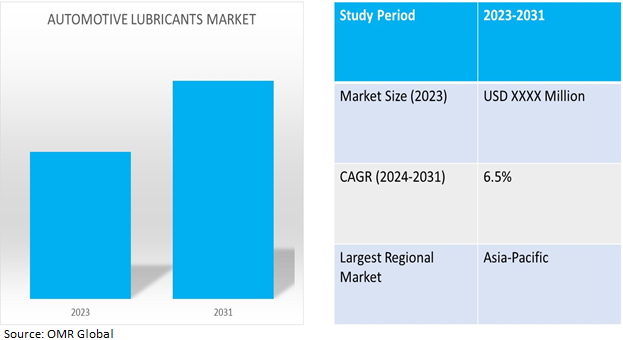

Automotive lubricants market is anticipated to grow at a CAGR of 6.5% during the forecast period (2024-2031). Automotive lubricant is a specialized fluid that reduces friction and wear between moving parts in an automobile's engine and other mechanical components. The growth of the market is attributed to the rising number of passenger vehicles, the expansion of the EV lubricant market, and the increasing need and awareness of vehicle maintenance and repair. Further, the market trends are moving toward the adoption of bio-based lubricants and a shift toward synthetic lubricants.

Market Dynamics

Growing Demand for Automotive and Related Components

Global vehicle network has steadily grown in recent decades, particularly in emerging markets, owing to rising incomes and standards of living. As more vehicles are on the road, the demand for automotive lubricants for routine maintenance and repair has increased. For instance, as per IBEF India, the passenger car market was valued at $32.7 billion in 2021 and it is expected to reach a value of $54.8 billion by 2027 while registering a CAGR of over 9.0% from 2022-2027. In November 2023, the total production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles was 2.2 million units. In (April-November) 2023-24, the total production of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers, and quadricycles was 15.6 million units. Simultaneously, the automobile component industry turnover stood at $56.5 billion from April 2021 to March 2022. The industry had revenue growth of 23.0% as compared to 2018-19. The auto components industry is expected to grow to $200.0 billion by FY26.

Adoption of Bio-Based Lubricants

Amid rising environmental concerns and regulatory requirements, there is an increasing trend toward the use of bio-based lubricants sourced from renewable sources such as plant oils and animal fats. When compared to traditional petroleum-based lubricants, bio-based lubricants have a lower carbon footprint, are biodegradable, and have less toxicity. For instance, in November 2022, wholly owned subsidiaries of Shell plc (Shell) in Switzerland, the UK, the US, and Sweden (Shell (Switzerland) AG, Shell U.K. Limited, Pennzoil-Quaker State Company, and Shell Aviation Sweden AB) have entered into agreements to acquire the environmentally considerate lubricants (ECLs) business of the PANOLIN group. Shell will manufacture, distribute, and market the PANOLIN array of ECL products alongside its existing Shell-natural branded goods. The acquisition will increase Shell's presence in mining, construction, agriculture, renewable energy, hydropower, and offshore wind.

Segmental Outlook

Our in-depth analysis of automotive lubricants market includes the following segments by oil type, vehicle type, and product type.

- Based on oil type, the market is segmented into synthetic lubricants, semisynthetic lubricants, bio-based lubricants, and conventional lubricants.

- Based on vehicle type, the market is segmented into passenger vehicles, commercial vehicles, and two-wheeler.

- Based on product type, the market is segmented into engine oil, gear and brake oil, transmission fluids, greases, and coolant.

Conventional Lubricant is the Dominant Segment

Currently, the conventional lubricant segment accounts for the biggest proportion of the automotive lubricant market. The major factor contributing to the dominance of the segment are the higher number of economy category vehicles, low-cost offerings, and the adaptability of the lubricant in different engines. However, the segment is expected to get stagnant as the adoption of semi, and fully synthetic lubricants increases owing to engine upgradation norms, and better efficiency.

Passenger Vehicle is the Most Demanded Vehicle Type

Passenger vehicle segment is expected to remain dominant in vehicle type owing to the rising population, increasing demand for four-wheelers in developing countries, market expansion in the passenger EV segment, and consumer inclination in developed countries towards four-wheelers. For instance, as per the Society for India Automobile Manufacturers, 2023 Q4 report, the passenger vehicle segment led the growth with overall sales touching almost 5.0 million units including 4.2 million domestic (growth of 8.4%) and 0.7 million exports.

