Automotive Sensors Market

Global Automotive Sensors Market Size, Share & Trends Analysis Report by Sensor Type (Position Sensor, Pressure Sensor, Temperature Sensor, Speed Sensor, and Others), By Vehicle Type (Commercial Vehicle and Passenger Cars) Forecast, 2021-2027 Update Available - Forecast 2025-2035

The global automotive sensors market is growing at a significant CAGR of around 11.2% during the forecast period. The market growth is attributed to the favorable government support for increasing passenger safety and security. Further, the increasing development in advanced driver-assistance systems (ADAS) technology tend to create demand for automotive sensors, which in turn, will drive the growth of the global market. For instance, in August 2020, Automotive technology company Veoneer, Inc. and Qualcomm Technologies, Inc. decided to collaborate on the delivery of scalable ADAS, Collaborative and Autonomous Driving (AD) solutions powered by Veoneer’s next-generation perception and driving policy software stack and Qualcomm Snapdragon Ride ADAS/AD scalable portfolio of System on a Chip (SoC), and Accelerators.

Moreover, in January 2021, Magna announced to collaborate with Fisker to develop an ADAS, which will be applied to the Fisker Ocean SUV that is expected to launch in late 2022. Magna and Fisker will work together to develop unique ADAS features, and a suite of software packages powered by a scalable domain controller architecture. In addition to leveraging cameras and ultrasonic sensors, the ADAS package includes a unique and first-to-market digital imaging radar technology. Such developments in the industry will significantly create demand for automotive sensors and hence will drive the market growth.

Segmental Outlook

The global automotive sensor market is segmented based on sensor type and vehicle type. Based on sensor type, the market is segmented into pressure sensor, temperature sensor, position sensor, speed sensor, and others. Based on vehicle type, the market is bifurcated into passenger vehicles and commercial vehicles.

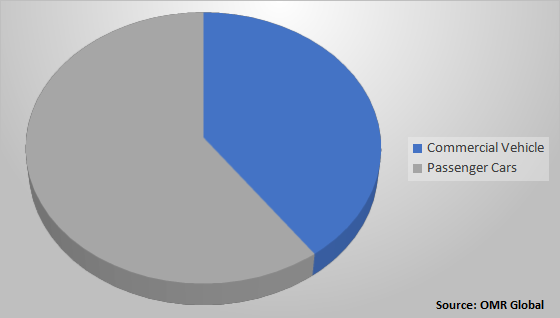

Global Automotive Sensor Market by Service, 2020 (%)

The Passenger Car Segment Projected to Dominate the Global Automotive Sensor Market

The passenger car segment is projected to hold a prominent share in the market owing to the largest shipments of the vehicle as compared to a commercial vehicle. Sensors improve the performance of cars and enhance passengers’ safety. The increasing demand for safe vehicles has directly impacted the demand for sensors. Moreover, the increasing purchasing power of consumers has also increased the demand for automobiles with enhanced safety and advanced features. Moreover, the increasing adoption of ADAS technology coupled with the increasing penetration of self-driving vehicles further gives a boost to the segmental growth of the market.

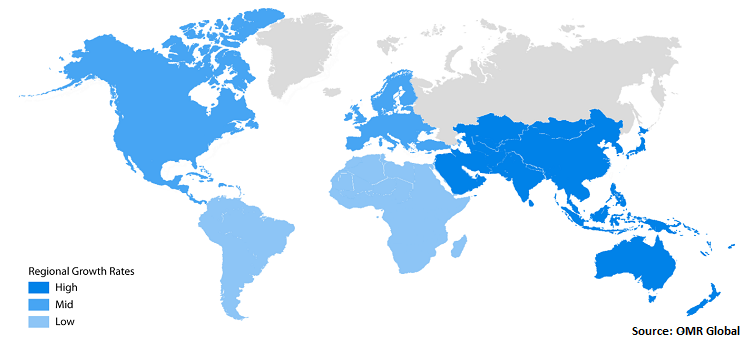

Regional Outlook

The global automotive sensors market is analyzed based on the geographical regions that are contributing significantly towards the growth of the market. The market report covers the analysis of four major regions including North America (the US and Canada), Europe (UK, Germany, Italy, Spain, France, and Rest of Europe), Asia-Pacific (China, Japan, India, and the Rest of Asia-Pacific) and Rest of the World (RoW). Europe is estimated to contribute a significant share in the global automotive sensors market. The presence of a well-established automotive industry owing to the presence of automotive giants in the region create significant demand for automotive sensors and hence contributes a prominent share.

Global Automotive Sensors Market Growth by Region, 2021-2027

Market Players Outlook

Further, the report covers the analysis of various players operating in the global automotive sensors market. Some of the major players covered in the report include Robert Bosch GmbH, Denso Corp., Continental AG, Infineon Technologies AG, CTS Corp., Bourns Inc., and Continental AG. To sustain a strong position in the market, these players adopt different marketing strategies such as a merger, acquisitions, product launches, and geographical expansion. For instance, in September 2020, LeddarTech announced the acquisition of the assets of Phantom Intelligence, including all of its intellectual property and technology. The Phantom Intelligence transaction is the second acquisition by LeddarTech during July-September 2020. In July of 2020, LeddarTech acquired VayaVision, an Israel-based sensor-fusion and perception technology company.

The Report Covers

- Market value data analysis of 2020 and forecast to 2027.

- Annualized market revenues ($ million) for each market segment.

- Country-wise analysis of major geographical regions.

- Key companies operating in the global female infertility diagnosis and treatment market. Based on the availability of data, information related to new product launches, and relevant news is also available in the report.

- Analysis of business strategies by identifying the key market segments positioned for strong growth in the future.

- Analysis of market entry and market expansion strategies.

- Competitive strategies by identifying ‘who-stands-where’ in the market.