Automotive Regenerative Braking Market

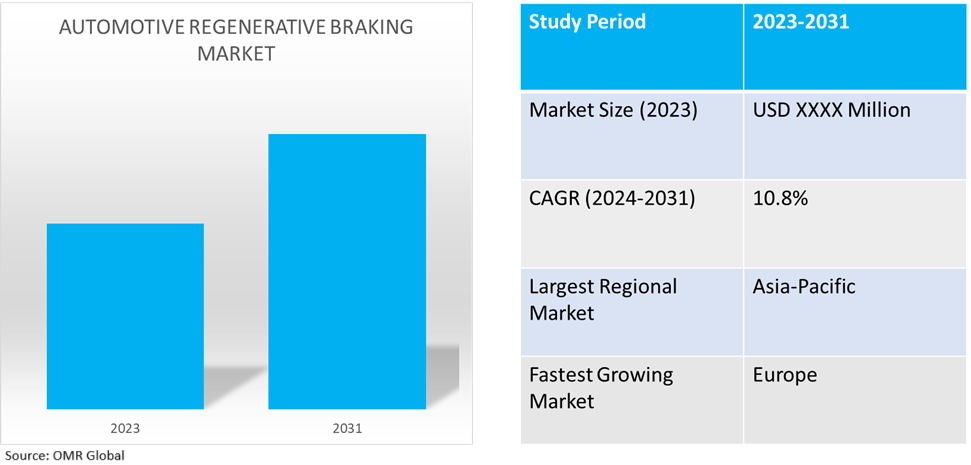

Automotive Regenerative Braking Market Size, Share & Trends Analysis Report by System (Electric, Hydraulics, and Kinetic), and by Vehicle Type (Passenger Vehicles and Commercial Vehicles) Forecast Period (2024-2031)

Automotive regenerative braking market is anticipated to grow at a significant CAGR of 10.8% during the forecast period (2024-2031). Pivotal factors such as the rising advancement in regenerative braking technology, increasing demand for electric vehicles and hybrids, and the rising utilization of Advanced Driver Assistance Systems (ADAS) with regenerative braking. According to the International Energy Agency (IEA), nearly 14 million new electric cars were registered globally in 2023, bringing the total number up to 40 million. The EV sales in 2023 grew by 35% year-on-year, exceeding 2022 figures by 3.5 million and marking a more than six-fold increase compared to 2018. Regenerative braking is a unique feature of EVs and is generally used among those developing next-gen cars. Regenerative braking in the commercial sector of electric vehicles (EVs) is recognized as a highly effective method for reducing energy consumption.

Market Dynamics

Increasing Adoption of lightweight Regenerative Braking

Lightweight regenerative braking systems improve vehicle efficiency by lowering overall weight and increasing energy storage during braking. As market players emphasize fuel efficiency and emissions action, lightweight components are growing increasingly important in vehicle design. In addition, government agencies support eco-friendly transportation resulting in increasing adoption of braking technologies. Innovation in material and engineering made it cost-effective in lightweight regenerative braking systems. Such types of trends expand the market with sustainable mobility solutions.

Technology Advancement in Regenerative Braking Systems

The automotive regenerative braking market is experiencing significant growth driven by various factors, including market players, who are increasingly investing in research and development to enhance the technology and improve the overall performance of regenerative braking systems. These investments focus on electrical endurance braking and energy efficiency. For instance, in September 2024, Accelera introduced its new integrated brake chopper resistor (iBCR). By utilizing the technology from the Accelera ELFA 3 inverter series, the iBCR is a versatile system designed to address two critical aspects of electric commercial vehicle performance, electrical endurance braking, and energy efficiency. The key features of the iBCR include Enhanced regenerative braking and safety improvements. Regenerative electric braking is advantageous for electric commercial vehicles since it uses the electric motor as a generator while braking. Excess energy is captured by the iBCR and transformed into heat, which can be utilized to temper the battery system or heat the car's cabin. This leads to overall energy savings in addition to improving efficiency.

Market Segmentation

- Based on the system, the market is segmented into electric, hydraulics, and kinetic.