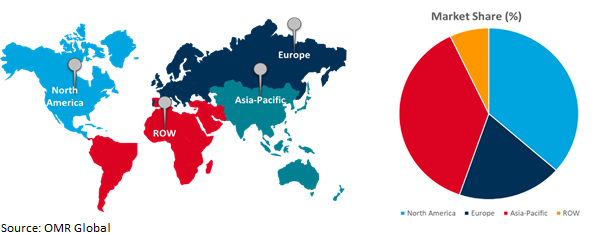

Regional Outlook

Automotive lubricants market is further segmented based on geography including North America (the US, and Canada), Europe (UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (Middle East & Africa, and Latin America).

Global Automotive Lubricants Market Growth by Region 2024-2031

Asia-Pacific Dominates the Global Automotive Lubricants Market

Asia-Pacific holds the highest share of automotive lubricants market. The key factors contributing to the growth are increasing investment in lubricant manufacturing capacities in the region, the presence of prominent market players such as PetroChina Company Ltd, and Indian Oil Corporation Ltd, high adoption of EVs, a growing trend toward synthetic and semisynthetic lubricants, industrial development, and an increase in automotive sales. For instance, in May 2023, ExxonMobil announced the final investment decision in India with the presence of Deputy Chief Minister Devendra Fadnavis, Industry Minister Uday Samant, and senior state government officials. The new $110.0 million plant will be capable of producing 159,000 kiloliters of finished lubricants per year and is slated to commence operations by the end of 2025. The factory will be erected in one of India's top industrial hubs, the Maharashtra Industrial Development Corporation's Isambe Industrial Area in Raigad, southeast of Mumbai, creating around 1,200 new jobs during its construction.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving automotive lubricants market include Royal Dutch Shell PLC, PetroChina Company Ltd, FUCHS Enprotec GmbH, TotalEnergies SE, and BP PLC, among others. The market players are focusing on capitalizing on growth by adopting strategies such as collaboration, partnerships, and market expansion among others. For instance, in March 2023, Shell Lubricants Egypt signed two exclusive strategic partnership contracts with General Motors and Al Mansour Automotive to supply lubricants, greases, and fluids for both firms. These collaborations are consistent with Shell's aim of providing high-quality products made with cutting-edge global technologies, in a bold drive to strengthen its position in Egypt.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in automotive lubricants market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Findings

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. BP PLC

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. FUCHS Enprotec GmbH

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. PetroChina Company Ltd.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Royal Dutch Shell PLC

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. TotalEnergies SE

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Lubricants Market by Oil Type

4.1.1. Synthetic Lubricants

4.1.2. Semi-synthetic Lubricants

4.1.3. Bio-Based Lubricants

4.1.4. Conventional Lubricants

4.2. Global Automotive Lubricants Market by Vehicle

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

4.2.3. Two-Wheeler

4.3. Global Automotive Lubricants Market by Product Type

4.3.1. Engine Oil

4.3.2. Gear and Brake Oil

4.3.3. Transmission Fluids

4.3.4. Greases

4.3.5. Coolant

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. Accu-Lube Manufacturing GmbH.