- Based on the vehicle type, the market is segmented into passenger vehicles and commercial vehicles.

Electric Segment is Projected to Hold the Largest Market Share

The automotive regenerative braking market for electric is experiencing significant growth owing to several factors such as increasing demand for regenerative braking to increase energy recovery systems. The regenerate braking system transfers the vehicle's kinetic energy into electrical energy to recharge the vehicle's battery. The adoption of advanced battery technology with government incentives and policies drives the growth of market expansion. Furthermore, the global shift trend toward electric vehicles propels market growth. For instance, BMW's brake system utilizes the electric motor's full recuperation potential and analyzes braking scenarios for optimal efficiency. The traditional brake system is also engaged if necessary. This innovative interaction minimizes brake particle emissions, recovers the most energy, and is kind to the brakes.

Passenger Vehicles to Hold a Considerable Market Share

The passenger vehicles segment is expanding significantly owing to the increasing adoption of regenerative braking in passenger electric vehicles, government subsidies, and the implementation of stringent emission regulations. According to the European Automobile Manufacturers' Association (EAMA), in May 2023, the European Union produced 10.9 million passenger cars in 2022, an 8.3% increase over 2021. Additionally, regenerative braking systems are designed to recover, store, and repurpose a portion of the vehicle's braking energy to increase the range of electric and hybrid vehicles and improve fuel efficiency. Electric batteries, flywheels, hydraulic accumulators, and/or ultracapacitors are a variety of energy storage systems. Market players provide regenerative braking systems for hybrid cars that use less fuel and have a smaller carbon footprint. For instance, Robert Bosch GmbH offers specialized regenerative braking technologies. Both vacuum-based and vacuum-independent regenerative braking technologies are part of the range. Strict safety regulations for electrical and conventional braking systems are met by all Bosch regenerative braking systems.

Regional Outlook

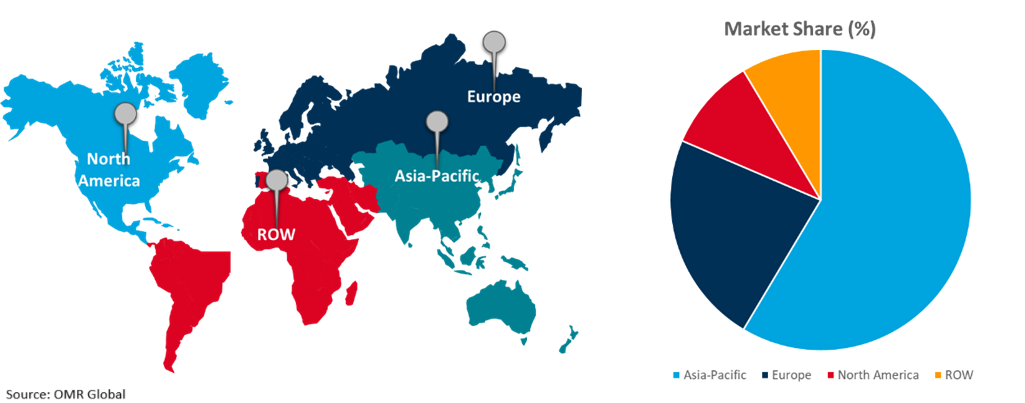

The global automotive regenerative braking market is further segmented based on geography including North America (the US, and Canada), Europe (the UK, Italy, Spain, Germany, France, and the Rest of Europe), Asia-Pacific (India, China, Japan, South Korea, and Rest of Asia-Pacific), and the Rest of the World (the Middle East & Africa, and Latin America).

Growing Demand for Lightweight Braking Systems in Europe

The market for automotive regenerative braking in Europe is growing significantly owing to rising innovation in advanced driver assistance systems with regenerative braking to enhance safety and performance. Europe region puts a high priority on strengthening its position in the market by putting strategies such as early standardization of autonomous vehicle use into practice. To improve road safety and lower the number of fatalities and injuries caused by traffic, the EU implemented new vehicle safety regulations in May 2022. New cars and vans sold in the EU are required to include advanced safety measures under these rules including Intelligent Speed Assistance (ISA), and Advanced Emergency Braking System (AEBS)

AEBS relies on advanced braking technologies, including regenerative braking systems, to improve vehicle safety. As governments enforce stricter safety regulations requiring AEBS in new vehicles, automotive manufacturers are increasingly integrating regenerative braking with AEBS to enhance both safety and energy efficiency.

Global Automotive Regenerative Braking Market Growth by Region 2024-2031

Asia-Pacific Holds Major Market Share

Asia-Pacific holds a significant share owing to the presence of automotive regenerative braking offering companies such as AISIN Corp., DENSO Corp., BYD Auto Co. Ltd., Toyota Industries Corp., Hyundai Mobis, and others. The Asia-Pacific automotive regenerative braking market is experiencing significant growth driven by the growing adoption of enhanced energy recovery systems with improved overall vehicle efficiency. The region's growing interest in the manufacturing of lightweight and reliable braking systems contributes to the growth of the industry. Adoption is also being accelerated by the government, increasing regulations on emissions and reduced CO? emissions boost market growth. According to the International Trade Administration (ITA), in April 2023, China remains the largest automobile market in terms of both yearly sales and production, with an anticipated 35 million vehicles produced domestically by 2025. Advanced brake technologies result in high efficiency and weight and size reduction. Market players provide a wide range of products, including both large and light motor vehicle models. For instance, AISIN Corp. offers a Regenerative Brake System that helps enhance the power consumption efficiency of electric vehicles and lower CO2 emissions. By optimizing energy recovered through regenerative braking, Power consumption efficiency is further increased by independent operation of the front and rear wheels.

Market Players Outlook

*Note: Major Players Sorted in No Particular Order.

The major companies serving the automotive regenerative braking market include AISIN Corp., Continental AG, DENSO Corp., Robert Bosch GmbH, and ZF Friedrichshafen AG among others. The market players are increasingly focusing on business expansion and product development by applying strategies such as collaborations, mergers, and acquisitions to stay competitive in the market.

The Report Covers

- Market value data analysis of 2023 and forecast to 2031.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global automotive regenerative braking market. Based on the availability of data, information related to new products, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market-entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.