6.2. Castrol India Ltd.

6.3. Chevron Corp.

6.4. Idemitsu Kosan

6.5. ENEOS Group

6.6. Exxon Mobil Corp.

6.7. Gulf Oil Lubricants Ltd

6.8. Indian Oil Corporation Ltd

6.9. Oscar Lubricants LLC

6.10. Panama Petrochem Ltd.

6.11. R.W. Davis Oil Co.

6.12. Savita Oil Technologies Ltd

6.13. SINOPEC Group

6.14. TRInternational, Inc.

6.15. Valvoline

1. GLOBAL AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY OIL TYPE, 2023-2031 ($ MILLION)

2. GLOBAL SYNTHETIC AUTOMOTIVE LUBRICANTSMARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

3. GLOBAL SEMI-SYNTHETIC AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

4. GLOBAL BIO-BASEDAUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

5. GLOBAL CONVENTIONAL AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

6. GLOBAL AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

7. GLOBAL AUTOMOTIVE LUBRICANTSFOR PASSENGER VEHICLES MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

8. GLOBALAUTOMOTIVE LUBRICANTSANALYSIS FOR COMMERCIAL VEHICLES MARKET RESEARCH AND BY REGION, 2023-2031 ($ MILLION)

9. GLOBAL AUTOMOTIVE LUBRICANTS ANALYSIS FOR TWO WHEELER MARKET RESEARCH AND BY REGION, 2023-2031 ($ MILLION)

10. GLOBAL AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

11. GLOBAL ENGINE OIL IN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

12. GLOBAL GEAR AND BRAKE OIL IN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

13. GLOBAL TRANSMISSION FLUIDS IN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

14. GLOBAL GREASES IN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

15. GLOBAL COOLANTS IN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

16. GLOBAL AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

17. NORTH AMERICAN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

18. NORTH AMERICAN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY OIL TYPE, 2023-2031 ($ MILLION)

19. NORTH AMERICAN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

20. NORTH AMERICAN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

21. EUROPEAN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

22. EUROPEAN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY OIL TYPE, 2023-2031 ($ MILLION)

23. EUROPEAN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

24. EUROPEAN AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

25. ASIA-PACIFIC AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY COUNTRY, 2023-2031 ($ MILLION)

26. ASIA-PACIFICAUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY OIL TYPE, 2023-2031 ($ MILLION)

27. ASIA-PACIFIC AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

28. ASIA-PACIFIC AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

29. REST OF THE WORLD AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY REGION, 2023-2031 ($ MILLION)

30. REST OF THE WORLD AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY OIL TYPE, 2023-2031 ($ MILLION)

31. REST OF THE WORLD AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY VEHICLE, 2023-2031 ($ MILLION)

32. REST OF THE WORLD AUTOMOTIVE LUBRICANTS MARKET RESEARCH AND ANALYSIS BY PRODUCT TYPE, 2023-2031 ($ MILLION)

1. GLOBAL AUTOMOTIVE LUBRICANTS MARKET SHARE BY OIL TYPE, 2023 VS 2031 (%)

2. GLOBAL SYNTHETIC AUTOMOTIVE LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

3. GLOBAL SEMI-SYNTHETIC AUTOMOTIVE LUBRICANTSMARKET SHARE BY REGION, 2023 VS 2031 (%)

4. GLOBAL BIO-BASEDAUTOMOTIVE LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

5. GLOBAL AUTOMOTIVE LUBRICANTS MARKET SHARE BY VEHICLE, 2023 VS 2031 (%)

6. GLOBAL AUTOMOTIVE LUBRICANTSFOR PASSENGER VEHICLES MARKET SHARE BY REGION, 2023 VS 2031 (%)

7. GLOBAL AUTOMOTIVE LUBRICANTSFOR COMMERCIAL VEHICLES MARKET SHARE BY REGION, 2023 VS 2031 (%)

8. GLOBAL AUTOMOTIVE LUBRICANTS FOR TWO WHEELER MARKET SHARE BY REGION, 2023 VS 2031 (%)

9. GLOBAL AUTOMOTIVE LUBRICANTS MARKET SHARE BY PRODUCT TYPE, 2023 VS 2031 (%)

10. GLOBAL ENGINE OIL IN AUTOMOTIVE LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

11. GLOBAL GEAR AND BRAKE OIL IN AUTOMOTIVE LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

12. GLOBAL TRANSMISSION FLUIDS IN AUTOMOTIVE LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

13. GLOBAL GREASE IN AUTOMOTIVE LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

14. GLOBAL COOLANTS IN AUTOMOTIVE LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

15. GLOBAL AUTOMOTIVE LUBRICANTS MARKET SHARE BY REGION, 2023 VS 2031 (%)

16. US AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

17. CANADA AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

18. UK AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

19. FRANCE AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

20. GERMANY AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

21. ITALY AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

22. SPAIN AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

23. REST OF EUROPE AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

24. INDIA AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

25. CHINA AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

26. JAPAN AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

27. SOUTH KOREA AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

28. REST OF ASIA-PACIFIC AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

29. LATIN AMERICA AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)

30. THE MIDDLE EAST AND AFRICA AUTOMOTIVE LUBRICANTS MARKET SIZE, 2023-2031 ($ MILLION)