1. Report Summary

• Current Industry Analysis and Growth Potential Outlook

1.1. Research Methods and Tools

1.2. Market Breakdown

1.2.1. By Segments

1.2.2. By Region

2. Market Overview and Insights

2.1. Scope of the Report

2.2. Analyst Insight & Current Market Trends

2.2.1. Key Market Trends

2.2.1.1. Advancements in Regenerative Braking Technology

2.2.1.2. Growing Automotive Electrification Trends

2.2.1.3. Rising Adoption of Electric and Hybrid Vehicles

2.2.2. Recommendations

2.2.3. Conclusion

3. Competitive Landscape

3.1. Key Company Analysis

3.2. AISIN Corp.

3.2.1. Overview

3.2.2. Financial Analysis

3.2.3. SWOT Analysis

3.2.4. Recent Developments

3.3. Continental AG

3.3.1. Overview

3.3.2. Financial Analysis

3.3.3. SWOT Analysis

3.3.4. Recent Developments

3.4. DENSO Corp.

3.4.1. Overview

3.4.2. Financial Analysis

3.4.3. SWOT Analysis

3.4.4. Recent Developments

3.5. Robert Bosch GmbH

3.5.1. Overview

3.5.2. Financial Analysis

3.5.3. SWOT Analysis

3.5.4. Recent Developments

3.6. ZF Friedrichshafen AG

3.6.1. Overview

3.6.2. Financial Analysis

3.6.3. SWOT Analysis

3.6.4. Recent Developments

3.7. Key Strategy Analysis

4. Market Segmentation

4.1. Global Automotive Regenerative Braking Market by System

4.1.1. Electric

4.1.2. Hydraulics

4.1.3. Kinetic

4.2. Global Automotive Regenerative Braking Market by Vehicle Type

4.2.1. Passenger Vehicles

4.2.2. Commercial Vehicles

5. Regional Analysis

5.1. North America

5.1.1. United States

5.1.2. Canada

5.2. Europe

5.2.1. UK

5.2.2. Germany

5.2.3. Italy

5.2.4. Spain

5.2.5. France

5.2.6. Rest of Europe

5.3. Asia-Pacific

5.3.1. China

5.3.2. India

5.3.3. Japan

5.3.4. South Korea

5.3.5. Rest of Asia-Pacific

5.4. Rest of the World

5.4.1. Latin America

5.4.2. Middle East and Africa

6. Company Profiles

6.1. ADVICS CO., LTD.

6.2. AISIN Corp.

6.3. Continental AG

6.4. DENSO Corp.

6.5. HL Mando Corp

6.6. Kendrion N.V.

6.7. Mazda Motor Corp.

6.8. Robert Bosch GmbH

6.9. ZF Friedrichshafen AG

1. Global Automotive Regenerative Braking Market Research And Analysis By System, 2023-2031 ($ Million)

2. Global Automotive Electric Regenerative Braking Market Research And Analysis By Region, 2023-2031 ($ Million)

3. Global Automotive Hydraulics Regenerative Braking Market Research And Analysis By Region, 2023-2031 ($ Million)

4. Global Automotive Kinetic Regenerative Braking Market Research And Analysis By Region, 2023-2031 ($ Million)

5. Global Automotive Regenerative Braking Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

6. Global Automotive Regenerative Braking For Passenger Vehicles Market Research And Analysis By Region, 2023-2031 ($ Million)

7. Global Automotive Regenerative Braking For Commercial Vehicles Market Research And Analysis By Region, 2023-2031 ($ Million)

8. Global Automotive Regenerative Braking Market Research And Analysis By Region, 2023-2031 ($ Million)

9. North American Automotive Regenerative Braking Market Research And Analysis By Country, 2023-2031 ($ Million)

10. North American Automotive Regenerative Braking Market Research And Analysis By System, 2023-2031 ($ Million)

11. North American Automotive Regenerative Braking Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

12. European Automotive Regenerative Braking Market Research And Analysis By Country, 2023-2031 ($ Million)

13. European Automotive Regenerative Braking Market Research And Analysis By System, 2023-2031 ($ Million)

14. European Automotive Regenerative Braking Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

15. Asia-Pacific Automotive Regenerative Braking Market Research And Analysis By Country, 2023-2031 ($ Million)

16. Asia-Pacific Automotive Regenerative Braking Market Research And Analysis By System, 2023-2031 ($ Million)

17. Asia-Pacific Automotive Regenerative Braking Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

18. Rest Of The World Automotive Regenerative Braking Market Research And Analysis By Region, 2023-2031 ($ Million)

19. Rest Of The World Automotive Regenerative Braking Market Research And Analysis By System, 2023-2031 ($ Million)

20. Rest Of The World Automotive Regenerative Braking Market Research And Analysis By Vehicle Type, 2023-2031 ($ Million)

1. Global Automotive Regenerative Braking Market Research And Analysis By System, 2023 Vs 2031 (%)

2. Global Automotive Electric Regenerative Braking Market Share By Region, 2023 Vs 2031 (%)

3. Global Automotive Hydraulics Regenerative Braking Market Share By Region, 2023 Vs 2031 (%)

4. Global Automotive Kinetic Regenerative Braking Market Share By Region, 2023 Vs 2031 (%)

5. Global Automotive Regenerative Braking Market Research And Analysis By Vehicle Type, 2023 Vs 2031 (%)

6. Global Automotive Regenerative Braking For Passenger Vehicles Market Share By Region, 2023 Vs 2031 (%)

7. Global Automotive Regenerative Braking For Commercial Vehicles Market Share By Region, 2023 Vs 2031 (%)

8. Global Automotive Regenerative Braking Market Share By Region, 2023 Vs 2031 (%)

9. US Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

10. Canada Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

11. UK Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

12. France Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

13. Germany Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

14. Italy Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

15. Spain Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

16. Rest Of Europe Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

17. India Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

18. China Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

19. Japan Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

20. South Korea Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

21. Rest Of Asia-Pacific Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

22. Latin America Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)

23. Middle East And Africa Automotive Regenerative Braking Market Size, 2023-2031 ($ Million)